Plastic Alternative Packaging Market Overview

The plastic alternative packaging market is experiencing rapid growth as industries and consumers shift towards sustainable, eco-friendly packaging solutions. With increasing awareness of plastic pollution and stringent government regulations banning single-use plastics, companies are actively investing in biodegradable, compostable, and recyclable packaging materials. Paper-based packaging, plant-derived bioplastics, and reusable alternatives are gaining traction across sectors such as food and beverage, personal care, e-commerce, and retail. Companies are also focusing on material innovations such as seaweed-based films, mushroom-based packaging, and cellulose-derived alternatives to reduce dependency on fossil fuel-based plastics. The push for circular economy principles is further driving adoption, with brands prioritizing packaging solutions that support recyclability and reduced waste. As consumer demand for sustainable products continues to rise, businesses are integrating eco-friendly packaging as a key element of their corporate social responsibility (CSR) and brand differentiation strategies.The market saw significant advancements with companies expanding their portfolios of plastic-free and compostable packaging solutions. Regulatory developments played a major role, with multiple regions implementing bans on single-use plastics and encouraging businesses to adopt greener alternatives. The food and beverage industry led the shift, with major brands launching plant-based and fiber-based packaging for takeout containers, bottled beverages, and snack packaging. Technological innovations such as water-soluble films, edible packaging, and advanced molded pulp solutions gained momentum. Additionally, collaborations between material scientists and packaging companies accelerated the development of high-barrier sustainable materials that offer the same protection as traditional plastics. Retailers also responded by reducing plastic in packaging, replacing polybags with paper-based alternatives, and offering refillable or zero-waste solutions to consumers. The global push for carbon neutrality further intensified the demand for materials with a lower environmental footprint.

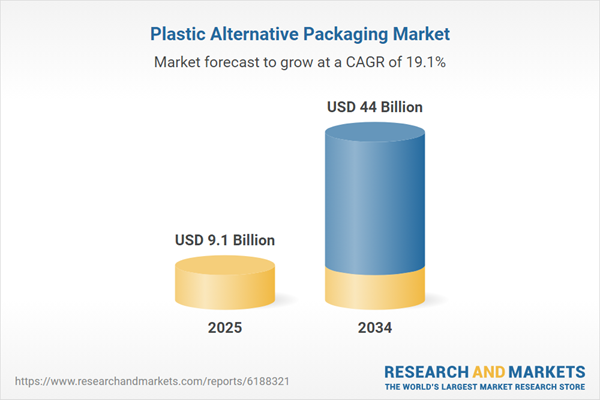

The plastic alternative packaging market is expected to witness accelerated growth with continued investments in research and development. Advanced biopolymers, enhanced fiber-based materials, and nanotechnology-driven coatings are anticipated to improve the functionality and performance of plastic-free packaging. The integration of smart packaging solutions, such as compostability indicators and bio-based sensors, will enhance consumer awareness and sustainability efforts. Governments are likely to introduce even stricter policies around extended producer responsibility (EPR), requiring brands to be accountable for their packaging waste. The rise of refillable and reusable packaging models will expand, driven by consumer preferences for waste-free shopping experiences. Additionally, the development of scalable production techniques will help reduce costs and make sustainable packaging more accessible to small and medium-sized enterprises (SMEs). As industries transition towards circular economy models, innovations in biodegradable and home-compostable materials will play a crucial role in shaping the future of sustainable packaging.

Key Insights: Plastic Alternative Packaging Market

- Rise of Fiber-Based Packaging - Paperboard, molded pulp, and cellulose-derived packaging solutions are increasingly replacing plastic due to their recyclability and biodegradability. Companies are innovating fiber-based coatings to enhance durability and moisture resistance.

- Edible and Water-Soluble Packaging - The development of packaging made from seaweed, starch, and other edible materials is gaining traction, particularly in the food industry. Water-soluble films for single-use applications such as detergent pods and instant food packaging are also becoming more popular.

- Growth of Refillable and Reusable Systems - Retailers and brands are launching refill stations and reusable packaging models to reduce single-use waste. This trend is expanding across cosmetics, household goods, and grocery packaging.

- Advanced Bioplastics Innovation - Next-generation biodegradable and compostable bioplastics derived from algae, agricultural waste, and mycelium (mushroom roots) are enhancing the market’s sustainability credentials.

- Smart and Intelligent Packaging - The integration of QR codes, compostability indicators, and blockchain technology is improving traceability and consumer engagement with sustainable packaging solutions.

- Stringent Government Regulations - Policies banning single-use plastics and enforcing sustainable packaging laws are compelling industries to adopt alternative materials and reduce their environmental impact.

- Rising Consumer Demand for Sustainability - Consumers are actively seeking products with eco-friendly packaging, prompting brands to shift toward compostable, biodegradable, and plastic-free options.

- Corporate Sustainability Commitments - Leading corporations are setting ambitious sustainability goals, pushing for carbon-neutral packaging and investing in alternative materials to align with ESG (Environmental, Social, and Governance) strategies.

- Advancements in Material Science - Innovations in biodegradable polymers, plant-based materials, and recyclable coatings are enhancing the performance and affordability of plastic alternatives.

- High Production Costs and Scalability Issues - The cost of producing alternative packaging remains higher than traditional plastics due to raw material expenses and limited production infrastructure. Scaling up manufacturing and achieving cost parity remain significant challenges for widespread adoption.

Plastic Alternative Packaging Market Segmentation

By Type

- Starch-Based Plastic

- Cellulose Based Plastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Other Types

By Process

- Bio-Based/Non-Biodegradable

- Biodegradable

By Application

- Food and Beverage

- Personal Care

- Health Care

- Other Applications

Key Companies Analysed

- BASF

- Amcor plc

- Tetra Pak International SA

- Sealed Air

- Evergreen Packaging

- Rengo Co. Ltd

- International Paper Company

- Mondi Group PLC

- Futamura Group

- SECOS Group

- Huhtamaki

- Shanghai PRECISE Packaging Co

- SIG Combibloc

- Greatview Aseptic Packaging

- BioPak

- Himalayan Packaging Industries Pvt. Ltd.

- Decon India Plastics Private Limited

- West Pharma

- Qingdao Likang Packing.

- Smurfit Kappa

- DS smith

- Element Packaging LTD

- Delyn Packaging Ltd

- CP Packaging Ltd

- Surepak innovative packaging company

- Epac flexible packaging

- Enviroplast Inc.

- TC Transcontinental

- PolyFerm Canada

- TerraVerdae Bioworks Inc.

- Kruger Inc.

- Klabin SA

- HP Inc.

- Choose Packaging

- Plastic Suppliers Inc.

- Saudi Investment Recycling Company (SIRC)

- Bemis Company Inc.

- Winpak LLC

- Rotopak LLC

- Gulf East Paper and Plastic Industries LLC

- Arabian Packaging LLC

- Amber Packaging Industries LLC

- Diamond Packaging Industries LLC

- Astrapak Ltd (RPC Group)

- Nampak Ltd.

- Mpact Pty Ltd

- Foster Packaging

- Consol Glass (Pty) Ltd.

- East African Packaging Industries Ltd (EAPI)

- Constantia Afripack (Pty) Ltd

- Bonpak (Pty) Ltd.

- Frigoglass South Africa (Pty) Ltd.

Plastic Alternative Packaging Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Plastic Alternative Packaging Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Plastic Alternative Packaging market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Plastic Alternative Packaging market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Plastic Alternative Packaging market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Plastic Alternative Packaging market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Plastic Alternative Packaging market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Plastic Alternative Packaging value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Plastic Alternative Packaging industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Plastic Alternative Packaging Market Report

- Global Plastic Alternative Packaging market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Plastic Alternative Packaging trade, costs, and supply chains

- Plastic Alternative Packaging market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Plastic Alternative Packaging market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Plastic Alternative Packaging market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Plastic Alternative Packaging supply chain analysis

- Plastic Alternative Packaging trade analysis, Plastic Alternative Packaging market price analysis, and Plastic Alternative Packaging supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Plastic Alternative Packaging market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF

- Amcor PLC

- Tetra Pak International SA

- Sealed Air

- Evergreen Packaging

- Rengo Co. Ltd.

- International Paper Company

- Mondi Group PLC

- Futamura Group

- SECOS Group

- Huhtamaki

- Shanghai PRECISE Packaging Co

- SIG Combibloc

- Greatview Aseptic Packaging

- BioPak

- Himalayan Packaging Industries Pvt. Ltd.

- Decon India Plastics Private Limited

- West Pharma

- Qingdao Likang Packing.

- Smurfit Kappa

- DS smith

- Element Packaging Ltd.

- Delyn Packaging Ltd.

- CP Packaging Ltd.

- Surepak innovative packaging company

- Epac flexible packaging

- Enviroplast Inc.

- TC Transcontinental

- PolyFerm Canada

- TerraVerdae Bioworks Inc.

- Kruger Inc.

- Klabin SA

- HP Inc.

- Choose Packaging

- Plastic Suppliers Inc.

- Saudi Investment Recycling Company (SIRC)

- Bemis Company Inc.

- Winpak LLC

- Rotopak LLC

- Gulf East Paper and Plastic Industries LLC

- Arabian Packaging LLC

- Amber Packaging Industries LLC

- Diamond Packaging Industries LLC

- Astrapak Ltd. (RPC Group)

- Nampak Ltd.

- Mpact Pty Ltd.

- Foster Packaging

- Consol Glass (Pty) Ltd.

- East African Packaging Industries Ltd. (EAPI)

- Constantia Afripack (Pty) Ltd.

- Bonpak (Pty) Ltd.

- Frigoglass South Africa (Pty) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 44 Billion |

| Compound Annual Growth Rate | 19.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 52 |