The Isothermal Forging Market centers around a specialized technique in which metal is forged at a constant temperature, typically near the material’s recrystallization point. This controlled environment minimizes thermal gradients, reduces residual stress, and results in highly precise, structurally sound components. It is especially valuable for aerospace, automotive, energy, and medical sectors where titanium and nickel-based alloys are used in mission-critical applications such as turbine disks, orthopedic implants, and high-performance engine parts. Unlike conventional forging, isothermal forging enables better flow characteristics and near-net shape production, minimizing material waste. As industries shift toward lightweight, durable components, isothermal forging is gaining traction for its efficiency and superior metallurgical quality.

The isothermal forging market expanded steadily as global aerospace and defense projects ramped up post-pandemic. OEMs sought high-strength, defect-free parts with consistent grain structures, making isothermal forging a preferred solution. Leading manufacturers like Arconic, ATI Metals, and Bharat Forge upgraded their press lines with real-time process monitoring and thermal control systems. Medical implant producers adopted isothermal forging for advanced titanium shapes, while EV component manufacturers began exploring the method for high-precision aluminum and magnesium alloy parts. Government-supported localization of aerospace supply chains in India and Europe further encouraged investments in isothermal forging infrastructure, particularly in titanium forging capabilities.

The isothermal forging market is poised to benefit from new material innovations and digital manufacturing integration. Aerospace demand will remain strong, particularly for turbine and engine parts where fatigue resistance and integrity are non-negotiable. The EV sector’s need for lightweight structural components will prompt increased experimentation with magnesium and aluminum alloys using this technique. AI and machine learning will be applied for real-time process correction and forge cycle optimization. Manufacturers will also explore hybrid forging approaches combining isothermal and conventional techniques to balance cost and quality. As the push for net-zero emissions continues, isothermal forging will play a critical role in producing the next generation of durable, lightweight, and sustainable components.

Key Insights: Isothermal Forging Market

- The analyst highlights growing adoption of isothermal forging for titanium and nickel alloys in aerospace applications, where uniform grain structure and high fatigue resistance are mission-critical.

- Expansion of isothermal forging in medical device manufacturing is trending, particularly for orthopedic implants that require bio-compatibility, dimensional accuracy, and minimal post-processing.

- According to the analyst, the EV industry is exploring isothermal forging for complex magnesium and aluminum alloy parts to achieve lighter, stronger battery casings and structural supports.

- Digital integration through sensors and AI-driven feedback loops is trending, enabling manufacturers to fine-tune temperature, pressure, and cycle time for optimal forge quality.

- Hybrid forging processes - combining isothermal techniques with conventional closed-die forging - are gaining traction for achieving cost-efficiency without compromising structural performance.

- The analyst identifies the aerospace sector’s requirement for fatigue-resistant, precision-forged turbine and engine parts as a core driver sustaining demand for isothermal forging globally.

- Growth in orthopedic implants and surgical hardware is pushing adoption of this forging method, which allows for precise shaping of titanium with minimal secondary machining, says the analyst.

- The analyst notes that interest in lightweight materials for electric vehicles and satellites is expanding isothermal forging applications into automotive and space-grade aluminum components.

- Government-backed industrial upgrades and localization programs are accelerating investments in forging infrastructure, especially in high-tech manufacturing hubs across Asia and Europe.

- The analyst highlights high equipment and tooling costs as significant barriers, particularly for small and mid-sized manufacturers lacking capital to invest in high-precision press systems and thermal controls.

- According to the analyst, narrow process windows and strict temperature management requirements make isothermal forging complex to operate, necessitating specialized workforce training and advanced monitoring systems.

Isothermal Forging Market Segmentation

By Raw Material

- Carbon Steel Metal Forging

- Alloy Steel Metal Forging

- Aluminum Metal Forging

- Magnesium Metal Forging

- Stainless Steel Metal Forging

- Titanium Metal Forging

- Other Raw Material Metal Forging

By Processes

- Conduction heating

- Induction heating

By End Use Vertical

- Aerospace and Defense

- Agriculture Equipment

- Automotive

- Construction and Mining Equipment and Components

- Electrical and Electronic

- Energy and Power

- Industrial and Manufacturing

- Marine and Rail

- Oil and Gas

Key Companies Analysed

- Anchor-Harvey Components LLC

- Arconic Corp.

- ATI Forged Inc.

- Bharat Forge Ltd.

- CFS Forge

- H C Starck Solutions Services Inc.

- Larsen & Toubro Ltd.

- Schuler Group

- Trenton Forging Company

- Pratt & Whitney

- Alcoa Corporation

- ALD Vacuum Technologies Pvt. Ltd.

- SMT Limited

- Precision Castparts Corp.

- Leistritz Turbinentechnik GmbH

- 3A Composites

- Sundaram Fasteners Ltd.

- Kalyani Forge Limited

- Aubert and Duval Pvt. Ltd.

- Bharat Dynamics Limited

- Bharat Electronics Limited

- Bharat Earth Movers Limited

- Bharat Petroleum Corporation Limited

- Amtek Auto Limited

- Tata Steel Limited

- Nanshan Forge Company

- Bharat Heavy Electricals Limited

- Formosa Plastics Group

- Howmet Aerospace Inc.

- Aalco metals ltd.

Isothermal Forging Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Isothermal Forging Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Isothermal Forging market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Isothermal Forging market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Isothermal Forging market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Isothermal Forging market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Isothermal Forging market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Isothermal Forging value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Isothermal Forging industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Isothermal Forging Market Report

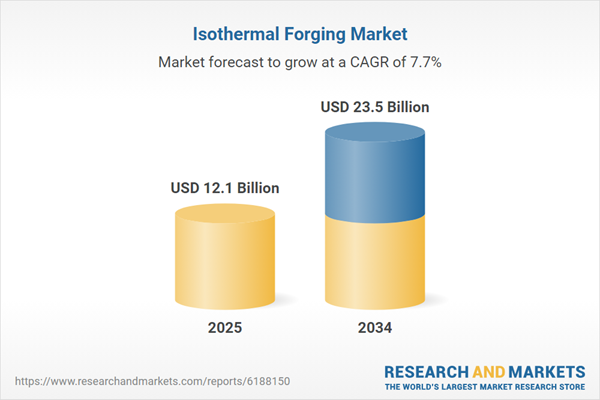

- Global Isothermal Forging market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Isothermal Forging trade, costs, and supply chains

- Isothermal Forging market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Isothermal Forging market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Isothermal Forging market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Isothermal Forging supply chain analysis

- Isothermal Forging trade analysis, Isothermal Forging market price analysis, and Isothermal Forging supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Isothermal Forging market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Anchor-Harvey Components LLC

- Arconic Corp.

- ATI Forged Inc.

- Bharat Forge Ltd.

- CFS Forge

- H C Starck Solutions Services Inc.

- Larsen & Toubro Ltd.

- Schuler Group

- Trenton Forging Company

- Pratt & Whitney

- Alcoa Corporation

- ALD Vacuum Technologies Pvt. Ltd.

- SMT Limited

- Precision Castparts Corp.

- Leistritz Turbinentechnik GmbH

- 3A Composites

- Sundaram Fasteners Ltd.

- Kalyani Forge Limited

- Aubert and Duval Pvt. Ltd.

- Bharat Dynamics Limited

- Bharat Electronics Limited

- Bharat Earth Movers Limited

- Bharat Petroleum Corporation Limited

- Amtek Auto Limited

- Tata Steel Limited

- Nanshan Forge Company

- Bharat Heavy Electricals Limited

- Formosa Plastics Group

- Howmet Aerospace Inc.

- Aalco metals Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 23.5 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |