General Electronic Components Market Overview

The General Electronic Components Market is witnessing consistent growth, driven by rising demand across various industries, including consumer electronics, automotive, industrial automation, healthcare, and telecommunications. Electronic components such as resistors, capacitors, diodes, transistors, and integrated circuits form the backbone of modern electronic devices, enabling efficient functionality and performance. The expansion of technologies like the Internet of Things (IoT), artificial intelligence (AI), 5G connectivity, and smart devices has fueled the need for advanced electronic components. Additionally, the growing push toward energy-efficient and miniaturized components has led to continuous innovation, improving the durability and efficiency of electronic products. Manufacturers are investing heavily in research and development (R&D) to produce high-performance components that cater to evolving technological demands. However, global supply chain disruptions and semiconductor shortages continue to challenge the market, affecting production timelines and pricing. Despite these challenges, the market outlook remains positive, with strong demand for high-quality electronic components across multiple applications.The General Electronic Components Market has experienced notable developments, particularly in the integration of AI-driven automation and smart manufacturing processes. With the ongoing digital transformation across industries, the demand for electronic components has surged, especially in sectors such as electric vehicles (EVs), industrial automation, and 5G infrastructure. The semiconductor industry, a critical component of the market, has seen increased investment as companies work to mitigate supply chain disruptions through localized production facilities. Additionally, advancements in printed circuit boards (PCBs) and flexible electronics have expanded the scope of electronic components in emerging applications such as wearable technology and biomedical devices. The rising focus on sustainability has also led manufacturers to develop energy-efficient and eco-friendly electronic components, reducing power consumption and minimizing e-waste. However, geopolitical tensions and trade restrictions have introduced uncertainties in the global supply chain, prompting companies to diversify sourcing strategies and invest in regional manufacturing hubs.

The General Electronic Components Market is expected to experience further growth, driven by the rapid expansion of AI-powered electronics, next-generation connectivity solutions, and automation in industrial sectors. The demand for high-speed and low-power components will continue to rise as industries adopt advanced digital technologies, including quantum computing and edge computing. Miniaturization and the development of ultra-thin electronic components will enable more compact and high-performance consumer devices, further fueling market demand. Additionally, the push for green electronics will intensify, with manufacturers emphasizing the use of recyclable materials and energy-efficient designs. As semiconductor shortages gradually stabilize, companies will focus on strengthening supply chains and enhancing production capacities to meet growing global demand. The increasing adoption of electric and autonomous vehicles will further propel demand for robust and reliable electronic components. Overall, the market is set to evolve with advancements in materials, design, and production techniques, ensuring a steady trajectory of innovation and expansion.

Key Insights: General Electronic Components Market

- Rise of AI-Integrated Components: Electronic components are increasingly being designed with AI-driven capabilities, improving automation, predictive maintenance, and real-time analytics in industrial and consumer applications.

- Expansion of 5G and Next-Gen Connectivity: The widespread deployment of 5G infrastructure is driving demand for high-frequency and low-latency electronic components, enabling faster and more reliable communication networks.

- Growth in Miniaturized and Flexible Electronics: The push toward smaller, lighter, and more flexible electronic components is enabling advancements in wearable technology, medical devices, and compact consumer electronics.

- Increased Focus on Green Electronics: Sustainability initiatives are encouraging manufacturers to develop energy-efficient electronic components, utilize recyclable materials, and minimize environmental impact through eco-friendly production processes.

- Localization of Semiconductor Manufacturing: To counteract supply chain disruptions, companies are investing in localized production facilities, reducing dependency on specific regions for semiconductor and electronic component sourcing.

- Rising Demand for Consumer Electronics: The growing adoption of smartphones, laptops, smart home devices, and IoT-enabled products is fueling demand for high-performance electronic components.

- Growth of Electric and Autonomous Vehicles: The automotive industry’s shift toward EVs and self-driving technology is driving the need for advanced sensors, microcontrollers, and power management components.

- Industrial Automation and Smart Manufacturing: Increasing reliance on automation and AI-powered industrial systems is accelerating demand for electronic components that enhance efficiency, precision, and connectivity.

- Advancements in Healthcare and Medical Electronics: The rise of medical devices, such as wearable health monitors, diagnostic equipment, and smart implants, is contributing to the growing need for reliable and efficient electronic components.

- Supply Chain Disruptions and Component Shortages: Ongoing supply chain challenges, geopolitical trade restrictions, and semiconductor shortages have led to delays in production and increased costs, posing a major challenge for manufacturers and end-users.

General Electronic Components Market Segmentation

By Product Type

- Passive

- Active

- Electromechanical Components

- Other Products

By End-Use Industry

- Aerospace

- Communication

- Automotive

- Other End-User

By Sales

- Aftermarket

- Manufacturer / Distributor / Service Provider

Key Companies Analysed

- Murata Manufacturing Co.

- Ltd.

- STMicroelectronics

- Infineon Technologies

- TE Connectivity

- TDK Corporation

- Yageo Corporation

- Amphenol Corporation

- Vishay Intertechnology

- Texas Instruments

- Analog Devices

- Inc.

- Fairchild Semiconductor

- EPCOS

- API Technologies

- Siemens Ltd

- Bosch Ltd

- ABB India Ltd

- Crompton Greaves Ltd

- Exide Industries Ltd

- Bharat Electronics Ltd

- Sterlite Technologies Ltd

- Amar Raja Batteries Ltd

- Surya Roshini Ltd

- Finolex Cables Ltd

- Qualcomm India Pvt Ltd

- Honey well Automations India Ltd

- 3M India Ltd

- V Guard Industries Ltd

- Schmersal India Private Limited

- Svel Sensors & Controls Private Limited

- Medical Sensors India Private Limited

- Turck India Automation Private Limited

- AAC Technologies

- China Electronics Cooperation

- Fujian Jinhua Integrated Circuit

- Suzhou Orientation Semiconductors

- Western Digital

- Seagate Technology

- Toshiba

- Xiaomi Corporation

- Meizu Technology Co.

- Ltd

- Konka Group Co.

- Ltd

- Hisense Group

- Kyocera

- Panasonic Corporation

- Renesas Electric Corporation

- Hitachi

- Agilent Technologies Japan

- Selko Epson

- Yamaha

- NEC

- Fujitsu Components

- Sharp

- Sanyo

- Pioneer

- Slovakia

- Sony

- Foxconn and Daimler

- Peugot

- Prestigio Technologies

- King Brother

- JSC Eltech-SPb

- Crocus nano Electronics

- Korona Semiconductor

- Rohm Semiconductors

- Maxim Integrated Products Inc.

- Arrow Electronics

- ON Semiconductor Corporation

- New York Semiconductor

- Rochester Electronics

- Gama Electronics

- AVX Corporation

- Eaton Corp

- Advanced Micro Devices

- Smart Modular Technologies

- IntelBras

- Tecsys

- The Leadership Group

- Multilaser

- Flextronics

- LG

- Digitron

- Foto Electronica Beta Srl

- AUTER

- Ducasse Comercial Ltd

- Tekemi

- Videocorp

- Satelinx Ingeniería Limited

- Linktronic

- Arabian Power Electronics Company

- Leap Technologies FZC

- United Transformers Electric

- Electro Power Systems

- Electro Mechanical Company LLC

- Avnet South Africa

- Samsung Electronics

- Electrocomp (PTY) Ltd

General Electronic Components Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

General Electronic Components Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - General Electronic Components market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - General Electronic Components market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - General Electronic Components market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - General Electronic Components market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - General Electronic Components market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the General Electronic Components value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the General Electronic Components industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the General Electronic Components Market Report

- Global General Electronic Components market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on General Electronic Components trade, costs, and supply chains

- General Electronic Components market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- General Electronic Components market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term General Electronic Components market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and General Electronic Components supply chain analysis

- General Electronic Components trade analysis, General Electronic Components market price analysis, and General Electronic Components supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest General Electronic Components market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Murata Manufacturing Co. Ltd.

- STMicroelectronics

- Infineon Technologies

- TE Connectivity

- TDK Corporation

- Yageo Corporation

- Amphenol Corporation

- Vishay Intertechnology

- Texas Instruments

- Analog Devices Inc.

- Fairchild Semiconductor

- EPCOS

- API Technologies

- Siemens Ltd.

- Bosch Ltd.

- ABB India Ltd.

- Crompton Greaves Ltd.

- Exide Industries Ltd.

- Bharat Electronics Ltd.

- Sterlite Technologies Ltd.

- Amar Raja Batteries Ltd.

- Surya Roshini Ltd.

- Finolex Cables Ltd.

- Qualcomm India Pvt Ltd.

- Honey well Automations India Ltd.

- 3M India Ltd.

- V Guard Industries Ltd.

- Schmersal India Private Limited

- Svel Sensors & Controls Private Limited

- Medical Sensors India Private Limited

- Turck India Automation Private Limited

- AAC Technologies

- China Electronics Cooperation

- Fujian Jinhua Integrated Circuit

- Suzhou Orientation Semiconductors

- Western Digital

- Seagate Technology

- Toshiba

- Xiaomi Corporation

- Meizu Technology Co. Ltd.

- Konka Group Co. Ltd.

- Hisense Group

- Kyocera

- Panasonic Corporation

- Renesas Electric Corporation

- Hitachi

- Agilent Technologies Japan

- Selko Epson

- Yamaha

- NEC

- Fujitsu Components

- Sharp

- Sanyo

- Pioneer

- Slovakia

- Sony

- Foxconn and Daimler

- Peugot

- Prestigio Technologies

- King Brother

- JSC Eltech-SPb

- Crocus nano Electronics

- Korona Semiconductor

- Rohm Semiconductors

- Maxim Integrated Products Inc.

- Arrow Electronics

- ON Semiconductor Corporation

- New York Semiconductor

- Rochester Electronics

- Gama Electronics

- AVX Corporation

- Eaton Corp

- Advanced Micro Devices

- Smart Modular Technologies

- IntelBras

- Tecsys

- The Leadership Group

- Multilaser

- Flextronics

- LG

- Digitron

- Foto Electronica Beta Srl

- AUTER

- Ducasse Comercial Ltd.

- Tekemi

- Videocorp

- Satelinx Ingeniería Limited

- Linktronic

- Arabian Power Electronics Company

- Leap Technologies FZC

- United Transformers Electric

- Electro Power Systems

- Electro Mechanical Company LLC

- Avnet South Africa

- Samsung Electronics

- Electrocomp (PTY) Ltd.

Table Information

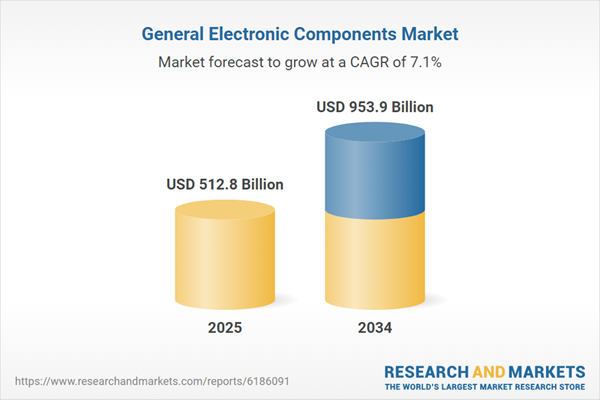

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 512.8 Billion |

| Forecasted Market Value ( USD | $ 953.9 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 96 |