Market Overview: Enterprise Application Market

The enterprise application market has grown substantially over the past decade as businesses seek solutions to streamline operations, enhance productivity, and improve customer experiences. Enterprise applications encompass a range of software solutions, including Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Supply Chain Management (SCM), and Human Resources Management Systems (HRMS). These applications allow businesses to integrate various processes and automate key functions, leading to increased efficiency and reduced operational costs. With the increasing complexity of business environments, organizations are looking for flexible, scalable, and customizable enterprise applications that can adapt to changing demands. Cloud-based enterprise applications have become especially popular due to their ability to offer real-time data access, collaboration features, and lower total cost of ownership. As digital transformation continues to reshape industries, the enterprise application market is expected to grow steadily, with significant opportunities arising in sectors such as healthcare, manufacturing, retail, and finance.The enterprise application market witnessed further innovation driven by advancements in artificial intelligence (AI), machine learning, and cloud technology. AI-powered enterprise applications became integral in improving data-driven decision-making and optimizing business processes, offering greater accuracy in forecasting, resource allocation, and customer service. The rise of low-code and no-code platforms enabled businesses to rapidly deploy customized solutions, allowing for more agile responses to market changes. Additionally, companies increasingly adopted integrated platforms that combined various enterprise applications in a single ecosystem, streamlining operations across departments. Cloud adoption accelerated, with businesses migrating more enterprise applications to hybrid and multi-cloud environments to increase scalability and flexibility. The integration of Internet of Things (IoT) technologies into enterprise applications further enhanced automation, enabling real-time tracking and management of assets, inventory, and supply chains. Furthermore, security remained a significant focus, with businesses prioritizing secure access controls and compliance with data protection regulations.

The enterprise application market is expected to see exponential growth driven by further advancements in AI, automation, and data analytics. The continued shift toward digital-first operations will encourage organizations to adopt enterprise applications that are more intuitive, intelligent, and interconnected. AI and automation will become even more embedded in enterprise applications, enabling businesses to automate routine tasks, improve operational efficiencies, and enhance customer experience through personalized solutions. The increasing demand for real-time data analytics will fuel the adoption of advanced analytics platforms and business intelligence tools. The rise of edge computing and 5G connectivity will also have a significant impact on enterprise applications, allowing businesses to leverage faster, more reliable data processing closer to the source. Additionally, the demand for more industry-specific enterprise solutions, especially in sectors like healthcare, finance, and logistics, will continue to grow, as businesses seek to address unique challenges and regulatory requirements. The enterprise application market will also be shaped by a growing emphasis on sustainability and corporate social responsibility, with companies using technology to optimize energy usage, reduce waste, and ensure ethical operations.

Key Insights: Enterprise Application Market

- AI-Powered Automation: Artificial intelligence is increasingly integrated into enterprise applications to automate routine tasks, enhance decision-making, and improve business processes. This trend allows organizations to reduce manual workloads and optimize resource allocation, leading to higher operational efficiency and lower costs.

- Cloud-Native Enterprise Applications: The adoption of cloud-native applications is on the rise, with organizations migrating their enterprise applications to cloud platforms. This trend offers businesses greater scalability, flexibility, and cost-efficiency, enabling them to innovate and adapt to changing market conditions.

- Low-Code and No-Code Development Platforms: Low-code and no-code platforms are gaining traction in the enterprise application market, enabling businesses to develop and customize applications quickly without requiring extensive programming knowledge. This trend democratizes application development, empowering non-technical users to create solutions tailored to their needs.

- Integration of IoT with Enterprise Applications: The integration of Internet of Things (IoT) technology into enterprise applications is enhancing automation and data collection. Real-time monitoring of assets, inventory, and operations allows businesses to optimize supply chains and improve operational efficiency.

- Increased Focus on Cybersecurity: With the increasing reliance on digital platforms, the focus on cybersecurity in enterprise applications is intensifying. Companies are prioritizing secure access controls, encryption, and compliance with data protection regulations to mitigate security risks and protect sensitive business data.

- Digital Transformation Initiatives: Organizations across industries are increasingly investing in digital transformation to stay competitive. The adoption of enterprise applications plays a key role in digitizing business processes, enabling businesses to improve efficiency, agility, and customer satisfaction.

- Growing Demand for Data-Driven Insights: The need for real-time analytics and actionable insights is driving the adoption of advanced business intelligence and analytics platforms. These solutions empower businesses to make informed decisions based on real-time data, improving overall performance and strategic planning.

- Cloud Computing Adoption: The shift toward cloud computing is accelerating the adoption of cloud-based enterprise applications. Cloud solutions provide businesses with flexible, scalable, and cost-effective options to manage their operations, ensuring greater agility and ease of access to mission-critical applications.

- Increased Focus on Customer Experience: To stay competitive in the market, businesses are focusing on improving customer experience. Enterprise applications, such as CRM systems, enable organizations to manage customer relationships more effectively and provide personalized experiences, fostering customer loyalty and retention.

- Complex Integration with Legacy Systems: One of the major challenges in the enterprise application market is integrating new solutions with existing legacy systems. Many businesses still rely on outdated software, and seamless integration of modern enterprise applications with these legacy systems can be complex, time-consuming, and costly.

Enterprise Application Market Segmentation

By Component

- Solution

- Service

By Deployment Mode

- On-premise

- Cloud

By Type

- Business Intelligence

- Supply Chain Management

- Web Conferencing Collaboration

- Customer Relationship Management

- Enterprise Resource Planning

- Other Types

By Enterprise Size

- Large Enterprise

- Small and Medium Enterprise

By End User

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Government

- Manufacturing

- Other Users

Key Companies Analysed

- Amazon.com Inc.

- Google LLC

- Microsoft Corporation

- Dell Technologies Inc.

- IBM Corporation

- Cisco Systems Inc.

- Oracle Corporation

- SAP SE

- Broadcom Inc.

- Hewlett Packard Enterprise Co.

- Saleforce.com Inc.

- Adobe Inc.

- VMware Inc.

- ServiceNow Inc.

- Workday Inc.

- Twilio Inc.

- Atlassian Corporation plc

- DocuSign Inc.

- Okta Inc.

- Slack Technologies Inc.

- Dropbox Inc.

- Epicor Software Corporation

- Software AG

- TIBCO Software Inc.

- Zoho Corporation Inc.

- Qlik Technologies Inc.

- Infor Inc.

- IFS AB

- QAD Inc.

- Red Hat Inc.

Enterprise Application Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modeling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behavior are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Enterprise Application Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Enterprise Application market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Enterprise Application market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Enterprise Application market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Enterprise Application market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Enterprise Application market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Enterprise Application value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Enterprise Application industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Enterprise Application Market Report

- Global Enterprise Application market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Enterprise Application trade, costs, and supply chains

- Enterprise Application market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Enterprise Application market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Enterprise Application market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Enterprise Application supply chain analysis

- Enterprise Application trade analysis, Enterprise Application market price analysis, and Enterprise Application supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Enterprise Application market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amazon.com Inc.

- Google LLC

- Microsoft Corporation

- Dell Technologies Inc.

- IBM Corporation

- Cisco Systems Inc.

- Oracle Corporation

- SAP SE

- Broadcom Inc.

- Hewlett Packard Enterprise Co.

- Saleforce.com Inc.

- Adobe Inc.

- VMware Inc.

- ServiceNow Inc.

- Workday Inc.

- Twilio Inc.

- Atlassian Corporation PLC

- DocuSign Inc.

- Okta Inc.

- Slack Technologies Inc.

- Dropbox Inc.

- Epicor Software Corporation

- Software AG

- TIBCO Software Inc.

- Zoho Corporation Inc.

- Qlik Technologies Inc.

- Infor Inc.

- IFS AB

- QAD Inc.

- Red Hat Inc.

Table Information

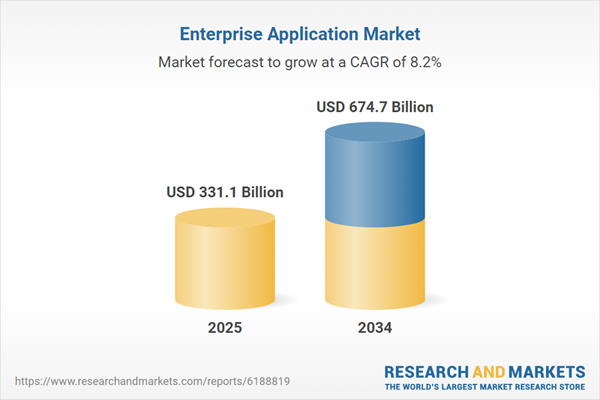

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 331.1 Billion |

| Forecasted Market Value ( USD | $ 674.7 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |