The Secure File Transfer market has become a crucial component of modern enterprise data management, addressing the need to exchange sensitive information across internal systems, partners, and customers in a secure and compliant manner. As data breaches and cyber threats continue to escalate, organizations across industries are increasingly prioritizing secure file transfer solutions that offer end-to-end encryption, access control, and compliance with global data protection regulations. Secure file transfer platforms - including managed file transfer (MFT), file transfer protocol over SSL (FTPS), and secure shell file transfer protocol (SFTP) - are widely used in sectors like banking, healthcare, government, and manufacturing where data confidentiality and integrity are paramount. Additionally, the rise of hybrid work, cloud adoption, and remote collaboration has further accelerated demand for seamless, scalable, and secure ways to transmit large volumes of critical data. With the stakes of data security higher than ever, secure file transfer is transitioning from an IT utility to a strategic business necessity.

The secure file transfer market witnessed notable advancements driven by rising compliance requirements and evolving cybersecurity threats. Organizations intensified their investments in enterprise-grade MFT solutions that supported automation, policy-based controls, and centralized visibility into file activity. Cloud-native secure transfer platforms saw increased adoption as businesses migrated workloads to multi-cloud environments, requiring resilient and compliant file exchange capabilities. Vendors rolled out enhanced features such as advanced data classification, secure APIs, and threat detection tools integrated with SIEM systems. Additionally, the introduction of AI-powered anomaly detection enabled real-time monitoring of unusual file-sharing behavior, helping prevent internal misuse and external threats. Industries such as healthcare and financial services adopted secure file transfer as part of broader zero-trust architectures. Meanwhile, global regulations such as GDPR, HIPAA, and PCI-DSS continued to influence solution design and implementation, particularly for cross-border data exchanges. These developments in 2024 positioned secure file transfer solutions as key enablers of secure digital operations and regulatory adherence.

The secure file transfer market is expected to evolve toward greater intelligence, interoperability, and user-centric design. Emerging trends will include the integration of blockchain for immutable audit trails, deeper convergence with identity and access management (IAM) platforms, and embedded data loss prevention (DLP) capabilities to safeguard sensitive files at every touchpoint. As edge computing and 5G networks expand, organizations will require secure file transfer solutions that support ultra-fast, low-latency transactions across distributed environments. Artificial intelligence will play a larger role in automating governance, detecting anomalous activity, and dynamically adapting security policies. Enterprises will also demand greater customization and UI simplicity to support user adoption without compromising compliance. Moreover, secure file transfer will become embedded within workflow automation, ERP, and content management platforms to eliminate silos and streamline operations. With digital ecosystems growing in complexity, the market will continue to expand, driven by the imperative to protect data integrity, ensure regulatory compliance, and maintain trust in digital interactions.

Key Insights: Secure File Transfer Market

- Cloud-native and hybrid file transfer solutions are gaining momentum, offering flexible deployment models and seamless integration with cloud storage and collaboration tools.

- AI and machine learning are being embedded in secure file transfer platforms to monitor behavior, flag anomalies, and automate compliance reporting and threat mitigation.

- Zero-trust security architectures are influencing design strategies, with secure file transfer platforms integrating more tightly with identity verification and endpoint protection systems.

- Blockchain technology is being explored for creating tamper-proof audit trails of file access and transfers, enhancing transparency and accountability.

- End-user experience improvements, including drag-and-drop interfaces and mobile support, are becoming standard to drive adoption across non-technical teams.

- Increasing cybersecurity threats and incidents of data breaches are pushing organizations to invest in secure file transfer solutions as a preventive measure.

- Stringent data protection and privacy regulations worldwide are compelling businesses to implement encrypted, auditable file exchange processes.

- Growth of remote work and digital collaboration is fueling demand for secure, scalable, and user-friendly platforms to share files without compromising security.

- Rising adoption of automation and workflow orchestration tools is driving the need for secure, integrated file transfer processes that align with enterprise systems.

- Managing security, compliance, and performance across complex, multi-cloud and hybrid IT environments remains a key challenge, particularly for organizations with fragmented or legacy systems that lack unified control.

Secure File Transfer Market Segmentation

By Type

- Business To Business

- Accelerated Transfer

- Ad hoc

- Other Types

By Deployment Model Type

- On-Premises

- Cloud-Based

- Hybrid

By Enterprise

- Small and Medium

- Large

By Industry Vertical

- Banking

- Financial Services and Insurance (BFSI)

- Healthcare

- Manufacturing

- Logistics

- Retail

- Media and Entertainment

- IT and Telecommunication

- Government

- Other Industry Verticals

Key Companies Analysed

- Accellion Inc.

- Axway India Private Limited

- Box Inc.

- Citrix Systems Inc.

- Egnyte Inc.

- Google LLC

- GlobalSCAPE Inc.

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Progress Software Corporation

- Attunity Ltd.

- Coviant Software LLC

- Saison Information Systems Co Ltd.

- BlackBerry Limited

- Biscom Inc.

- Ipswitch Inc.

- CTERA Networks Ltd.

- HelpSystems LLC

- Hightail Inc.

- Huddle

- Seeburger AG

- SolarWinds Worldwide LLC

- South River Technologies Inc.

- Cleo Communications Inc.

- Cornerstone Technology S.A.

- DataMotion Inc.

- FileCatalyst

- FileZilla

- Flux Corporation

- JSCAPE

- Leapfile Inc.

- Linoma Software

Secure File Transfer Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.

Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.Secure File Transfer Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.

Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.Countries Covered

- North America - Secure File Transfer market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Secure File Transfer market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Secure File Transfer market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Secure File Transfer market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Secure File Transfer market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Secure File Transfer value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Secure File Transfer industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Secure File Transfer Market Report

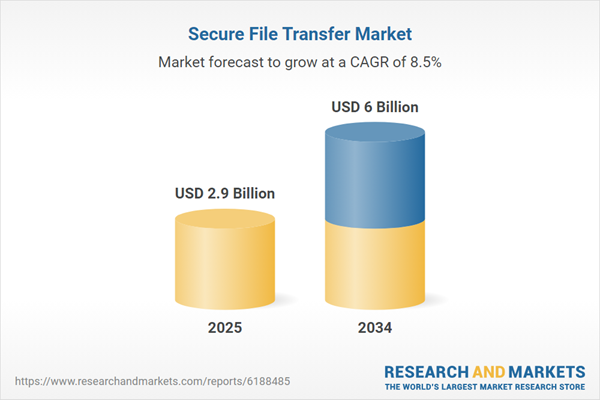

- Global Secure File Transfer market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Secure File Transfer trade, costs, and supply chains

- Secure File Transfer market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Secure File Transfer market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Secure File Transfer market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Secure File Transfer supply chain analysis

- Secure File Transfer trade analysis, Secure File Transfer market price analysis, and Secure File Transfer supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Secure File Transfer market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Accellion Inc.

- Axway India Private Limited

- Box Inc.

- Citrix Systems Inc.

- Egnyte Inc.

- Google LLC

- GlobalSCAPE Inc.

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Progress Software Corporation

- Attunity Ltd.

- Coviant Software LLC

- Saison Information Systems Co Ltd.

- BlackBerry Limited

- Biscom Inc.

- Ipswitch Inc.

- CTERA Networks Ltd.

- HelpSystems LLC

- Hightail Inc.

- Huddle

- Seeburger AG

- SolarWinds Worldwide LLC

- South River Technologies Inc.

- Cleo Communications Inc.

- Cornerstone Technology S.A.

- DataMotion Inc.

- FileCatalyst

- FileZilla

- Flux Corporation

- JSCAPE

- Leapfile Inc.

- Linoma Software

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |