The file integrity monitoring (FIM) market is expanding rapidly as organizations increasingly prioritize cybersecurity and regulatory compliance. FIM solutions help detect unauthorized modifications, access, or anomalies in critical files, ensuring data integrity and security. With the rising frequency of cyber threats, data breaches, and ransomware attacks, businesses are adopting FIM tools to protect sensitive information and maintain operational continuity. Industries such as banking, healthcare, government, and IT are particularly dependent on FIM for compliance with stringent data protection regulations like GDPR, HIPAA, and PCI DSS. The integration of artificial intelligence (AI) and machine learning (ML) is enhancing FIM capabilities by enabling real-time monitoring, automated threat detection, and proactive security responses. As digital transformation accelerates, organizations are increasingly relying on cloud-based and hybrid IT infrastructures, further driving the demand for robust file integrity monitoring solutions to secure critical assets and mitigate risks.

The file integrity monitoring market is witnessing significant advancements driven by the growing sophistication of cyber threats and stricter regulatory requirements. Enterprises are prioritizing real-time monitoring solutions that provide continuous visibility into file changes and user activities. The shift towards cloud-native and hybrid security solutions is gaining traction, as businesses seek scalable and flexible FIM deployments. AI-powered anomaly detection is playing a crucial role in strengthening security posture, helping organizations quickly identify and respond to suspicious activities. Additionally, regulatory compliance pressures are pushing businesses to invest in automated FIM solutions that seamlessly integrate with broader security information and event management (SIEM) platforms. The demand for FIM tools in critical sectors such as financial services, healthcare, and government is surging, as organizations recognize the need for advanced security frameworks to combat insider threats and evolving attack vectors.

The file integrity monitoring market is expected to witness continued innovation, particularly in AI-driven automation and predictive threat intelligence. Organizations will increasingly adopt advanced behavioral analytics to detect subtle and sophisticated threats in real time. Cloud security will remain a focal point, with businesses deploying cloud-native FIM solutions to secure multi-cloud environments and remote work infrastructures. The integration of blockchain technology for immutable file integrity verification is also expected to gain momentum, providing enhanced transparency and tamper-proof auditing capabilities. Additionally, the growing use of zero-trust security frameworks will drive the adoption of FIM as a core component of proactive cybersecurity strategies. As cybercriminal tactics evolve, organizations will continue to seek holistic security solutions that offer seamless integration, adaptive threat detection, and compliance automation, ensuring that FIM remains a critical pillar of enterprise security.

Key Insights: File Integrity Monitoring Market

- AI-Driven Threat Detection: The integration of artificial intelligence and machine learning in FIM solutions is enhancing anomaly detection, reducing false positives, and enabling faster response to security threats.

- Cloud-Native FIM Solutions: As organizations move towards hybrid and multi-cloud infrastructures, the adoption of cloud-native file integrity monitoring tools is increasing to provide seamless protection across distributed environments.

- Blockchain for Tamper-Proof Security: The use of blockchain in FIM is emerging as a new trend, offering immutable file integrity verification and enhancing data transparency and auditability.

- Automated Compliance Management: Businesses are leveraging automated FIM tools to meet regulatory requirements efficiently, ensuring continuous compliance with data protection laws like GDPR, PCI DSS, and HIPAA.

- Integration with Zero-Trust Security Models: File integrity monitoring is becoming a key component of zero-trust architectures, ensuring continuous verification of user and file activity to prevent unauthorized access and data breaches.

- Rising Cybersecurity Threats: Increasing incidents of ransomware, insider threats, and data breaches are driving organizations to adopt FIM solutions to monitor file changes and detect unauthorized activities in real time.

- Stricter Regulatory Compliance Requirements: Governments and industry bodies are enforcing stringent data security regulations, compelling businesses to implement FIM tools to maintain compliance and avoid hefty penalties.

- Expansion of Cloud and Hybrid IT Environments: The growing adoption of cloud computing and hybrid infrastructures is fueling demand for advanced FIM solutions capable of securing dynamic and distributed IT environments.

- Shift Towards Proactive Security Strategies: Organizations are increasingly adopting proactive cybersecurity measures, integrating FIM with SIEM and endpoint detection and response (EDR) solutions to enhance threat detection and mitigation.

- Complex Implementation and Management: Deploying and managing FIM solutions across diverse IT infrastructures can be complex, requiring continuous fine-tuning and integration with existing security tools to ensure optimal performance and minimal false positives.

File Integrity Monitoring Market Segmentation

By Component

- Software

- Services

By Installation Mode

- Agentless

- Agent-Based

By Deployment Mode

- Cloud

- On-Premises

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Vertical

- Banking

- Financial Services and Insurance (BFSI)

- Healthcare and Life sciences

- Government

- Education

- Media and Entertainment

- Manufacturing and Automotive

- Retail and E-Commerce

- Other Verticals

Key Companies Analysed

- AT&T Cybersecurity

- VMware LLC

- Fortinet Inc.

- Splunk Inc.

- Micro Focus International plc

- McAfee LLC

- Trend Micro Incorporated

- CrowdStrike Holdings Inc.

- ManageEngine

- HelpSystems

- SolarWinds Worldwide LLC

- Rapid7 Inc.

- Qualys Inc.

- Varonis Systems Inc.

- Trustwave Holdings Inc.

- LogRhythm Inc.

- Alert Logic Inc.

- Lacework

- Netwrix Corporation

- Paessler AG

- Sophos Ltd.

- UpGuard Inc.

- New Net Technologies LLC

- Cimcor Inc.

- ATOMICORP

File Integrity Monitoring Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

File Integrity Monitoring Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - File Integrity Monitoring market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - File Integrity Monitoring market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - File Integrity Monitoring market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - File Integrity Monitoring market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - File Integrity Monitoring market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the File Integrity Monitoring value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the File Integrity Monitoring industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the File Integrity Monitoring Market Report

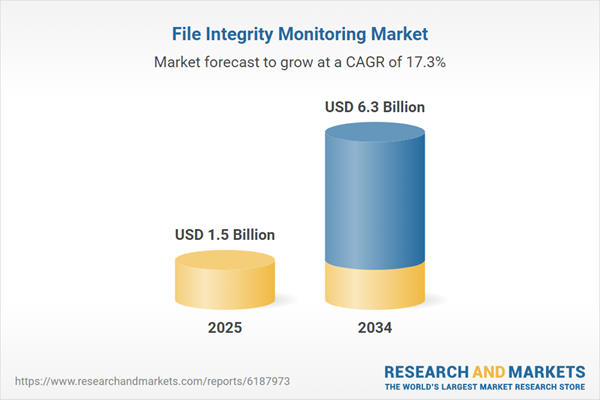

- Global File Integrity Monitoring market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on File Integrity Monitoring trade, costs, and supply chains

- File Integrity Monitoring market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- File Integrity Monitoring market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term File Integrity Monitoring market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and File Integrity Monitoring supply chain analysis

- File Integrity Monitoring trade analysis, File Integrity Monitoring market price analysis, and File Integrity Monitoring supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest File Integrity Monitoring market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AT&T Cybersecurity

- VMware LLC

- Fortinet Inc.

- Splunk Inc.

- Micro Focus International PLC

- McAfee LLC

- Trend Micro Incorporated

- CrowdStrike Holdings Inc.

- ManageEngine

- HelpSystems

- SolarWinds Worldwide LLC

- Rapid7 Inc.

- Qualys Inc.

- Varonis Systems Inc.

- Trustwave Holdings Inc.

- LogRhythm Inc.

- Alert Logic Inc.

- Lacework

- Netwrix Corporation

- Paessler AG

- Sophos Ltd.

- UpGuard Inc.

- New Net Technologies LLC

- Cimcor Inc.

- ATOMICORP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 6.3 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |