The global passive optical network (PON) market is experiencing rapid growth due to increasing demand for high-speed internet, fiber-optic network expansion, and advancements in broadband connectivity. Passive optical networks, which use fiber-optic technology to deliver high-bandwidth data transmission, are gaining traction as a cost-effective and energy-efficient alternative to traditional copper-based networks. PON technology supports multiple applications, including fiber-to-the-home (FTTH), fiber-to-the-premises (FTTP), and fiber-to-the-building (FTTB), enabling seamless connectivity for residential, commercial, and industrial users. Leading companies such as Huawei, Nokia, ZTE, and Cisco are actively investing in next-generation PON solutions, including 10G PON, 25G PON, and 50G PON, to support the growing demand for ultra-fast internet. Governments worldwide are prioritizing fiber-optic infrastructure development to enhance digital transformation, smart city initiatives, and 5G backhaul connectivity. As internet consumption continues to rise, the passive optical network market is set to expand further, offering high-speed, reliable, and future-ready broadband solutions.

The passive optical network market has witnessed significant advancements driven by the large-scale deployment of fiber-optic networks and the growing adoption of AI-driven network management solutions. The increasing rollout of 10G PON and 25G PON technologies has enabled faster broadband speeds, catering to the rising demand for ultra-HD video streaming, cloud computing, and remote work applications. Telecom operators and internet service providers (ISPs) have accelerated fiber-optic deployments to bridge the digital divide and enhance connectivity in underserved regions. Additionally, artificial intelligence (AI) and machine learning (ML) are being integrated into PON network management systems to improve traffic optimization, predictive maintenance, and fault detection. The growing demand for 5G infrastructure has also propelled the adoption of passive optical networks for mobile backhaul, enabling low-latency and high-bandwidth connectivity. Meanwhile, sustainability has become a key focus area, with companies investing in energy-efficient optical networking solutions to reduce power consumption and minimize environmental impact. Despite these advancements, supply chain disruptions and semiconductor shortages have posed challenges to the smooth deployment of fiber-optic equipment.

The passive optical network market is expected to see widespread adoption of 50G PON and beyond, paving the way for next-generation fiber-optic networks with enhanced scalability and speed. The convergence of fixed and wireless networks will drive the demand for hybrid fiber-wireless solutions, enabling seamless integration between broadband and 5G connectivity. Software-defined networking (SDN) and network function virtualization (NFV) will gain traction, allowing telecom operators to automate network provisioning, optimize traffic flow, and enhance service agility. AI-powered self-healing networks will further improve operational efficiency by identifying and resolving network issues in real time. Additionally, the expansion of fiber-optic connectivity in smart cities and industrial automation will create new growth opportunities for PON solutions. With continued investments in digital infrastructure, rural broadband initiatives, and government-backed connectivity projects, the passive optical network market will remain a key enabler of high-speed, reliable, and future-ready broadband connectivity.

Key Insights: Passive Optical Network Market

- Adoption of 10G, 25G, and 50G PON Technologies: Next-generation PON solutions are being deployed to support ultra-fast broadband speeds and high-capacity data transmission for residential and enterprise applications.

- Integration of AI & Machine Learning in Network Management: AI-driven automation is improving network efficiency by enabling real-time fault detection, traffic optimization, and predictive maintenance.

- Expansion of Fiber-to-the-Home (FTTH) & FTTP Deployments: The growing need for high-speed internet is driving large-scale fiber-optic rollouts in urban and rural areas, improving connectivity for households and businesses.

- Passive Optical Networks for 5G Backhaul: PON technology is increasingly being used to support 5G infrastructure, ensuring seamless connectivity and high-speed data transmission for mobile networks.

- Sustainability & Energy-Efficient Optical Networking: Vendors are focusing on green networking solutions, reducing power consumption, and developing eco-friendly PON infrastructure to meet environmental sustainability goals.

- Rising Demand for High-Speed Internet & Cloud Applications: The increasing adoption of video streaming, remote work, IoT devices, and cloud computing is driving the need for high-bandwidth fiber-optic networks.

- Government Investments in Broadband Infrastructure: National broadband initiatives and digital transformation projects are accelerating the deployment of passive optical networks in both urban and rural areas.

- Growing 5G Rollout & Edge Computing Demand: The expansion of 5G networks and edge computing applications requires robust fiber-optic backhaul solutions to ensure low-latency connectivity and high-speed data processing.

- Transition from Copper to Fiber-Based Networks: The shift from legacy copper networks to fiber-optic solutions is improving network reliability, reducing maintenance costs, and enhancing data transmission speeds.

- Supply Chain Disruptions & Semiconductor Shortages: The availability of critical components such as optical transceivers and semiconductor chips remains a challenge, delaying network deployments and increasing costs for telecom operators.

Passive Optical Network Market Segmentation

By Component

- Optical Power Splitters

- Optical Filters

- Wavelength Division Multiplexer/De-Multiplexe

By Structure

- Ethernet Passive Optical Networks (EPON)

- Optical Network Terminal (ONT)

- Optical Line Terminal (OLT)

- Gigabit Passive Optical Network (GPON)

- Optical Network Terminal (ONT)

- Optical Line Terminal (OLT)

By Application

- Residential Service (FTTH)

- Business Service (Other FTTx)

- Mobile Backhaul

Key Companies Analysed

- Verizon Communications Inc.

- Huawei Technologies Co Ltd.

- Hitachi Ltd.

- Cisco Systems Inc.

- Mitsubishi Electric Corporation

- Broadcom Corporation Inc.

- Fujitsu Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Sumitomo Electric Industries Ltd.

- NEC Corporation

- ZTE Corporation

- Corning Inc.

- Freescale Semiconductor Inc.

- NXP Semiconductors

- Motorola Solutions Inc.

- FiberHome Technologies Group

- Ciena Corporation

- Lumentum Operations LLC

- Infinera Corporation

- Finisar Corporation

- ADTRAN Inc.

- Calix Inc.

- Tellabs Inc.

- Acacia Communications Inc.

- ADVA Optical Networking SE

- Oclaro Inc.

- NeoPhotonics Corporation

- Source Photonics Inc.

- Alphion Corporation

- TP-Link Technologies Co Ltd.

Passive Optical Network Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.

Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.Passive Optical Network Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.

Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.Countries Covered

- North America - Passive Optical Network market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Passive Optical Network market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Passive Optical Network market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Passive Optical Network market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Passive Optical Network market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Passive Optical Network value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Passive Optical Network industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Passive Optical Network Market Report

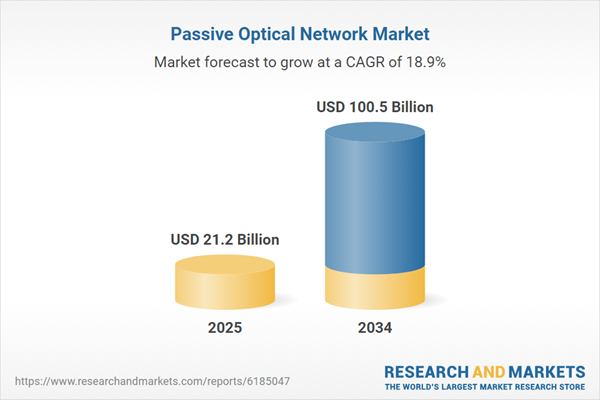

- Global Passive Optical Network market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Passive Optical Network trade, costs, and supply chains

- Passive Optical Network market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Passive Optical Network market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Passive Optical Network market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Passive Optical Network supply chain analysis

- Passive Optical Network trade analysis, Passive Optical Network market price analysis, and Passive Optical Network supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Passive Optical Network market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Verizon Communications Inc.

- Huawei Technologies Co Ltd.

- Hitachi Ltd.

- Cisco Systems Inc.

- Mitsubishi Electric Corporation

- Broadcom Corporation Inc.

- Fujitsu Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Sumitomo Electric Industries Ltd.

- NEC Corporation

- ZTE Corporation

- Corning Inc.

- Freescale Semiconductor Inc.

- NXP Semiconductors

- Motorola Solutions Inc.

- FiberHome Technologies Group

- Ciena Corporation

- Lumentum Operations LLC

- Infinera Corporation

- Finisar Corporation

- ADTRAN Inc.

- Calix Inc.

- Tellabs Inc.

- Acacia Communications Inc.

- ADVA Optical Networking SE

- Oclaro Inc.

- NeoPhotonics Corporation

- Source Photonics Inc.

- Alphion Corporation

- TP-Link Technologies Co Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 21.2 Billion |

| Forecasted Market Value ( USD | $ 100.5 Billion |

| Compound Annual Growth Rate | 18.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |