Wound Healing Film Market

The Wound Healing Film market encompasses transparent and semi-occlusive polyurethane (PU) and elastomeric films, often with acrylic or silicone adhesives, engineered to protect wounds while managing moisture and gas exchange. Core applications include post-operative incisions, superficial traumatic wounds, catheter/IV sites, donor sites, first- and superficial second-degree burns, and as cover dressings atop primary therapies in chronic wounds such as DFUs, VLUs, and pressure injuries. Trends emphasize tunable MVTR for different exudate levels, atraumatic removal with soft silicone borders, borderless conformable sheets for joints, and antimicrobial options (silver, iodine, PHMB) balanced against stewardship concerns. Digitally enabled “smart” films integrate micro-sensors for temperature, pH, or exudate analytics to support remote monitoring and early infection warning. Growth is propelled by rising surgical volumes, aging populations with comorbidities, home-care expansion, and value-based purchasing that rewards fewer dressing changes and reduced complications. The competitive landscape blends diversified wound-care leaders and specialty converters focusing on coating, lamination, and adhesive science; differentiation hinges on skin-friendliness, wear time, conformability, clarity for inspection, and compatibility with imaging and low-temperature sterilization. Execution priorities include robust clinical evidence, MDR and FDA compliance, human-factors design for self-care, and supply reliability for films, liners, and adhesives. Challenges persist around cost pressure, counterfeit risk in some channels, environmental scrutiny of solvents and plastics, and the need for standardized outcome reporting across care settings.Wound Healing Film Market Key Insights

- Clinical use is stratified by exudate and acuity.

For chronic wounds, films serve as secondary covers over hydrogels, foams, or alginates, preserving moisture balance and bacterial barriers.

Protocols focus on minimizing disturbance to the peri-wound while maintaining edge seal integrity, particularly on mobile anatomical sites.

Education on when not to use films - heavily exudative or infected wounds - reduces failure rates and unnecessary costs.

Integrating films into bundled post-op kits standardizes practice and improves adherence.

- Tunable MVTR is a core performance lever.

Clinicians select higher-MVTR films for perspiring or humid environments and lower-MVTR for fragile skin requiring extra hydration.

In vitro MVTR does not always predict in-use performance; sweat, heat, and joint motion affect effective permeability.

Clear labeling of MVTR ranges and intended indications aids formulary decisions and reduces off-label misuse.

Consistency across lot runs is critical for protocols in multi-site health systems.

- Atraumatic adhesives drive patient experience and outcomes.

Acrylics remain preferred for long wear and strong edge seals in high-motion zones, provided removal aids are available.

Hybrid constructions pair silicone edge zones with acrylic centers to balance comfort and durability.

Human-factors testing around hair management, showering, and sweat improves real-world wear time.

Clear IFUs on removal angle and skin-prep mitigate MARSI and blistering events.

- Antimicrobial stewardship reshapes product roadmaps.

Hospitals increasingly require justification and stop dates to avoid resistance concerns and cost creep.

Non-leaching antimicrobial surfaces and quorum-sensing disruptors are explored to reduce bioburden with lower cytotoxicity.

Transparent reporting of cytotoxicity and biofilm performance under clinically relevant conditions aids formulary trust.

Alignment with infection-control policies becomes a tender prerequisite.

- Smart films and remote monitoring move from pilots to protocols.

BLE/NFC logging enables asynchronous review by nurses and telehealth teams, reducing unnecessary clinic visits.

Battery-free designs and colorimetric cues help in low-resource and home-care settings.

Data privacy, interoperability, and reimbursement for remote monitoring shape adoption pace.

Clinically validated alert thresholds are essential to prevent alarm fatigue.

- Post-operative pathways are the fastest adoption lane.

Clear films allow inspection for hematoma or dehiscence without breaking sterility, supporting ERAS protocols.

Waterproofing for showering within 24-48 hours improves patient satisfaction and mobility.

Compatibility with adhesives, glues, and negative-pressure interfaces prevents edge lift and leakage.

Hospitals track dressing-related incident metrics to guide vendor performance reviews.

- Chronic wound programs prioritize total cost of care.

Edge-lift resistance on calves and sacral areas lowers unplanned changes in home-care routes.

Transparent documentation of wear-time medians under real-use conditions supports value-analysis committees.

Bundle contracts link films with foams and cleansers to simplify procurement and ensure continuity.

Case-mix adjusted outcomes (healing days, visits avoided) underpin renewals.

- Material science and sustainability influence tenders.

Thinner, stronger films cut plastic mass while preserving tear resistance and conformability.

Monomaterial designs and recyclable liners are piloted where regulatory frameworks permit.

Traceability for medical-grade resins and adhesives mitigates supply risk.

Environmental disclosures increasingly appear in RFP scoring rubrics.

- Regulatory rigor and evidence depth differentiate leaders.

Human-factors studies, labeling clarity, and biocompatibility data accelerate market access.

Hospitals scrutinize IFUs for compatibility with imaging and sterilization modalities.

Post-market vigilance on skin events and adhesive injuries is a selection criterion.

Vendors offering audit-ready technical files gain multi-year framework agreements.

- Channel dynamics reward education and kit design.

Retail/pharmacy lines for first aid and minor burns grow with consumer-friendly messaging.

Home-care kits with pre-cut shapes and easy-lift tabs reduce caregiver burden.

Color-coded sizing and pictograms help low-literacy settings.

QR-linked micro-lessons support correct application and removal in the home.

Wound Healing Film Market Reginal Analysis

North America

High procedural volumes and home-care penetration support premium films with silicone borders and waterproof showering claims. Value-analysis committees emphasize total episode cost, reduced dressing changes, and MARSI prevention. Hospitals push smart-film pilots tied to remote monitoring and early infection flags. MDR-style evidence expectations spill into private systems, raising the bar for clinical dossiers.Europe

Stringent MDR requirements elevate post-market surveillance and real-world evidence for legacy portfolios. Strong adoption of atraumatic silicones in elderly care and orthopedic pathways. Public tenders weigh sustainability (solvent-free coatings, reduced plastics) and human-factors data. Standardized protocols favor clear labeling of MVTR ranges and intended use to reduce practice variability across national health systems.Asia-Pacific

Rapid growth driven by surgical expansion, private hospital investments, and rising diabetes prevalence. Price tiers range from basic acrylic films to premium silicone-bordered and antimicrobial options. Humid climates and high mobility demand robust edge seals and higher-MVTR variants. Distributor education and localized IFUs in multiple languages accelerate uptake in peri-urban and home-care markets.Middle East & Africa

Demand concentrates in tertiary hospitals and private clinics with strong post-operative caseloads. Heat and perspiration necessitate films with resilient adhesion and moisture management. Procurement favors waterproof, shower-friendly options and simple application for short-staffed wards. Training on MARSI prevention and correct removal improves outcomes; bilingual packaging and pictograms aid compliance.South & Central America

Urban hospital networks adopt silicone-bordered films for post-op pathways, while public systems utilize cost-optimized acrylic lines. Supply reliability and clear IFUs drive brand loyalty amid import variability. Education on when to escalate beyond films in exudative or infected wounds reduces complications. Partnerships with home-care and pharmacy chains extend reach into self-care segments.Wound Healing Film Market Segmentation

By Type

- Hydrocolloid Dressings

- Hydrogel Dressings

- Alginate Dressings

- Collagen Dressings

- Foam Dressings

By Application

- Chronic Wounds

- Acute Wounds

By End-User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

Key Market players

3M, Smith+Nephew, Mölnlycke Health Care, ConvaTec Group, Coloplast, Paul Hartmann, Johnson & Johnson (Ethicon), BSN medical (Essity), Cardinal Health, Medline Industries, Lohmann & Rauscher, Avery Dennison Medical, Urgo Medical, Winner Medical, Nitto Denko CorporationWound Healing Film Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Wound Healing Film Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Wound Healing Film market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Wound Healing Film market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Wound Healing Film market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Wound Healing Film market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Wound Healing Film market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Wound Healing Film value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Wound Healing Film industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Wound Healing Film Market Report

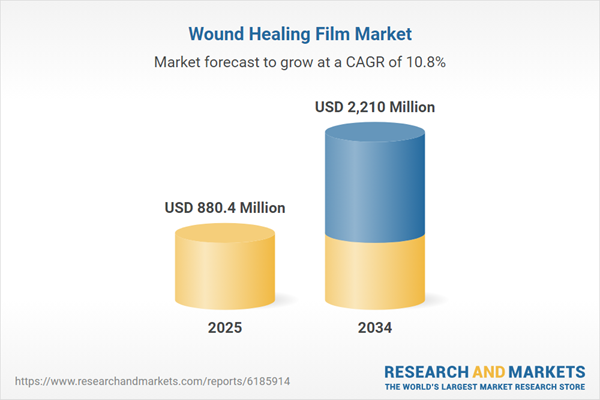

- Global Wound Healing Film market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Wound Healing Film trade, costs, and supply chains

- Wound Healing Film market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Wound Healing Film market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Wound Healing Film market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Wound Healing Film supply chain analysis

- Wound Healing Film trade analysis, Wound Healing Film market price analysis, and Wound Healing Film supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Wound Healing Film market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M

- Smith+Nephew

- Mölnlycke Health Care

- ConvaTec Group

- Coloplast

- Paul Hartmann

- Johnson & Johnson (Ethicon)

- BSN medical (Essity)

- Cardinal Health

- Medline Industries

- Lohmann & Rauscher

- Avery Dennison Medical

- Urgo Medical

- Winner Medical

- Nitto Denko Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 880.4 Million |

| Forecasted Market Value ( USD | $ 2210 Million |

| Compound Annual Growth Rate | 10.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |