The High Performance Computing as a Service (HPCaaS) market is evolving as a transformative force in computational technology, providing organizations with access to powerful computing resources on-demand without the need for significant infrastructure investment. This model enables businesses, research institutions, and governments to perform complex computations, simulations, and data analysis at scale, driving innovation across fields such as aerospace, climate modeling, drug discovery, financial modeling, and artificial intelligence. The growing need for faster insights, reduced time-to-market, and scalable computing environments has led to a surge in demand for HPCaaS. With cloud-based solutions becoming more accessible and secure, companies are increasingly shifting from traditional on-premises HPC setups to flexible, cost-efficient HPCaaS platforms, unlocking agility and performance at a fraction of the cost.

The HPCaaS market witnessed robust growth, fueled by accelerated digital transformation initiatives and the growing volume of data-intensive workloads. The integration of artificial intelligence and machine learning capabilities into HPC workloads became more pronounced, allowing businesses to run advanced analytics and AI models efficiently. Key players expanded their service portfolios, emphasizing vertical-specific solutions for industries such as life sciences, automotive, and energy. Hybrid cloud models gained traction, combining the security of private environments with the scalability of public cloud infrastructure. The year also marked significant collaboration between HPC providers and research institutions to support high-impact scientific breakthroughs. Enhanced focus on sustainability further drove the optimization of HPC systems for energy efficiency, setting the tone for more eco-conscious computational practices.

The HPCaaS market is expected to mature further, driven by advances in quantum computing, edge computing integration, and broader AI adoption. Service providers are likely to focus on offering highly customized solutions with seamless orchestration across multi-cloud and edge environments. As enterprises increasingly rely on predictive modeling, real-time data processing, and digital twins, the demand for scalable, low-latency HPCaaS platforms will soar. Additionally, the convergence of 5G and HPCaaS is set to unlock new possibilities in autonomous systems, real-time analytics, and immersive simulations. Regulatory compliance and data sovereignty will become more pivotal, leading to the rise of region-specific HPCaaS offerings. Overall, the market is poised for exponential growth, backed by continuous innovation and the need for high-performance infrastructure across an expanding range of use cases.

Key Insights: High Performance Computing As A Service Market

- Enterprises are increasingly adopting hybrid HPCaaS models, combining public and private cloud resources to balance scalability, performance, and compliance needs.

- Integration of AI and machine learning into HPCaaS platforms is enhancing automation, enabling more efficient modeling, simulation, and predictive analytics.

- Edge computing is being paired with HPCaaS to support real-time data processing, especially in sectors like autonomous driving and industrial IoT.

- Greater emphasis is being placed on sustainable and energy-efficient HPC infrastructure, aligning with global carbon neutrality goals.

- Quantum computing is emerging as a complementary force, with early-stage HPCaaS solutions beginning to support quantum workloads and hybrid classical-quantum models.

- Growing demand for high-speed data processing and analytics is pushing organizations to shift toward HPCaaS for its cost-effective and scalable capabilities.

- Continuous innovation in cloud technologies and virtualization is lowering the entry barriers for HPCaaS adoption across mid-sized enterprises.

- Expansion of AI, genomics, and big data applications across various sectors is increasing the need for powerful computing infrastructures on demand.

- Collaborations between HPCaaS providers and academic or research institutions are fostering breakthroughs in science and innovation, supporting market expansion.

- Data privacy and security concerns remain a major challenge, particularly in highly regulated industries, where sensitive information requires strict compliance and governance.

High Performance Computing As A Service Market Segmentation

By Component

- Solutions

- Services

By Deployment Type

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Industry Vertical

- Manufacturing

- BFSI

- Healthcare

- Government

- Media and Entertainment

- Other Industry Verticals

Key Companies Analysed

- Amazon Web Services Inc.

- Dell Technologies Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Nimbix Inc.

- Penguin Computing Inc.

- Sabalcore Computing Inc.

- The UberCloud Inc.

- IDG Communications Inc.

- Adaptive Computing Enterprises Inc.

- Hitachi Ltd.

- Atos SE

- NVIDIA Corporation

- Rescale Inc.

- Hadean Supercomputing Ltd.

- Super Micro Computer Inc.

- Intel Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Advanced Micro Devices Inc.

- NEC Corporation

- Lenovo Group Limited

- Inspur Software Co. Ltd.

- Seagate Technology Holdings plc

- NetApp Inc.

- Cisco Systems Inc.

- Oracle Corporation

- VMware Inc.

- Juniper Networks Inc.

- Cray Inc.

- Silicon Graphics International Corp.

- Bull Atos Technologies

- Univa Corporation

- Bright Computing Inc.

High Performance Computing As A Service Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

High Performance Computing As A Service Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - High Performance Computing As A Service market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - High Performance Computing As A Service market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - High Performance Computing As A Service market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - High Performance Computing As A Service market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - High Performance Computing As A Service market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the High Performance Computing As A Service value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the High Performance Computing As A Service industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the High Performance Computing As A Service Market Report

- Global High Performance Computing As A Service market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on High Performance Computing As A Service trade, costs, and supply chains

- High Performance Computing As A Service market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- High Performance Computing As A Service market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term High Performance Computing As A Service market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and High Performance Computing As A Service supply chain analysis

- High Performance Computing As A Service trade analysis, High Performance Computing As A Service market price analysis, and High Performance Computing As A Service supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest High Performance Computing As A Service market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amazon Web Services Inc.

- Dell Technologies Inc.

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Nimbix Inc.

- Penguin Computing Inc.

- Sabalcore Computing Inc.

- The UberCloud Inc.

- IDG Communications Inc.

- Adaptive Computing Enterprises Inc.

- Hitachi Ltd.

- Atos SE

- NVIDIA Corporation

- Rescale Inc.

- Hadean Supercomputing Ltd.

- Super Micro Computer Inc.

- Intel Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- Advanced Micro Devices Inc.

- NEC Corporation

- Lenovo Group Limited

- Inspur Software Co. Ltd.

- Seagate Technology Holdings PLC

- NetApp Inc.

- Cisco Systems Inc.

- Oracle Corporation

- VMware Inc.

- Juniper Networks Inc.

- Cray Inc.

- Silicon Graphics International Corp.

- Bull Atos Technologies

- Univa Corporation

- Bright Computing Inc.

Table Information

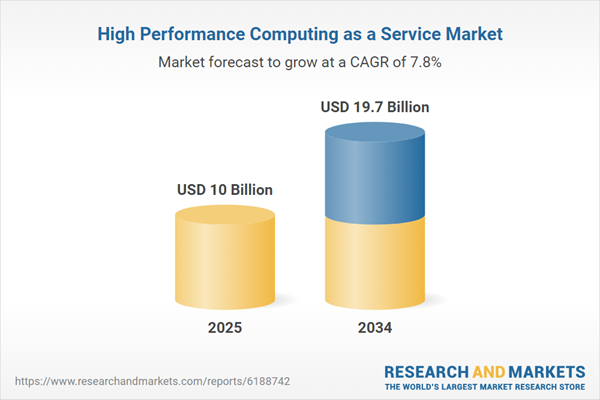

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10 Billion |

| Forecasted Market Value ( USD | $ 19.7 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |