The Insurance Fraud Detection Market is experiencing substantial growth, driven by the increasing sophistication of fraudulent activities and the growing need for insurers to protect their bottom lines. This market encompasses a wide array of technologies and solutions, including artificial intelligence (AI), machine learning (ML), predictive analytics, and big data, all aimed at identifying and preventing fraudulent insurance claims across various sectors like health, automotive, property, and life insurance. The rise in digital transactions and the availability of vast amounts of data have made it imperative for insurers to adopt advanced fraud detection systems. These systems help in analyzing patterns, identifying anomalies, and flagging suspicious activities in real-time. The market is also seeing a surge in demand for cloud-based solutions, which offer scalability and flexibility. As insurers grapple with the complexities of modern fraud, the need for robust, efficient, and adaptable detection systems has never been more critical, propelling the market's expansion.

The year 2024 has witnessed significant developments in the Insurance Fraud Detection Market, marked by enhanced integration of AI and ML technologies. Insurers are increasingly leveraging these tools to automate the detection process, reducing manual intervention and improving accuracy. There's a noticeable shift towards real-time fraud detection, driven by the need to intercept fraudulent activities before payouts are made. Additionally, the adoption of behavioral analytics has gained momentum, enabling insurers to understand customer behavior patterns and identify deviations that may indicate fraud. Regulatory changes and compliance requirements are also influencing market dynamics, pushing insurers to invest in advanced solutions that meet stringent data privacy and security standards. Furthermore, strategic partnerships and collaborations between technology providers and insurance companies are becoming more common, fostering innovation and driving the development of customized fraud detection solutions.

The Insurance Fraud Detection Market is poised for further expansion, driven by continuous technological advancements and evolving fraud tactics. We can expect to see greater adoption of explainable AI (XAI) to enhance transparency and trust in fraud detection models. The integration of blockchain technology for secure data sharing and fraud prevention is also likely to gain traction. The market will see a rise in the use of federated learning, which allows for collaborative model training without sharing sensitive data, addressing privacy concerns. As the Internet of Things (IoT) becomes more prevalent, insurers will leverage IoT data for real-time risk assessment and fraud detection. The focus will be on developing holistic fraud management systems that integrate multiple data sources and provide a comprehensive view of potential fraud risks. Personalized fraud detection solutions, tailored to specific insurance products and customer segments, will also become increasingly common.

Key Insights: Insurance Fraud Detection Market

- Increased adoption of AI and ML for real-time fraud detection, enhancing accuracy and reducing manual intervention.

- Growing use of behavioral analytics to identify deviations from normal customer behavior, indicating potential fraud.

- Rising demand for cloud-based fraud detection solutions, offering scalability and flexibility to insurers.

- Integration of blockchain technology for secure data sharing and fraud prevention, enhancing transparency.

- Emphasis on explainable AI (XAI) to build trust and understanding in automated fraud detection processes.

- The escalating sophistication of fraud tactics necessitates advanced detection systems to protect insurers' financial interests.

- Regulatory compliance requirements and data privacy concerns are driving investments in robust fraud detection technologies.

- The increasing volume of digital transactions and data availability necessitates efficient fraud analysis tools.

- Growing awareness of the financial impact of fraud on insurance companies, prompting proactive prevention measures.

- The constant evolution of fraud techniques requires continuous updates and adaptations to detection systems.

- Balancing fraud prevention with customer experience and privacy concerns poses a significant challenge for insurers.

Insurance Fraud Detection Market Segmentation

By Deployment Type

- On-Premises

- Cloud

By Component

- Solution

- Services

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Application

- Claims Fraud

- Identity Theft

- Payment and Billing Fraud

- Money Laundering

By End User

- Insurance Companies

- Agents and Brokers

- Insurance Intermediaries

- Other End Users

Key Companies Analysed

- ACI Worldwide Inc.

- BAE Systems PLC

- BRIDGEi2i Analytics Solutions Pvt. Ltd.

- Datawalk Inc.

- DXC Technology Co.

- Experian PLC

- Fair Isaac Corp.

- Fiserv Inc.

- FRISS Inc.

- International Business Machines Corporation

- iovation Inc.

- Kount Inc.

- Relx Group

- Oracle Corp.

- SAP SE

- SAS Institute Inc.

- Scorto Inc.

- TransUnion LLC

- Wipro Ltd.

- Accenture plc

- Equifax Inc.

- Perceptiviti Inc

- Shift Technology S. A.

- Verisk Analytics

- Inc.

- Mody Data Solution Pvt. Ltd.

- Pixalate

- Inc.

- Skopenow Inc.

- Owl Cyber Defense Solutions

- LLC

- Sigma Insights Inc.

- Fraud Guard LLC

Insurance Fraud Detection Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Insurance Fraud Detection Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Insurance Fraud Detection market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Insurance Fraud Detection market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Insurance Fraud Detection market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Insurance Fraud Detection market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Insurance Fraud Detection market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Insurance Fraud Detection value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Insurance Fraud Detection industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Insurance Fraud Detection Market Report

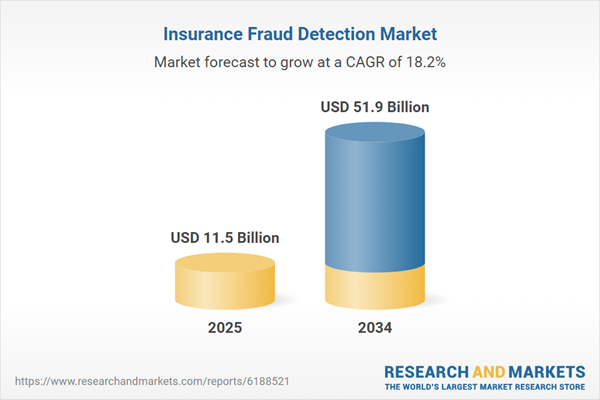

- Global Insurance Fraud Detection market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Insurance Fraud Detection trade, costs, and supply chains

- Insurance Fraud Detection market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Insurance Fraud Detection market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Insurance Fraud Detection market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Insurance Fraud Detection supply chain analysis

- Insurance Fraud Detection trade analysis, Insurance Fraud Detection market price analysis, and Insurance Fraud Detection supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Insurance Fraud Detection market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ACI Worldwide Inc.

- BAE Systems PLC

- BRIDGEi2i Analytics Solutions Pvt. Ltd.

- Datawalk Inc.

- DXC Technology Co.

- Experian PLC

- Fair Isaac Corp.

- Fiserv Inc.

- FRISS Inc.

- International Business Machines Corporation

- iovation Inc.

- Kount Inc.

- Relx Group

- Oracle Corp.

- SAP SE

- SAS Institute Inc.

- Scorto Inc.

- TransUnion LLC

- Wipro Ltd.

- Accenture PLC

- Equifax Inc.

- Perceptiviti Inc.

- Shift Technology S. A.

- Verisk Analytics Inc.

- Mody Data Solution Pvt. Ltd.

- Pixalate Inc.

- Skopenow Inc.

- Owl Cyber Defense Solutions LLC

- Sigma Insights Inc.

- Fraud Guard LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 11.5 Billion |

| Forecasted Market Value ( USD | $ 51.9 Billion |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |