The global homeopathy market has grown steadily in recent years, driven by rising consumer interest in alternative medicine and a preference for holistic, natural, and personalized treatment options. Homeopathy, a system of medicine based on the principle of 'like cures like,' has found increasing acceptance among consumers seeking treatments with minimal side effects and a focus on overall wellness. The market includes a wide range of products such as tinctures, tablets, gels, and creams, covering health issues like allergies, chronic pain, stress, respiratory ailments, and digestive disorders. With a growing number of practitioners, regulatory frameworks becoming more favorable in some countries, and increasing awareness through online platforms and homeopathic clinics, the market is expanding beyond traditional strongholds in Europe and India. The convergence of wellness trends and the rise of integrative healthcare models have further amplified the visibility and reach of homeopathic solutions, positioning the market for sustained growth.

The homeopathy market experienced a resurgence in consumer engagement, largely due to increased health consciousness and a desire for preventive care in the post-pandemic era. Manufacturers introduced innovative formulations combining homeopathy with herbal and nutraceutical ingredients to appeal to a broader demographic. Digital health platforms began offering personalized homeopathy consultations and e-prescriptions, improving accessibility and consumer trust. In regions like Europe and South Asia, where homeopathy has deep cultural roots, governments showed renewed support through inclusion in public healthcare frameworks and insurance coverage. However, market players also faced regulatory scrutiny in certain Western markets, prompting stricter labeling and evidence-based marketing practices. Additionally, collaborations between homeopathy brands and wellness influencers boosted consumer awareness, while product availability in pharmacies and e-commerce platforms made it easier for consumers to explore natural alternatives for common health concerns.

The homeopathy market is expected to witness broader acceptance, fueled by advancements in clinical research and growing integration into complementary and integrative healthcare systems. As scientific validation of homeopathic remedies improves, regulatory clarity in key regions is likely to follow, creating a more structured environment for product development and marketing. Technological innovations such as AI-powered symptom analysis and teleconsultation tools will enhance personalized treatment offerings and patient engagement. Additionally, the expansion of homeopathy into wellness tourism and preventive health programs will open new avenues of growth, especially in Asia and Europe. Increasing consumer demand for natural, side-effect-free remedies for chronic and lifestyle-related conditions will continue to drive product diversification. However, the industry must invest in educational initiatives and transparent communication to overcome skepticism and misinformation, ensuring sustained credibility and long-term consumer loyalty.

Key Insights: Homeopathy Market

- Growing consumer demand for natural, side-effect-free treatments is pushing the adoption of homeopathic remedies across a broader range of health conditions.

- Digital health integration is enabling virtual consultations, AI-based symptom tracking, and customized homeopathy recommendations via mobile apps and platforms.

- Homeopathic products are increasingly blended with herbal, ayurvedic, and nutraceutical ingredients to create hybrid wellness solutions.

- Retail distribution through pharmacies, wellness stores, and e-commerce platforms is improving product visibility and accessibility for new users.

- Educational campaigns and influencer partnerships are reshaping perceptions and increasing mainstream acceptance of homeopathy among younger demographics.

- Rising health awareness and preference for preventive and holistic healthcare approaches are increasing the demand for homeopathic treatments.

- Supportive government policies and inclusion of homeopathy in public healthcare systems in countries like India and Germany are driving market growth.

- Widespread availability and affordability of homeopathic products make them accessible to both urban and rural populations globally.

- Increasing chronic lifestyle diseases and dissatisfaction with conventional medicine side effects are prompting patients to explore alternative therapies.

- Lack of consistent scientific evidence and regulatory differences across regions continue to hinder broader acceptance and limit market penetration in highly regulated pharmaceutical environments.

Homeopathy Market Segmentation

By Type

- Dilutions

- Tinctures

- Biochemics

- Ointments

- Tablets

- Other Types

By Source

- Plants

- Animals

- Minerals

By Distribution Channel

- Homeopathic Clinics

- Retailers

- E-Retailers

- Other Distribution Channels

By Application

- Analgesic and Antipyretic

- Respiratory

- Neurology

- Immunology

- Gastroenterology

- Dermatology

- Other Applications

Key Companies Analysed

- Boiron Group

- Dr. Reckeweg and Co. GmbH

- Hyland's Inc.

- Hahnemann Laboratories Inc.

- Dr. Willmar Schwabe GmbH and Co. KG

- Bombay Homeolab

- JNSON LABORATORIES PVT. LTD.

- Hapdco Herbals Pvt. Ltd.

- Fourrts Laboratories Pvt. Ltd.

- Bjain Pharmaceuticals Pvt. Ltd.

- Ainsworths London Limited

- Powell Laboratories Pvt. Ltd.

- Similasan Corp.

- PEKANA Naturheilmittel GmbH

- GMP Laboratories of America Inc.

- Allen Healthcare Co. Ltd.

- Nelson Pharmacies Limited

- DHU-Arzneimittel GmbH & Co. KG

- Weleda UK

- A Nelson & Co Ltd.

- Doliosis Homoeo Pharma Pvt. Ltd.

- Standard Homeopathic Co.

- Homeocan Inc.

- R. S. Bhargava Pharmacy Pvt. Ltd.

- Bakson Drugs & Pharmaceuticals Pvt. Ltd.

- Bhandari Homoeopathic Laboratories

- Bioforce AG

- Biologische Heilmittel Heel GmbH

- Blackmores Limited

- SBL Pvt. Ltd.

- Natural Health Supply

- Hevert - Arzneimittel GmbH & Co. KG

- Lord's Homoeopathic Laboratory

- Medilife Impex Pvt. Ltd.

- Medisynth Chemicals Pvt. Ltd.

Homeopathy Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Homeopathy Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Homeopathy market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Homeopathy market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Homeopathy market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Homeopathy market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Homeopathy market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Homeopathy value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Homeopathy industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Homeopathy Market Report

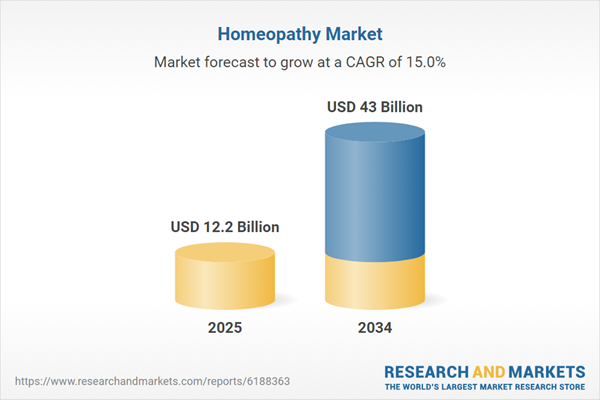

- Global Homeopathy market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Homeopathy trade, costs, and supply chains

- Homeopathy market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Homeopathy market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Homeopathy market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Homeopathy supply chain analysis

- Homeopathy trade analysis, Homeopathy market price analysis, and Homeopathy supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Homeopathy market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Boiron Group

- Dr. Reckeweg and Co. GmbH

- Hyland's Inc.

- Hahnemann Laboratories Inc.

- Dr. Willmar Schwabe GmbH and Co. KG

- Bombay Homeolab

- JNSON LABORATORIES PVT. Ltd.

- Hapdco Herbals Pvt. Ltd.

- Fourrts Laboratories Pvt. Ltd.

- Bjain Pharmaceuticals Pvt. Ltd.

- Ainsworths London Limited

- Powell Laboratories Pvt. Ltd.

- Similasan Corp.

- PEKANA Naturheilmittel GmbH

- GMP Laboratories of America Inc.

- Allen Healthcare Co. Ltd.

- Nelson Pharmacies Limited

- DHU-Arzneimittel GmbH & Co. KG

- Weleda UK

- A Nelson & Co Ltd.

- Doliosis Homoeo Pharma Pvt. Ltd.

- Standard Homeopathic Co.

- Homeocan Inc.

- R. S. Bhargava Pharmacy Pvt. Ltd.

- Bakson Drugs & Pharmaceuticals Pvt. Ltd.

- Bhandari Homoeopathic Laboratories

- Bioforce AG

- Biologische Heilmittel Heel GmbH

- Blackmores Limited

- SBL Pvt. Ltd.

- Natural Health Supply

- Hevert - Arzneimittel GmbH & Co. KG

- Lord's Homoeopathic Laboratory

- Medilife Impex Pvt. Ltd.

- Medisynth Chemicals Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 12.2 Billion |

| Forecasted Market Value ( USD | $ 43 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |