The Iron and Steel Pipe and Tube Market is a crucial segment of the broader metal manufacturing industry, providing essential components for water supply, oil and gas transmission, construction, automotive, and mechanical applications. Steel pipes and tubes come in various forms - seamless, welded, and spiral - each designed for specific pressure ratings, durability, and corrosion resistance. These products play a pivotal role in modern infrastructure, from underground pipelines to structural supports and high-pressure systems in industrial environments. As urbanization, energy projects, and manufacturing accelerate globally, the demand for robust, high-quality steel pipes and tubes continues to grow. Technological advancements in coatings, alloys, and forming processes are improving product performance while supporting sustainability initiatives.

The iron and steel pipe and tube market showed solid growth driven by global infrastructure recovery, increased oil and gas exploration, and rising construction activity in both developed and emerging economies. Energy pipeline projects in North America, Asia, and the Middle East stimulated demand for high-strength line pipes. In parallel, water infrastructure upgrades and smart city initiatives drove the use of corrosion-resistant tubes for utilities and sanitation. Major manufacturers like Nippon Steel, Tenaris, Tata Steel, and Vallourec invested in precision forming and automated welding technologies. Seamless pipe production rebounded as industrial activity resumed post-pandemic, while welded pipe demand surged in cost-sensitive projects. Green certifications and lifecycle assessments became more prominent in procurement processes, reflecting ESG goals.

The market will see further diversification in materials and applications. The emergence of hydrogen infrastructure will create demand for high-pressure, H2-compatible steel pipes with advanced coatings. Urban verticalization and modular construction will expand usage of hollow steel sections. Digital twins and smart sensors embedded in pipes will enable predictive maintenance in energy and water sectors. Manufacturers will adopt lower-emission production methods such as EAFs and explore green steel pipe variants. Additionally, recyclability and end-of-life tracking will gain importance in regulatory frameworks. With global infrastructure needs growing and sustainability taking center stage, iron and steel pipes and tubes will continue to evolve as high-value components in future-ready projects.

Key Insights: Iron and Steel Pipe and Tube Market

- The analyst highlights the rising demand for corrosion-resistant and high-pressure pipe materials to support oil, gas, and emerging hydrogen transmission networks under global energy transition initiatives.

- Automation in pipe manufacturing is trending, with robotic welding, laser cutting, and non-destructive testing technologies improving output quality and consistency while reducing labor dependency.

- According to the analyst, increased use of hollow structural steel sections in modular buildings and urban infrastructure is driving growth in architectural and construction-grade tube products.

- Green steel pipe offerings are gaining attention, aligning with buyer requirements for low-carbon materials and life-cycle assessments in major public and industrial procurement contracts.

- Integration of sensors and IoT in pipelines is emerging, enabling real-time monitoring for pressure, leaks, and structural integrity - particularly in critical infrastructure and high-risk transmission lines.

- The analyst identifies infrastructure investments - including water systems, transportation corridors, and urban development - as a primary driver fueling sustained demand for durable, multi-use steel pipes and tubes.

- Energy sector projects, especially in oil, gas, and now hydrogen, are spurring demand for seamless and alloyed pipes designed to handle extreme pressures and corrosive environments, says the analyst.

- The analyst notes that rapid construction growth in emerging markets, paired with modular and prefabricated building techniques, is increasing reliance on steel tubing for structural frameworks and scaffolding.

- Advances in material science and metallurgical coatings are making steel pipes more versatile and long-lasting, expanding their use in niche applications like geothermal and offshore energy installations.

- The analyst highlights volatility in raw material and energy prices, which can disrupt production schedules and profit margins, especially for welded pipe manufacturers operating under tight project timelines.

- According to the analyst, intense competition from alternative materials - such as plastic composites or aluminum - poses a challenge, particularly in cost-sensitive or non-pressurized applications like residential plumbing or conduits.

Iron and Steel Pipe and Tube Market Segmentation

By Type

- Seamless Pipes and Tubes

- Welded Pipes and Tubes

By Material

- Steel and Alloys

- Cooper and Alloys

- Aluminum and Magnesium Alloys

- Nickel and Alloys

- Other Materials

By End-Users

- Oil and Gas

- Power Generation

- Automotive

- Aviation

- Construction

- Process Industry

- Other End Users

Key Companies Analysed

- Nippon Steel Corporation

- US Steel Tubular Products Inc.

- Sandvik AB

- Zaffertec SL

- ArcelorMittal SA

- United Metallurgical Company JSC

- Samuel Associated Tube Group

- Tubos Reunidos SA

- Sumitomo Corporation

- ChelPipe Group

- Wheatland Tube Company

- Aaditya Stainless Pvt. Ltd.

- Anand Seamless Tubes Pvt. Ltd.

- Bhuwalka Pipes

- AK Steel Holding Corporation

- American Cast Iron Pipe Company

- Ansteel Group Corporation Limited

- Baoshan Iron and Steel Co. Ltd.

- Baotou Iron and Steel Group Co. Ltd.

- Borusan Mannesmann Boru Sanayi ve Ticaret AS

- China Baowu Steel Group Corp. Ltd.

- Choo Bee Metal Industries Berhad

- Hebei Iron and Steel Group Co. Ltd.

- Hunan Standard Steel Co. Ltd.

- JFE Holdings Inc.

- Jiangsu Changbao Steel Tube Co. Ltd.

- Jindal Steel & Power Ltd.

- Maharashtra Seamless Limited

- Mannesmann Stainless Tubes GmbH

- Maruichi Steel Tube Ltd.

- Northwest Pipe Company

- Nucor Corporation

- Pohang Iron and Steel Company

- Ratnamani Metals & Tubes Ltd.

- Shandong Iron and Steel Group Co. Ltd.

- Tata Steel Limited

- Tenaris S.A.

- Tianjin Pipe (Group) Corporation

- TMK Group

- United States Steel Corporation

- Vallourec S.A.

- Welspun Corp Limited.

Iron and Steel Pipe and Tube Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Iron and Steel Pipe and Tube Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Iron and Steel Pipe and Tube market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Iron and Steel Pipe and Tube market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Iron and Steel Pipe and Tube market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Iron and Steel Pipe and Tube market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Iron and Steel Pipe and Tube market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Iron and Steel Pipe and Tube value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Iron and Steel Pipe and Tube industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Iron and Steel Pipe and Tube Market Report

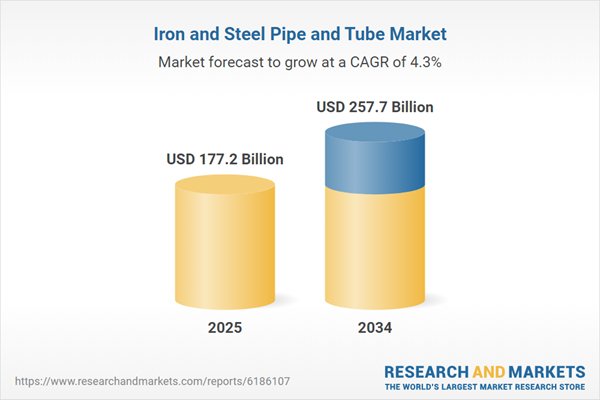

- Global Iron and Steel Pipe and Tube market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Iron and Steel Pipe and Tube trade, costs, and supply chains

- Iron and Steel Pipe and Tube market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Iron and Steel Pipe and Tube market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Iron and Steel Pipe and Tube market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Iron and Steel Pipe and Tube supply chain analysis

- Iron and Steel Pipe and Tube trade analysis, Iron and Steel Pipe and Tube market price analysis, and Iron and Steel Pipe and Tube supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Iron and Steel Pipe and Tube market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nippon Steel Corporation

- US Steel Tubular Products Inc.

- Sandvik AB

- Zaffertec SL

- ArcelorMittal SA

- United Metallurgical Company JSC

- Samuel Associated Tube Group

- Tubos Reunidos SA

- Sumitomo Corporation

- ChelPipe Group

- Wheatland Tube Company

- Aaditya Stainless Pvt. Ltd.

- Anand Seamless Tubes Pvt. Ltd.

- Bhuwalka Pipes

- AK Steel Holding Corporation

- American Cast Iron Pipe Company

- Ansteel Group Corporation Limited

- Baoshan Iron and Steel Co. Ltd.

- Baotou Iron and Steel Group Co. Ltd.

- Borusan Mannesmann Boru Sanayi ve Ticaret AS

- China Baowu Steel Group Corp. Ltd.

- Choo Bee Metal Industries Berhad

- Hebei Iron and Steel Group Co. Ltd.

- Hunan Standard Steel Co. Ltd.

- JFE Holdings Inc.

- Jiangsu Changbao Steel Tube Co. Ltd.

- Jindal Steel & Power Ltd.

- Maharashtra Seamless Limited

- Mannesmann Stainless Tubes GmbH

- Maruichi Steel Tube Ltd.

- Northwest Pipe Company

- Nucor Corporation

- Pohang Iron and Steel Company

- Ratnamani Metals & Tubes Ltd.

- Shandong Iron and Steel Group Co. Ltd.

- Tata Steel Limited

- Tenaris S.A.

- Tianjin Pipe (Group) Corporation

- TMK Group

- United States Steel Corporation

- Vallourec S.A.

- Welspun Corp Limited .

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 177.2 Billion |

| Forecasted Market Value ( USD | $ 257.7 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |