Red Algae Market

The Red Algae market spans cultivated and wild-harvested Rhodophyta streams supplying food (nori/laver sheets, dulse flakes, condiments), hydrocolloids (agar, carrageenan, specialty blends), nutraceuticals (minerals, fibers, omega-rich oils), cosmetic actives (phyco-compounds for hydration/anti-oxidation), agricultural biostimulants, animal nutrition, and emerging bioplastics and pigment applications. Top end-uses revolve around sushi/nori, texturizing and stabilization in dairy/plant-based beverages and desserts, clean-label gels in confectionery, premium snack seasonings, and seaweed-forward meal kits. Trends emphasize certified sustainable aquaculture, traceability to farm and species, lower-impact extraction (enzymatic/green solvents), offshore and IMTA (integrated multi-trophic aquaculture) systems, and biorefinery cascades valorizing every biomass fraction. Growth is propelled by wellness and umami-led culinary adoption, reformulation away from synthetic stabilizers, regenerative narratives (carbon uptake, nutrient remediation), and retailer policies favoring verifiable ocean stewardship. The competitive landscape blends Asian scale producers, Latin and North African agar supply chains, specialist processors for high-purity food/biopharma grades, and fast-growing brands in snacks and condiments. Differentiation hinges on species identity and consistency (Kappaphycus, Eucheuma, Porphyra, Gracilaria, Gelidium), gel strength and kappa/iota ratios, sensory neutrality or targeted sea notes, heavy-metal/iodine governance, and documentation depth. Execution priorities include climate-resilient farming strains, disease control (“ice-ice”), post-harvest drying standards, cold-chain for premium edible products, and contract stability with co-ops. Challenges persist around weather and El Niño variability, biosecurity and invasive-species rules, certification cost, price swings when harvests tighten, and the need to align ESG claims with audited data.Red Algae Market Key Insights

- Aquaculture scale and resilience define supply security. IMTA and offshore longline systems dilute disease pressure, diversify nutrient inputs, and free nearshore space, while hatchery-bred seedlings improve uniformity and growth rates. Farm design now incorporates climate stress tests and contingency moorings to withstand storms and swell. Co-op models with deferred payments stabilize farmer income across seasonal dips. Drying infrastructure near landing sites cuts spoilage and preserves gel strength for high-value grades.

- Species and fraction management unlock premium value. Food brands demand Porphyra with consistent sheet strength and color; hydrocolloid buyers specify kappa/iota/neutral agar profiles by species and origin. Processors separate proteins, fibers, and pigments to monetize the full biomass. Sensory control - mitigating iodine harshness or metallic notes - broadens usage in snacks and plant-based dairy. Tight spec sheets on ash, moisture, and particle size reduce downstream reformulation risk and QA holds.

- Hydrocolloid performance remains a core profit driver. Carrageenan and agar displace synthetic stabilizers through predictable gelation, freeze-thaw stability, and acid/heat tolerance across dairy and alt-dairy matrices, confectionery, and meat analogs. Customers benchmark lot-to-lot gel strength, clarity, and synergy with locust bean/xanthan. Inline rheology and SPC minimize drift, lowering dose and total cost-in-use. Clean-label blends with defined E-codes or “processing aid” positions accelerate retailer acceptance.

- Edible seaweed shifts from niche to mainstream formats. Nori snacks, ramen toppings, and seasoning blends leverage umami and mineral cues, while chef collaborations push dulse and laver into fine dining and meal kits. Dehydration curves and packaging OTR/WVTR specs preserve crispness and color. Private-label assortment grows as retailers seek transparent origin stories and allergen governance, supported by QR traceability and cooking guidance to drive repeat purchase.

- Biostimulants and feed are fast-maturing adjacencies. Red algae extracts support root vigor, abiotic stress tolerance, and nutrient-use efficiency in crops; standardization of actives and compatibility with tank mixes decide adoption. In animal nutrition, controlled inclusion rates target gut health and methane reduction programs, demanding stable iodine and heavy-metal profiles. Field trials and farm-gate economics - yield uplift vs. cost - govern repeat buying.

- Biorefinery and green extraction improve yield and optics. Enzymatic cell disruption and membrane separations deliver higher-purity phycocolloids and pigments at lower energy and solvent footprints. Cascading valorization - oils, proteins, fibers, then ash for minerals - boosts revenue per ton and cuts waste. LCA and mass-balance documentation support ESG claims in brand tenders. Investment focuses on modular units near farms to reduce wet biomass transport.

- Quality and safety governance are non-negotiable. Heavy-metal, iodine, micro, and radionuclide panels are now routine for premium buyers. HACCP and allergen controls in mixed seafood facilities reduce cross-contact risk. Change-control and rapid CAPA maintain multi-country approvals. For edible sheets and snacks, foreign-material prevention (sand/shell) and optical sorting protect consumer trust and retailer scorecards.

- Regulatory nuance shapes labeling and market access. Country-specific rules on carrageenan/agar usage levels, additive codes, and infant/clinical nutrition dictate formulation. Organic and MSC-style certifications, country-of-origin marks, and invasive-species rules drive sourcing decisions. Harmonized dossiers - specs, contaminants, allergen statements - shorten time-to-shelf for multinational launches.

- Route-to-market strategy balances freshness and flexibility. Premium edibles favor cold-chain and rapid distribution to preserve texture and color; hydrocolloids and powders move via ambient, with VMI and regional stock to buffer seasonality. Direct-to-consumer boxes and specialty e-commerce expand trials; B2B relies on distributors with application labs that localize recipes and reduce reformulation cycles.

- ESG claims must be measurable, not aspirational. Verified biodiversity and habitat outcomes, nutrient remediation metrics, and worker welfare programs separate credible suppliers from marketing noise. Recyclable films, lower-energy dryers, and optimized freight reduce Scope 1-3 footprints. Public progress dashboards and third-party reviews increasingly appear in retailer RFPs and brand procurement scorecards.

Red Algae Market Reginal Analysis

North America

Demand grows across edible seaweed snacks, culinary sheets, plant-based texturizers, and biostimulants. Buyers emphasize traceability, heavy-metal/iodine controls, and sustainably certified farms. Culinary adoption in premium retail and foodservice coexists with strong B2B hydrocolloid pull. Logistics focus on rapid dehydration and regional stock positions, while innovation centers explore bioplastics and pigment extraction for cosmetics and beverages.Europe

A regulation-dense market with high expectations for sustainability and safety data. Premium edible lines and gourmet condiments leverage provenance and clean labels; hydrocolloids serve dairy, confectionery, and bakery. Retailers scrutinize contaminants and recyclability of packs; organic and country-of-origin labels boost acceptance. R&D targets green extraction and biorefinery cascades, with coastal nations scaling aquaculture and IMTA pilots.Asia-Pacific

The production and consumption hub for nori/laver and carrageenan species, with mature farming know-how and processing clusters. Growth extends to snacks, ramen, and meal kits in urban centers, alongside exports of hydrocolloids. Climate variability drives investment in resilient seedstock and offshore lines. Domestic regulators tighten contaminant limits; brands leverage authenticity and culinary heritage to defend premium tiers.Middle East & Africa

Emerging demand in premium retail, hospitality, and functional food lines within major cities. Imports dominate, with buyers prioritizing clean documentation, halal alignment, and consistent sensory. Biostimulant trials expand in horticulture and high-value crops under water stress. Heat-resilient packaging and port-side QA are critical to protect color and texture in edible products.South & Central America

Agar supply chains in select coastal nations anchor exports, while local consumption of edible sheets and seasonings grows in metropolitan markets. Processors invest in drying capacity, quality labs, and regional distribution to stabilize specs. Biostimulants and feed additives gain traction in horticulture and aquaculture. Currency and logistics volatility favor flexible contracts, local finishing, and bilingual technical support.Red Algae Market Segmentation

By Type

- Freshwater Red Algae

- Marine Red Algae

- Calcified Red Algae

By Application

- Food and Beverages

- Pharmaceutical

- Industrial

- Cosmetics and Personal Care

- Others

By Form

- Powder

- Liquid

- Natural Dried

- Gel

- Others

Key Market players

CP Kelco, Gelymar, Algaia, KIMICA Corporation, CEAMSA, W Hydrocolloids, Hispanagar, Arthur Branwell & Co. Ltd., Qingdao Bright Moon Seaweed Group, Shemberg Group, Marine Hydrocolloids (Meron), Greenfresh Group, DuPont (IFF) - Danisco, The Seaweed Company, Ocean’s BalanceRed Algae Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Red Algae Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Red Algae market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Red Algae market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Red Algae market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Red Algae market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Red Algae market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Red Algae value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Red Algae industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Red Algae Market Report

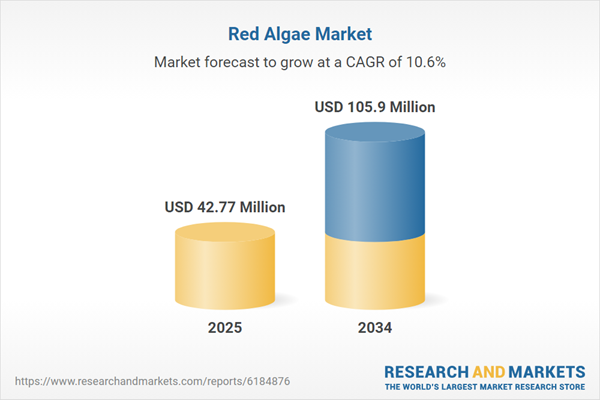

- Global Red Algae market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Red Algae trade, costs, and supply chains

- Red Algae market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Red Algae market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Red Algae market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Red Algae supply chain analysis

- Red Algae trade analysis, Red Algae market price analysis, and Red Algae supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Red Algae market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- CP Kelco

- Gelymar

- Algaia

- KIMICA Corporation

- CEAMSA

- W Hydrocolloids

- Hispanagar

- Arthur Branwell & Co. Ltd.

- Qingdao Bright Moon Seaweed Group

- Shemberg Group

- Marine Hydrocolloids (Meron)

- Greenfresh Group

- DuPont (IFF) – Danisco

- The Seaweed Company

- Ocean’s Balance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 42.77 Million |

| Forecasted Market Value ( USD | $ 105.9 Million |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |