The Hepatitis B Virus (HBV) market represents a critical segment of the global infectious disease landscape, driven by the persistent global burden of chronic hepatitis B infections. HBV continues to affect over 250 million individuals worldwide, making it a leading cause of liver-related complications such as cirrhosis and hepatocellular carcinoma. The market comprises a range of therapeutic offerings, including antivirals, vaccines, and diagnostics, with pharmaceutical companies and biotechnology firms focusing on both prevention and long-term disease management. Governments and international health bodies have intensified efforts to eliminate HBV as a public health threat, which is accelerating research funding and vaccine adoption. Furthermore, rising awareness, increasing healthcare access in developing economies, and continuous product innovations are creating a favorable environment for market expansion. Strategic collaborations, licensing deals, and clinical development pipelines are reshaping the competitive dynamics of the HBV treatment and prevention landscape.

The HBV market saw notable advancements in both vaccine development and therapeutic approaches. Several biopharmaceutical firms progressed their investigational agents into mid-to-late-stage clinical trials, with an emphasis on finite therapy and potential functional cure solutions. The year was marked by regulatory approvals for next-generation antiviral drugs offering improved safety profiles and enhanced viral suppression. Additionally, dual-action immunotherapies combining antivirals with immune modulators gained traction as a promising strategy to reduce viral load while restoring host immune response. The expansion of national immunization programs and improved diagnostic screening in high-burden regions such as Sub-Saharan Africa and Southeast Asia contributed to increased vaccine coverage and early detection. Technological integration in HBV diagnostics, including point-of-care testing and molecular assays, also enabled more efficient disease monitoring. Overall, the market in 2024 moved towards more personalized and accessible HBV care paradigms.

The HBV market is expected to shift further toward curative and combination therapies, targeting both viral suppression and immune reconstitution. Biotech and pharmaceutical companies are expected to continue advancing therapeutic vaccine candidates and RNA-based treatments, with several promising molecules poised to enter pivotal trial phases. As the World Health Organization's goal to eliminate hepatitis B as a public health threat by 2030 gains momentum, governments are anticipated to scale up investments in screening, vaccination, and public health campaigns. Furthermore, strategic partnerships between academia, industry, and public health organizations are expected to foster innovation and expedite product pipelines. AI-powered drug discovery platforms and biomarker-driven clinical trials may also play a pivotal role in accelerating breakthroughs in HBV therapeutics. Emerging economies will remain key growth regions due to the high prevalence of chronic HBV infections and ongoing improvements in healthcare infrastructure. The integration of digital health tools and real-time monitoring solutions is likely to enhance patient management and adherence, ultimately reshaping the future of HBV care delivery.

Key Insights: Hepatitis B Virus (Hbv) Market

- Combination therapies integrating antiviral drugs with immunomodulators are gaining prominence, aiming to offer finite treatment and potentially functional cures for chronic hepatitis B patients.

- Next-generation vaccine formulations with improved immunogenicity and longer-lasting protection are entering clinical stages, particularly for populations with poor response to existing vaccines.

- Digital health solutions and telemedicine platforms are being increasingly adopted for HBV patient management, improving treatment adherence and long-term monitoring.

- Growing adoption of molecular diagnostic assays and point-of-care technologies is transforming early detection and disease staging in low-resource settings.

- Biopharma collaborations with academic institutions and nonprofit organizations are accelerating innovation and access, particularly in high-prevalence regions.

- Rising global HBV prevalence and increasing complications such as liver cancer and cirrhosis are driving demand for better treatment and prevention strategies.

- Expanding government-led vaccination programs and increased awareness about HBV transmission are boosting immunization rates worldwide.

- Ongoing R&D investments and promising clinical pipelines, especially involving RNA-based and immunotherapeutic agents, are fueling innovation.

- Supportive regulatory frameworks and fast-track approvals for breakthrough therapies are enabling quicker market access for novel treatments.

- Despite medical advancements, HBV stigma, low disease awareness, and limited healthcare infrastructure in some regions continue to hinder diagnosis and treatment uptake, particularly in low-income and rural populations.

Hepatitis B Virus (Hbv) Market Segmentation

By Type

- Acute

- Chronic

By Treatment

- Immune Modulator Drugs

- Antiviral Drugs

- Vaccine

- Surgery

By Age Group

- Pediatrics

- Adults

- Seniors

By End User

- Medical Providers

- Patients

- Healthcare Payers

Key Companies Analysed

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmon La Roche Ltd.

- Merck & Co. Inc.

- AbbVie Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- AstraZeneca PLC

- Sanofi SA

- GlaxoSmithKline PLC

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Gilead Sciences Inc.

- Boehringer Ingelheim International GmbH

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Incorporated

- Eisai Co. Ltd.

- Aurobindo Pharma Limited

- Apotex Corp.

- Lupin Pharmaceuticals Inc.

- Cadila Healthcare Ltd.

- Celltrion Inc.

- Dynavax Technologies Corporation

- Accord Healthcare Inc.

- Par Pharmaceutical Inc.

- Arrowhead Pharmaceuticals Inc.

- Arbutus Biopharma Corporation

- Globeimmune Inc.

- Antios Therapeutics Inc.

Hepatitis B Virus (Hbv) Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Hepatitis B Virus (Hbv) Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Hepatitis B Virus (Hbv) market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Hepatitis B Virus (Hbv) market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Hepatitis B Virus (Hbv) market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Hepatitis B Virus (Hbv) market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Hepatitis B Virus (Hbv) market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Hepatitis B Virus (Hbv) value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Hepatitis B Virus (Hbv) industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Hepatitis B Virus (Hbv) Market Report

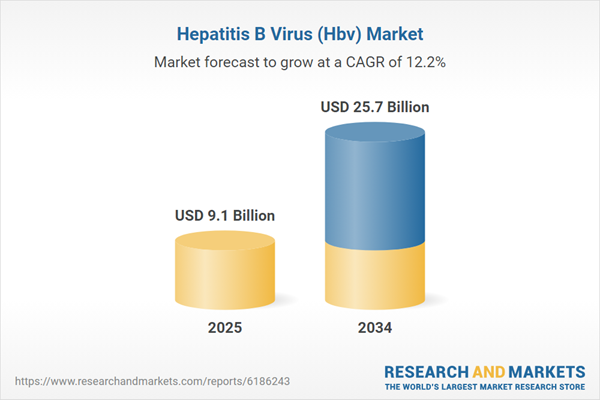

- Global Hepatitis B Virus (Hbv) market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Hepatitis B Virus (Hbv) trade, costs, and supply chains

- Hepatitis B Virus (Hbv) market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Hepatitis B Virus (Hbv) market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Hepatitis B Virus (Hbv) market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Hepatitis B Virus (Hbv) supply chain analysis

- Hepatitis B Virus (Hbv) trade analysis, Hepatitis B Virus (Hbv) market price analysis, and Hepatitis B Virus (Hbv) supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Hepatitis B Virus (Hbv) market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- F. Hoffmon La Roche Ltd.

- Merck & Co. Inc.

- AbbVie Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- AstraZeneca PLC

- Sanofi SA

- GlaxoSmithKline PLC

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Gilead Sciences Inc.

- Boehringer Ingelheim International GmbH

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- Vertex Pharmaceuticals Incorporated

- Eisai Co. Ltd.

- Aurobindo Pharma Limited

- Apotex Corp.

- Lupin Pharmaceuticals Inc.

- Cadila Healthcare Ltd.

- Celltrion Inc.

- Dynavax Technologies Corporation

- Accord Healthcare Inc.

- Par Pharmaceutical Inc.

- Arrowhead Pharmaceuticals Inc.

- Arbutus Biopharma Corporation

- Globeimmune Inc.

- Antios Therapeutics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 25.7 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |