Speak directly to the analyst to clarify any post sales queries you may have.

A structured introduction framing clinical, technological, procurement, and regulatory lenses to orient strategic decision-making in the insufflator ecosystem

This executive summary introduces a structured analysis of the insufflator landscape, integrating clinical practice evolution, device innovation, procurement dynamics, and regulatory shifts that collectively influence decision-making across stakeholders. The analysis synthesizes device design trends, evolving clinical requirements, and distribution channel behaviors to provide a cohesive starting point for manufacturers, hospital procurement teams, clinicians, and distributors seeking to align strategy with emerging realities.The introduction situates insufflators within contemporary operating room workflows where minimally invasive and robotic-assisted procedures increasingly demand precise pressure control, reliable gas delivery, and ergonomic integration with imaging and energy platforms. It also highlights the concurrent pressures on health systems to demonstrate value through reduced procedure time, lower complication rates, and efficient capital deployment. Taken together, these forces create clear expectations for next-generation insufflators: systems that balance clinical performance with workflow compatibility and total cost of ownership considerations.

Finally, this section frames the subsequent analysis by identifying the core analytical lenses applied throughout the report: product differentiation across mechanical and integrated designs, insufflation medium and delivery logistics, clinical application-specific requirements, end-user purchasing behavior, regional adoption patterns, and competitive positioning. These lenses guide the insights and recommendations that follow and provide an operational roadmap for teams aiming to convert insight into execution.

How clinical advancements, value-driven procurement, and platform convergence are reshaping product innovation and purchasing behavior in surgical insufflation

Significant transformative shifts are driving product road maps and procurement strategies across the insufflator space. Advances in robotic-assisted surgery and integrated endoscopy towers have accelerated demand for systems that offer precise pressure control, seamless interoperability, and compact footprints for hybrid operating rooms. Device manufacturers are responding by embedding sophisticated pressure-sensing algorithms, enabling continuous flow and stable pneumoperitoneum performance while also developing heated-humidified CO2 capabilities to reduce patient hypothermia and postoperative pain, thus addressing clinician priorities for enhanced patient outcomes.Concurrently, hospital procurement teams are moving toward value-based purchasing models that factor in lifecycle costs, maintenance contracts, and consumable dependencies. This shift has elevated the importance of connectivity and remote diagnostics as features that reduce downtime and streamline maintenance workflows. Moreover, the rise of ambulatory surgical centers and office-based procedures has increased demand for portable and battery-powered compact insufflators designed to support shorter turnover times and flexible care pathways.

Another material change is the convergence of endoscopy and laparoscopy platforms; integrated tower modules and standalone units are being evaluated for their ability to consolidate capital equipment while preserving clinical versatility. Finally, regulatory scrutiny and clinical evidence requirements have intensified, prompting manufacturers to invest in clinical trials, real-world evidence collection, and cross-disciplinary clinician education programs to demonstrate differential clinical benefits and secure preference within surgical teams.

Operational and commercial responses to 2025 tariff changes that elevate supply chain resilience, contractual flexibility, and service-led value propositions

The cumulative effects of tariff adjustments and trade policy shifts in 2025 are forcing stakeholders to reassess supply chain resilience and procurement strategies. Manufacturers are examining component sourcing, contract structures, and inventory buffers to mitigate the immediate operational impacts of increased import duties and related compliance requirements. At the same time, distributors and hospital supply chain leaders are recalibrating tender specifications and long-term purchasing agreements to accommodate possible cost escalation or lead-time variability.In response, several operational adaptations have emerged. Companies are diversifying supplier bases and evaluating regional manufacturing and assembly to reduce exposure to single-source risks. Procurement teams are negotiating more flexible contracts that include clauses for tariff pass-through or price renegotiation tied to objective indices, thereby preserving budgetary predictability. Parallel efforts to shorten supply chains through local partnerships or nearshoring initiatives have gained traction in order to limit cross-border friction and maintain just-in-time delivery models.

These dynamics also exert pressure on commercial strategies. Manufacturers with vertically integrated supply chains or modular architectures that allow interchangeability of critical components gain a comparative advantage when tariffs increase landed costs. As a transitional measure, many firms are enhancing service offerings and outcome-based warranties to preserve customer relationships while absorbing short-term price sensitivity. In sum, the tariff environment in 2025 is accelerating structural shifts toward supply chain agility, contractual flexibility, and service-oriented value propositions.

Segmentation intelligence connecting product architectures, insufflation mediums, clinical use cases, end-user purchasing behaviors, and pricing tiers to practical commercial choices

Segmentation analysis reveals how product design choices, clinical applications, and end-user environments intersect to shape clinical adoption and purchasing preferences. Product segmentation highlights distinctions among dual-mode laparoscopy and endoscopy systems, endoscopic CO2 insufflators for gastrointestinal use that appear both as integrated endoscopy tower modules and standalone units, traditional laparoscopic insufflators available as continuous flow or stable pneumoperitoneum systems, heated-humidified CO2 systems, and standard pressure-controlled devices, pediatric-optimized insufflators with scaled delivery profiles, and platforms explicitly compatible with robotic surgery architectures. Each product archetype targets distinct clinical workflows and procurement rationales, with integrations and compatibility playing an outsized role where capital consolidation and interoperability are priorities.When considering insufflation medium, the market bifurcates between carbon dioxide delivery and room air approaches; carbon dioxide remains differentiated by central gas supply versus cylinder supply logistics, while room air implementations divide into external compressor connections and integrated air pump designs. These choices have practical implications for facilities with centralized gas systems versus ambulatory settings that prioritize portability and reduced infrastructure dependencies.

Application-based segmentation underscores the diversity of clinical needs across bariatric, colorectal, gastroenterology endoscopy-further delineated into colonoscopy and upper gastrointestinal endoscopy-general laparoscopic procedures, gynecologic laparoscopic interventions, pediatric surgery, robotic-assisted procedures, thoracic/VATS, and urology. Variations in typical insufflation pressures, flow rate demands, and specialized accessory compatibility drive product selection across each clinical domain. End-user segmentation captures differences in purchasing models and operational priorities among academic and research institutes, ambulatory surgical centers that may be hospital-owned or independent, hospitals segmented by bed size and teaching status, office-based practices, and specialty clinics. Flow-rate requirements further categorize equipment by high, medium, and low performance envelopes, while portability considerations create demand for cart-mounted, integrated tower/console, and portable compact options, the latter including battery-powered and mains-powered formats.

Finally, patient group segmentation between adult and pediatric populations introduces nuanced clinical constraints, with pediatric use cases separating child/adolescent and neonatal/infant needs. Distribution channel segmentation spans direct sales, distributors and dealers, group purchasing organizations, online and e-commerce channels, and public procurement and tender processes. Price-tier segmentation from economy through mid-range to premium aligns with expectations for feature sets, warranty coverage, and service-level agreements. This layered segmentation framework supports targeted product development, tailored go-to-market approaches, and differentiated clinical messaging.

Regional adoption patterns and access dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific that influence procurement, localization, and commercialization strategies

Regional dynamics continue to shape deployment priorities and competitive strategies across the global landscape, with distinct adoption patterns emerging in the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, there is a pronounced focus on integration with robotic platforms and expanded ambulatory surgical center activity, driving demand for interoperable systems that support high throughput and streamlined sterilization workflows. Procurement strategies in this region favor bundled service agreements and evidence-backed clinical differentiation to justify capital allocation.Across Europe, the Middle East, and Africa, heterogeneity in health system funding and regulatory environments produces variable adoption timelines. Higher-income markets within Europe emphasize energy efficiency, serviceability, and integration with existing tower ecosystems, while select markets in the Middle East prioritize advanced features and rapid adoption for tertiary centers. In parts of Africa, constrained capital and infrastructure priorities favor robust, low-maintenance designs and cylinder-based gas logistics.

Asia-Pacific presents a dynamic mix of rapid hospital modernization in urban centers and a growing network of decentralized surgical facilities. Demand in this region increasingly values modularity and cost-effective service models that accommodate diverse clinical settings. Local manufacturing and regional partnerships play a critical role in market access strategies, enabling faster regulatory approvals and supply continuity. Across all regions, reimbursement policy, clinician training programs, and the availability of capital for OR modernization remain decisive factors influencing adoption timing and product specification choices.

How product differentiation, partnership ecosystems, and blended distribution strategies combine to create sustainable competitive advantage in the insufflator market

Competitive dynamics are defined by a combination of product innovation, strategic partnerships, and service models that prioritize uptime and clinical outcomes. Leading manufacturers differentiate through investments in pressure-control algorithms, heated-humidified delivery, compact and battery-powered form factors, and robotic compatibility, creating clusters of capability that align with specific clinical workflows. Companies that also offer integrated imaging or endoscopy tower solutions can leverage cross-selling opportunities and justify premium positioning through interoperability benefits.Partnership strategies also shape competitive advantage. Collaborations with imaging vendors, surgical robotics providers, and hospital systems facilitate product validation and foster pathways for bundled procurement. Similarly, manufacturers that establish strong training and clinical education programs accelerate clinician acceptance and build referral momentum among early adopters. Service networks and remote monitoring capabilities further compound value by reducing downtime and enabling predictive maintenance, which is particularly valuable for high-volume centers.

Finally, distribution strategy remains a differentiator. Firms that blend direct sales expertise for flagship accounts with strong distributor networks for regional reach can optimize penetration across hospital tiers and ambulatory settings. Firms that invest in digital channels and e-commerce capabilities expand access in lower-touch environments and streamline replenishment for consumables. Overall, the firms that combine product excellence with demonstrable service economics, interoperability, and targeted commercialization partnerships will be best positioned to capture preference across diverse end-user archetypes.

Actionable recommendations for manufacturers and providers to align product design, supply chain resilience, and commercial models with clinician needs and procurement realities

Industry leaders should pursue a multipronged strategy to align product portfolios with clinical workflows, supply chain realities, and evolving procurement models. First, prioritize interoperability and modularity so devices can be integrated into existing tower architectures and robotic systems, reducing friction during clinical adoption. Complement hardware investment with robust software features for pressure control, remote diagnostics, and connectivity to hospital asset management systems to enhance perceived and real value.Second, strengthen supply chain resilience by diversifying suppliers, considering regional assembly or nearshoring, and building contractual mechanisms to mitigate tariff-related volatility. These steps will protect margin and ensure continuity of supply, which is critical for maintaining market trust. Third, tailor commercial models to end-user profiles: offer outcome-based service contracts and bundled consumable agreements for large hospital systems, while delivering compact, battery-powered solutions with simplified maintenance packages for ambulatory centers and office-based practices.

Fourth, invest in clinical evidence generation that targets procedure-specific benefits, especially in areas like robotic-assisted surgery, pediatric procedures, and heated-humidified delivery advantages. Well-structured clinical programs accelerate clinician acceptance and support reimbursement conversations. Lastly, refine channel strategies by combining direct engagement for strategic accounts with strong distributor networks and selective e-commerce capabilities to expand reach and improve replenishment efficiency. These recommendations together will help industry leaders convert capability into durable market preference and operational growth.

A mixed-methods research approach integrating clinician interviews, procurement perspectives, technical verification, and rigorous evidence synthesis to ensure actionable insights

The research methodology combines a mixed-methods approach designed to ensure rigor, triangulation, and practical relevance. Primary research consisted of structured interviews with clinicians across surgical specialties, procurement leaders in hospitals and ambulatory settings, distributor partners, and device development professionals. These qualitative insights were supplemented with a systematic review of regulatory filings, technical specifications, clinical publications, and publicly available procurement documents to validate claims and identify emergent patterns.Secondary analysis included a comparative assessment of device feature sets, warranty and service models, and reported clinical outcomes where available. Evidence synthesis employed thematic analysis to identify recurring operational priorities, innovation trends, and purchasing levers. Quality assurance procedures included cross-validation of primary interview transcripts, double-coding of thematic categories, and reconciliation of any inconsistencies through follow-up queries with domain experts. Throughout the process, attention was paid to representativeness across hospital tiers, geographic regions, and clinical specialties to mitigate bias and ensure the findings are actionable for a range of stakeholders.

A concise synthesis of strategic imperatives, operational adjustments, and collaboration opportunities to convert clinical and commercial insight into sustained advantage

In conclusion, the insufflator landscape is at an inflection point where clinical requirements, device innovation, and procurement dynamics intersect to redefine value. Manufacturers that deliver interoperable, clinically validated systems with flexible service models will gain preference among high-volume centers and ambulatory settings alike. Supply chain agility and strategic localization will be decisive in an environment shaped by tariff volatility and regional manufacturing priorities.Clinician-focused evidence generation and robust training programs remain essential to accelerate adoption, particularly for modalities that claim procedural benefits or improved patient outcomes. At the same time, thoughtful segmentation and tailored commercial approaches-matching product features to clinical applications, end-user purchasing behavior, and price-tier expectations-will improve market access and customer retention. Ultimately, success will depend on a balanced strategy that pairs technical excellence with operational reliability and commercial flexibility, enabling stakeholders to convert insight into sustained clinical and business impact.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Component

- Accessories & Consumables

- Filters

- Gas Heating & Humidification Modules

- Insufflation Needles

- Regulators & Connectors

- Smoke Evacuation Filters & Cartridges

- Tubing Sets

- Insufflator Units

- High-Flow Units

- Integrated Insufflation & Smoke Evacuation Systems

- Standard Units

- Software & Services

- Maintenance & Service Contracts

- OR Integration Software

- Training & Installation

- Accessories & Consumables

- Insufflation Medium

- Carbon Dioxide

- Central Gas Supply

- Cylinder Supply

- Room Air

- External Compressor Connection

- Integrated Air Pump

- Carbon Dioxide

- Flow Rate

- High (≥31 L/min)

- Low (≤15 L/min)

- Medium (16-30 L/min)

- Portability

- Cart-Mounted

- Integrated Tower/Console

- Portable/Compact

- Battery-Powered

- Mains-Powered

- Price Tier

- Economy

- Mid-Range

- Premium

- Technology

- Gas Conditioning

- Heated & Humidified CO2

- Heated CO2

- Unconditioned CO2

- Insufflation Control

- Closed-Loop Pressure & Flow Control

- Open-Loop/Manual Control

- Safety Features

- Automatic Pressure Relief

- Leak Detection

- Overpressure/Underpressure Alarms

- Smoke Management

- External/Standalone Smoke Evacuation

- Integrated Smoke Evacuation

- Sterility Path

- Disposable Tubing Sets

- Reusable Tubing Sets

- User Interface

- Physical Knobs & Buttons

- Touchscreen Interface

- Gas Conditioning

- End User

- Academic & Research Institutes

- Ambulatory Surgical Centers

- Hospital-Owned ASCs

- Independent ASCs

- Hospitals

- Community/General Hospitals

- Tertiary/Teaching Hospitals

- Office-Based Practices

- Specialty Clinics

- Distribution Channel

- Direct Sales

- Distributors/Dealers

- Online/E-Commerce

- Application

- Gastrointestinal Endoscopy

- Colonoscopy

- Enteroscopy

- ERCP

- Upper GI Endoscopy (EGD)

- Hysteroscopy

- Diagnostic

- Operative

- Laparoscopic Surgery

- Bariatric Surgery

- Colorectal Surgery

- General Surgery

- Gynecology

- Hepatobiliary & Pancreatic Surgery

- Robotic-Assisted Laparoscopy

- Urology

- Gastrointestinal Endoscopy

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Medtronic plc

- Stryker Corporation

- CONMED Corporation

- KARL STORZ SE & Co. KG

- Olympus Corporation

- Smith & Nephew plc

- Applied Medical Resources Corporation

- B. Braun Melsungen AG

- Richard Wolf GmbH

- Aspen Surgical Products, Inc.

- Advin Health Care

- CooperSurgical, Inc.

- Diamond Electronic Enterprises

- Eisai Co., Ltd.

- Erbe Elektromedizin GmbH

- Fujifilm Holdings Corporation

- Hangzhou Kangyou Medical Equipment Co., Ltd.

- Hawklux

- HOYA Corporation

- Hunan Vathin Medical Instrument Co., Ltd

- Johnson & Johnson

- LEXION Medical

- Mindray Medical International Limited

- Ningbo Yaoming Medical Technology Co., Ltd.

- Nissha Co. Ltd.

- Novanta Inc

- Shanghai Shiyin Photoelectric Instrument Co.,Ltd.

- Shenyang Shenda Endoscope Co., Ltd.

- STERIS PLC

- Surgaid Medical (Xiamen) Co., Ltd.

- VIMAP Technologies

- WISAP Medical Technology GmbH

- Zhejiang Chuangxiang Medical Technology Co., Ltd.

- JINSHAN Science & Technology (Group) Co., Ltd.

- Shenzhen Tuyou Medical Imaging Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Insufflator market report include:- Medtronic plc

- Stryker Corporation

- CONMED Corporation

- KARL STORZ SE & Co. KG

- Olympus Corporation

- Smith & Nephew plc

- Applied Medical Resources Corporation

- B. Braun Melsungen AG

- Richard Wolf GmbH

- Aspen Surgical Products, Inc.

- Advin Health Care

- CooperSurgical, Inc.

- Diamond Electronic Enterprises

- Eisai Co., Ltd.

- Erbe Elektromedizin GmbH

- Fujifilm Holdings Corporation

- Hangzhou Kangyou Medical Equipment Co., Ltd.

- Hawklux

- HOYA Corporation

- Hunan Vathin Medical Instrument Co., Ltd

- Johnson & Johnson

- LEXION Medical

- Mindray Medical International Limited

- Ningbo Yaoming Medical Technology Co., Ltd.

- Nissha Co. Ltd.

- Novanta Inc

- Shanghai Shiyin Photoelectric Instrument Co.,Ltd.

- Shenyang Shenda Endoscope Co., Ltd.

- STERIS PLC

- Surgaid Medical (Xiamen) Co., Ltd.

- VIMAP Technologies

- WISAP Medical Technology GmbH

- Zhejiang Chuangxiang Medical Technology Co., Ltd.

- JINSHAN Science & Technology (Group) Co., Ltd.

- Shenzhen Tuyou Medical Imaging Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | October 2025 |

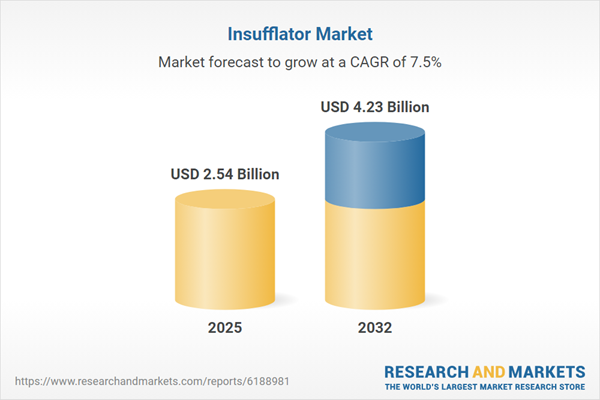

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.54 Billion |

| Forecasted Market Value ( USD | $ 4.23 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 36 |