The organophosphate pesticides market continues to play a crucial role in global agriculture, aiding in pest control and crop yield optimization. Organophosphate pesticides are widely used due to their effectiveness in eliminating insects, nematodes, and other pests that threaten food production. These pesticides function by inhibiting acetylcholinesterase, an enzyme necessary for nervous system function in pests, making them highly effective at lower concentrations. While organophosphates are preferred for their broad-spectrum action, concerns over toxicity, environmental impact, and health risks have led to increasing regulatory scrutiny. Various governments and regulatory bodies, such as the Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA), have introduced stricter regulations to limit the use of certain organophosphate compounds. However, demand remains strong in developing countries where agricultural productivity is a key priority. While alternative pest control methods, including bio-based pesticides and integrated pest management (IPM) strategies, are gaining traction, organophosphate pesticides continue to be widely adopted in commercial farming due to their cost-effectiveness and rapid action. The market is evolving, with major agrochemical companies focusing on developing safer formulations with reduced environmental impact.

The organophosphate pesticides market witnessed notable shifts, driven by changing regulations, technological advancements, and evolving agricultural practices. Several countries strengthened restrictions on high-toxicity organophosphates, phasing out hazardous variants while allowing limited use of safer alternatives. At the same time, agrochemical companies invested in developing new formulations with improved efficacy and lower toxicity to align with regulatory requirements. Precision agriculture technologies, including drone-based pesticide spraying and AI-driven pest detection, became more prevalent, optimizing pesticide usage and minimizing environmental damage. Additionally, the demand for organophosphates remained stable in regions with high agricultural dependency, such as Asia-Pacific and Latin America, where farmers continue to rely on chemical pest control to protect staple crops. Meanwhile, the rise of integrated pest management (IPM) strategies, combining chemical and biological controls, led to a decline in excessive pesticide use. The global push for sustainable agriculture also encouraged research into eco-friendly pesticide formulations. However, public concerns over pesticide residues in food and water sources fueled demand for organic farming alternatives. Despite these challenges, the market maintained steady growth, supported by ongoing advancements in pesticide formulations and targeted application methods.

The organophosphate pesticides market is expected to undergo further transformation, with a growing emphasis on sustainability, innovation, and regulatory compliance. Agrochemical companies will focus on developing next-generation organophosphate formulations with improved biodegradability, lower persistence in the environment, and reduced human toxicity. Governments worldwide will likely enforce stricter pesticide residue limits in food products, prompting agricultural sectors to adopt safer application techniques and alternative pest management solutions. The expansion of precision agriculture, including sensor-based pest monitoring and automated pesticide application, will further optimize pesticide use and reduce chemical runoff. Emerging markets in Africa and Southeast Asia will continue to drive demand for organophosphates, as these regions face increasing food security challenges due to climate change and pest infestations. However, the gradual shift toward organic farming and the rising adoption of bio-based pesticides will pose a competitive challenge to conventional organophosphates. As the agricultural industry seeks to balance productivity with sustainability, the future of the organophosphate pesticides market will depend on regulatory adaptations, technological advancements, and evolving consumer preferences for safer, eco-friendly food production.

Key Insights: Organophosphates Pesticides Market

- Rise of Precision Agriculture in Pesticide Application: The adoption of drone-based spraying, AI-driven pest monitoring, and sensor-based application techniques is optimizing organophosphate pesticide use, reducing environmental contamination and enhancing field efficiency.

- Development of Low-Toxicity and Biodegradable Organophosphates: Agrochemical companies are investing in advanced formulations that break down faster in the environment, reducing long-term toxicity and aligning with stricter regulatory requirements.

- Expansion of Integrated Pest Management (IPM) Strategies: Farmers are increasingly adopting IPM techniques that combine chemical, biological, and cultural pest control methods to minimize pesticide dependency while maintaining agricultural productivity.

- Regulatory Pressures Leading to Phased-Out Pesticide Variants: Governments worldwide are tightening regulations on high-risk organophosphates, gradually replacing them with safer alternatives, thereby reshaping market dynamics and product availability.

- Growing Consumer Preference for Organic and Chemical-Free Food: Increasing awareness of pesticide residues in food is driving demand for organic farming practices, putting pressure on conventional pesticide markets to adopt safer and more sustainable pest control methods.

- Growing Global Food Demand and Agricultural Productivity Needs: Rising populations and increasing food security concerns are driving demand for efficient pest control solutions, with organophosphates remaining a cost-effective choice for large-scale farming.

- Advancements in Agrochemical Formulations and Safer Alternatives: Ongoing R&D efforts are leading to improved organophosphate formulations with lower toxicity and reduced environmental persistence, ensuring compliance with global safety standards.

- Expansion of Agriculture in Emerging Markets: Developing economies in Asia, Latin America, and Africa are experiencing rapid agricultural growth, increasing reliance on organophosphate pesticides to enhance crop yields and prevent losses from pests.

- Climate Change Impact on Pest Populations: Rising temperatures and changing weather patterns are contributing to increased pest infestations, leading to higher demand for chemical pest control solutions, including organophosphates.

- Regulatory Restrictions and Environmental Concerns: Stringent government regulations and growing environmental awareness are leading to the phase-out of hazardous organophosphates, pushing companies to reformulate products while facing increasing pressure from alternative pest control solutions.

Key Trends, market drivers, and challenges shaping its future. Would you like insights into specific pesticide types, regional market dynamics, or competitive strategies?

Organophosphates Pesticides Market Segmentation

By Type

- Herbicides

- Insecticides

- Fungicides

- Other Types

By Ingredients

- Malathion

- Diazinon

- Glyphosate

- Methamidophos

- Dimethoate

- Chloropyriphos

- Parathion

- Other Ingredients

By Application

- Crop Based

- Non-Crop Based

Key Companies Analysed

- BASF SE

- Dow AgroSciences LLC

- Bayer AG

- Hebei Chenguang Pesticide Co Ltd.

- Yara International ASA

- Sumitomo Chemicals

- The Mosaic Company

- Syngenta Crop Protection AG

- Solvay S.A.

- The Monsanto Company

- DuPont de Nemours Inc.

- Sociedad Quimica y Minera

- United Phosphorus Limited

- FMC Corporation

- Adama Agricultural Solutions

- Nufarm Ltd.

- Chambal Fertilizers and Chemicals Ltd.

- Croda International PLC

- Tata Chemicals Ltd.

- Piramal Agro Ltd.

- Ishihara Sangyo Kaisha Limited

- Godrej Agrovet Ltd.

- Anhui Huaxing Chemical Industry Co Ltd.

- American Vanguard Corporation

- Cheminova A/S

- Valent USA LLC

- Rallis India Ltd.

- Isagro SpA

- Shandong Longlive Agrochem Co Ltd.

- Nantong Evergreen Agrochemical Co Ltd.

- Jiangsu Huai'an Chemical Industry Group Co Ltd.

- Zhejiang Xinyi Agrochemical Co Ltd.

- National Fertilizers Ltd.

Organophosphates Pesticides Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Organophosphates Pesticides Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Organophosphates Pesticides market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Organophosphates Pesticides market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Organophosphates Pesticides market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Organophosphates Pesticides market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Organophosphates Pesticides market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Organophosphates Pesticides value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Organophosphates Pesticides industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Organophosphates Pesticides Market Report

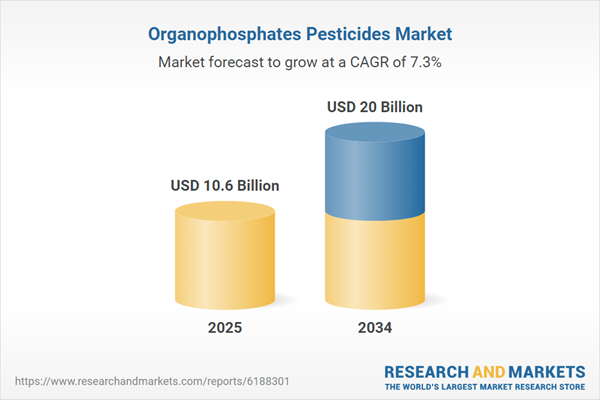

- Global Organophosphates Pesticides market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Organophosphates Pesticides trade, costs, and supply chains

- Organophosphates Pesticides market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Organophosphates Pesticides market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Organophosphates Pesticides market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Organophosphates Pesticides supply chain analysis

- Organophosphates Pesticides trade analysis, Organophosphates Pesticides market price analysis, and Organophosphates Pesticides supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Organophosphates Pesticides market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Dow AgroSciences LLC

- Bayer AG

- Hebei Chenguang Pesticide Co Ltd.

- Yara International ASA

- Sumitomo Chemicals

- The Mosaic Company

- Syngenta Crop Protection AG

- Solvay S.A.

- The Monsanto Company

- DuPont de Nemours Inc.

- Sociedad Quimica y Minera

- United Phosphorus Limited

- FMC Corporation

- Adama Agricultural Solutions

- Nufarm Ltd.

- Chambal Fertilizers and Chemicals Ltd.

- Croda International PLC

- Tata Chemicals Ltd.

- Piramal Agro Ltd.

- Ishihara Sangyo Kaisha Limited

- Godrej Agrovet Ltd.

- Anhui Huaxing Chemical Industry Co Ltd.

- American Vanguard Corporation

- Cheminova A/S

- Valent USA LLC

- Rallis India Ltd.

- Isagro SpA

- Shandong Longlive Agrochem Co Ltd.

- Nantong Evergreen Agrochemical Co Ltd.

- Jiangsu Huai'an Chemical Industry Group Co Ltd.

- Zhejiang Xinyi Agrochemical Co Ltd.

- National Fertilizers Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.6 Billion |

| Forecasted Market Value ( USD | $ 20 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |