Family Offices Market Overview

The family offices market is growing steadily as ultra-high-net-worth individuals (UHNWIs) seek personalized wealth management solutions tailored to their complex financial needs. Family offices, which manage the investments, estate planning, philanthropy, and financial affairs of wealthy families, have gained prominence due to their ability to provide long-term financial sustainability and strategic asset allocation. The rise of multi-family offices (MFOs) has also expanded accessibility for affluent families who prefer shared resources and expertise over single-family office structures. As financial markets become more volatile, family offices are increasingly diversifying their portfolios by allocating assets to private equity, venture capital, impact investing, and alternative assets such as real estate and digital assets. Additionally, technological advancements in wealth management, including AI-driven financial analytics and blockchain solutions, are enhancing operational efficiency and security. With an increasing focus on generational wealth transfer and succession planning, family offices are evolving to meet the needs of younger family members who prioritize sustainable and ethical investments.the family offices market has seen notable shifts driven by economic uncertainty, regulatory changes, and evolving investment preferences. Geopolitical instability and inflationary pressures have prompted family offices to adopt more defensive investment strategies, favoring assets with long-term resilience such as infrastructure, commodities, and defensive equities. The rise of artificial intelligence and automation in portfolio management has streamlined investment decision-making, allowing family offices to leverage predictive analytics for risk management and asset allocation. Additionally, sustainable and impact investing has gained traction, with a growing number of family offices aligning their investments with environmental, social, and governance (ESG) criteria. Family offices are also expanding their direct investment strategies, favoring private deals and co-investments alongside institutional investors to reduce reliance on traditional asset managers. Furthermore, increased regulatory scrutiny, particularly concerning tax transparency and compliance, has led family offices to strengthen governance structures and risk management practices. As wealth preservation remains a primary goal, diversification into non-traditional assets, including digital currencies and collectibles, has continued to gain momentum.

The family offices market is expected to witness significant transformation through further integration of digital tools, AI-driven advisory services, and sustainable investment strategies. The increasing influence of next-generation family members will reshape investment priorities, with a stronger emphasis on social impact, technology-driven ventures, and climate-conscious portfolios. The adoption of blockchain for secure transactions and digital identity management is likely to streamline operational processes, improving transparency and security in wealth management. Furthermore, family offices will continue to expand their footprint in venture capital, funding innovative startups in fintech, biotech, and clean energy sectors. The rise of virtual family offices (VFOs), leveraging digital infrastructure to provide global wealth management solutions, will enhance accessibility for international families. As regulatory frameworks evolve, family offices will face stricter compliance measures, necessitating greater transparency and reporting standards. With geopolitical shifts and economic cycles influencing market dynamics, family offices will increasingly rely on data-driven strategies and cross-border investment opportunities to sustain and grow wealth in a rapidly changing financial landscape.

Key Insights: Family Offices Market

- Increased Adoption of AI and Data Analytics: Family offices are leveraging AI-powered financial tools for predictive analytics, risk assessment, and automated portfolio management, improving efficiency and investment decision-making.

- Expansion of Direct and Co-Investment Strategies: More family offices are bypassing traditional asset managers to invest directly in private equity, venture capital, and impact-driven businesses to enhance returns and control.

- Growing Influence of Next-Generation Investors: Younger family members are steering investment strategies towards technology startups, ESG-driven initiatives, and climate-friendly assets, shifting priorities within family offices.

- Integration of Blockchain in Wealth Management: Blockchain technology is enhancing transactional security, compliance, and asset tracking, helping family offices mitigate risks associated with fraud and cyber threats.

- Rise of Virtual Family Offices (VFOs): Digital transformation is enabling families to manage global wealth remotely through virtual platforms, reducing operational costs and enhancing access to financial expertise.

- Growing Demand for Alternative Investments: Family offices are increasingly diversifying into private equity, venture capital, and digital assets to optimize portfolio performance and hedge against market volatility.

- Regulatory and Tax Compliance Pressures: Governments worldwide are tightening tax regulations and financial disclosure requirements, pushing family offices to adopt stronger governance and risk management practices.

- Technological Innovations in Wealth Management: Advanced financial software, blockchain solutions, and AI-powered advisory platforms are transforming how family offices manage and allocate wealth.

- Shift Toward ESG and Sustainable Investing: The increasing demand for ethical and impact-driven investments is influencing family office strategies, aligning wealth management with sustainability goals.

- Complexity of Succession Planning and Wealth Transfer: Family offices face challenges in balancing generational wealth transfer while aligning investment strategies with the diverse priorities of heirs, requiring structured governance and long-term planning solutions.

Family Offices Market Segmentation

By Type

- Single Family Office

- Multi-Family Office

- Virtual Family Office

By Asset Class

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash Or Cash Equivalents

By Office

- Founders’ Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder's Office

- Other Offices

By Net-Worth Managed

- Less Than 50 Million

- 50 Million To 100 Million

- More Than 100 Million

Key Companies Analysed

- Cascade Investment Group Inc.

- MSD Partners LP

- Stonehage Fleming Group

- Glenmede Trust Co

- The Bessemer Group Incorporated.

- The Bank of New York Mellon Corporation

- UBS Group AG

- BMO Financial Group

- Cambridge Associates Ltd.

- Citigroup Inc.

- Wells Fargo & Company

- Northern Trust Corporation

- Silvercrest Asset Management Group LLC

- The Pictet Group

- Emerson Collective LLC

- Bezos Expeditions LLC

- Fedesa Europe S.A.

- The Woodbridge Company Ltd.

- Hillhouse Capital Management Limited

- Premji Invest

- ICONIQ Capital LLC

- Bregal Investments LLP

- Gart Capital Partners

- Rockefeller Capital Management L.P.

- Soros Fund Management LLC

- The Blackstone Group Inc.

- The Carlyle Group Inc.

- The Chernin Group Inc.

- The Pritzker Organization LLC

- The Raine Group LLC

- The Yucaipa Companies LLC

- Tiger Global Management LLC

Family Offices Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Family Offices Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Family Offices market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Family Offices market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Family Offices market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Family Offices market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Family Offices market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Family Offices value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Family Offices industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Family Offices Market Report

- Global Family Offices market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Family Offices trade, costs, and supply chains

- Family Offices market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Family Offices market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Family Offices market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Family Offices supply chain analysis

- Family Offices trade analysis, Family Offices market price analysis, and Family Offices supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Family Offices market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cascade Investment Group Inc.

- MSD Partners LP

- Stonehage Fleming Group

- Glenmede Trust Co

- The Bessemer Group Incorporated.

- The Bank of New York Mellon Corporation

- UBS Group AG

- BMO Financial Group

- Cambridge Associates Ltd.

- Citigroup Inc.

- Wells Fargo & Company

- Northern Trust Corporation

- Silvercrest Asset Management Group LLC

- The Pictet Group

- Emerson Collective LLC

- Bezos Expeditions LLC

- Fedesa Europe S.A.

- The Woodbridge Company Ltd.

- Hillhouse Capital Management Limited

- Premji Invest

- ICONIQ Capital LLC

- Bregal Investments LLP

- Gart Capital Partners

- Rockefeller Capital Management L.P.

- Soros Fund Management LLC

- The Blackstone Group Inc.

- The Carlyle Group Inc.

- The Chernin Group Inc.

- The Pritzker Organization LLC

- The Raine Group LLC

- The Yucaipa Companies LLC

- Tiger Global Management LLC

Table Information

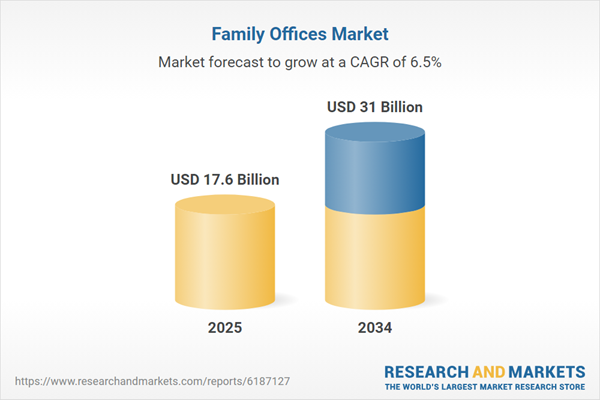

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 17.6 Billion |

| Forecasted Market Value ( USD | $ 31 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |