Consumable Spirits Market

The Consumable Spirits market spans distilled categories - whisk(e)y, vodka, gin, rum, tequila/mezcal, brandy/cognac, liqueurs, bitters and aperitifs - delivered through on-trade (bars, restaurants, hotels, travel retail) and off-trade (grocery, specialty, e-commerce, club). Core end-uses include classic and contemporary cocktails, premium sipping occasions, food-pairing menus, gifting, and festival/catering programs. Trends shaping the category center on premiumization and “drink better, not more,” terroir and cask experimentation, agave momentum, botanical gin diversification, colored/flavored line extensions, and bartender-led innovation that migrates to ready-to-serve (RTS) and ready-to-drink (RTD) formats. Growth catalysts include evolving cocktail culture, digital discovery, rising middle-class incomes in emerging markets, and expanding cold-chain/lightweight packaging that supports single-serve convenience. Competitive dynamics feature global multinationals with portfolio breadth, regional craft distillers emphasizing provenance, private-label challengers, and celebrity-backed brands; differentiation rests on credentialed storytelling (origin, maturation, sustainability), mixology partnerships, consistent sensory quality, and route-to-market execution. Supply-side priorities include resilient grain/fruit/agave sourcing, barrel availability, energy-efficient distillation, and compliance with labeling and advertising codes. Challenges persist around taxation and advertising restrictions, shifting duty-free dynamics, glass and logistics inflation, category blurring with aperitivos and low/no-alcohol adjacency, and the need to balance innovation with responsible marketing. Overall, the market is transitioning from volume-led competition to value-led portfolios that align occasion, format, and price-pack architecture - anchored in credible provenance, disciplined innovation, and omnichannel engagement.Consumable Spirits Market Key Insights

- Premiumization is a durable engine across price ladders. Consumers trade up to age-stated whiskies, additive-free agaves, single-estate rums, and craft gins with defined botanicals. Limited releases and cask finishes create scarcity loops, while core SKUs fund scale. The winners articulate why a step-up delivers superior aroma, mouthfeel, and mixability - not just packaging. Retailers favor clear good/better/best tiers with tasting notes and food-pairings to convert casual shoppers into category explorers with higher basket values over time.

- Cocktail culture drives repertoire expansion and trial. Home mixology and elevated on-trade menus broaden usage beyond shots and simple serves. Education (QR recipes, bar tools in gift packs) reduces intimidation and increases repeat. Brands that supply bartender playbooks, cross-category specs (vermouths, bitters, syrups), and glassware programs embed themselves in venue SOPs. Iconic classics (Negroni, Margarita, Old Fashioned) act as gateways for flavor exploration and seasonal limited editions.

- Agave spirits sustain outsized momentum with provenance cues. Tequila/mezcal growth leans on NOM transparency, additive-free positioning, roasting/fermentation narratives, and regional agave varietals. Barrel finishes extend sipping occasions while blanco purity underpins cocktail consistency. Supply discipline - agave age, farming practices, yeast management - is central to sensory stability. Collaborations with chefs and bars translate terroir into recognizable flavor language for mainstream consumers.

- RTD/RTS formats convert on-premise trends to convenience. Canned cocktails, bottled classics, and bar-strength mixers deliver consistency and portion control for at-home and events. Flavor stability, carbonation management, and ABV clarity are critical. Channel-smart pack sizes (single-serve, 4-packs, 750 mL RTS) unlock incremental occasions. Compliance-ready labels and responsible-drinking prompts improve retailer acceptance and long-term category credibility.

- Portfolio science beats single-hero bets. Balanced estates pair scale brands with craft credentials, ensuring year-round velocity and innovation headroom. Cross-segmentation (flavored vodkas for entry, aged rum for sipping, amari/aperitivos for low-ABV occasions) hedges macro and seasonal swings. Data-led assortment pruning avoids SKU sprawl; sensory guardrails keep line extensions from diluting flagship equity.

- Sustainability is moving from claims to audited practice. Grain/agave/fruit sourcing, water stewardship, and spent-grain/biogas recovery shape tender outcomes and trade partnerships. Lightweight glass, recycled aluminum, and alternative closures reduce freight emissions. Carbon disclosure and verified certifications increasingly influence premium placement and corporate accounts. Storytelling now requires measurable progress, not aspirational targets.

- Digital and first-party data reshape discovery and loyalty. DTC (where legal), e-grocery, and marketplace pages serve education (flavor maps, cocktail videos, reviews). CRM programs segment by occasion (sippers, mixers, hosts) and trigger tailored bundles. Geotargeted on-trade activations, QR to drink lists, and influencer-led content compress the awareness-to-trial funnel. Analytics inform flavor bets, pack sizes, and promo cadence across regions.

- Regulation and social responsibility set the playing field. Taxation, marketing codes, sponsorship rules, and age-gating govern claims and activations. Brands that invest in compliance training, transparent ABV communication, and responsible-drinking messaging build trust with retailers and authorities. Travel retail and cross-border sales require meticulous documentation and pack/label harmonization to prevent delistings.

- Supply-chain resilience protects sensory and service levels. Grain and barrel availability, glass supply, and logistics costs pressure COGS and NPD calendars. Dual-sourcing, inventory buffers for critical inputs, and sensory release protocols preserve quality. For agave, field agronomy, clonal diversity, and long-cycle planning are decisive. Predictive demand planning aligns festival spikes, gifting seasons, and limited-release drops.

- Route-to-market excellence compounds brand equity. Winning distributors execute with staff education, menu placements, and cold-box discipline for RTDs. In retail, end-caps, gifting towers, and cocktail kiosks outperform generic shelf sets. In on-trade, speed-rail standards, pour cost alignment, and bartender incentives build sustainable throughput. Consistency in service beats episodic campaigns for long-term share.

Consumable Spirits Market Reginal Analysis

North America

Premiumization and cocktail mainstreaming anchor demand across on- and off-trade. Agave leads repertoire expansion, while American whiskey and craft gin retain loyal bases. RTD cocktails scale through convenience and club channels. Retailers push clear tiering, gift packs, and recipe education; on-trade emphasizes speed rails and seasonal menus. Compliance, age-gating, and responsible-drinking activations are tightly policed, and e-commerce plays a growing role where permitted.Europe

A mature, category-diverse market with strong heritage in whisky, gin, aperitifs/amari, and brandies. On-trade sophistication drives classic cocktails and low-ABV aperitivo occasions, while off-trade leans into provenance and sustainability. Private-label growth coexists with premium craft. Cross-border labeling rigor and deposit systems shape packaging. Travel retail remains a brand theater for limited editions and gifting.Asia-Pacific

Rapid premiumization accompanies urban cocktail culture in Tier-1 cities, with Japanese whisky, craft gin, and highball formats notable. Agave gains in metropolitan bars; flavored/vodka mixes cater to young adults. E-commerce and super-apps accelerate discovery and delivery. Localization (flavors, spice tolerance, food pairings) improves resonance. Regulatory frameworks vary widely; education and compliant marketing are essential.Middle East & Africa

Demand concentrates in tourism corridors, premium hotels, private clubs, and selected retail in permitted markets. Mixology programs emphasize international classics and premium sipping SKUs. Logistics robustness, climate-resilient packaging, and training for consistent serves are decisive. Responsible-drinking and cultural sensitivity guide activations. Where alcohol sale is restricted, travel retail and hospitality anchor visibility.South & Central America

Vibrant local traditions (cachaça, rum, agave where permitted) intersect with global cocktail trends. On-trade revival and music/sports sponsorships lift premium segments, while off-trade embraces gift packs and RTDs for gatherings. Supply reliability, price-pack architecture for value channels, and bilingual education drive execution. Provenance and sustainability stories resonate with younger consumers entering the category.Consumable Spirits Market Segmentation

By Type

- Flavored

- Natural

By Product

- Vodka

- Brandy

- Whiskey

- Rum

- Tequila

By Application

- Household

- Restaurants

- Hotels

By Distribution Channel

- Liquor Shops

- Online Stores

- Hypermarket

- Others

Key Market players

Diageo plc, Pernod Ricard SA, Brown‑Forman Corporation, Suntory Holdings Limited, Bacardi Limited, Rémy Cointreau SA, LVMH Moët Hennessy Louis Vuitton SE, Davide Campari‑Milano N.V., William Grant & Sons Ltd, Sazerac Company, Inc., Kweichow Moutai Co., Ltd., Wuliangye Yibin Co., Ltd., Constellation Brands, Inc., Thai Beverage Public Company Limited, Edrington Group LimitedConsumable Spirits Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Consumable Spirits Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Consumable Spirits market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Consumable Spirits market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Consumable Spirits market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Consumable Spirits market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Consumable Spirits market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Consumable Spirits value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Consumable Spirits industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Consumable Spirits Market Report

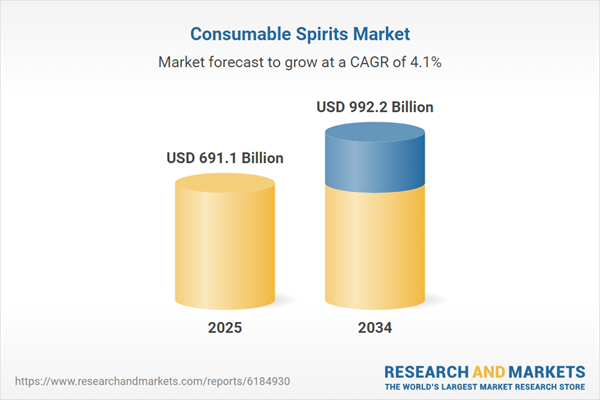

- Global Consumable Spirits market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Consumable Spirits trade, costs, and supply chains

- Consumable Spirits market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Consumable Spirits market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Consumable Spirits market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Consumable Spirits supply chain analysis

- Consumable Spirits trade analysis, Consumable Spirits market price analysis, and Consumable Spirits supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Consumable Spirits market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Diageo PLC

- Pernod Ricard SA

- Brown-Forman Corporation

- Suntory Holdings Limited

- Bacardi Limited

- Rémy Cointreau SA

- LVMH Moët Hennessy Louis Vuitton SE

- Davide Campari-Milano N.V.

- William Grant & Sons Ltd.

- Sazerac Company Inc.

- Kweichow Moutai Co. Ltd.

- Wuliangye Yibin Co. Ltd.

- Constellation Brands Inc.

- Thai Beverage Public Company Limited

- Edrington Group Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 691.1 Billion |

| Forecasted Market Value ( USD | $ 992.2 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |