The Resistor Market plays a crucial role in the global electronics and semiconductor industry, supplying one of the most fundamental components in electronic circuits. Resistors regulate current flow, divide voltages, and protect sensitive components by dissipating excess energy. The market includes various types such as fixed resistors, variable resistors, wire-wound, film, and surface mount (SMD) resistors, catering to diverse applications across consumer electronics, automotive, industrial automation, telecommunications, and aerospace. As electronic content continues to grow in nearly every product category - from smartphones and EVs to smart home systems and industrial IoT devices - the demand for miniaturized, high-performance, and thermally stable resistors has increased significantly. Resistor innovation is particularly important for meeting the needs of high-frequency, high-voltage, and low-noise applications, making this market an essential enabler of modern electronics and emerging technologies.

The global resistor market witnessed steady growth as demand for consumer electronics and electric vehicles rebounded across key regions. Surface mount resistors dominated shipments due to their compact size and compatibility with high-density PCB designs. Automotive applications saw increased uptake of resistors capable of operating in harsh environments, especially for powertrain, infotainment, and advanced driver-assistance systems (ADAS). The proliferation of 5G infrastructure and smart appliances further expanded the need for precision resistors that maintain consistent performance in high-frequency ranges. Supply chain stabilization post-COVID and ramped-up semiconductor production improved component availability, supporting market expansion. Additionally, environmental regulations led to the phasing out of certain materials, prompting manufacturers to introduce RoHS-compliant and halogen-free resistors. The rise of local electronics manufacturing hubs in Southeast Asia and Eastern Europe added competitive dynamics while reducing dependency on single-source suppliers.

The resistor market is expected to benefit from long-term trends in electrification, digitalization, and automation. Electric vehicle adoption will drive demand for high-power, temperature-resistant resistors in battery management and motor control systems. Emerging applications in renewable energy, smart grids, and medical electronics will require ultra-reliable, low-noise resistor technologies. Manufacturers are likely to invest more in nano-scale resistor development and integrated resistor networks to support shrinking PCB real estate in compact devices. AI, robotics, and next-gen wireless communication will call for tighter tolerance and high-stability resistors. Moreover, as chiplet-based and modular electronics grow in prominence, resistor designs may evolve to support co-packaging and integration with other passive components. Sustainability will also be a key focus, prompting innovation in recyclable materials and energy-efficient production techniques. However, ongoing risks such as geopolitical tensions and raw material shortages may still pose short-term challenges to consistent supply and pricing.

Key Insights: Resistor Market

- Miniaturization and surface mount technology (SMT) are dominating resistor design, enabling integration into increasingly compact and complex electronic devices.

- Automotive-grade resistors with high thermal tolerance and reliability are in high demand due to the electrification of vehicles and expansion of ADAS.

- High-precision and low-noise resistors are gaining traction in 5G, medical devices, and advanced industrial control applications.

- Resistor arrays and integrated passive networks are simplifying circuit designs and reducing component counts on densely packed PCBs.

- Eco-friendly and RoHS-compliant resistor variants are being developed in response to growing regulatory and sustainability pressures.

- Rising global demand for consumer electronics, particularly smartphones, laptops, and smart home devices, is fueling continuous resistor consumption.

- Growth in electric vehicles and hybrid transportation systems is increasing the need for power resistors in automotive electronics.

- Expansion of 5G infrastructure and industrial automation is driving the use of precision and high-frequency resistors.

- Increasing complexity and miniaturization of electronics are creating demand for high-performance, compact resistors with tighter tolerances.

- Volatility in raw material prices and supply chain disruptions can significantly impact production costs and lead times, particularly for specialized resistor materials such as nichrome, tantalum, and metal oxide films.

Resistor Market Segmentation

By Type

- Linear Resistors

- Fixed Resistors

By Material

- Thin Films

- Thick Films

By Application

- Automotive

- Aerospace and Defense

- Communications

- Consumer Electronics and Computing

- Other End-user Industries

Key Companies Analysed

- Panasonic Corporation

- Honeywell International Inc.

- Walsin Technology Corporation

- TE Connectivity

- Murata Manufacturing

- OKAYA Electric Industries Co. Ltd.

- Samsung Electro-Mechanics

- Rohm Co. Ltd.

- Yageo Corporation

- Vishay Intertechnology

- Bourns Inc.

- AVX Corporation

- CTS Corporation

- Ohmite Manufacturing Company

- Viking Tech Corporation

- Susumu Co. Ltd.

- Stackpole Electronics Inc.

- Cyntec Electronics

- Caddock Electronics Inc.

- Cressall Resistors

- Arcol

- HVR Pentagon

- KOA Corporation

- Shenzhen Sunlord Electronics Co. Ltd.

Resistor Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Resistor Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Resistor market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Resistor market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Resistor market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Resistor market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Resistor market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Resistor value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Resistor industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Resistor Market Report

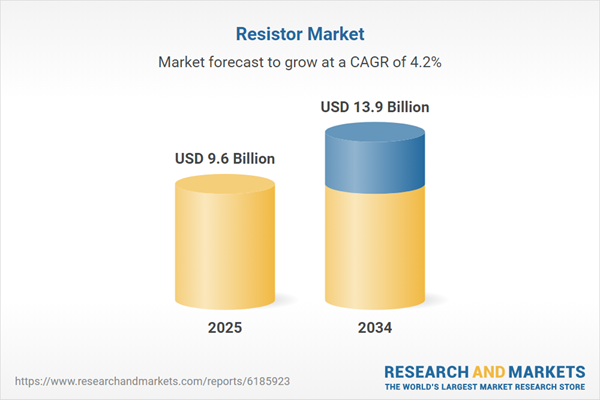

- Global Resistor market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Resistor trade, costs, and supply chains

- Resistor market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Resistor market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Resistor market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Resistor supply chain analysis

- Resistor trade analysis, Resistor market price analysis, and Resistor supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Resistor market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Panasonic Corporation

- Honeywell International Inc.

- Walsin Technology Corporation

- TE Connectivity

- Murata Manufacturing

- OKAYA Electric Industries Co. Ltd.

- Samsung Electro-Mechanics

- Rohm Co. Ltd.

- Yageo Corporation

- Vishay Intertechnology

- Bourns Inc.

- AVX Corporation

- CTS Corporation

- Ohmite Manufacturing Company

- Viking Tech Corporation

- Susumu Co. Ltd.

- Stackpole Electronics Inc.

- Cyntec Electronics

- Caddock Electronics Inc.

- Cressall Resistors

- Arcol

- HVR Pentagon

- KOA Corporation

- Shenzhen Sunlord Electronics Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |