Peripheral Vascular Devices and Equipment Market Overview

The peripheral vascular devices and equipment market is experiencing steady growth, driven by the increasing prevalence of peripheral vascular diseases (PVD) such as peripheral artery disease (PAD), chronic venous insufficiency, and varicose veins. These conditions often result from lifestyle factors like poor diet, lack of exercise, smoking, and obesity, which are becoming more common globally. Peripheral vascular devices, including catheters, stents, balloons, and angioplasty devices, are essential for diagnosing, treating, and managing these diseases. The rising aging population, along with the increasing incidence of diabetes, hypertension, and other comorbidities, is further expanding the market for vascular interventions. Technological advancements in medical devices, such as drug-coated stents, minimally invasive surgical tools, and 3D imaging systems, have enhanced the efficacy and safety of vascular procedures, making them more accessible to patients. Moreover, the increasing focus on improving patient outcomes and reducing recovery times has led to the widespread adoption of these advanced devices in hospitals, outpatient clinics, and specialty centers. With growing awareness and healthcare investments, the market is expected to continue expanding as peripheral vascular interventions become more widely accessible.The market for peripheral vascular devices and equipment has seen significant developments, particularly with the continued rise in minimally invasive procedures. Advancements in stenting and balloon angioplasty technologies have led to higher success rates in treating peripheral artery disease (PAD) and other vascular conditions. New-generation drug-eluting stents and bioresorbable devices are gaining traction, offering patients longer-lasting results and reducing the need for repeat interventions. Moreover, the growing demand for less invasive treatments has spurred the development of new technologies, such as endovenous laser therapy (EVLT) and radiofrequency ablation (RFA) devices for venous diseases. The increasing shift toward outpatient and same-day discharge procedures has also contributed to the demand for smaller, more efficient vascular devices that can be used in office-based settings. Additionally, digitalization and the adoption of robotic-assisted vascular surgery are expected to improve precision in surgeries, making the treatment of peripheral vascular diseases more accurate and effective. These advancements are expected to further propel market growth, providing more targeted and less invasive treatment options for patients with vascular disorders.

The peripheral vascular devices and equipment market is expected to witness continued innovation and growth. There will be a greater emphasis on developing personalized treatments for patients with peripheral vascular diseases, leveraging advanced imaging technologies, and AI-driven solutions to improve diagnosis and treatment planning. New drug-coated devices and improved stent designs that promote endothelial healing will continue to drive patient outcomes and reduce complications. Additionally, the integration of nanotechnology and regenerative medicine is expected to play a pivotal role in developing advanced vascular devices that support tissue regeneration and improve blood flow. The shift toward home-based care and ambulatory settings will increase the demand for portable and user-friendly vascular equipment, providing patients with greater flexibility and reducing hospital visits. As the healthcare sector increasingly focuses on preventative care, new therapies aimed at preventing vascular diseases, along with early-stage interventions, will play a key role in reducing the need for invasive procedures. These advancements, combined with rising healthcare investments, will continue to fuel the growth of the peripheral vascular devices market, offering new opportunities for patients and healthcare providers alike.

Key Insights: Peripheral Vascular Devices and Equipment Market

- Advancement of Drug-Eluting and Bioresorbable Devices: Drug-coated stents and bioresorbable vascular scaffolds are becoming more popular for treating peripheral artery disease, providing better long-term outcomes.

- Growth in Minimally Invasive Procedures: The demand for minimally invasive vascular procedures is increasing, with innovations in devices like stents, catheters, and balloons improving patient outcomes and reducing recovery times.

- Robotic-Assisted Vascular Surgery and Digitalization: The integration of robotic systems and AI-driven technologies is enhancing precision, safety, and efficiency in vascular surgeries.

- Rise of Home and Outpatient Care Options: The shift towards outpatient and home-based care is driving demand for portable and user-friendly vascular equipment that can be used in ambulatory settings.

- Integration of Nanotechnology and Regenerative Medicine: Nanotechnology and regenerative therapies are expected to play an essential role in the development of advanced vascular devices, improving healing and long-term recovery.

- Increasing Prevalence of Peripheral Vascular Diseases: The growing incidence of peripheral artery disease, varicose veins, and other vascular conditions is driving demand for more effective vascular devices.

- Technological Advancements in Vascular Device Design: New-generation stents, balloons, and bioresorbable devices are improving treatment efficacy and patient outcomes, fueling market demand.

- Rising Focus on Minimally Invasive Treatments: There is an increasing preference for minimally invasive treatment options, as they offer shorter recovery times and fewer complications than traditional surgeries.

- Growth in Outpatient and Same-Day Discharge Procedures: The growing trend of outpatient procedures and same-day discharges is contributing to the demand for more efficient, cost-effective peripheral vascular devices that can be used in non-hospital settings.

- High Costs of Advanced Vascular Devices and Procedures: The high cost of cutting-edge vascular devices, particularly drug-eluting and bioresorbable stents, poses a challenge for accessibility and adoption, especially in lower-income regions and for patients with limited healthcare coverage.

Peripheral Vascular Devices and Equipment Market Segmentation

By Type

- Peripheral vascular stents

- Percutaneous transluminal angioplasty balloons

- Catheters

- PTA guide wires

- Atherectomy devices

- Chronic total acclusion devices

- Aortic stents

- Synthetic surgical grafts

- Embolic protection devices

- Inferior vena cava filters

By Application

- Treatment of Peripheral Blood Vessels Damaged

- Treatment of Peripheral Blood Vessels Blockage

By End User

- Hospital applications

- Clinic applications

Key Companies Analysed

- Medtronic plc

- Boston Scientific Corporation

- Abbott Laboratories

- Cook Group

- Angiomed GmbH & Co. Medizintechnik KG

- Terumo Corporation

- ENDOLOGIX Inc.

- Bolton Medical Inc.

- JOTEC GmbH

- Clearstream Technologies

- Aesculap AG

- Curative Medical Devices

- Lepu Medical Technology

- MicroPort

- Bioteque Corporation Co.Ltd.

- Cardinal Health

- iVascular

- B. Braun Group

- Biosensors International Group

- BIOTRONIK SE & Co.

- COVIDien

- Volcano Corporation

- AngioScore

- Edwards Lifesciences Corporation

- Cordis Corporation

- Koninklijke Philips N.V.

- Nipro Corporation

- Bluesail Medical Co. Ltd

- Rex Medical

- Teleflex Incorporated

- Penumbra Inc.

- Lombard Medical Technologies PLC

- W.L. Gore & Associates Inc.

- Merit Medical Systems Inc.

- Vascular Solutions Inc.

- LeMaitre Vascular Inc.

- Spectranetics Corporation

Peripheral Vascular Devices and Equipment Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Peripheral Vascular Devices and Equipment Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Peripheral Vascular Devices and Equipment market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Peripheral Vascular Devices and Equipment market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Peripheral Vascular Devices and Equipment market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Peripheral Vascular Devices and Equipment market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Peripheral Vascular Devices and Equipment market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Peripheral Vascular Devices and Equipment value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Peripheral Vascular Devices and Equipment industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Peripheral Vascular Devices and Equipment Market Report

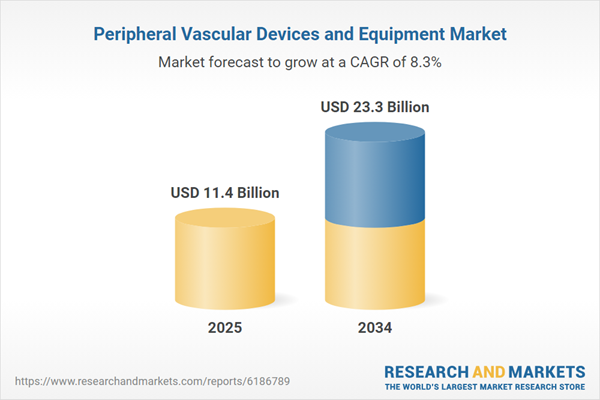

- Global Peripheral Vascular Devices and Equipment market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Peripheral Vascular Devices and Equipment trade, costs, and supply chains

- Peripheral Vascular Devices and Equipment market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Peripheral Vascular Devices and Equipment market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Peripheral Vascular Devices and Equipment market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Peripheral Vascular Devices and Equipment supply chain analysis

- Peripheral Vascular Devices and Equipment trade analysis, Peripheral Vascular Devices and Equipment market price analysis, and Peripheral Vascular Devices and Equipment supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Peripheral Vascular Devices and Equipment market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Medtronic PLC

- Boston Scientific Corporation

- Abbott Laboratories

- Cook Group

- Angiomed GmbH & Co. Medizintechnik KG

- Terumo Corporation

- ENDOLOGIX Inc.

- Bolton Medical Inc.

- JOTEC GmbH

- Clearstream Technologies

- Aesculap AG

- Curative Medical Devices

- Lepu Medical Technology

- MicroPort

- Bioteque Corporation Co.Ltd.

- Cardinal Health

- iVascular

- B. Braun Group

- Biosensors International Group

- BIOTRONIK SE & Co.

- COVIDien

- Volcano Corporation

- AngioScore

- Edwards Lifesciences Corporation

- Cordis Corporation

- Koninklijke Philips N.V.

- Nipro Corporation

- Bluesail Medical Co. Ltd.

- Rex Medical

- Teleflex Incorporated

- Penumbra Inc.

- Lombard Medical Technologies PLC

- W.L. Gore & Associates Inc.

- Merit Medical Systems Inc.

- Vascular Solutions Inc.

- LeMaitre Vascular Inc.

- Spectranetics Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.4 Billion |

| Forecasted Market Value ( USD | $ 23.3 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |