Pulp and Paper Machinery Market Overview

The pulp and paper machinery market forms the backbone of the global paper manufacturing industry, providing the essential equipment used in processing wood pulp and producing various types of paper, including packaging, printing, and tissue paper. These machines encompass a wide range of systems, including pulpers, refiners, digesters, paper machines, drying systems, and winders. With growing demand for paper-based packaging, driven by e-commerce growth and sustainability concerns, the market has gained renewed momentum despite digitization trends reducing demand for print media. Developing economies, especially in Asia-Pacific and Latin America, are emerging as significant growth hubs due to rising urbanization, literacy rates, and industrial development. At the same time, modern pulp and paper manufacturers are increasingly investing in advanced machinery that offers higher energy efficiency, lower emissions, greater automation, and reduced water consumption, aligning with both cost optimization goals and regulatory requirements.The pulp and paper machinery market experienced a moderate resurgence, driven by strategic capital expenditures in sustainable packaging and infrastructure modernization. Several paper producers expanded capacity by upgrading to high-speed, energy-efficient machinery with integrated automation and quality control systems. The shift toward recycled and non-wood fibers prompted machine redesigns to accommodate varied raw material characteristics. China and India led new plant installations, while European producers invested in retrofitting to meet strict carbon emission standards. Suppliers increasingly offered end-to-end solutions, bundling machinery with automation software, remote diagnostics, and maintenance services. Trade activity also improved as supply chains stabilized post-pandemic, although machinery lead times remained extended due to high demand and persistent component shortages. Additionally, joint ventures between OEMs and regional players enabled localized production and service support, enhancing market competitiveness and equipment lifecycle value.

The pulp and paper machinery market is expected to be shaped by digital transformation, circular economy goals, and evolving consumer preferences. Advanced technologies such as AI-enabled monitoring, machine learning-based predictive maintenance, and smart sensors will become standard features in new machinery. Manufacturers will focus on modular machine designs that allow easier retrofitting, lower capital costs, and scalable capacity expansion. With the global push toward sustainable practices, demand for machinery capable of processing alternative fibers - such as agricultural residues, bamboo, and hemp - will increase. Export opportunities are expected to rise in Africa and Southeast Asia as governments invest in domestic paper production to reduce imports. Strategic partnerships will drive innovation and regional market penetration, while strong aftersales service, local support, and remote troubleshooting will become critical differentiators for vendors. Overall, the future market will demand machinery that is not only efficient and durable but also adaptable, digital-ready, and environmentally compliant.

Key Insights: Pulp and Paper Machinery Market

- Growing adoption of energy-efficient and low-emission paper machinery is helping manufacturers reduce operating costs and comply with environmental regulations.

- Integration of smart sensors and AI-based predictive maintenance tools is transforming machinery into intelligent, self-monitoring production assets.

- Rising use of alternative and recycled fibers is driving demand for versatile machinery capable of processing non-traditional raw materials.

- Modular machine designs are enabling cost-effective upgrades and capacity scaling without large capital investment or production disruption.

- OEMs are expanding service portfolios to include remote diagnostics, cloud-based monitoring, and machinery-as-a-service models.

- Increasing global demand for sustainable and biodegradable packaging solutions is fueling investment in high-performance pulp and paper machines.

- Rising paper consumption in emerging economies, especially for hygiene and packaging products, is creating new capacity expansion opportunities.

- Technological advancements in machine automation and control systems are enhancing operational efficiency and product consistency.

- Government support for green manufacturing and recycling infrastructure is accelerating modernization of older mills and machinery.

- High initial investment costs and extended ROI periods remain major barriers, particularly for small and mid-sized paper producers considering machinery upgrades or replacements in cost-sensitive markets.

Pulp and Paper Machinery Market Segmentation

By Type

- Continuous Digesters

- Pulp Washers

- Black Liquor Recovery Boiler (BRLB)

- Bleaching Towers

- Fourdrinier Machine

- Chip Piles

- Other Types

By Machine Type

- Specialty Paper Machine

- Graphic Paper Machine

- Packaging Paper Machine

- Tissue Paper Making Machines

By Distribution Channel

- Direct Sale (OEM)

- Indirect Sales

By Application

- Industrial

- Commercial

Key Companies Analysed

- Cargill Incorporated

- Tyson Foods Inc.

- National Foods Limited

- Hormel Foods Corporation

- Smithfield Foods Inc.

- Pilgrim's Pride Corporation

- Conagra Brands Inc.

- BRF S.A.

- Foster Farms

- JBS S.A.

- Koch Foods LLC

- Marfrig Global Foods S.A.

- National Beef Packing Company LLC

- Sanderson Farms Inc.

- Marel hf

- Perdue Farms Inc.

- Sadia S.A.

- Danish Crown A/S

- Keystone Foods LLC

- Empire Kosher Poultry Inc.

- Butterball LLC

- Boar's Head Provisions Co. Inc.

- Applegate Farms LLC

- Johnsonville LLC

- Farmland Foods Inc.

- Hillshire Brands Company

- Catena Zapata

- Malbec wines from various Argentine wineries

- Bodegas Muga

Pulp and Paper Machinery Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Pulp and Paper Machinery Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Pulp and Paper Machinery market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Pulp and Paper Machinery market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Pulp and Paper Machinery market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Pulp and Paper Machinery market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Pulp and Paper Machinery market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Pulp and Paper Machinery value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Pulp and Paper Machinery industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Pulp and Paper Machinery Market Report

- Global Pulp and Paper Machinery market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Pulp and Paper Machinery trade, costs, and supply chains

- Pulp and Paper Machinery market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Pulp and Paper Machinery market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Pulp and Paper Machinery market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Pulp and Paper Machinery supply chain analysis

- Pulp and Paper Machinery trade analysis, Pulp and Paper Machinery market price analysis, and Pulp and Paper Machinery supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Pulp and Paper Machinery market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cargill Incorporated

- Tyson Foods Inc.

- National Foods Limited

- Hormel Foods Corporation

- Smithfield Foods Inc.

- Pilgrim's Pride Corporation

- Conagra Brands Inc.

- BRF S.A.

- Foster Farms

- JBS S.A.

- Koch Foods LLC

- Marfrig Global Foods S.A.

- National Beef Packing Company LLC

- Sanderson Farms Inc.

- Marel hf

- Perdue Farms Inc.

- Sadia S.A.

- Danish Crown A/S

- Keystone Foods LLC

- Empire Kosher Poultry Inc.

- Butterball LLC

- Boar's Head Provisions Co. Inc.

- Applegate Farms LLC

- Johnsonville LLC

- Farmland Foods Inc.

- Hillshire Brands Company

- Catena Zapata

- Malbec wines from various Argentine wineries

- Bodegas Muga

Table Information

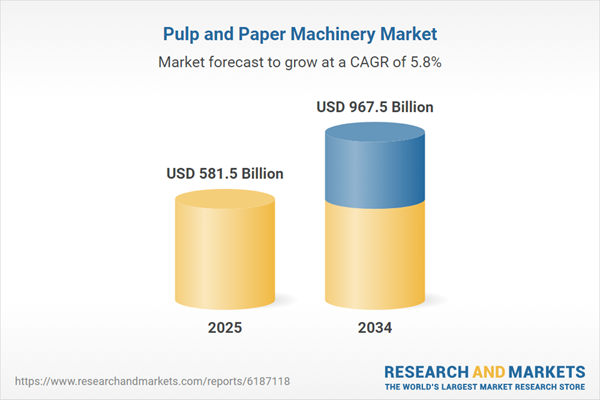

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 581.5 Billion |

| Forecasted Market Value ( USD | $ 967.5 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |