The precision turned product manufacturing market is a critical segment within the machining industry, focused on the production of high-precision components through turning operations. These products are used in various industries, including automotive, aerospace, electronics, and medical devices, where the need for highly accurate, durable, and complex parts is essential. Precision turning involves the use of advanced machinery such as CNC lathes, which enable manufacturers to produce parts with tight tolerances and high surface quality. The demand for precision turned products is driven by the ongoing trend toward miniaturization of components, the need for enhanced performance in complex applications, and the increasing demand for automation and precision engineering across various sectors. As industries seek higher efficiencies and product performance, the precision turned product manufacturing market continues to expand, especially with the rise of technologically advanced products that require a higher level of precision.

The precision turned product manufacturing market saw continued advancements in automation and digitalization, with the integration of AI-driven systems and real-time data analytics into production processes. The adoption of advanced CNC turning centers, capable of producing more complex shapes and geometries, became more prevalent. These technologies have reduced production times while improving precision, especially in industries like aerospace and automotive, where high-quality components are crucial. Additionally, the market saw increased demand from the medical device industry, driven by the need for precise components for implants, surgical instruments, and diagnostic equipment. The implementation of Industry 4.0 solutions, such as interconnected machines and predictive maintenance, also gained traction in this sector, ensuring more efficient operations and reduced downtime. Despite these advancements, challenges such as the high cost of equipment, the need for skilled labor, and supply chain disruptions impacted market growth, particularly in smaller manufacturing operations.

The precision turned product manufacturing market is expected to grow as technological innovations continue to shape the industry. The introduction of more advanced materials, including composites and lightweight alloys, will drive demand for precision turned products in sectors such as aerospace and electric vehicles (EVs). Additionally, the market is likely to see greater adoption of additive manufacturing and hybrid machining technologies that combine traditional turning processes with 3D printing for more complex geometries. The increased focus on sustainability will also influence the market, as manufacturers seek to reduce waste and energy consumption in the production of precision parts. Moreover, the continued integration of smart technologies, such as IoT-enabled machines and cloud-based analytics, will enable more efficient, data-driven production processes, improving both the speed and quality of manufacturing. As the demand for precision components grows, the market for precision turned products will continue to thrive, with innovations and efficiency improvements driving the industry forward.

Key Insights: Precision Turned Product Manufacturing Market

- Integration of AI and Real-Time Data Analytics: AI-driven systems and real-time analytics are enabling more efficient production processes and better quality control in precision turned product manufacturing.

- Advancements in CNC Turning Centers: The use of advanced CNC turning centers with enhanced capabilities to handle complex shapes and geometries is growing in demand.

- Increased Demand from Medical Device Industry: The need for highly precise components for implants, diagnostic tools, and surgical instruments is driving the market's growth in the healthcare sector.

- Implementation of Industry 4.0 Solutions: The rise of smart, interconnected machines and predictive maintenance systems is improving efficiency and reducing downtime in precision manufacturing.

- Focus on Sustainability and Energy Efficiency: Manufacturers are adopting greener technologies and processes to reduce waste and energy consumption in precision turned product manufacturing.

- Rising Demand for Precision in Automotive and Aerospace: The growing need for highly accurate and durable components in aerospace, automotive, and defense sectors is driving the demand for precision turned products.

- Technological Advancements in CNC Machinery: The development of more advanced CNC turning machines capable of higher precision and complex parts production is a significant market driver.

- Increase in Automation and Manufacturing Efficiency: Automation and smart manufacturing systems are improving production efficiency, reducing labor costs, and ensuring higher product consistency.

- Demand for High-Quality Medical Components: The increasing use of precision turned components in the medical industry for implants, surgical devices, and diagnostics is fueling market growth.

- High Equipment Costs and Skilled Labor Shortage: The high cost of advanced CNC equipment and the need for skilled operators to manage complex machinery remain significant challenges in the precision turned product manufacturing market.

Precision Turned Product Manufacturing Market Segmentation

By Type

- Automatic Screw Machines

- Rotary Transfer Machines

- Computer Numerically Controlled (CNC)

- Lathes Or Turning Centers

By Operation

- Manual Operation

- CNC Operation

By End User

- Automobile

- Electronics

- Defense

- Healthcare

Key Companies Analysed

- Stanley Black & Decker Inc.

- Parker Hannifin Corporation

- Doosan Corporation

- Sandvik AB

- NSK Ltd.

- FANUC Corporation

- Moog Inc.

- DMG MORI Co. Ltd.

- Kennametal Inc.

- Barnes Group Inc.

- Gleason Corporation

- Haas Automation Inc.

- Tsugami Corporation

- Hardinge Inc.

- Tompkins Products Inc.

- Hurco Companies Inc.

- Tornos Holding AG

- Creed Monarch

- Greystone of Lincoln

- Brother Industries Ltd.

- Mahr GmbH

- Alpha Grainger Mfg

- Herker Industries

- Hydromat Inc.

- Swiss Precision Machining Inc.

Precision Turned Product Manufacturing Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Precision Turned Product Manufacturing Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Precision Turned Product Manufacturing market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Precision Turned Product Manufacturing market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Precision Turned Product Manufacturing market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Precision Turned Product Manufacturing market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Precision Turned Product Manufacturing market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Precision Turned Product Manufacturing value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Precision Turned Product Manufacturing industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Precision Turned Product Manufacturing Market Report

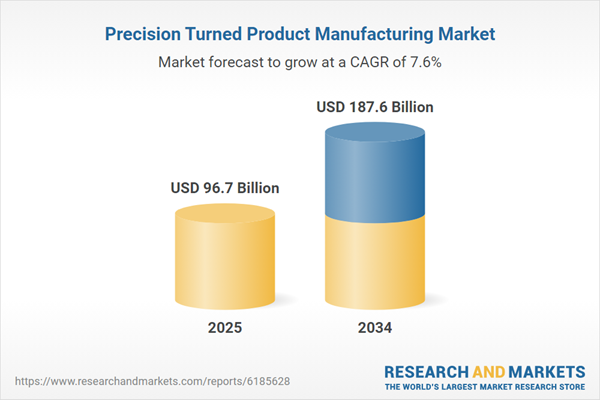

- Global Precision Turned Product Manufacturing market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Precision Turned Product Manufacturing trade, costs, and supply chains

- Precision Turned Product Manufacturing market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Precision Turned Product Manufacturing market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Precision Turned Product Manufacturing market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Precision Turned Product Manufacturing supply chain analysis

- Precision Turned Product Manufacturing trade analysis, Precision Turned Product Manufacturing market price analysis, and Precision Turned Product Manufacturing supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Precision Turned Product Manufacturing market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Stanley Black & Decker Inc.

- Parker Hannifin Corporation

- Doosan Corporation

- Sandvik AB

- NSK Ltd.

- FANUC Corporation

- Moog Inc.

- DMG MORI Co. Ltd.

- Kennametal Inc.

- Barnes Group Inc.

- Gleason Corporation

- Haas Automation Inc.

- Tsugami Corporation

- Hardinge Inc.

- Tompkins Products Inc.

- Hurco Companies Inc.

- Tornos Holding AG

- Creed Monarch

- Greystone of Lincoln

- Brother Industries Ltd.

- Mahr GmbH

- Alpha Grainger Mfg

- Herker Industries

- Hydromat Inc.

- Swiss Precision Machining Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 96.7 Billion |

| Forecasted Market Value ( USD | $ 187.6 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |