Farm Tractor Rental Market Overview

The farm tractor rental market is witnessing significant growth as farmers seek cost-effective alternatives to owning agricultural machinery. High capital costs associated with purchasing tractors, combined with fluctuating farm incomes, have driven demand for rental services. Small and medium-scale farmers, in particular, benefit from rental solutions that provide access to advanced machinery without the financial burden of ownership. The rise of digital platforms offering on-demand tractor rentals has further streamlined the process, making farm mechanization more accessible. Additionally, government initiatives promoting sustainable agriculture and farm mechanization in developing regions have contributed to market expansion. With increasing awareness about precision farming and efficiency-driven agricultural practices, farmers are turning to rental services to access technologically advanced tractors equipped with GPS, automation, and data-driven farming solutions. The shift towards shared economy models in agriculture is expected to sustain long-term demand for tractor rentals.the farm tractor rental market has experienced rapid digitalization, with online rental platforms and mobile applications driving convenience and accessibility. Companies offering tractor rentals have expanded their service portfolios by integrating real-time tracking, telematics, and AI-driven predictive maintenance, ensuring optimal tractor performance and minimizing downtime. Governments and financial institutions have introduced subsidy programs and financing options to support small-scale farmers in adopting rental solutions, reducing operational barriers. The adoption of electric and autonomous tractors in rental fleets has gained momentum, addressing sustainability concerns while improving efficiency. Additionally, rising fuel prices and climate change-driven uncertainties have encouraged farmers to opt for rental tractors with lower operating costs and high fuel efficiency. The market has also seen a surge in short-term and seasonal rental contracts, allowing farmers to align machinery usage with specific harvesting and planting cycles. Partnerships between tractor manufacturers, rental service providers, and agritech firms are further optimizing service offerings, ensuring farmers have access to customized solutions tailored to their specific needs.

The farm tractor rental market is expected to see greater integration of smart farming technologies, with AI-powered automation and IoT-enabled tractors becoming standard in rental fleets. The expansion of subscription-based rental models, where farmers pay monthly fees for flexible tractor access, will gain traction as an alternative to conventional rental contracts. The proliferation of blockchain-based rental agreements will enhance transparency, ensuring secure transactions and improved asset tracking. Furthermore, the shift toward sustainable agricultural practices will drive demand for electric and hybrid tractors in rental fleets, reducing carbon emissions and operational costs. The increasing adoption of data-driven decision-making in farming will lead to tractors equipped with precision farming analytics, optimizing productivity and resource utilization. As demand rises in emerging economies, rental service providers will focus on expanding rural penetration through localized distribution networks and farmer education programs. With continued technological advancements and supportive policy frameworks, the farm tractor rental market will play a pivotal role in the future of mechanized agriculture.

Key Insights: Farm Tractor Rental Market

- Rise of Digital Rental Platforms: Online marketplaces and mobile applications are revolutionizing tractor rentals by offering real-time availability, pricing transparency, and seamless booking processes for farmers.

- Integration of Telematics and Predictive Maintenance: Rental tractors equipped with telematics and AI-based maintenance tools are improving uptime and efficiency, minimizing breakdown risks during critical farming operations.

- Adoption of Electric and Autonomous Tractors: The shift toward sustainable agriculture is driving the inclusion of electric and self-driving tractors in rental fleets, reducing fuel costs and labor dependency.

- Short-Term and Seasonal Rental Growth: Farmers increasingly prefer flexible rental options that align with specific planting and harvesting cycles, optimizing costs and machinery utilization.

- Blockchain-Enabled Smart Contracts: Blockchain-based rental agreements ensure secure, transparent, and tamper-proof transactions, enhancing trust between service providers and farmers.

- High Cost of Tractor Ownership: The significant capital investment required for tractor purchases has led farmers to seek rental solutions as a more affordable alternative.

- Government Support for Farm Mechanization: Subsidies, financial assistance, and policy initiatives promoting mechanized agriculture are driving the adoption of tractor rental services, particularly in developing regions.

- Growing Demand for Precision Agriculture: Farmers are increasingly relying on advanced tractors equipped with GPS and AI-driven analytics, making rental a viable option for accessing modern farming technology.

- Rising Fuel Prices and Operational Costs: Increasing fuel and maintenance expenses have encouraged farmers to rent fuel-efficient and technologically advanced tractors to optimize costs.

- Limited Rural Infrastructure and Awareness: In many developing regions, lack of awareness about rental services and inadequate infrastructure for machinery distribution hinder market penetration and adoption rates.

Farm Tractor Rental Market Segmentation

By Type

- Internal Combustion Engine (ICE)

- Electric

By Operations

- Manual Tractor Vehicle

- Autonomous Tractor Vehicle

By Power Output

- 250 HP

By Drive type

- Two Wheel

- Four Wheel

By Application

- Harvesting

- Seed Sowing

- Irrigation

- Other Applications

Key Companies Analysed

- Messick’s Farm Equipment Inc.

- Deere & Company

- CNH Industrial NV

- Kubota Corporation

- Mahindra & Mahindra Limited

- AGCO Corporation

- Titan Machinery Inc.

- Escorts Limited

- The Papé Group Inc.

- Atlantic Tractor LLC

- Sunsouth LLC

- Birkey's Farm Store Inc.

- Rocky Mountain Equipment

- Agri-Service LLC

- Flaman Group of Companies

- Friesen Sales & Rentals Ltd.

- Van der Sluis Technische Bedrijven

- Stotz Equipment

- Hoober Inc.

- Green Diamond Equipment Ltd.

- Pacific Ag Rentals LLC

- S&H Farm Supply Inc.

- Meade Tractor

- Beard Implement Co.

- Tractors and Farm Equipment Limited

- Pacific Tractor & Implement

- Premier Equipment Rental Inc.

- Shearer Equipment

- Chupp Implement Co.

- Dowda Farm Equipment Inc.

Farm Tractor Rental Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Farm Tractor Rental Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Farm Tractor Rental market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Farm Tractor Rental market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Farm Tractor Rental market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Farm Tractor Rental market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Farm Tractor Rental market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Farm Tractor Rental value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Farm Tractor Rental industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Farm Tractor Rental Market Report

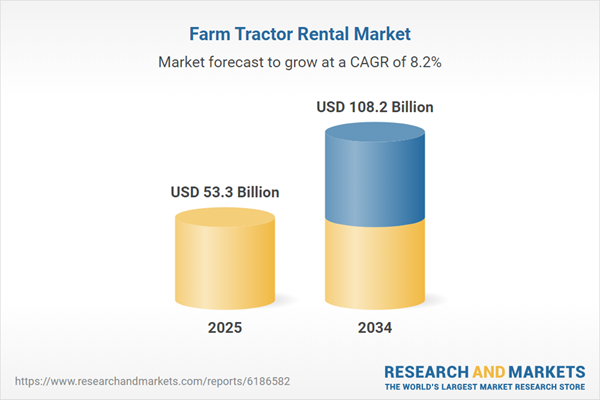

- Global Farm Tractor Rental market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Farm Tractor Rental trade, costs, and supply chains

- Farm Tractor Rental market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Farm Tractor Rental market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Farm Tractor Rental market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Farm Tractor Rental supply chain analysis

- Farm Tractor Rental trade analysis, Farm Tractor Rental market price analysis, and Farm Tractor Rental supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Farm Tractor Rental market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Messick’s Farm Equipment Inc.

- Deere & Company

- CNH Industrial NV

- Kubota Corporation

- Mahindra & Mahindra Limited

- AGCO Corporation

- Titan Machinery Inc.

- Escorts Limited

- The Papé Group Inc.

- Atlantic Tractor LLC

- Sunsouth LLC

- Birkey's Farm Store Inc.

- Rocky Mountain Equipment

- Agri-Service LLC

- Flaman Group of Companies

- Friesen Sales & Rentals Ltd.

- Van der Sluis Technische Bedrijven

- Stotz Equipment

- Hoober Inc.

- Green Diamond Equipment Ltd.

- Pacific Ag Rentals LLC

- S&H Farm Supply Inc.

- Meade Tractor

- Beard Implement Co.

- Tractors and Farm Equipment Limited

- Pacific Tractor & Implement

- Premier Equipment Rental Inc.

- Shearer Equipment

- Chupp Implement Co.

- Dowda Farm Equipment Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 53.3 Billion |

| Forecasted Market Value ( USD | $ 108.2 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |