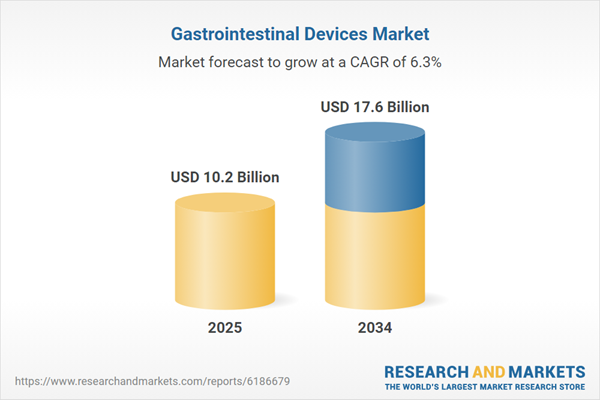

Gastrointestinal Devices Market Overview

The Gastrointestinal (GI) Devices Market is witnessing steady growth, driven by the increasing prevalence of gastrointestinal diseases, rising demand for minimally invasive procedures, and advancements in medical technology. GI devices are widely used for diagnosing, treating, and managing disorders such as gastroesophageal reflux disease (GERD), colorectal cancer, inflammatory bowel disease (IBD), and ulcers. With an aging population and growing awareness about early diagnosis, the demand for endoscopic and surgical interventions has surged. Additionally, technological innovations, such as AI-assisted endoscopy, capsule endoscopy, and robotic-assisted surgeries, are enhancing the accuracy and efficiency of GI procedures. The growing adoption of minimally invasive techniques is reducing hospital stays, lowering healthcare costs, and improving patient outcomes. As healthcare infrastructure improves globally, emerging markets are also witnessing increased demand for GI devices. Companies in the market are focusing on product innovations, regulatory approvals, and strategic collaborations to expand their portfolios and market presence.The Gastrointestinal Devices Market has experienced notable developments, primarily influenced by advancements in endoscopic technology and an increasing number of GI-related procedures. The adoption of artificial intelligence (AI) in endoscopy has significantly improved the detection and diagnosis of conditions such as colorectal cancer and polyps, enabling faster and more precise interventions. Additionally, the market has seen a rise in demand for single-use endoscopic devices to reduce the risk of cross-contamination and hospital-acquired infections. With healthcare facilities emphasizing patient safety, the shift from reusable to disposable GI devices has accelerated. Another key trend has been the expansion of robotic-assisted surgeries in gastroenterology, allowing for greater precision in complex procedures such as bariatric surgeries and tumor resections. Meanwhile, regulatory approvals for new and advanced GI devices have increased, fostering competition among leading medical device manufacturers. However, challenges such as high procedure costs and reimbursement limitations in certain regions continue to hinder market growth, particularly in developing countries.

The Gastrointestinal Devices Market is expected to see further innovation, particularly in AI-driven diagnostics, telemedicine integration, and patient-friendly minimally invasive procedures. The expansion of smart endoscopic technologies, capable of real-time image enhancement and early cancer detection, will continue to transform the GI healthcare landscape. Additionally, improvements in 3D imaging and robotic-assisted procedures will enhance surgical accuracy and reduce procedural risks. The increasing adoption of capsule endoscopy, which provides a non-invasive alternative for diagnosing GI disorders, is expected to gain traction, particularly for detecting small bowel diseases. With a growing focus on personalized medicine, targeted therapies for gastrointestinal disorders will see greater integration with advanced GI devices, improving patient-specific treatments. The market will also witness a rise in home-based diagnostic solutions, enabling early disease detection and remote patient monitoring. As healthcare systems continue to emphasize cost-effective, efficient solutions, manufacturers will prioritize innovations that enhance patient care while minimizing procedural expenses, driving sustained market expansion.

Key Insights: Gastrointestinal Devices Market

- AI-Powered Endoscopy: The integration of artificial intelligence in endoscopy is revolutionizing GI diagnostics by enhancing real-time detection of abnormalities, reducing false negatives, and improving diagnostic accuracy for conditions like colorectal cancer and polyps.

- Rise of Single-Use Endoscopic Devices: The growing emphasis on infection control and patient safety has led to increased adoption of disposable GI devices, reducing the risk of cross-contamination and hospital-acquired infections.

- Advancements in Robotic-Assisted GI Surgeries: Robotic technology is enhancing precision in gastrointestinal procedures, allowing for minimally invasive interventions with improved surgical outcomes and faster patient recovery times.

- Expansion of Capsule Endoscopy: The growing use of capsule endoscopy for diagnosing small bowel diseases and detecting internal bleeding is gaining popularity due to its non-invasive nature and patient-friendly approach.

- Integration of Telemedicine and Remote Diagnostics: The use of telehealth platforms for GI consultations and remote patient monitoring is improving access to care, allowing for early diagnosis and treatment of gastrointestinal disorders.

- Increasing Prevalence of GI Disorders: The rising incidence of gastrointestinal diseases, including colorectal cancer, GERD, and IBD, is driving demand for advanced diagnostic and therapeutic devices.

- Growing Preference for Minimally Invasive Procedures: Patients and healthcare providers are opting for minimally invasive GI interventions due to reduced hospital stays, faster recovery, and lower healthcare costs.

- Technological Innovations in Endoscopy: Continuous advancements in imaging, AI-assisted diagnostics, and robotic-assisted surgeries are enhancing the effectiveness and precision of GI procedures.

- Expanding Healthcare Infrastructure in Emerging Markets: Improving access to healthcare services and increasing investments in medical technologies are fueling demand for gastrointestinal devices in developing regions.

- High Cost of GI Procedures and Devices: The expensive nature of advanced GI devices and procedures, coupled with reimbursement limitations in certain regions, poses a significant barrier to market expansion, especially in developing economies.

Gastrointestinal Devices Market Segmentation

By Product Type

- GI Videoscopes

- Biopsy Devices

- Endoscopic Retrograde Cholangiopancreatography Devices (ERCP)

- Capsule Endoscopy

- Endoscopic Ultrasound

- Endoscopic Mucosal Resection (EMR)

- Hemostasis Devices

- Other Product Types

By Sales Channel

- Online Retailing

- Medical Stores & Brand Outlet

By End Users

- Hospitals

- Clinics & Dialysis Centers

- Ambulatory Surgical Center

Key Companies Analysed

- Johnson and Johnson Services Inc.

- Medtronic plc

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

- Becton

- Dickinson and Company

- Stryker Corporation

- Boston Scientific Corporation

- B. Braun Melsungen AG

- Olympus Corporation

- Interscope Inc.

- Hologic Inc.

- Steris plc

- Cook Group Incorporated

- MICRO-TECH Co. Ltd.

- Cantel Medical Corp.

- CONMED Corporation

- PENTAX Medical Company

- Karl Storz SE & Co. KG

- US Endoscopy Inc.

- Richard Wolf GmbH

- Motus GI Holdings Inc.

- Congentix Medical Inc.

- ERBE Elektromedizin GmbH

- Creo Medical Group plc

- GI Dynamics Inc.

- Millennium Surgical Corp.

- Mauna Kea Technologies SA

- EndoMaster Pte Ltd.

- EndoChoice Holdings Inc.

- Zhanjiang Bokang Biotechnology Co. Ltd.

- Jinshan Science & Technology Co.

- Safe Medical Design Inc.

Gastrointestinal Devices Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Gastrointestinal Devices Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Gastrointestinal Devices market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Gastrointestinal Devices market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Gastrointestinal Devices market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Gastrointestinal Devices market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Gastrointestinal Devices market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Gastrointestinal Devices value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Gastrointestinal Devices industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Gastrointestinal Devices Market Report

- Global Gastrointestinal Devices market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Gastrointestinal Devices trade, costs, and supply chains

- Gastrointestinal Devices market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Gastrointestinal Devices market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Gastrointestinal Devices market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Gastrointestinal Devices supply chain analysis

- Gastrointestinal Devices trade analysis, Gastrointestinal Devices market price analysis, and Gastrointestinal Devices supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Gastrointestinal Devices market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Johnson and Johnson Services Inc.

- Medtronic PLC

- Siemens Healthineers AG

- Fujifilm Holdings Corporation

- Becton

- Dickinson and Company

- Stryker Corporation

- Boston Scientific Corporation

- B. Braun Melsungen AG

- Olympus Corporation

- Interscope Inc.

- Hologic Inc.

- Steris PLC

- Cook Group Incorporated

- MICRO-TECH Co. Ltd.

- Cantel Medical Corp.

- CONMED Corporation

- PENTAX Medical Company

- Karl Storz SE & Co. KG

- US Endoscopy Inc.

- Richard Wolf GmbH

- Motus GI Holdings Inc.

- Congentix Medical Inc.

- ERBE Elektromedizin GmbH

- Creo Medical Group PLC

- GI Dynamics Inc.

- Millennium Surgical Corp.

- Mauna Kea Technologies SA

- EndoMaster Pte Ltd.

- EndoChoice Holdings Inc.

- Zhanjiang Bokang Biotechnology Co. Ltd.

- Jinshan Science & Technology Co.

- Safe Medical Design Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.2 Billion |

| Forecasted Market Value ( USD | $ 17.6 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |