The global geothermal energy market is experiencing steady growth, driven by increasing demand for renewable energy and the global transition towards low-carbon power generation. Geothermal energy offers a reliable, sustainable, and continuous power source, making it an attractive alternative to fossil fuels. Governments and energy companies are investing in geothermal projects to diversify their energy portfolios and reduce greenhouse gas emissions. Advancements in drilling and exploration technologies have improved the efficiency of geothermal plants, making previously untapped resources viable for commercial use. Additionally, supportive policies and financial incentives are encouraging the development of new geothermal projects worldwide. However, high initial investment costs and site-specific resource availability remain key challenges. Despite these hurdles, the long-term economic and environmental benefits of geothermal energy continue to drive market expansion.

The geothermal energy market saw significant advancements in both capacity expansion and technological innovation. Several countries, including the United States, Indonesia, and Kenya, commissioned new geothermal plants to strengthen their renewable energy infrastructure. Enhanced Geothermal Systems (EGS) gained traction, allowing geothermal development in regions with lower natural permeability. The integration of geothermal energy with hybrid renewable systems, such as solar-geothermal and geothermal-battery storage, improved overall energy efficiency and reliability. Additionally, policy reforms and carbon reduction commitments accelerated investments in geothermal projects, particularly in Europe and Asia-Pacific. Geothermal heat applications, including district heating and industrial processes, also gained momentum, diversifying the market beyond electricity generation. These developments positioned geothermal energy as a critical component in achieving global decarbonization goals.

The geothermal energy market is expected to witness further expansion, driven by technological breakthroughs and increased government support. AI and machine learning will play a growing role in optimizing exploration and resource assessment, reducing project risks and costs. The development of supercritical geothermal systems, which can extract energy from deeper and hotter reservoirs, is anticipated to enhance power generation efficiency. Geothermal desalination projects are also expected to gain traction, addressing both energy and water scarcity challenges in arid regions. Additionally, growing collaboration between public and private sectors will facilitate faster project approvals and financing. However, competition from other renewable sources, such as solar and wind, may create pricing pressures and affect investment decisions. Nonetheless, the geothermal sector's ability to provide stable baseload power will continue to make it a crucial part of the global renewable energy mix.

Key Insights: Geothermal Energy Market

- Expansion of Enhanced Geothermal Systems (EGS): Advancements in drilling and fracturing technologies are enabling geothermal power generation in new regions with lower natural permeability.

- Hybrid Renewable Energy Integration: Geothermal energy is increasingly being integrated with solar and battery storage systems to enhance grid reliability and energy efficiency.

- Geothermal Direct Use Applications: The use of geothermal energy for heating, cooling, and industrial applications is expanding, reducing reliance on fossil fuels beyond electricity generation.

- AI and Digitalization in Exploration: Artificial intelligence and machine learning are improving geothermal resource identification and operational efficiency, reducing project risks and costs.

- Growth in Emerging Markets: Developing countries, particularly in Asia, Africa, and Latin America, are investing in geothermal projects to strengthen their renewable energy infrastructure.

- Rising Demand for Clean Energy: Governments and industries are prioritizing geothermal energy as a stable and low-carbon alternative to fossil fuels.

- Technological Advancements in Drilling: Innovations in deep drilling and reservoir stimulation techniques are making geothermal projects more cost-effective and widely accessible.

- Government Incentives and Policies: Supportive regulations, tax credits, and funding initiatives are driving increased investment in geothermal energy projects worldwide.

- Energy Security and Baseload Power Supply: Unlike intermittent renewables, geothermal energy provides continuous power generation, ensuring grid stability and reducing dependency on fossil fuels.

- High Initial Capital Costs: The upfront costs associated with geothermal exploration, drilling, and plant construction remain a significant barrier to market growth, limiting project development in some regions.

Geothermal Energy Market Segmentation

By Technology

- Binary Cycle Plants

- Flash Steam Plants

- Dry Steam Plants

- Ground Source Heat Pumps

- Direct Systems

- Other Technologies

By Application

- Power Generation

- Residential Heating and Cooling

- Commercial Heating and Cooling

By End Use

- Industrial

- Residential

- Commercial

Key Companies Analysed

- Berkshire Hathaway Energy

- Chevron Corporation

- Mitsubishi Corporation

- Enel Group

- Engie SA

- Siemens AG

- General Electric Group

- KEPCO Group

- PT. Pertamina Geothermal Energy

- Asea Brown Boveri Ltd.

- Toshiba International Corporation

- Calpine Corporation

- Tetra Tech Inc.

- Aboitiz Power Corporation

- First Gen Corporation

- Ormat Technologies

- Energy Development Corporation

- EthosEnergy Group

- Therma Source LLC

- Sarulla Operations Ltd.

- Turboden S.P.A.

- Terra-Green Power LLC

- Gradient Resources

- ElectraTherm

- Reykjavik Geothermal

Geothermal Energy Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Geothermal Energy Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Geothermal Energy market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Geothermal Energy market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Geothermal Energy market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Geothermal Energy market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Geothermal Energy market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Geothermal Energy value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Geothermal Energy industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Geothermal Energy Market Report

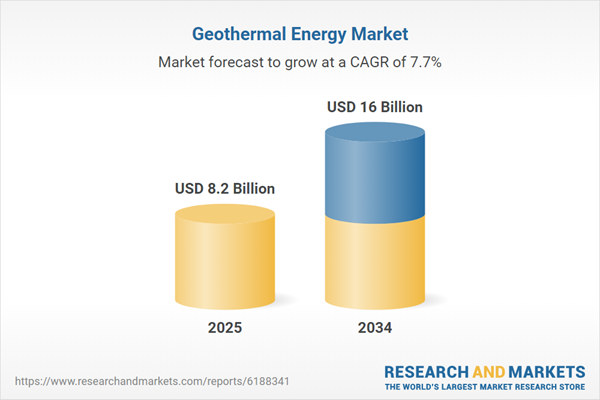

- Global Geothermal Energy market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Geothermal Energy trade, costs, and supply chains

- Geothermal Energy market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Geothermal Energy market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Geothermal Energy market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Geothermal Energy supply chain analysis

- Geothermal Energy trade analysis, Geothermal Energy market price analysis, and Geothermal Energy supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Geothermal Energy market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Berkshire Hathaway Energy

- Chevron Corporation

- Mitsubishi Corporation

- Enel Group

- Engie SA

- Siemens AG

- General Electric Group

- KEPCO Group

- PT. Pertamina Geothermal Energy

- Asea Brown Boveri Ltd.

- Toshiba International Corporation

- Calpine Corporation

- Tetra Tech Inc.

- Aboitiz Power Corporation

- First Gen Corporation

- Ormat Technologies

- Energy Development Corporation

- EthosEnergy Group

- Therma Source LLC

- Sarulla Operations Ltd.

- Turboden S.P.A.

- Terra-Green Power LLC

- Gradient Resources

- ElectraTherm

- Reykjavik Geothermal

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 16 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |