Tigernut Milk Market

The Tigernut Milk Market comprises plant-based beverages derived from Cyperus esculentus (tigernut/chufa), offered as chilled and shelf-stable RTD, UHT, barista blends, concentrates, and powders. Core end-uses span lactose-free drinking milk, cereal and smoothie bases, coffee/tea applications, frozen desserts, bakery and pastry, and culinary sauces - supported by café/foodservice, grocery, natural/organic retail, and e-commerce channels. Trends emphasize allergen-friendly positioning (nut-free, dairy-free, soy-free), low-FODMAP and clean-label formulas with short ingredients, and nutrition stories around natural sweetness, fiber/resistant starch, and prebiotic potential. Formulation advances focus on fine-particle milling, high-shear/dual-stage homogenization, and enzyme treatments to reduce grittiness, stabilize emulsions, and manage sweetness without heavy sugar additions. Barista SKUs add calcium/vitamin fortification and foam stability for micro-foam, while culinary lines optimize heat tolerance and Maillard behavior. Sourcing highlights Spanish “horchata de chufa” heritage and West African cultivation, with emerging regional crops to de-risk supply. Competitive dynamics include plant-milk majors extending into niche bases, specialty horchata brands, and private labels; differentiation rests on mouthfeel, authentic flavor, fortification without chalkiness, and credible sustainability (water footprint, regenerative practices). Challenges include relatively higher ingredient cost versus oat/soy, sediment control during shelf life, protein content below pea/soy peers, and consumer familiarity outside traditional markets. Overall, tigernut milk is evolving from regional horchata to a modern, allergy-savvy dairy alternative that competes on taste, digestibility, and clean labels - particularly in breakfast, café, and family snacking occasions.Tigernut Milk Market Key Insights

- Allergen-friendly edge: Naturally nut-free and lactose-free profiles broaden household penetration and school suitability; clear “contains none of the big allergens” messaging reduces shopper friction.

- Texture & stability are make-or-break: Ultrafinishing, enzyme pre-treatments, and gellan/pectin systems limit sediment and sandiness; low-oil separation and neutral pH enhance shelf appeal.

- Barista performance matters: Calcium buffering, protein-mimicking hydrocolloids, and controlled fat systems enable micro-foam, latte art, and heat stability without burnt notes.

- Balanced sweetness without sugar spikes: Endogenous sugars and caramel notes from gentle thermal steps allow low-added-sugar SKUs; acids and salts tune perceived sweetness and cereal compatibility.

- Nutrition positioning with credibility: Fortification (Ca, D, B12) bridges parity with dairy; fiber/resistant starch narratives focus on everyday gut-friendly usage rather than clinical claims.

- Culinary versatility: Reduced-water concentrates and powders expand into baking, desserts, and sauces, giving foodservice cost control and storage efficiency.

- Supply resilience & identity: Dual-region sourcing (Mediterranean/West Africa and local trials) plus traceability stories protect continuity and support premium provenance tiers.

- Sustainability cues: Low irrigation needs, regenerative rotations, and recyclable packs (rPET, cartons) resonate with eco-aware buyers and retailer scorecards.

- Price-pack architecture: Entry 1L cartons and café-size formats pair with single-serve and multi-packs online; limited flavors (vanilla, cinnamon) test elasticity without reformulating base.

- Education & trial mechanics: In-store sampling, café collaborations, and recipe content demystify usage beyond horchata, accelerating repeat in breakfast and coffee occasions.

Tigernut Milk Market Reginal Analysis

North America

Natural/organic retail and cafés drive discovery; consumers value allergen-friendly, clean-label SKUs with barista performance. E-commerce bundles (original, unsweetened, barista) and fortification parity with dairy support pantry rotation. Brands emphasize sediment control and neutral flavor for cereal and latte use; co-packing proximity reduces freight and out-of-stocks.Europe

Heritage familiarity via Spanish horchata coexists with modern, fortified plant-milk sets. Retailers favor short-ingredient lists, recyclable cartons, and verified sourcing. Barista and unsweetened lines expand in specialty coffee; private label tests value tiers. Northern markets prioritize calcium/B-vitamin parity and low sugar; Southern markets lean into authentic cinnamon-lemon profiles.Asia-Pacific

Café culture and lactose sensitivity support uptake in Australia/New Zealand and urban Japan/Korea; China’s premium channels trial flavored horchata. Light, dessert-friendly profiles and shelf-stable packs suit e-commerce and convenience. Local milling/finishing partners improve mouthfeel and cost; education around “not a nut” aids adoption.Middle East & Africa

West African origin stories and diaspora demand aid awareness; GCC cafés and premium grocers list barista and cinnamon variants. Heat-resilient, UHT formats and robust emulsions are critical. Halal compliance, bilingual labeling, and dependable cold-chain for chilled SKUs influence listings.South & Central America

Plant-milk aisles add tigernut as a differentiated, nut-free option alongside oat/almond. Shelf-stable cartons and value multipacks succeed in modern trade; café partnerships seed trial. Flavor riffs (vanilla-cinnamon) align with dessert culture; cost control relies on concentrates and regional sourcing where feasible.Tigernut Milk Market Segmentation

By Product

- Tigernut Whole Milk

- Tigernut Low-Fat Milk

- Tigernut Fat-Free Milk

By Application

- Food and Beverages

- Nutraceuticals

By Type

- Flavored

- Unflavored

By Category

- Organic

- Regular

Key Market players

Chufi (Calidad Pascual), Don Simón (J. García Carrión), Horchata Costa, Panach, Terra i Xufa, Ecomil (Nutriops), Rude Health, Organic Gemini, The Tiger Nut Company (UK), Tigernuts Traders S.L., Hacendado (Mercadona), Carrefour, Lidl (Solevita), Chufas Bou, Horchatería DanielTigernut Milk Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Tigernut Milk Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Tigernut Milk market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Tigernut Milk market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Tigernut Milk market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Tigernut Milk market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Tigernut Milk market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Tigernut Milk value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Tigernut Milk industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Tigernut Milk Market Report

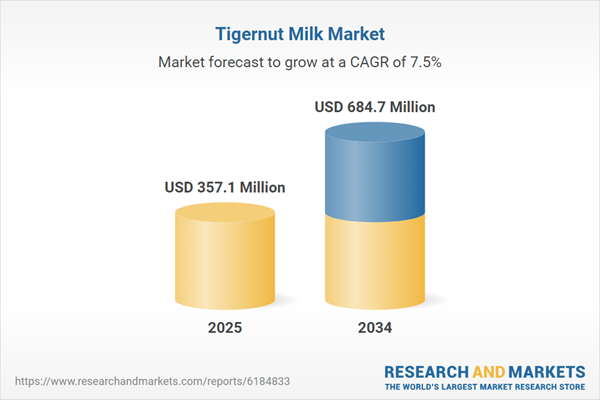

- Global Tigernut Milk market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Tigernut Milk trade, costs, and supply chains

- Tigernut Milk market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Tigernut Milk market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Tigernut Milk market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Tigernut Milk supply chain analysis

- Tigernut Milk trade analysis, Tigernut Milk market price analysis, and Tigernut Milk supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Tigernut Milk market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Chufi (Calidad Pascual)

- Don Simón (J. García Carrión)

- Horchata Costa

- Panach

- Terra i Xufa

- Ecomil (Nutriops)

- Rude Health

- Organic Gemini

- The Tiger Nut Company (UK)

- Tigernuts Traders S.L.

- Hacendado (Mercadona)

- Carrefour

- Lidl (Solevita)

- Chufas Bou

- Horchatería Daniel

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 357.1 Million |

| Forecasted Market Value ( USD | $ 684.7 Million |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |