Amphibious Excavator Market

Amphibious excavators - often called swamp or marsh buggies - combine an excavator upper structure with sealed, track-mounted pontoons to operate in soft, saturated, and shallow-water terrain where conventional machines bog down. Typical applications include wetland and mangrove restoration, river/lake desilting, canal maintenance, levee and stormwater rehabilitation, flood-control and climate-resilience works, tailings pond management, shoreline/port development, pipeline right-of-way maintenance, aquaculture pond excavation, and environmental remediation. Product evolution centers on modular extendable/retractable undercarriages for transportability and stability, long-reach booms for wider working envelopes, and high-flow auxiliary circuits to drive dredge pumps, cutters, and mulchers. OEMs and specialist converters emphasize anti-corrosion fabrication, sealed roller systems, low-ground-pressure track shoes, and safety features (fall-protection, anti-two-block, emergency flotation). Telematics, remote diagnostics, geo-fencing, and e-maintenance records improve uptime and compliance, while pilot programs explore hybrid powertrains, bio-hydraulic fluids, and auto-lube systems to reduce emissions and wear. Demand is driven by urban flood events, regulatory mandates for waterway maintenance, public funding for resilience infrastructure, port expansion, and ESG-led habitat projects; cyclical support comes from mining and oil & gas dewatering. Competitive dynamics blend global excavator brands, regional pontoon/undercarriage specialists, and attachment makers, with rentals and turnkey dredging contractors gaining share where project timing is uncertain. Key purchasing criteria include stability in variable depths, transport width/weight, attachment compatibility, fuel efficiency, corrosion resistance, and after-sales support. Barriers include permitting windows, seasonal access constraints, skilled operator availability, and logistics for oversize loads. Overall, value is migrating toward integrated solutions - machine plus engineered attachments, temporary access, service packages, and guaranteed performance outcomes.Amphibious Excavator Market Key Insights

- Regulation, resilience, and public funding as demand catalysts: Waterway maintenance mandates, climate-resilience programs, and flood-mitigation budgets underpin steady tender pipelines. Vendors that align proposals with environmental permits, fish-spawning windows, and habitat protections shorten award cycles and reduce project risk for EPCs and agencies.

- Application mix favors long-reach and pump-assisted work: River desilting, canal clearance, and shoreline restoration require long-reach fronts and high-flow auxiliary hydraulics for submersible pumps. Configurations that switch quickly between buckets, rakes, cutters, and pumps improve asset utilization across seasonal tasking.

- Undercarriage innovation expands safe working envelopes: Extendable pontoons, side-pontoon kits, and spud-leg stabilizers improve lateral stability in variable depths and currents. Lightweight, high-strength steels and sealed idlers lower operating mass, reduce ground pressure, and curb premature wear in abrasive sediments.

- Powertrain and fluid strategies target uptime and ESG: Auto-idle, load-sensing hydraulics, and refined cooling packages manage heat in silty, high-load environments. Bio-hydraulic fluids, extended-life filtration, and centralized greasing mitigate spill risks and reduce maintenance windows at remote sites.

- Telematics transforms fleet economics: Real-time health monitoring, silt-pump hour tracking, and geo-fencing support predictive maintenance and proof-of-work reporting to clients. Remote diagnostics accelerate parts triage, cutting downtime tied to specialized components and seals.

- Attachment ecosystems drive margin and stickiness: Purpose-built dredge pumps, vegetation cutters, rakes, and thumb grapples enable turnkey scopes. Quick-couplers and standardized interfaces let contractors redeploy assets rapidly across wetlands, ports, and tailings jobs.

- Channel shift toward rental and turnkey contracting: Project-based buyers favor rental with operator, or performance-based packages that bundle machine, attachments, spares, and on-site service. Dealers with amphibious fleets, training, and transport solutions win repeat business.

- Corrosion control and materials engineering matter: Epoxy systems, stainless fasteners, sacrificial anodes, and sealed rollers extend life in brackish and acidic waters. Fabrication quality and weld procedures materially affect pontoon integrity under cyclical loads.

- Transportability and compliance shape specs: Retractable undercarriages and modular pontoons reduce escort requirements and demurrage. Clear documentation on weights, widths, lifting points, and tie-downs streamlines multi-modal moves between remote water bodies.

- Workforce, safety, and training as differentiators: OEM-grade training on amphibious stability, spud-leg use, and current/wave limits reduces incidents. Integrated fall-protection points, non-slip walkways, and pictogram checklists support safety culture and insurer acceptance.

Amphibious Excavator Market Reginal Analysis

North America

Demand is supported by federal, state, and municipal spending on flood control, stormwater upgrades, and navigable waterway maintenance. Wetland restoration and coastal resilience projects emphasize low-impact access and strict environmental windows. Dealer networks with rental fleets, certified operator training, and rapid parts availability are decisive. Specifications prioritize long-reach fronts, high-flow auxiliaries for pumps, corrosion-resistant coatings, and telematics for compliance reporting.Europe

A mature market shaped by stringent environmental permitting and Natura-type habitat protections. Canal and riverine maintenance, peatland restoration, and coastal defense drive consistent workloads. Buyers value low-emission engines, bio-fluids, and noise-reduction measures near communities. Transport-friendly, modular pontoons and CE-conformity documentation are baseline requirements, with preference for integrated packages that include spud-legs, anchor systems, and certified lifting points.Asia-Pacific

Large addressable need from deltaic cities, monsoon-affected regions, aquaculture expansion, mining tailings, and port development. Price-performance is critical, but top contractors adopt higher-spec undercarriages and pump systems for productivity. Local fabrication of pontoons and attachments reduces lead times; international brands compete via technology, durability, and after-sales programs. Government-backed resilience and dredging programs sustain multi-year project pipelines.Middle East & Africa

Saline, high-temperature environments, coastal reclamation, and desalination intakes favor corrosion-resistant builds and robust cooling. Project execution hinges on logistics to remote wetlands and security of parts supply. Public infrastructure, oil & gas dewatering, and tourism shoreline works provide cyclical pull; turnkey contractors with rental capacity, trained crews, and mobile service units see the strongest traction.South & Central America

River network maintenance, hydroelectric reservoirs, and mining tailings management underpin demand. Procurement stresses ruggedization, service reach into interior geographies, and transportability over limited road/bridge infrastructure. Local partners for assembly, operator training, and pump maintenance are pivotal. Environmental approvals and community engagement shape schedules, rewarding suppliers with credible compliance records and bilingual technical support.Amphibious Excavator Market Segmentation

By Type

- Small Amphibious Excavators

- Medium Amphibious Excavators

- Large Amphibious Excavators

By Application

- Dredging

- Highway Construction

- Oil and Gas Pipeline Installation

- Environmental Restoration & Remediation

- Others

Key Market players

Caterpillar Inc., Hitachi Construction Machinery Co., Ltd., Liebherr-International AG, Volvo Construction Equipment AB, Sany Heavy Industry Co., Ltd., HD Hyundai Infracore Co., Ltd., Xuzhou Construction Machinery Group Co., Ltd. (XCMG), Jiangsu River Heavy Industry Co., Ltd., Sinoway Industrial (Shanghai) Co., Ltd., EIK Engineering Sdn Bhd., Ultratrex Machinery Sdn. Bhd., Wilco Manufacturing LLC, Wilson Marsh Equipment, Inc., Wetland Equipment CompanyAmphibious Excavator Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Amphibious Excavator Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Amphibious Excavator market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Amphibious Excavator market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Amphibious Excavator market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Amphibious Excavator market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Amphibious Excavator market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Amphibious Excavator value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Amphibious Excavator industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Amphibious Excavator Market Report

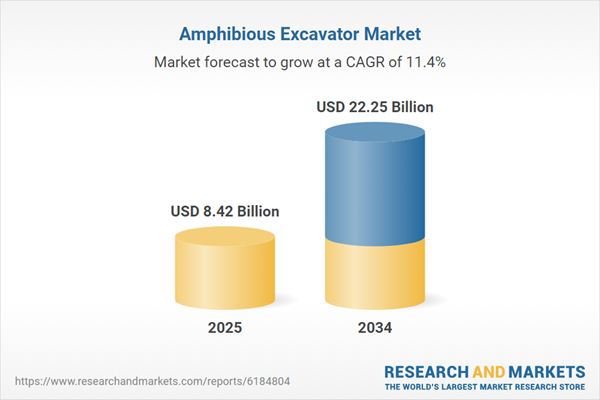

- Global Amphibious Excavator market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Amphibious Excavator trade, costs, and supply chains

- Amphibious Excavator market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Amphibious Excavator market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Amphibious Excavator market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Amphibious Excavator supply chain analysis

- Amphibious Excavator trade analysis, Amphibious Excavator market price analysis, and Amphibious Excavator supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Amphibious Excavator market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Caterpillar Inc.

- Hitachi Construction Machinery Co. Ltd.

- Liebherr-International AG

- Volvo Construction Equipment AB

- Sany Heavy Industry Co. Ltd.

- HD Hyundai Infracore Co. Ltd.

- Xuzhou Construction Machinery Group Co.

- Ltd. (XCMG)

- Jiangsu River Heavy Industry Co. Ltd.

- Sinoway Industrial (Shanghai) Co. Ltd.

- EIK Engineering Sdn Bhd.

- Ultratrex Machinery Sdn. Bhd.

- Wilco Manufacturing LLC

- Wilson Marsh Equipment Inc.

- Wetland Equipment Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.42 Billion |

| Forecasted Market Value ( USD | $ 22.25 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |