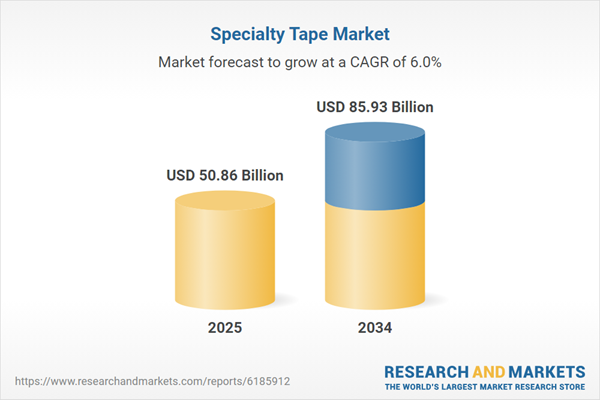

Specialty Tape Market

The Specialty Tape market spans engineered pressure-sensitive and heat-activated tapes designed to bond, seal, mask, protect, damp, insulate, and mark across demanding industrial and healthcare environments. Core constructions pair performance backings (PET, PP, PE and EVA foams, PU foams, PVC, polyimide, paper, cloth, nonwovens) with tailored adhesive chemistries (solvent/waterborne/hot-melt acrylics, rubber/resin, silicones) and calibrated release liners. Top end-uses include automotive and mobility (panel bonding, NVH damping, wire harnessing, battery pack gasketing), electronics and semiconductors (assembly, EMI/RFI shielding, thermal interface, reworkable masking), building and construction (flashing, vapor barrier, HVAC), medical (wound care, wearable sensors, drapes), hygiene, aerospace, renewable energy (PV module edge seals, wind blade protection), and industrial MRO/paint shops. Structural tailwinds come from lightweighting, design for manufacturability, and the shift from mechanical fasteners/liquid adhesives to clean, fast, low-profile assemblies that enable automation and mixed materials. Innovation clusters around high-temperature stability, adhesion to low-surface-energy (LSE) plastics, foam-core conformability, repositionable/removable systems, and integrated functions (thermal/electrical/optical). Sustainability priorities drive solvent-free processing, liner/thin-film down-gauging, bio-based or recycled backings, and take-back/recycling of spent liners. Competitive differentiation turns on consistent tack/peel/shear under humidity and thermal cycling, residue-free removal, liner handling at speed, and converting flexibility for kiss-cut parts and kitted assemblies. Route-to-market blends direct OEM specification with converter networks that offer rapid prototyping, clean-room slitting, and VMI programs. As EVs, wearables, and high-density electronics proliferate - and construction codes tighten around air/vapor control - spec-grade specialty tapes gain share by delivering repeatable, validated performance with fewer process steps and less rework.Specialty Tape Market Key Insights

- Adhesion to LSE substrates is decisive. Polyolefins and painted composites demand primers, specialty acrylics, or silicone systems; success depends on surface-energy tuning, wet-out at low pressure, and stable peel after thermal shock.

- From fixings to functional layers. Tapes now provide EMI shielding, thermal spreading, flame retardancy, and optical clarity - reducing part count and enabling thinner devices and modular assemblies.

- Process productivity rules. Instant handling strength, predictable liner release, and die-cut cleanliness cut cycle times. Converters with clean-room slitting, laser kiss-cut, and rapid CAD-to-part workflows win tooling-sensitive programs.

- High-temp and rework coexist. Paint-shop masking and electronics require heat/chem resistance, while serviceability needs clean removability; hybrid adhesives and engineered carriers balance these trade-offs.

- Foam tapes enable lightweighting. Acrylic and PU foams replace rivets and welds for exterior trim, glazing, and façade panels, delivering stress dissipation and NVH gains with weatherable, UV-stable bonds.

- Medical skin science matters. Wearable and wound-care tapes hinge on atraumatic removal, moisture vapor transmission, and extended wear; soft silicones and breathable nonwovens raise patient comfort and adherence.

- Sustainability shifts portfolios. Waterborne/hot-melt acrylics, solvent-free lines, recycled/bio-based films, and liner take-back programs lower footprint without sacrificing tack or shear. Down-gauging delivers material and logistics wins.

- Data-driven qualification. OEMs demand multi-axis aging (heat/humidity/chemicals/UV), fogging/VOC, dielectric and flame ratings, and PPAP-style documentation to de-risk long-life applications.

- Supply resilience is a moat. Redundant coaters, global liner/film sourcing, and spec-equivalent alternates protect build schedules from polymer, paper, and silicone shortages.

- Digital customer experience. Selector tools, QR-linked TDS/SDS, and inline QA (vision, coat-weight) compress design cycles; EDI/VMI and kitted SKUs reduce line changeovers and inventory.

Specialty Tape Market Reginal Analysis

North America

Demand is anchored in automotive (including EV battery assembly), construction air/vapor sealing, and electronics. Specs emphasize adhesion to composites/LSE plastics, cold-weather installability, and UL/ASTM/ISO compliance. Converters with clean-room capacity, rapid prototyping, and kitting support OEM just-in-time programs. Sustainability programs push solvent-free acrylics and liner recycling, while e-commerce drives protective and tamper-evident tapes.Europe

A standards-intensive market shaped by e-mobility, building-envelope airtightness, and medical device regulations. Façade and roofing tapes require durable UV/weather resistance and low-emission credentials for indoor air quality. OEMs prioritize EPDs, recycled content, and MEKO-/tin-free systems. Precision converting for premium automotive interiors and appliances favors low-fogging, odor-controlled adhesives and color-stable carriers.Asia-Pacific

The production hub for films/liners and the volume engine for electronics and mobility. Japan/Korea focus on high-spec electronics, thermal/EMI tapes, and optical grades; China and Southeast Asia scale foam/acrylic systems for appliances, 2-wheelers, and construction. Speed to tool and localized technical service are critical. Renewable energy, battery modules, and 5G infrastructure expand thermal and flame-retardant tape demand.Middle East & Africa

Growth centers on construction sealing, HVAC, and industrial MRO under high heat, UV, and dust. Tapes with aggressive initial tack, temperature resilience, and sand/UV resistance outperform. Infrastructure programs and logistics hubs favor durable lane-marking, floor, and protective films; reliable supply and on-site training differentiate vendors.South & Central America

Automotive, white goods, and commercial building projects underpin demand. Currency and duty dynamics elevate interest in locally converted, multi-purpose tapes that reduce SKU count. Humidity and tropical climates require mold-resistant, clean-removal systems and robust liners. Distributors with technical support, quick die-cut turnarounds, and VMI solutions gain share across fragmented retail and pro channels.Specialty Tape Market Segmentation

By Resin

- Acrylic

- Rubber

- Silicone

- Others

By Backing Material

- Polyvinyl Chloride (PVC)

- Paper

- Woven/Non-Woven

- PET

- Foam

- Polypropylene (PP)

- Others

By End-User

- Electrical & Electronics

- Healthcare & Hygiene

- Automotive

- White Goods

- Paper & Printing

- Building & Construction

- Retail & Graphics

- Others

Key Market players

3M, Nitto Denko Corporation, tesa SE, Avery Dennison, Intertape Polymer Group (IPG), Scapa (Mativ), Saint-Gobain Performance Plastics, Shurtape Technologies, Berry Global, SEKISUI Chemical Co., Ltd., Lohmann GmbH & Co. KG, Rogers Corporation, LINTEC Corporation, ORAFOL Europe GmbH, Teraoka Seisakusho Co., Ltd.Specialty Tape Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Specialty Tape Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Specialty Tape market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Specialty Tape market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Specialty Tape market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Specialty Tape market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Specialty Tape market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Specialty Tape value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Specialty Tape industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Specialty Tape Market Report

- Global Specialty Tape market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Specialty Tape trade, costs, and supply chains

- Specialty Tape market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Specialty Tape market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Specialty Tape market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Specialty Tape supply chain analysis

- Specialty Tape trade analysis, Specialty Tape market price analysis, and Specialty Tape supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Specialty Tape market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M

- Nitto Denko Corporation

- tesa SE

- Avery Dennison

- Intertape Polymer Group (IPG)

- Scapa (Mativ)

- Saint-Gobain Performance Plastics

- Shurtape Technologies

- Berry Global

- SEKISUI Chemical Co. Ltd.

- Lohmann GmbH & Co. KG

- Rogers Corporation

- LINTEC Corporation

- ORAFOL Europe GmbH

- Teraoka Seisakusho Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 50.86 Billion |

| Forecasted Market Value ( USD | $ 85.93 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |