Water Blocking Tapes Market

Water blocking tapes are swellable, nonwoven- or film-based components coated with superabsorbent polymers (SAP) that prevent longitudinal water ingress in cables. They are used across medium/high-voltage power cables, HVDC export and interconnect projects, offshore wind array cables, submarine telecom lines, FTTH/5G optical cables, rail and industrial controls, and oil & gas umbilicals. Modern portfolios include dry swellable tapes for conductors and screens, semi-conductive swellable tapes for power-cable interfaces, yarns and powders as adjuncts, and low-dust, slit-stable grades for high-speed cabling. Buyers prioritize fast swelling, high swell pressure, ionic cleanliness (to protect metals and optical fibers), thermal/chemical compatibility with XLPE/HEPR/HFFR jackets, and stable performance under compression and bending.Demand is propelled by grid expansion and undergrounding, offshore wind and interconnect pipelines, rural broadband and 5G densification, data-center corridors, and utility resilience programs. Technology roadmaps emphasize “dry-core” fiber designs replacing gels; low-sodium, corrosion-inhibiting recipes; semiconductive swellables that maintain screen continuity; high-temperature, low-shrink carriers; and PFAS-free, REACH-aligned chemistries. Converters focus on uniform SAP laydown, anti-shedding coatings, and narrow-width slitting for compact cable designs. Competitive dynamics span specialty chemical suppliers, inlay/nonwoven producers, cable-component converters, and integrated cable OEMs; differentiation centers on proven qualification with leading cable standards, consistency across lots, slit quality at line speed, global application support, and total landed cost. As qualification cycles are long and outages are costly, purchasing favors vendors with robust QA, local technical service, and contingency supply. The market is shifting from commodity tapes to engineered, application-specific solutions that reduce rework, speed cabling runs, and improve lifetime reliability in increasingly harsh operating environments.

Water Blocking Tapes Market Key Insights

- Dry construction becomes default. Fiber and power cables migrate from gels to dry swellable elements to cut weight, simplify splicing, and raise line speeds. Tapes with rapid activation and low dust improve throughput and field handling.

- Offshore wind and HVDC set the bar. Higher voltages, large conductor cross-sections, and dynamic cable movement demand tapes with high swell pressure, stable compression set, and semiconductive options that preserve screen integrity.

- Performance is multi-variable. Beyond swell height/time, buyers test ionic contamination, pH, corrosivity, and extractables; compatibility with XLPE cures, semicon layers, and HFFR jackets is critical to avoid interface defects.

- Semiconductive swellables mature. Carbon-loaded swellable tapes deliver water blocking without interrupting electrical continuity, improving partial-discharge performance in MV/HV designs.

- Processability drives TCO. Anti-shedding coatings, slit-edge stability, and controlled caliper reduce breaks and dust at high line speed. Wider master rolls and narrow precise slits lower scrap and changeover time.

- Materials innovation widens use. Low-sodium SAPs, hybrid binders, high-temp carriers, and on-metal/nonwoven laminates extend tapes to hot, dynamic, or metallic environments; sensorized variants enable moisture indication in specialty builds.

- Sustainability enters specs. PFAS-free and REACH-aligned chemistries, recycled/nonwoven carriers, and energy-efficient coating/drying improve ESG profiles; long-life reliability supports circularity by avoiding early failure.

- Qualification is a moat. Passing utility/cable-maker test suites (aging, salt-fog, pressure, bend) and securing multi-plant approvals create stickiness and pricing power; lot-to-lot uniformity is a renewal trigger.

- Supply risk management matters. SAP and polymer volatility pushes dual-sourcing and regionalized converting. Vendors with buffer stocks, alternate carriers, and rapid requalification paths win programs.

- Adjacencies add value. Bundled swellable yarns, tapes, and powders with matched swelling kinetics simplify design; tech service for splicing, drying cycles, and defect analysis reduces customer scrap.

Water Blocking Tapes Market Reginal Analysis

North America

Grid hardening, undergrounding for wildfire mitigation, and submarine interconnects boost MV/HV demand, while broadband programs accelerate dry-core fiber adoption. Utilities and cable OEMs emphasize semiconductive swellables, corrosion-controlled recipes, and qualification across multiple factories. Local content and resilience drive regional converting, short lead times, and field-service support for splice design and training.Europe

Offshore wind build-out and cross-border interconnectors dominate specifications for high-performance, REACH-compliant chemistries and low-sodium SAP. Sustainability and documentation rigor are weighted in tenders; converters compete on narrow-slit quality for compact cables and on recyclability of carriers. Established telecom networks continue gel-to-dry transitions to cut OPEX in splicing and maintenance.Asia-Pacific

The largest base of cable manufacturing supports rapid, cost-optimized deployments for power and fiber. Mega-city densification, rail, and 5G drive high-speed cabling lines that favor low-dust, slit-stable tapes. Export-oriented plants require global approvals; coastal projects and inter-island links expand corrosion-controlled, high-swell tapes. Local sourcing and price discipline are decisive.Middle East & Africa

High temperature, sand, and long transmission runs require thermally robust, anti-shedding tapes that perform under compression. Subsea links and desalination/industrial complexes add specialty power and control cable demand. Government infrastructure programs favor suppliers with sovereign-compliant chemistries, Arabic documentation, and regional inventory for fast turnarounds.South & Central America

Grid expansion for renewables, mining corridors, and urban FTTH rollouts drive mixed demand across MV power and optical cables. Buyers value reliable dry-core performance to reduce splicing OPEX and truck rolls. Currency and logistics variability favor phased contracts, regional distribution partners, and tapes proven on local converting lines with stable quality and support.Water Blocking Tapes Market Segmentation

By Conductive Type

- Conductive

- Semi-Conductive

- Non-Conductive

By Application

- Optical Fiber Cable

- Submarine Cable

- Power Cable

- Communication cable

- Others

Key Market players

3M, tesa SE, Nitto Denko, Avery Dennison, Saint-Gobain, Mativ (Scapa), Intertape Polymer Group (IPG), Shurtape Technologies, Berry Global, ORAFOL, ATP Adhesive Systems, Nichiban, Coroplast Tape, Chase Corporation (NEPTCO), TrelleborgWater Blocking Tapes Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Water Blocking Tapes Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Water Blocking Tapes market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Water Blocking Tapes market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Water Blocking Tapes market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Water Blocking Tapes market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Water Blocking Tapes market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Water Blocking Tapes value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Water Blocking Tapes industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Water Blocking Tapes Market Report

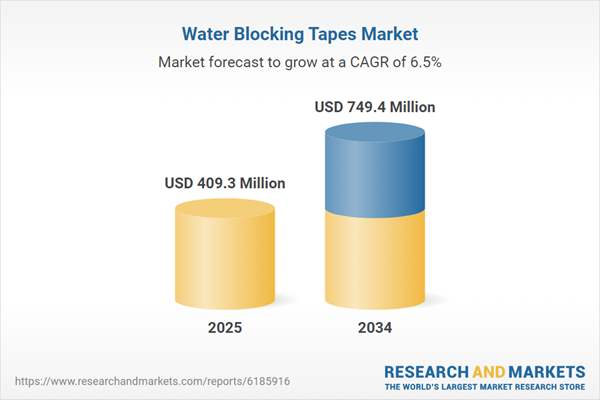

- Global Water Blocking Tapes market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Water Blocking Tapes trade, costs, and supply chains

- Water Blocking Tapes market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Water Blocking Tapes market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Water Blocking Tapes market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Water Blocking Tapes supply chain analysis

- Water Blocking Tapes trade analysis, Water Blocking Tapes market price analysis, and Water Blocking Tapes supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Water Blocking Tapes market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M

- tesa SE

- Nitto Denko

- Avery Dennison

- Saint-Gobain

- Mativ (Scapa)

- Intertape Polymer Group (IPG)

- Shurtape Technologies

- Berry Global

- ORAFOL

- ATP Adhesive Systems

- Nichiban

- Coroplast Tape

- Chase Corporation (NEPTCO)

- Trelleborg

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 409.3 Million |

| Forecasted Market Value ( USD | $ 749.4 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |