The Intercoms Systems and Equipment Market is evolving rapidly, driven by the growing demand for secure, real-time communication across commercial, residential, industrial, and institutional environments. Intercom systems - ranging from basic audio intercoms to sophisticated IP-based video systems - facilitate internal communication, access control, and surveillance. Modern systems integrate with building management systems (BMS), alarms, and video surveillance networks, offering centralized control and enhanced situational awareness. In residential applications, smart intercoms are increasingly integrated with mobile apps, facial recognition, and remote access features, meeting the rising demand for connected living. In commercial and industrial spaces, intercoms ensure communication in mission-critical environments such as hospitals, transport hubs, and manufacturing facilities. As urban development and infrastructure upgrades continue, the intercom market is gaining prominence as a key component of smart building solutions. The proliferation of IoT, AI-enabled analytics, and cloud-based security platforms is further reshaping the market landscape toward more intelligent and user-friendly systems.

The intercom systems market saw a significant transition toward IP-based and wireless technologies. Companies like Aiphone, Commend, and Hikvision launched systems that combined video, audio, and access control into single integrated platforms, enhancing convenience and security. Smart intercoms supporting remote operation via smartphones and tablets became the standard in new residential complexes and high-rise apartments. In the commercial sector, cloud-connected intercoms enabled real-time monitoring and multi-site communication, particularly appealing to retail chains and campus environments. Industrial users adopted rugged intercoms compatible with harsh environments and explosive zones. Healthcare facilities implemented nurse-call systems with intercom features to streamline patient communication and reduce response time. With remote work and hybrid environments becoming permanent, enterprises also retrofitted office buildings with touchless entry systems and mobile-operated intercoms. Integration with biometric readers and facial recognition also gained momentum, creating more seamless and secure access workflows across a variety of infrastructures.

The Intercom Systems and Equipment Market is expected to experience deeper convergence with AI, edge computing, and smart automation ecosystems. Future systems will offer predictive analytics for threat detection, facial emotion recognition for behavioral alerts, and seamless handoff between intercom and surveillance systems. Integration with cloud-based identity management platforms will allow centralized access control across distributed buildings and facilities. In smart homes, intercoms will function as AI voice hubs, capable of recognizing household members, adjusting settings, or integrating with digital assistants. Demand for interoperable, open-platform intercoms will rise, driven by organizations seeking vendor-agnostic solutions. Green building certifications and ESG goals will also influence product design, with manufacturers introducing energy-efficient components and recyclable materials. Additionally, smart city infrastructure investments will further boost adoption in transit systems, public buildings, and parking structures. As intercoms shift from passive devices to intelligent communication tools, the market will mature into a crucial element of digital building transformation.

Key Insights: Intercoms Systems and Equipment Market

- The analyst highlights the rise of IP-based intercom systems, which offer better scalability, remote monitoring, and integration with smart security networks across residential and commercial infrastructure projects.

- Wireless intercom adoption is growing due to easier installation, flexibility in retrofitting old buildings, and compatibility with mobile apps for remote access and notifications, according to the analyst.

- According to the analyst, intercoms with biometric and facial recognition capabilities are gaining traction in high-security zones like corporate campuses, data centers, and luxury housing complexes.

- Smart intercoms with AI-powered voice recognition and voice-to-text features are emerging, making them accessible to users with disabilities and improving communication in noisy environments, notes the analyst.

- The analyst observes increased demand for weather-resistant and explosion-proof intercoms tailored for industrial environments, ensuring communication in oil rigs, chemical plants, and logistics warehouses.

- The analyst identifies rapid urbanization and smart building developments as key drivers, with intercoms integrated into connected infrastructure for seamless communication and access control solutions.

- Rising concerns over safety and security are prompting commercial buildings and residential communities to invest in advanced intercom systems to monitor, authenticate, and control entry points, says the analyst.

- According to the analyst, technological advancements in audio and video clarity, remote management, and interoperability are pushing users to upgrade from analog to IP-based intercom solutions.

- Government mandates for safety protocols in hospitals, schools, and transit systems are fueling demand for intercoms that ensure fast, real-time communication during emergencies, the analyst notes.

- The analyst highlights integration complexity with legacy systems as a common challenge, particularly in retrofitting older buildings with new intercoms requiring network upgrades or structural modifications.

- According to the analyst, high initial costs and long procurement cycles in public infrastructure projects often delay deployment of modern intercom systems in transport hubs and government facilities.

Intercoms Systems and Equipment Market Segmentation

By Product Type

- Audio

- Video

By Technology

- IP Based

- Analog Based

By End-User

- Government

- Residential

- Commercial

Key Companies Analysed

- Berkshire Hathaway Inc.

- Centene

- Anthem Inc.

- Allianz Group

- Axa Group

- Assicurazioni Generali S.p.A.

- Humana

- State Farm Mutual Automobile Insurance Company

- People's Insurance Company of China

- Japan Post Group

- Nationwide Mutual Insurance Company

- Allstate Corporation

- Liberty Mutual Holding Company Inc.

- Chubb Limited

- The Travelers Companies Inc.

- Fairfax Financial Holdings Limited

- The Hartford Financial Services Group Inc.

- American Family Insurance Group

- CNA Financial Corporation

- Markel Corporation

- W. R. Berkley Corporation

- Auto-Owners Insurance Company

- The Cincinnati Insurance Companies

- Erie Insurance Group

- AmTrust Financial Services Inc.

- The Hanover Insurance Group Inc.

- Church Mutual Insurance Company

- Brotherhood Mutual Insurance Company

- Ping An Insurance

- China Life Insurance

- Tokio Marine & Nichido Fire Insurance Co. Ltd.

- Farmers Group Inc.

- Tata AIG General Insurance Company Limited

- GNY Insurance Companies

Intercoms Systems and Equipment Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Intercoms Systems and Equipment Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Intercoms Systems and Equipment market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Intercoms Systems and Equipment market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Intercoms Systems and Equipment market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Intercoms Systems and Equipment market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Intercoms Systems and Equipment market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Intercoms Systems and Equipment value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Intercoms Systems and Equipment industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Intercoms Systems and Equipment Market Report

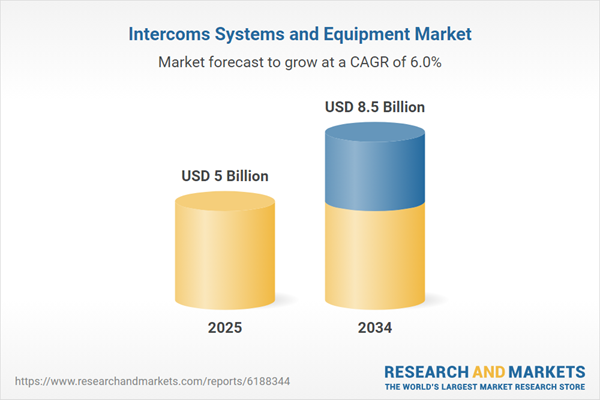

- Global Intercoms Systems and Equipment market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Intercoms Systems and Equipment trade, costs, and supply chains

- Intercoms Systems and Equipment market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Intercoms Systems and Equipment market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Intercoms Systems and Equipment market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Intercoms Systems and Equipment supply chain analysis

- Intercoms Systems and Equipment trade analysis, Intercoms Systems and Equipment market price analysis, and Intercoms Systems and Equipment supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Intercoms Systems and Equipment market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Berkshire Hathaway Inc.

- Centene

- Anthem Inc.

- Allianz Group

- Axa Group

- Assicurazioni Generali S.p.A.

- Humana

- State Farm Mutual Automobile Insurance Company

- People's Insurance Company of China

- Japan Post Group

- Nationwide Mutual Insurance Company

- Allstate Corporation

- Liberty Mutual Holding Company Inc.

- Chubb Limited

- The Travelers Companies Inc.

- Fairfax Financial Holdings Limited

- The Hartford Financial Services Group Inc.

- American Family Insurance Group

- CNA Financial Corporation

- Markel Corporation

- W. R. Berkley Corporation

- Auto-Owners Insurance Company

- The Cincinnati Insurance Companies

- Erie Insurance Group

- AmTrust Financial Services Inc.

- The Hanover Insurance Group Inc.

- Church Mutual Insurance Company

- Brotherhood Mutual Insurance Company

- Ping An Insurance

- China Life Insurance

- Tokio Marine & Nichido Fire Insurance Co. Ltd.

- Farmers Group Inc.

- Tata AIG General Insurance Company Limited

- GNY Insurance Companies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5 Billion |

| Forecasted Market Value ( USD | $ 8.5 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |