The Software Defined Networking (SDN) market represents a transformative shift in how modern networks are designed, deployed, and managed. Unlike traditional hardware-centric models, SDN decouples the control plane from the data plane, enabling centralized, programmable network management through software applications. This approach allows enterprises to respond more quickly to changing business requirements, optimize traffic flow, and automate tasks that were once manual and complex. SDN supports dynamic scaling, efficient bandwidth usage, and enhanced security - benefits that are especially critical in cloud computing, data centers, enterprise IT, and telecommunications. As digital transformation accelerates, businesses are demanding agile, responsive, and cost-effective network infrastructures. SDN is now seen as a foundational technology for managing the complexity of multi-cloud environments, edge computing, and 5G networks. By enabling centralized control and end-to-end visibility, SDN empowers organizations to innovate faster, reduce operational costs, and enhance network resilience in an increasingly connected world.

The SDN market experienced strong momentum as enterprises and service providers scaled digital operations and integrated more intelligent infrastructure. A surge in hybrid and multi-cloud adoption fueled demand for SDN solutions capable of managing diverse, distributed network environments. Vendors expanded SDN platforms to include AI-driven automation features such as intent-based networking, predictive analytics, and automated remediation for network anomalies. Telecom providers accelerated SDN deployments to support 5G rollouts, focusing on programmable network slicing and real-time service orchestration. Additionally, enterprises upgraded data center networks to SDN architectures to support containerized workloads and microservices applications. Open-source initiatives and interoperability standards gained traction, giving customers more flexibility in selecting vendors and reducing lock-in. Security enhancements such as micro-segmentation and zero-trust frameworks were embedded into SDN solutions to address rising cyber threats. These 2024 developments underscored SDN’s maturation from experimental deployments to a core enabler of network agility, efficiency, and security in enterprise and carrier environments.

The SDN market is poised for deeper integration with AI, edge computing, and cloud-native frameworks. AI-powered SDN controllers will provide real-time, autonomous network management, enabling predictive maintenance, dynamic load balancing, and proactive threat mitigation. As edge deployments proliferate in retail, manufacturing, and transportation, SDN will play a crucial role in orchestrating low-latency, distributed networks. Integration with Network Function Virtualization (NFV) and service meshes will further streamline network operations in telco and enterprise use cases. The adoption of disaggregated network hardware and white-box switching will rise, driven by the need for cost efficiency and vendor neutrality. Meanwhile, sustainability considerations will influence the development of energy-efficient SDN infrastructure, especially in large-scale data centers. However, skill shortages and operational complexity may hinder adoption among smaller enterprises lacking deep networking expertise. To succeed in this evolving landscape, vendors and integrators must prioritize interoperability, automation, and simplified user interfaces to make SDN more accessible and scalable for all business types.

Key Insights: Software Defined Networking Market

- Growth of AI-Driven Network Automation: SDN platforms are embedding AI and machine learning capabilities to enable intent-based networking, proactive maintenance, and real-time traffic optimization across cloud and on-premise environments.

- Expansion of SDN in 5G Infrastructure: Telecom providers are leveraging SDN to deploy programmable, scalable, and efficient networks that support 5G use cases such as network slicing, URLLC, and massive IoT.

- Rise of Disaggregated and Open Networking: Enterprises are adopting white-box switches and open standards to reduce vendor lock-in and increase flexibility in SDN deployments across data centers and campuses.

- Integration with Edge Computing and IoT: As edge infrastructure grows, SDN is being used to manage and automate connectivity across decentralized nodes, ensuring low-latency and secure data flows.

- Embedded Network Security Features: SDN platforms now offer built-in security capabilities such as micro-segmentation, policy enforcement, and anomaly detection, addressing modern cybersecurity challenges.

- Demand for Agile and Programmable Networks: Organizations require flexible networks that can adapt quickly to shifting workloads, user demands, and digital service delivery models - driving the shift to software-defined infrastructure.

- Acceleration of Cloud and Multi-Cloud Adoption: The complexity of managing connectivity and traffic across multiple cloud environments is prompting enterprises to adopt SDN for centralized visibility and control.

- Need for Operational Cost Reduction: SDN reduces the reliance on proprietary hardware and simplifies network management, enabling enterprises to lower CapEx and OpEx while improving performance.

- Increased Focus on Network Security and Compliance: With growing cyber threats and regulatory scrutiny, SDN provides dynamic and granular control over traffic flows, enabling secure network segmentation and policy enforcement.

- Complexity in Integration and Skill Shortages: Despite its advantages, SDN deployment can be complex and resource-intensive, requiring specialized skills that many organizations lack - slowing adoption, especially among smaller enterprises and legacy infrastructure environments.

Software Defined Networking Market Segmentation

By Type

- Open Software Defined Networking

- Software Defined Networking Via Application Programming Interfaces (API)

- Software Defined Networking Via Overlay

By Component

- Solution

- Service

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Banking

- Financial Services and Insurance (BFSI)

- Information Technology Enabled Services (ITeS)

- Education

- Retail

- Manufacturing

- Government and Defense

- Healthcare

- Other Applications

Key Companies Analysed

- Dell Technologies Inc.

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Broadcom Inc.

- Hewlett Packard Enterprise (HPE)

- Nokia Corporation

- VMware Inc.

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Arista Networks Inc.

- Fortinet Inc.

- Ciena Corporation

- Citrix Systems Inc.

- Avaya Inc.

- F5 Networks Inc.

- Check Point Software Technologies Ltd.

- Nutanix Inc.

- Riverbed Holdings Inc.

- Extreme Networks Inc.

- Zscaler Inc.

- Silver Peak Systems Inc.

- Versa Networks Inc.

- Aryaka Networks Inc.

- Gigamon Inc.

- Masergy Communications Inc.

Software Defined Networking Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Software Defined Networking Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Software Defined Networking market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Software Defined Networking market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Software Defined Networking market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Software Defined Networking market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Software Defined Networking market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Software Defined Networking value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Software Defined Networking industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Software Defined Networking Market Report

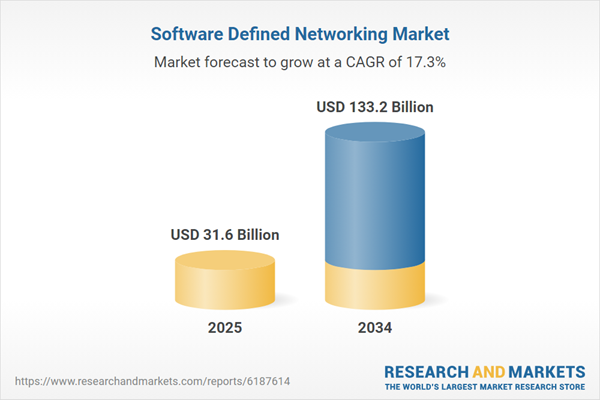

- Global Software Defined Networking market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Software Defined Networking trade, costs, and supply chains

- Software Defined Networking market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Software Defined Networking market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Software Defined Networking market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Software Defined Networking supply chain analysis

- Software Defined Networking trade analysis, Software Defined Networking market price analysis, and Software Defined Networking supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Software Defined Networking market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Dell Technologies Inc.

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Broadcom Inc.

- Hewlett Packard Enterprise (HPE)

- Nokia Corporation

- VMware Inc.

- Palo Alto Networks Inc.

- Juniper Networks Inc.

- Arista Networks Inc.

- Fortinet Inc.

- Ciena Corporation

- Citrix Systems Inc.

- Avaya Inc.

- F5 Networks Inc.

- Check Point Software Technologies Ltd.

- Nutanix Inc.

- Riverbed Holdings Inc.

- Extreme Networks Inc.

- Zscaler Inc.

- Silver Peak Systems Inc.

- Versa Networks Inc.

- Aryaka Networks Inc.

- Gigamon Inc.

- Masergy Communications Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 31.6 Billion |

| Forecasted Market Value ( USD | $ 133.2 Billion |

| Compound Annual Growth Rate | 17.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |