Residential HVAC Market

The Residential HVAC market covers ducted split systems, packaged rooftop units for multifamily, ductless mini-splits and multi-splits, variable-refrigerant-flow (VRF) systems, air-to-air and ground-source heat pumps, air handlers, furnaces, smart thermostats, ERV/HRV ventilation, indoor air quality (IAQ) modules, and connected service platforms for single-family and low- to mid-rise multifamily homes. Top applications include new construction, retrofit replacement, weatherization upgrades, additions/ADUs, and high-performance homes targeting near-zero energy. Trends center on electrification via high-efficiency heat pumps, inverter compressors, low-GWP refrigerants, grid-interactive controls, whole-home IAQ, and prefabricated/compact mechanical packages for space-constrained urban housing. Growth is supported by energy-efficiency standards, building-code updates, decarbonization policies, utility rebates, and homeowner demand for comfort, quiet operation, and lower bills. Competition spans global HVAC majors, regional OEMs, ODM/white-label lines, and a fast-growing ecosystem of smart controls and installer-software providers; differentiation hinges on seasonal efficiency at low ambient conditions, comfort at part load, acoustics, commissioning simplicity, and connected serviceability. Channel dynamics remain installer-led, with distributors, aggregators, and online marketplaces shaping brand choice; labor availability, training, and commissioning quality materially influence realized performance. Execution priorities include readiness for new refrigerants, robust supply chains for compressors/electronics, flexible product platforms, and end-to-end homeowner experiences from quote to maintenance. Challenges include skilled-labor shortages, variability in housing starts, climate-driven peak loads, grid constraints, and the need to balance upfront cost with lifecycle value.Residential HVAC Market Key Insights

- Electrification and heat pumps are redefining the core product mix. Air-to-air and cold-climate heat pumps with variable-speed inverters are displacing fossil systems in both new build and replacement; dual-fuel hybrids persist where grid or envelope constraints exist. Low-ambient capacity retention, defrost strategies, and auxiliary heat optimization are central to homeowner satisfaction and utility program eligibility. OEMs that document real-world seasonal performance at part load win specifications and rebate listings.

- Inverter and VRF architectures push comfort and acoustic leadership. Variable-speed compressors and electronically commutated motors deliver tight temperature/humidity control, lower noise, and high SEER/HSPF equivalents under diverse climates. Multi-split and small-VRF platforms enable zoning and architectural flexibility for retrofits. Simpler line-sets, pre-charged kits, and app-guided commissioning reduce truck rolls and installation variability while preserving warranty integrity.

- Refrigerant transition is a multi-year competitive separator. Migration from legacy refrigerants to lower-GWP options requires charge-size management, new safety features, and installer certification. Early movers with field-proven components, compatible tools, and clear retrofit guidance reduce channel friction. Transparent flammability risk management and inventory planning across mixed fleets protect distributors during the crossover.

- IAQ and ventilation have become baseline, not upsell. Integrated ERV/HRV, filtration beyond standard minimums, humidity control, and germicidal options are now table stakes for wellness-minded homeowners. Packaged solutions that balance ventilation with energy recovery and tight envelopes avoid comfort penalties. Data-backed IAQ dashboards increase perceived value and justify premium service plans.

- Connected controls and service platforms unlock lifetime value. Smart thermostats, cloud telemetry, and predictive maintenance convert intermittent installs into recurring relationships. Field diagnostics, fault code libraries, and digital twins shorten downtime and improve first-time-fix rates. Interoperability with utility demand response and home ecosystems strengthens rebate cases and retail attachment.

- Installer capability is as critical as equipment efficiency. Workforce shortages elevate brands that simplify design and commissioning through auto-charging, built-in airflow measurement, and guided apps. Training academies, virtual reality modules, and certified dealer tiers improve quality and reduce callbacks. Transparent labor planning and jobsite kitting help contractors scale during seasonal peaks.

- Envelope and HVAC co-optimization is gaining traction. Programs increasingly couple HVAC upgrades with insulation, air sealing, and windows to reduce peak load and downsize equipment. Compact, modular mechanical rooms and packaged DOAS + heat pump stacks enable multifamily standardization. OEMs partnering with builders and energy raters secure specification pathways in high-performance communities.

- Affordability pressures favor mid-tier efficiency with smart features. While ultra-premium systems grow, the volume center remains value lines that pair inverter comfort with basic connectivity. Clear lifecycle cost narratives, financing, and subscription maintenance mitigate sticker shock. Private-label and ODM offerings intensify price competition, making warranty, serviceability, and installer loyalty key defenses.

- Climate resilience and peak-load management shape designs. Heat waves and cold snaps demand robust low-ambient operation, surge protection, and backup strategies. Grid-interactive water heaters and thermal storage pair with HVAC to shave peaks. Outdoor unit placement, corrosion resistance, and flood-hardening influence coastal and storm-exposed markets’ specifications.

- Sustainability and transparency are differentiators in bids. Product environmental profiles, recycled content, and end-of-life take-back programs support builder and multifamily ESG goals. Quiet operation, low refrigerant leakage, and grid-friendly controls align with green certifications. Suppliers offering verifiable documentation and procurement compliance streamline large-lot awards.

Residential HVAC Market Reginal Analysis

North America

Electrification expands rapidly through heat pump incentives, while cold-climate performance and dual-fuel strategies address extreme weather. Replacement dominates volume; mini-splits gain share in retrofits and additions. Distributors and dealer networks steer brand choice; connected controls and utility DR compatibility influence rebates. Labor constraints elevate ease-of-install and commissioning tools.Europe

Policy-driven decarbonization and high energy costs accelerate air-to-water and air-to-air heat pumps, with hydronic retrofits in older housing stock. Low-GWP readiness, acoustic performance, and compact footprints are key. Ventilation with heat recovery is widely adopted. Install capacity, subsidy administration, and building-fabric upgrades shape pace and product mix across northern vs. southern climates.Asia-Pacific

Largest manufacturing base and diverse demand: mini-splits dominate in many markets; premium inverter systems and multi-splits grow in urban high-rises. Heat pump water heaters and space heating expand in cooler regions. Smart home integration and e-commerce channels influence retail. Price sensitivity coexists with rapid adoption of connected, high-efficiency units.Middle East & Africa

Cooling-led markets prioritize high-efficiency, robust systems capable of extreme temperatures and dust mitigation. District cooling intersects with residential in dense metros; inverter mini-splits and packaged units lead. Power reliability and water scarcity drive interest in efficient ventilation and controls. Service networks and after-sales support are critical differentiators.South & Central America

Demand tied to urbanization, climate zones, and affordability; mini-splits and window/simplified splits remain common with gradual inverter migration. Energy-labeling programs guide consumer choice; import dynamics and currency volatility impact mix. Growing interest in IAQ and smart thermostats in upper-middle segments; installer training and supply reliability sway brand loyalty.Residential HVAC Market Segmentation

By Type

- HVAC equipment

- HVAC services

By Product

- Air conditioning system

- Heating system

- Ventilating system

By AC Type

- Single splits/ multi splits

- VRF

- Air Handling Units

- Others

By Heating system Type

- Boilers/radiators/Furnaces

- Heat Pumps

Key Market players

Daikin Industries, Carrier, Trane Technologies, Lennox International, Johnson Controls (York), Rheem Manufacturing, Bosch Thermotechnology, Mitsubishi Electric, LG Electronics, Panasonic, Samsung Electronics, Gree Electric Appliances, Midea Group, Haier Smart Home, Fujitsu GeneralResidential HVAC Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Residential HVAC Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Residential HVAC market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Residential HVAC market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Residential HVAC market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Residential HVAC market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Residential HVAC market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Residential HVAC value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Residential HVAC industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Residential HVAC Market Report

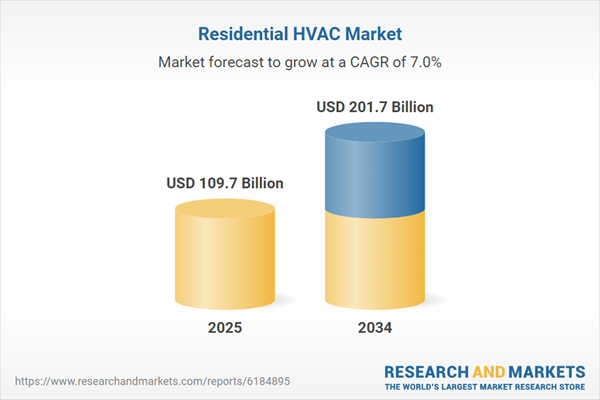

- Global Residential HVAC market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Residential HVAC trade, costs, and supply chains

- Residential HVAC market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Residential HVAC market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Residential HVAC market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Residential HVAC supply chain analysis

- Residential HVAC trade analysis, Residential HVAC market price analysis, and Residential HVAC supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Residential HVAC market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daikin Industries

- Carrier

- Trane Technologies

- Lennox International

- Johnson Controls (York)

- Rheem Manufacturing

- Bosch Thermotechnology

- Mitsubishi Electric

- LG Electronics

- Panasonic

- Samsung Electronics

- Gree Electric Appliances

- Midea Group

- Haier Smart Home

- Fujitsu General

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 109.7 Billion |

| Forecasted Market Value ( USD | $ 201.7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |