Thermoplastic Polyurethane Adhesive Market

The Thermoplastic Polyurethane (TPU) Adhesive market spans solvent-based cements, waterborne dispersions, hot-melt pellets/sticks, and heat-activated films and webs engineered for flexible, high-peel bonding. Top applications include technical footwear uppers/soles and toe caps; apparel and technical textiles (seam sealing, logos, reflective tapes); automotive interiors (instrument panels, seats, headliners), e-mobility foams and trims; electronics and wearables (device housings, speaker fabrics, fold/hinge laminates); wood/furniture edge-banding; medical devices and hygiene; and multilayer laminations in outdoor gear and inflatable structures. Key trends emphasize the migration from solvent to 100% solids and waterborne technologies, low-temperature activation for delicate substrates, faster line speeds via hot-melt films/webs, and improved hydrolysis/UV stability for outdoor and automotive cycles. Growth catalysts include automation in footwear/textiles, tighter VOC and worker-exposure rules, the need for elastic bonds that withstand flex/fatigue, and brand-owner pressure for recyclability and mono-material laminates. The competitive landscape blends global polyurethane leaders, specialty hot-melt formulators, and film converters; alternatives include EVA and polyolefin HMAs, polyamide/polyester HMAs, reactive PUR hot melts, acrylics, and epoxies. Differentiation hinges on peel at low gauge, adhesion to low-surface-energy (LSE) plastics, transparency and non-yellowing, plasticizer-migration resistance, aging across -30°C to +90°C, and consistency on high-speed lamination lines. Execution priorities are primer/Corona/Plasma surface prep, robust heat/pressure dwell windows, and change-control discipline. Challenges remain around solvent abatement, cost competitiveness versus commodity HMAs, balancing soft touch with creep resistance, and designing for disassembly within emerging recycling schemes.Thermoplastic Polyurethane Adhesive Market Key Insights

- Performance envelope: elasticity with durable peel and shear. TPU adhesives deliver rubber-like elongation and energy return while maintaining cohesive strength under cyclic flex, making them ideal for shoes, textiles, and interior trims. Formulators tune hard/soft segment ratios and molecular weight to balance tack, green strength, and heat resistance. Stabilizer and UV packages extend outdoor life, while anti-hydrolysis chemistry sustains bonds in humidity and sweat exposure across seasons and geographies.

- Technology shift from solvent to hot-melt and waterborne. Environmental and safety pressures accelerate adoption of waterborne TPU dispersions and hot-melt films/webs that cut VOCs and curing time. Films enable clean, automated lamination with consistent coatweights and minimal squeeze-out. Waterborne grades meet breathability or softness targets in apparel and hygiene, while retaining robust peel after laundering, boosting brand acceptance in regulated retail channels.

- Adhesion to difficult substrates requires surface science. LSE polymers (PP/PE/TPO), fluoropolymers, and coated textiles need Corona/Plasma/Flame activation or adhesion promoters to unlock TPU performance. Primer-adhesive pairs and tie-layer chemistry mitigate plasticizer migration from PVC and soft PU foams. For metals and glass, hybrid TPU systems incorporate polar functionality to raise wet-out and corrosion-creep resistance without sacrificing flexibility and impact absorption.

- Films and webs enable speed, cleanliness, and design freedom. Heat-activated TPU films deliver predictable bondlines, clear optics for logos/graphics, and easy die-cutting for complex shapes. Webs add loft that bridges fabric porosity and uneven surfaces, improving hand feel and reducing telegraphing. Multi-zone lamination profiles (preheat, nip, post-cure) allow delicate textiles, foams, and membranes to be processed without scorch or print-through at scale.

- Automotive and e-mobility raise aging and odor bars. Cabin VOC/FOG, sunscreen/cleaner resistance, and thermal cycling drive tighter specs than legacy interior adhesives. TPU’s low odor and elastic recovery suit instrument panels, door skins, headliners, and acoustic parts. In EVs, bonds must tolerate battery-pack temperature swings and foams’ compression set; TPU’s flexibility helps damp buzz/squeak/rattle while accommodating differential expansion.

- Footwear automation favors consistent, primer-light systems. Robotic roughening, laser activation, and heat-press steps pair with TPU cements/films to reduce labor variability and rework. Low-temp activation prevents upper scorching and speeds line takt, while migration-resistant grades prevent edge lift in white soles. Data-logged lamination profiles and in-line peel testing tighten process windows for global brand audits.

- Electronics and wearables need clarity, reworkability, and thin-bond control. TPU films offer optical clarity, soft touch, and micro-gap filling for speakers, fabrics, and housings. Controlled softening points allow service rework without damaging substrates, useful in refurb channels. Anti-yellowing packages and halogen-free declarations support compliance and premium aesthetics for consumer devices and accessories.

- Medical and hygiene demand biocompatible, skin-friendly bonds. Low-residual-monomer content, clean extractables profiles, and soft-hand films are sought for drapes, braces, ostomy pouches, and breathable laminates. RF/ultrasonic-friendly grades and EtO/gamma-tolerant films streamline device assembly. Skin-contact applications leverage hypoallergenic formulations with moisture-vapor transmission that maintains comfort during extended wear.

- Circularity: mono-material and repairable designs. TPU-to-TPU bonds and TPU films with polyolefin-compatible layers support future separation or melt-compatibility strategies. Designers target reversible bonds via controlled heat to enable repair or component reuse. Suppliers publish recyclability guidance and eco-profiles, while lightweighting via films (vs. thick cements) lowers embodied carbon and shipping emissions.

- Operational excellence decides total cost-in-use. Robust storage stability, low stringing, and wide lamination windows reduce stoppages and scrap. Tech-service playbooks - surface energy measurement, primer selection, nip pressure maps - shrink troubleshooting time. Digital lot traceability, color/clarity consistency, and global change-notification discipline are now standard award criteria across footwear, auto, and consumer-brand RFPs.

Thermoplastic Polyurethane Adhesive Market Reginal Analysis

North America

Demand is anchored in automotive interiors, technical footwear, outdoor gear, and electronics accessories. Buyers emphasize low-VOC, low-odor, and halogen-free declarations, alongside data for sunscreen/cleaner resistance and cabin FOG. Hot-melt films/webs gain share for automation and labor savings. Local tech centers providing lamination profiles, peel/creep dashboards, and primer guidance are a common differentiator in awards.Europe

A regulation-dense environment prioritizing solvent reduction, worker exposure controls, and recyclability. Automotive OEMs drive strict aging/odor and sustainability scorecards, pushing waterborne and film-based TPU systems. Premium apparel and technical textiles favor breathable laminates and seam-sealing films with durable wash performance. Documentation depth (REACH/SVHC) and mono-material design support improve tender outcomes.Asia-Pacific

Scale comes from footwear, apparel manufacturing hubs, consumer electronics, and expanding auto interiors. Price sensitivity coexists with rapid adoption of films/webs for clean, fast lamination. Regional brands seek low-temp activation for heat-sensitive textiles and migration-resistant grades for white soles. Proximity of resin producers and converters accelerates customization and shortens lead times for seasonal launches.Middle East & Africa

Growth concentrates in automotive trim, construction interiors, and sportswear in major metros. Hot climates raise UV/hydrolysis requirements and push for non-yellowing, high-heat staples. Distributors with training on surface prep and lamination setup gain traction. Projects in hospitality and healthcare value low odor and durable, cleanable bonds in high-traffic environments.South & Central America

Demand reflects footwear clusters, upholstery, and consumer goods with rising interest in waterborne and film technologies to improve shop safety and throughput. Currency volatility favors simplified SKUs and locally converted films. Buyers look for robust adhesion on mixed substrates and guidance to reduce solvent usage without sacrificing peel, helping meet retailer compliance and sustainability targets.Thermoplastic Polyurethane Adhesive Market Segmentation

By Type

- Hot Melt Adhesives

- Solvent-based Adhesives

By Form

- Granular

- Powder

- Liquid

By End-User

- Packaging

- Textile

- Consumer Goods

- Automotive

Key Market players

Henkel, H.B. Fuller, 3M, Bostik (Arkema), Sika, Dow, Huntsman, Covestro, BASF, Lubrizol, Toyobo, Jowat SE, COIM Group (Novacote), Huitian Adhesive, Tex Year IndustriesThermoplastic Polyurethane Adhesive Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Thermoplastic Polyurethane Adhesive Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Thermoplastic Polyurethane Adhesive market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Thermoplastic Polyurethane Adhesive market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Thermoplastic Polyurethane Adhesive market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Thermoplastic Polyurethane Adhesive market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Thermoplastic Polyurethane Adhesive market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Thermoplastic Polyurethane Adhesive value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Thermoplastic Polyurethane Adhesive industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Thermoplastic Polyurethane Adhesive Market Report

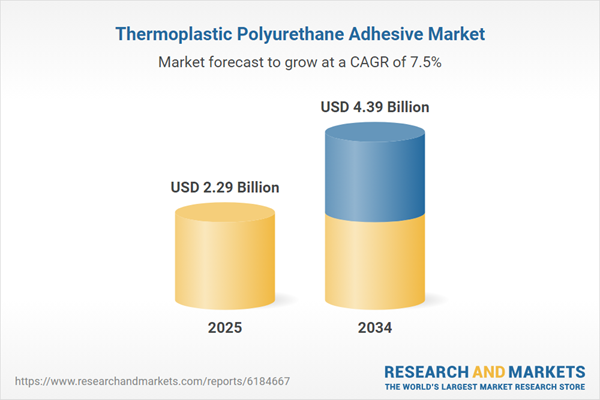

- Global Thermoplastic Polyurethane Adhesive market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Thermoplastic Polyurethane Adhesive trade, costs, and supply chains

- Thermoplastic Polyurethane Adhesive market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Thermoplastic Polyurethane Adhesive market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Thermoplastic Polyurethane Adhesive market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Thermoplastic Polyurethane Adhesive supply chain analysis

- Thermoplastic Polyurethane Adhesive trade analysis, Thermoplastic Polyurethane Adhesive market price analysis, and Thermoplastic Polyurethane Adhesive supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Thermoplastic Polyurethane Adhesive market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Henkel

- H.B. Fuller

- 3M

- Bostik (Arkema)

- Sika

- Dow

- Huntsman

- Covestro

- BASF

- Lubrizol

- Toyobo

- Jowat SE

- COIM Group (Novacote)

- Huitian Adhesive

- Tex Year Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.29 Billion |

| Forecasted Market Value ( USD | $ 4.39 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |