Corn Syrup Market

The Corn Syrup Market encompasses a broad spectrum of glucose-based syrups derived from wet-milled corn starch and tailored through enzyme conversion and fractionation to deliver specific functional profiles. Core end-uses span confectionery and bakery (chews, caramels, icings, fillings), beverages (carbonated soft drinks, ready-to-drink teas, juice drinks), dairy and frozen desserts, processed foods (sauces, ketchups, dressings, canned fruit), and industrial applications such as brewing and fermentation. Buyers value corn syrup’s multi-functionality - humectancy for softness and shelf-life, controlled sweetness, body and mouthfeel, crystallization control, browning, and freezing-point depression - along with reliable year-round availability and consistent quality. The market is shaped by ongoing reformulation cycles in response to consumer perceptions of sweeteners, front-of-pack labeling, and “added sugars” disclosures, which push producers to broaden portfolios across dextrose-equivalent (DE) ranges, high-maltose and maltose-rich grades, low-ash/low-color options, and specialized syrups for clean flavor release. Enzymatic innovations (e.g., advanced glucoamylase and pullulanase systems) improve conversion efficiency, while process optimization, membrane filtration, and carbon treatment enhance sensory attributes and heat stability. Sustainability programs - covering regenerative corn sourcing, water stewardship, and Scope 3 engagement - are increasingly embedded into large buyers’ procurement criteria. Competitive dynamics feature integrated starch platforms supplying corn syrup alongside native/modified starches, polyols, dextrose, and specialty sweetener systems, enabling cross-category solution selling and risk-managed supply. Exposure to agricultural, energy, and transport cost swings underpins pricing mechanisms and contract structures, while trade policies, ethanol demand, and crop yields influence regional balances. The near-to-medium term outlook centers on value-added grades, formulation support services, and hybrid sweetening systems that protect taste and texture while meeting nutrition and labeling objectives.Corn Syrup Market Key Insights

- Portfolio shift to functionality over commodity. Buyers increasingly specify DE windows, osmolality, and viscosity curves to tune texture, freeze-thaw stability, and moisture migration. Suppliers respond with tighter spec control, low-flavor “bland” syrups for delicate flavors, and high-maltose grades for hard-boiled candy clarity - reducing reliance on price-only competitions and deepening technical lock-in at accounts.

- Reformulation cycles driven by labeling and perception. “Added sugars” lines on nutrition panels and school/retail standards push beverage and snack makers to reduce total sugar loading without compromising sensory. Corn syrup remains pivotal for body, crystallization control, and processability, often paired with high-intensity sweeteners, fibers, or allulose to balance taste, calories, and label messaging.

- Process and enzyme innovation lift yields and quality. Advanced alpha-amylase/pullulanase stacks, improved liquefaction controls, and multi-effect evaporation reduce color bodies and energy intensity. Inline analytics and membrane separations deliver tighter saccharide distributions, enabling syrups with cleaner flavor release and better heat/acid stability for retort, jam, and ketchup lines.

- Sustainability as a procurement gate. Large CPG and beverage contracts increasingly evaluate verified sustainable corn programs, water-reuse ratios, and scope-3 initiatives. Suppliers with traceable grower networks, regenerative ag pilots, and rail-optimized footprints gain RFP advantages and de-risk logistics during peak demand windows.

- Competitive advantage from integrated sweetener systems. Multinationals leverage adjacency in starches, polyols, HFCS, dextrose, and flavor modifiers to deliver turnkey solutions (e.g., chewy bar binders, gummy systems, frozen dessert solids). This expands wallet share through co-development, pilot plant trials, and rapid iterative prototyping.

- Quality and sensory remain decisive in confectionery. High-maltose and low-ash syrups drive glassy clarity and reduced stickiness in hard candy; specific viscosity profiles support controlled pull and set in caramels and nougat. Tight microbial specs and color management are critical for premium positioning and export compliance.

- Risk management and contracting sophistication. Exposure to crop yields, ethanol pull on corn, energy tariffs, and freight availability encourages formula-based pricing, hedging, and multi-origin sourcing. Customers favor partners with diversified grind, robust railcar fleets, and contingency inventory near key manufacturing clusters.

- Growth in hybrid and “better-for-you” architectures. Formulators blend corn syrup with fibers, rare sugars, and natural high-intensity sweeteners to retain bulking and water activity control while meeting sugar-reduction targets. Application labs that validate shelf-life, water migration, and freeze-thaw cycles shorten commercialization timelines.

- Regional specialization in grades and specs. Beverage-heavy corridors prioritize consistent flavor neutrality and microbial stability; bakery and cereal clusters demand mid-DE binders for machinability and cutability; condiment hubs emphasize acid/heat stability and color control - driving localized stock-keeping units and service models.

- Digitalization of technical service. Virtual line audits, formulation simulators, and data-logged trial runs accelerate scale-up. Suppliers offering rapid sample-to-plant pathways, documented HACCP support, and bilingual QA packages improve first-pass success and reduce waste in high-throughput plants.

Corn Syrup Market Reginal Analysis

North America

A mature, highly integrated wet-milling base supplies diverse syrup grades to dense confectionery, bakery, and beverage corridors. Rail logistics and proximity to crop belts underpin reliability, while customer demands focus on clean flavor release, tight microbial controls, and sustainability assurances. Reformulation in beverages and snacks sustains demand for functional bulking and texture systems. Contracting sophistication, multi-plant redundancy, and technical service access are primary supplier selection criteria.Europe

Balancing sugar taxes, Nutri-Score type schemes, and retailer standards, European buyers emphasize reduced sugar architectures with uncompromised sensory. Import dynamics and local starch capacity shape availability, while high-maltose and low-color syrups serve premium confectionery and artisan bakery. Verified sustainability, allergen and traceability documentation, and EU-compliant labeling support are essential. Hybrid sweetening with fibers and approved high-intensity sweeteners advances across beverages and dairy desserts.Asia-Pacific

Rapidly expanding confectionery, bakery, dairy alternative, and RTD beverage categories drive versatile syrup demand. Portfolio breadth - from mid-DE binders to specialty high-maltose - supports both multinational and local brands. Sourcing flexibility, halal compliance, and competitive delivered-cost models are crucial. Technical centers that localize texture and sweetness to regional palates, and support heat/acid stability in sauces and condiments, accelerate wins in fast-moving markets.Middle East & Africa

Growth is anchored in bakery, confectionery, and beverage manufacturing hubs, with emphasis on shelf-life, moisture retention, and heat stability under warm climates. Import dependence elevates the value of reliable logistics, temperature-controlled storage, and robust microbial specs. Partners that provide formulation guidance for chewy confectionery, jams, and syrups suited to regional taste profiles gain traction. Documentation for halal, food safety, and traceability is a baseline requirement.South & Central America

Expanding snack, confectionery, and beverage industries seek cost-effective functional sweetening with consistent quality. Local milling footprints, where present, reduce lead times; otherwise, stable supply chains and rail/port connectivity are decisive. Syrups tuned for tropical processing conditions - addressing water activity, stickiness, and color - support performance across candies, baked goods, and frozen treats. Sustainability credentials and bilingual technical service strengthen supplier positions in multinational and regional accounts.Corn Syrup Market Segmentation

By Type

- Light Syrup

- Dark Syrup

- Corn Syrup Solids

- High Fructose Corn Syrup

By Application

- Food and Beverages

- Pharmaceuticals

By Distribution Channel

- B2B

- B2C

Key Market players

Cargill, Archer Daniels Midland (ADM), Ingredion, Tate & Lyle, Roquette, Tereos, COFCO Biochemical, Global Sweeteners Holdings, Baolingbao Biology, Shandong Fuyang Biotechnology, Grain Processing Corporation (GPC), AGRANA, Sukhjit Starch & Chemicals, Gujarat Ambuja Exports, Gulshan PolyolsCorn Syrup Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Corn Syrup Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Corn Syrup market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Corn Syrup market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Corn Syrup market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Corn Syrup market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Corn Syrup market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Corn Syrup value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Corn Syrup industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Corn Syrup Market Report

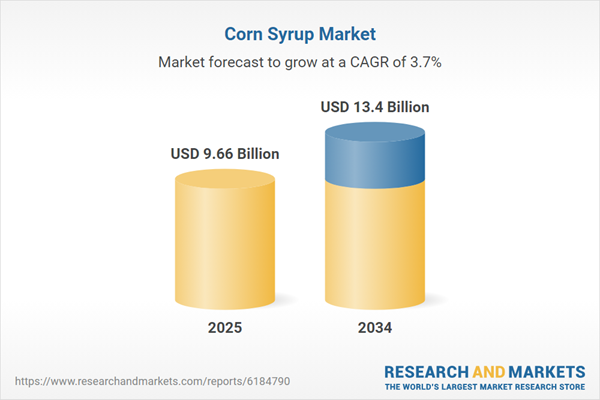

- Global Corn Syrup market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Corn Syrup trade, costs, and supply chains

- Corn Syrup market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Corn Syrup market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Corn Syrup market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Corn Syrup supply chain analysis

- Corn Syrup trade analysis, Corn Syrup market price analysis, and Corn Syrup supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Corn Syrup market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cargill

- Archer Daniels Midland (ADM)

- Ingredion

- Tate & Lyle

- Roquette

- Tereos

- COFCO Biochemical

- Global Sweeteners Holdings

- Baolingbao Biology

- Shandong Fuyang Biotechnology

- Grain Processing Corporation (GPC)

- AGRANA

- Sukhjit Starch & Chemicals

- Gujarat Ambuja Exports

- Gulshan Polyols

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.66 Billion |

| Forecasted Market Value ( USD | $ 13.4 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |