The serum market is a vital component of the life sciences and biotechnology ecosystem, playing a key role in cell culture, diagnostics, and therapeutic development. Serum - most commonly fetal bovine serum (FBS) - provides essential growth factors, hormones, and nutrients for in vitro cell cultivation. Its applications span pharmaceutical R&D, vaccine production, regenerative medicine, and academic research. As the demand for biologics, stem cell therapies, and personalized medicine expands, so does the need for high-quality, contamination-free serum products. While traditional FBS continues to dominate, the market is gradually exploring alternatives such as human serum, recombinant serum replacements, and chemically defined media to address ethical concerns, supply chain volatility, and batch-to-batch variability. Manufacturers are focusing on stringent quality control, traceability, and compliance with Good Manufacturing Practices (GMP), as regulatory agencies closely monitor the sourcing and handling of biological materials used in preclinical and clinical workflows.

The serum market witnessed steady growth driven by increased biopharmaceutical production, global vaccine initiatives, and investments in advanced cell-based research. Demand for GMP-grade FBS rose, particularly in North America and Europe, as regulatory compliance for therapeutic development became more stringent. Asia-Pacific saw rising consumption due to the rapid expansion of contract research organizations (CROs) and biomanufacturing hubs in China, India, and South Korea. Several suppliers ramped up production and introduced certified, virus-tested serum batches to enhance product safety and traceability. Ethical concerns around animal-derived products prompted more researchers and companies to trial serum-free or recombinant serum alternatives, particularly in stem cell and vaccine applications. Strategic partnerships between academic institutes and industry players supported the development of hybrid media solutions designed to reduce FBS usage while maintaining cell performance. Despite rising prices due to supply constraints and sourcing challenges, serum remained a cornerstone in upstream bioprocessing workflows.

The serum market is expected to evolve with increased focus on sustainability, reproducibility, and ethical sourcing. The adoption of serum-free and chemically defined media will gain momentum, especially in regenerative medicine, immunotherapy, and precision cell culture. Advances in synthetic biology and protein engineering will support the creation of serum alternatives with superior consistency and safety profiles. Regulatory frameworks around animal welfare and traceability will tighten globally, encouraging suppliers to innovate and diversify sourcing strategies. Meanwhile, AI-powered bioprocess optimization will drive demand for highly customized serum formulations tailored to specific cell lines and applications. Emerging markets in Latin America and Africa are anticipated to grow as public health systems and R&D infrastructure improve. However, the need for skilled personnel and high-cost purification processes will continue to influence market dynamics. Overall, the serum market will transition from dependency on traditional FBS toward a more balanced ecosystem of legacy products and modern replacements.

Key Insights: Serum Market

- Shift toward recombinant and chemically defined serum alternatives is gaining momentum, particularly in cell therapy and stem cell applications to improve consistency and reduce ethical concerns.

- Increased adoption of GMP-compliant and virus-tested serum batches is driven by rising regulatory scrutiny in therapeutic and vaccine manufacturing.

- Growing interest in hybrid media formulations is enabling partial replacement of FBS while maintaining high cell growth and productivity standards.

- Automation in cell culture processes is influencing demand for serum products compatible with closed-loop, large-scale bioprocessing systems.

- Globalization of biopharma R&D is pushing demand for high-quality serum products in emerging research hubs in Asia-Pacific, Latin America, and the Middle East.

- Rising biopharmaceutical production, including monoclonal antibodies, vaccines, and cell-based therapies, is fueling continuous demand for high-performance serum.

- Expansion of stem cell and regenerative medicine research is increasing the need for specialized and standardized serum formulations.

- Increased public and private investment in life sciences R&D is supporting long-term growth in academic and commercial research applications.

- Stringent quality and safety regulations in clinical and preclinical research are driving adoption of traceable, GMP-certified serum products.

- High cost, batch-to-batch variability, and supply chain risks associated with animal-derived serum products continue to challenge scalability and reproducibility, prompting a push for reliable, ethically sourced alternatives across research and biomanufacturing settings.

Serum Market Segmentation

By Type

- Bovine Serum

- Fetal bovine serum (FBS)

- Other Types

By Inactivation Technique

- Heat Inactivated

- Non-Heat Inactivated

By Application

- Biological Products

- Research

- Cell Culture

- Biopharmaceutical Drugs

- Vaccine Products

- Diagnostic Products

- Other Applications

Key Companies Analysed

- Merck Group

- Thermo Fisher Scientific Inc.

- Danaher Corp

- Corning Incorporated

- VWR International LLC

- Sartorius AG

- Bio-Techne Corporation

- Takara Bio Inc.

- Atlas Biologicals Inc.

- Proliant Health & Biologicals

- Seracare Life Sciences Inc.

- Lampire Biological Labs Inc.

- Altogen Labs

- Innovative Research Inc.

- Lee Biosolutions Inc.

- Bovogen Biologicals Pty. Ltd.

- Caisson Labs Inc.

- Gemini BioProducts Holding Inc.

- Valley Biomedical Products & Services Inc.

- Equitech-Bio Inc.

- Rocky Mountain Biologicals

- PAN-Biotech GmbH

- BIOWEST SAS

- Moregate Biotech

- Tissue Culture Biologicals

- Kerafast Inc.

- Access Biologicals LLC

- Animal Technologies Inc.

- Cell Applications Inc.

- Cell Sciences Inc.

Serum Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Serum Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Serum market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Serum market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Serum market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Serum market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Serum market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Serum value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Serum industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Serum Market Report

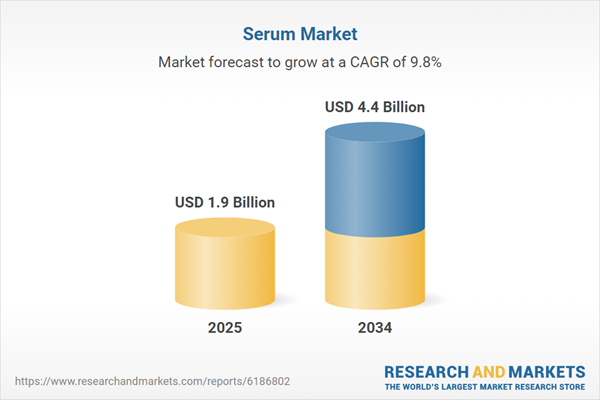

- Global Serum market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Serum trade, costs, and supply chains

- Serum market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Serum market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Serum market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Serum supply chain analysis

- Serum trade analysis, Serum market price analysis, and Serum supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Serum market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Merck Group

- Thermo Fisher Scientific Inc.

- Danaher Corp

- Corning Incorporated

- VWR International LLC

- Sartorius AG

- Bio-Techne Corporation

- Takara Bio Inc.

- Atlas Biologicals Inc.

- Proliant Health & Biologicals

- Seracare Life Sciences Inc.

- Lampire Biological Labs Inc.

- Altogen Labs

- Innovative Research Inc.

- Lee Biosolutions Inc.

- Bovogen Biologicals Pty. Ltd.

- Caisson Labs Inc.

- Gemini BioProducts Holding Inc.

- Valley Biomedical Products & Services Inc.

- Equitech-Bio Inc.

- Rocky Mountain Biologicals

- PAN-Biotech GmbH

- BIOWEST SAS

- Moregate Biotech

- Tissue Culture Biologicals

- Kerafast Inc.

- Access Biologicals LLC

- Animal Technologies Inc.

- Cell Applications Inc.

- Cell Sciences Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |