Liquid Fluoroelastomers Market

The Liquid Fluoroelastomers (L-FKM) market comprises low-viscosity fluoroelastomer systems supplied as 100% solids, solventborne, or waterborne dispersions for sealing, coating, potting, impregnation, and adhesive applications where exceptional chemical, heat, and fuel resistance are critical. Top end-uses include automotive and e-mobility (shaft seals, gasket coatings, fuel and e-fuel contact components, e-drive thermal interfaces), semiconductor and electronics (chemical-resistant coatings, low-metal-ion sealants), aerospace (fuel system elastomeric films), chemical processing (lining and tank sealants), and oil & gas (downhole and refinery contact). Latest trends center on high-purity and low-extractables grades for wafer fabs, peroxide-curable and dual-cure chemistries for faster takt times, and waterborne/low-VOC platforms that meet tightening EHS expectations. Drivers include the shift to higher operating temperatures, aggressive chemistries (biofuels, e-fuels, amine sweetening, new battery electrolytes), and OEM durability targets that exceed conventional elastomer performance. Competitive dynamics feature integrated fluoromaterials producers and specialty formulators competing on purity, cure speed, adhesion to diverse substrates (metals, FFKM/FKM, engineering plastics), and global technical service. Supply security of upstream fluorochemicals and energy costs remain watchpoints; meanwhile, regulatory scrutiny of PFAS pushes innovation toward polymer architecture with improved environmental profiles, reduced residuals, and traceable manufacturing. Over the forecast horizon, growth will favor L-FKM systems that enable thinner, more uniform films, automated 2K/3K dispensing, and reliable bondlines on mixed assemblies used in EV powertrains, semiconductor wet benches, and corrosive chemical handling - delivering lifecycle value via longer maintenance intervals, reduced permeation, and stable performance under thermal cycling.Liquid Fluoroelastomers Market Key Insights

- Performance moat vs. alternatives. L-FKM’s resistance to fuels, solvents, acids, and high temperatures underpins replacement of conventional elastomers in critical duty. Formulators tailor fluorine content and cure packages to balance flexibility with low permeation for thin coatings and impregnations.

- Processing versatility expands use cases. Spray, dip-spin, screen print, micro-dispense, and capillary impregnation enable uniform films on complex geometries. Controlled rheology supports automated 2K lines, minimizing squeeze-out and ensuring consistent bondline thickness in high-volume assemblies.

- Cure chemistry evolution. Peroxide-curable and dual-cure (thermal/UV) systems shorten cycle times and improve green strength for rapid handling. Bisphenol cure remains for specific adhesion/chemical profiles, with optimized accelerators to lower post-cure requirements.

- Adhesion engineering. Primerless adhesion to metals and engineering plastics is a differentiator. Silane-modified and latent-adhesive variants improve interfacial durability after thermal shock, salt fog, and chemical immersion, reducing warranty risk.

- High-purity electronics focus. Low metal ion, low outgassing L-FKMs support wafer-fab chemistries and display wet processes. Particle and extractables control, plus certificate-of-analysis detail, are decisive for vendor qualification at fabs and toolmakers.

- E-mobility opportunities. EV powertrains, battery modules, and thermal loops need seals and coatings tolerant of glycols, novel coolants, and phosphate/borate packages at elevated temperatures. L-FKM aids noise/vibration damping and dielectric stability in compact assemblies.

- Regulatory pressure and PFAS strategy. Producers invest in cleaner processes, lower residuals, and transparency. Waterborne dispersions and solvent-reduced systems address VOC and worker exposure while maintaining chemical envelope.

- Supply chain resilience. Availability of fluorspar-to-HF intermediates and specialty monomers shapes regional pricing and lead times. Dual-sourcing, regional finishing, and formulation flexibility mitigate disruptions and logistics cost surges.

- Cost-value calculus. Although premium-priced, L-FKM reduces downtime, leakage, and maintenance intervals in corrosive service. Lifecycle analyses increasingly inform procurement, particularly in fabs, refineries, and high-reliability aerospace components.

- Sustainability and end-of-life. Longer service life, thinner films, and solvent-lean systems lower environmental footprint per function. Documentation, traceability, and compliance toolkits support customer ESG reporting without compromising performance.

Liquid Fluoroelastomers Market Reginal Analysis

North America

Demand is anchored by automotive, aerospace, semiconductor, and chemical processing. EV platform launches increase specification of L-FKM for thermal management, coolant contact, and high-temperature gasketing. Semiconductor expansions require high-purity dispersions with tight extractables control. Buyers emphasize local technical support, rapid prototyping, and VOC-compliant lines; dual-sourcing and regional inventory help buffer feedstock volatility.Europe

Regulatory scrutiny drives preference for waterborne and low-residual formulations alongside robust compliance documentation. Automotive and industrial OEMs deploy L-FKM for e-fuel compatibility, turbo-thermal environments, and long drain intervals. Chemical cluster upgrades in Northern and Western Europe value thin, repairable linings and seal coats. Qualification cycles are rigorous, rewarding suppliers with strong application labs and field engineering.Asia-Pacific

Electronics manufacturing hubs and expanding semiconductor capacity underpin high-purity L-FKM adoption. Japan and Korea prioritize ultra-clean grades; China’s battery and EV ecosystems favor automated dispensing and primerless adhesion systems for scale. Industrial chemicals and refining projects in Southeast Asia add steady demand. Localized blending and technical centers accelerate approvals and reduce lead times.Middle East & Africa

Refining, petrochemicals, and gas processing drive a need for chemically robust, high-temperature coatings and sealants. Turnkey contractors specify L-FKM for aggressive media and extended maintenance cycles. Harsh environments elevate requirements for permeability resistance and thermal cycling stability. Vendor selection hinges on field service, training, and documented performance in corrosive duty.South & Central America

Oil, gas, mining, and chemical sectors adopt L-FKM for acidizing, solvent handling, and hot-service sealing. Automotive assembly and aftermarket provide additional pull for gasket coatings and adhesives. Reliability under variable utilities and logistics conditions makes solvent-reduced and fast-cure systems attractive. Distributors with technical capability and consistent regional stock position gain share with industrial end users.Liquid Fluoroelastomers Market Segmentation

By Product

- FSR

- FKM-based liquid formulations

- FFKM-based liquid formulations

By Application

- Automotive

- Aerospace

- Oil & Gas

- Pharmaceutical & Food Processing

- Chemical Processing

- Others

Key Market players

3M, Daikin Industries Ltd., Solvay S.A., The Chemours Company, Asahi Glass Co., Ltd. (AGC Inc.), Gujarat Fluorochemicals Limited (GFL), Shin-Etsu Chemical Co., Ltd., Dow Inc., Halopolymer Trading House, Shanghai 3F New Materials Co., Ltd., Dongyue Group Limited, Chenguang Research Institute, Saint-Gobain Performance Plastics, Lanxess AG, Zhuzhou Hongda Polymer Materials Co., Ltd.Liquid Fluoroelastomers Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Liquid Fluoroelastomers Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Liquid Fluoroelastomers market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Liquid Fluoroelastomers market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Liquid Fluoroelastomers market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Liquid Fluoroelastomers market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Liquid Fluoroelastomers market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Liquid Fluoroelastomers value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Liquid Fluoroelastomers industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Liquid Fluoroelastomers Market Report

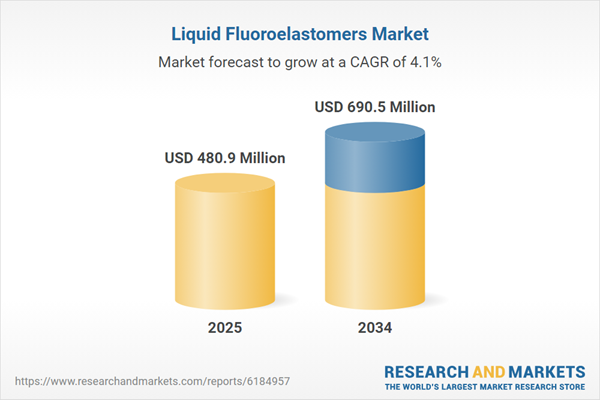

- Global Liquid Fluoroelastomers market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Liquid Fluoroelastomers trade, costs, and supply chains

- Liquid Fluoroelastomers market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Liquid Fluoroelastomers market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Liquid Fluoroelastomers market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Liquid Fluoroelastomers supply chain analysis

- Liquid Fluoroelastomers trade analysis, Liquid Fluoroelastomers market price analysis, and Liquid Fluoroelastomers supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Liquid Fluoroelastomers market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M

- Daikin Industries Ltd.

- Solvay S.A.

- The Chemours Company

- Asahi Glass Co.

- Ltd. (AGC Inc.)

- Gujarat Fluorochemicals Limited (GFL)

- Shin-Etsu Chemical Co. Ltd.

- Dow Inc.

- Halopolymer Trading House

- Shanghai 3F New Materials Co. Ltd.

- Dongyue Group Limited

- Chenguang Research Institute

- Saint-Gobain Performance Plastics

- Lanxess AG

- Zhuzhou Hongda Polymer Materials Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 480.9 Million |

| Forecasted Market Value ( USD | $ 690.5 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |