The organic pharmaceutical excipients market has been gaining traction as pharmaceutical companies increasingly shift toward natural, non-toxic, and environmentally friendly formulation ingredients. Pharmaceutical excipients play a crucial role in drug formulation by enhancing stability, bioavailability, and the overall effectiveness of active pharmaceutical ingredients (APIs). Organic excipients, derived from plant-based, biodegradable, and non-synthetic sources, are emerging as a preferred choice due to their superior compatibility with clean-label and green chemistry initiatives. Rising regulatory scrutiny over synthetic excipients, concerns about chemical toxicity, and growing consumer demand for natural ingredients in medications have fueled the market’s expansion. Organic excipients such as starches, celluloses, proteins, sugars, and fatty acids are widely used in tablet binding, coating, and controlled drug release systems. The pharmaceutical industry’s increasing adoption of sustainable manufacturing processes has further propelled demand for organic excipients. While higher production costs and stringent regulatory compliance remain challenges, continued investment in research and development, coupled with advancements in excipient functionality, is expected to drive steady growth in the organic pharmaceutical excipients market.

The organic pharmaceutical excipients market witnessed notable advancements, with increased adoption in drug formulation, nutraceuticals, and biopharmaceuticals. The shift toward plant-based and biodegradable excipients accelerated as pharmaceutical manufacturers sought alternatives to synthetic binders and fillers. Innovations in natural polymers, including cellulose derivatives and alginates, improved drug delivery efficiency, making organic excipients more appealing to drug developers. The market also saw a surge in demand for lactose-free and gluten-free excipients, catering to patients with allergies and dietary restrictions. Regulatory agencies such as the FDA and EMA introduced updated guidelines favoring sustainable and non-toxic excipients, leading to greater transparency in ingredient sourcing. Additionally, pharmaceutical companies explored innovative processing techniques, such as microencapsulation and nanotechnology, to enhance the stability and solubility of organic excipients. Despite these positive developments, supply chain disruptions and high extraction costs posed challenges for manufacturers. However, strategic partnerships between pharmaceutical companies and organic excipient suppliers strengthened market resilience, ensuring steady supply and quality consistency. Overall, 2024 marked a transformative year, solidifying the position of organic pharmaceutical excipients in mainstream drug formulation.

The organic pharmaceutical excipients market is expected to witness further expansion, driven by technological advancements, regulatory support, and increasing demand for sustainable drug formulations. AI-powered formulation techniques will enable precise customization of excipient compositions, optimizing drug efficacy and patient compliance. The rise of biologics and personalized medicine will boost demand for specialized organic excipients tailored for targeted drug delivery. Additionally, the growing focus on environmental sustainability will push pharmaceutical manufacturers to adopt carbon-neutral and eco-friendly excipient sourcing practices. Emerging markets in Asia and Latin America will become key growth regions as regulatory frameworks evolve and consumer demand for natural healthcare solutions rises. The integration of blockchain technology in excipient supply chains will enhance traceability and ensure compliance with organic certification standards. However, challenges such as standardization issues, cost competitiveness, and scalability concerns will need to be addressed for widespread market penetration. Despite these hurdles, the organic pharmaceutical excipients industry is poised for long-term growth, driven by a combination of regulatory advancements, consumer preference for natural ingredients, and ongoing innovations in drug formulation science.

Key Insights: Organic Pharmaceutical Excipients Market

- Rising Demand for Plant-Based and Biodegradable Excipients: Pharmaceutical companies are increasingly shifting towards plant-derived and biodegradable excipients such as cellulose, starches, and alginates to align with sustainability goals and enhance drug formulation safety.

- Advancements in Nanotechnology for Organic Excipients: The adoption of nanotechnology is revolutionizing the organic excipient market by improving drug solubility, bioavailability, and targeted delivery. These advancements are enhancing formulation efficiency and expanding the application of organic excipients in complex drug development.

- Integration of Blockchain for Supply Chain Transparency: Pharmaceutical companies are leveraging blockchain technology to track and authenticate organic excipient sourcing, ensuring compliance with stringent regulatory standards and improving traceability throughout the supply chain.

- Growth of Personalized and Biologic Medications: The increasing focus on personalized medicine and biologics is driving demand for highly specialized organic excipients that enhance targeted drug delivery while maintaining biocompatibility and stability in complex formulations.

- Expansion of Clean-Label and Non-Allergenic Excipients: The market is seeing a rise in lactose-free, gluten-free, and non-allergenic organic excipients, catering to patients with dietary restrictions and ensuring broader pharmaceutical accessibility.

- Stringent Regulations on Synthetic Excipients: Regulatory agencies worldwide are tightening restrictions on synthetic and chemically processed excipients, prompting pharmaceutical companies to adopt safer, organic alternatives that comply with evolving safety and sustainability standards.

- Increasing Consumer Demand for Natural Ingredients in Medications: Patients and healthcare providers are prioritizing natural and organic ingredients in pharmaceuticals, driving the need for cleaner, non-toxic excipients that align with consumer preferences for safe and effective treatments.

- Advancements in Green Chemistry and Sustainable Drug Manufacturing: The adoption of eco-friendly and green chemistry practices in pharmaceutical production is encouraging the use of organic excipients, reducing environmental impact while improving drug formulation efficiency.

- Rising Investments in Biopharmaceutical and Nutraceutical Sectors: The rapid expansion of biopharmaceuticals and nutraceuticals is fueling demand for organic excipients that enhance drug stability, improve absorption, and support innovative delivery mechanisms in modern medicine.

- High Production Costs and Scalability Issues: The extraction, processing, and certification of organic excipients involve higher costs compared to synthetic alternatives. Scalability challenges in organic ingredient sourcing can impact production efficiency and limit market penetration, especially in price-sensitive pharmaceutical markets.

Organic Pharmaceutical Excipients Market Segmentation

By Type

- Oleochemicals

- Carbohydrates

- Petrochemicals

- Protein

- Other Types

By Functions

- Binders

- Coating Agents

- Colorants

- Disintegrates

- Other Functions

By Application

- Oral Formulations

- Topical Formulations

- Parenteral Formulations

- Other Applications

Key Companies Analysed

- Roquette Frères SA

- DuPont de Nemours Inc.

- Ashland Inc.

- Badische Anilin- und Sodafabrik

- Kerry Group plc

- Evonik Industries AG

- Croda International plc

- The Lubrizol Corporation

- Innophos Holdings Inc.

- Wacker Chemie AG

- Merck KGaA

- Colorcon Asia Private Limited

- Rochem International Inc.

- Eastman Chemical Company

- JRS PHARMA GMBH + CO KG

- Cargill Incorporated

- Ingredion Incorporated

- Sensient Technologies Corporation

- Internatio-Müller Chemical Distribution

- Lonza Group Ltd.

- DFE PHARMA INDIA PRIVATE LIMITED.

- Omya AG

- Sigachi Industries Pvt. Ltd.

- Meggle AG

- Associated British Foods plc

- Archer Daniels Midland Company

- Food Machinery & Chemical Corporation

- Innospec Inc.

- Mitsubishi Chemical Corporation

- International Flavors & Fragrances Inc

Organic Pharmaceutical Excipients Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Organic Pharmaceutical Excipients Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Organic Pharmaceutical Excipients market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Organic Pharmaceutical Excipients market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Organic Pharmaceutical Excipients market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Organic Pharmaceutical Excipients market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Organic Pharmaceutical Excipients market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Organic Pharmaceutical Excipients value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Organic Pharmaceutical Excipients industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Organic Pharmaceutical Excipients Market Report

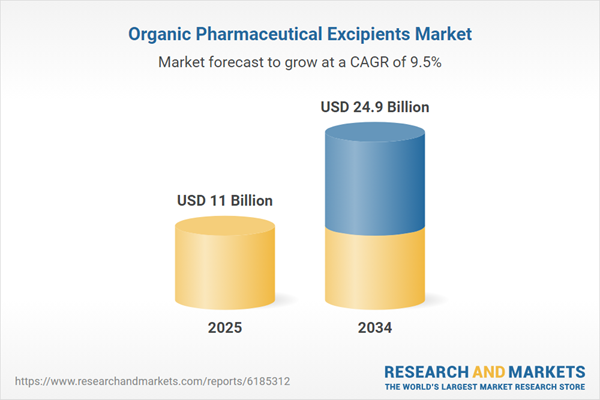

- Global Organic Pharmaceutical Excipients market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Organic Pharmaceutical Excipients trade, costs, and supply chains

- Organic Pharmaceutical Excipients market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Organic Pharmaceutical Excipients market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Organic Pharmaceutical Excipients market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Organic Pharmaceutical Excipients supply chain analysis

- Organic Pharmaceutical Excipients trade analysis, Organic Pharmaceutical Excipients market price analysis, and Organic Pharmaceutical Excipients supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Organic Pharmaceutical Excipients market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roquette Frères SA

- DuPont de Nemours Inc.

- Ashland Inc.

- Badische Anilin- und Sodafabrik

- Kerry Group PLC

- Evonik Industries AG

- Croda International PLC

- The Lubrizol Corporation

- Innophos Holdings Inc.

- Wacker Chemie AG

- Merck KGaA

- Colorcon Asia Private Limited

- Rochem International Inc.

- Eastman Chemical Company

- JRS PHARMA GMBH + CO KG

- Cargill Incorporated

- Ingredion Incorporated

- Sensient Technologies Corporation

- Internatio-Müller Chemical Distribution

- Lonza Group Ltd.

- DFE PHARMA INDIA PRIVATE LIMITED.

- Omya AG

- Sigachi Industries Pvt. Ltd.

- Meggle AG

- Associated British Foods PLC

- Archer Daniels Midland Company

- Food Machinery & Chemical Corporation

- Innospec Inc.

- Mitsubishi Chemical Corporation

- International Flavors & Fragrances Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 24.9 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |