Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Adaptive Camouflage Evolution by Outlining Market Drivers Strategic Imperatives and Innovation Pathways in Defense

Adaptive camouflage technologies are rapidly transforming defense capabilities by offering dynamic concealment solutions across visual, infrared, and radar spectrums. As nations prioritize force protection and strategic advantage, the appetite for solutions that can seamlessly blend platforms into contested environments has never been stronger. From smart coatings that shift color in response to temperature to projection-based systems that mimic surrounding landscapes, the evolution of these technologies underscores a fundamental shift toward more integrated, autonomous, and resilient defense architectures.This executive summary provides an authoritative snapshot of the latest developments shaping this domain, including the driving forces behind research investments, the competitive landscape, and the technological breakthroughs redefining operational readiness. By synthesizing insights across multiple dimensions-technology, operational spectrum, end users, application scenarios, and geographical trends-it establishes the foundational context for stakeholders seeking clarity in an increasingly complex market. The subsequent sections translate these insights into actionable perspectives, ensuring that decision-makers can navigate emerging opportunities, anticipate regulatory headwinds, and execute strategies that align with both current demands and future imperatives.

Charting Transformative Breakthroughs in Dynamic Camouflage Technologies and Collaborative Innovations Reshaping Modern Defense Strategies

Recent years have witnessed an accelerated pivot in military strategic thinking, where traditional static concealment methods give way to systems that dynamically adapt to shifting battlefield conditions. Pioneering electrochromic materials now promise instantaneous changes in reflectivity, while projection-based camouflage leverages advanced algorithms to render vehicles virtually invisible against complex terrains. Meanwhile, the integration of multispectral sensor networks has enabled real-time feedback loops, ensuring that camouflage performance aligns with both visual and infrared threat vectors.Moreover, the proliferation of unmanned platforms and the growing significance of asymmetric warfare have compelled defense planners to seek scalable, modular solutions that can be rapidly deployed across air, land, and sea. This shift has driven partnerships between traditional defense primes and startups specializing in novel display technologies, accelerating the transition from laboratory prototypes to fielded capabilities. In parallel, investments in additive manufacturing have streamlined production processes, reducing both cost and lead times, and fostering a competitive landscape where incumbents and new entrants vie to deliver the next generation of adaptive concealment.

Understanding the Strategic Realignment of Supply Chains and Material Sourcing Driven by Upcoming United States Tariffs on Critical System Components in 2025

The introduction of a 2025 tariff regime on key components integral to adaptive camouflage systems has prompted widespread reassessment of global supply chains. Components such as specialized electrochromic films, rare-earth doped pigments, and inertial measurement sensors have become subject to increased duties, prompting manufacturers to explore alternative sourcing strategies. Consequently, original equipment manufacturers have accelerated localization efforts, establishing regional production hubs capable of mitigating cost escalation and minimizing lead-time disruptions.In response, a growing number of system integrators are forging strategic alliances with local suppliers to secure preferential access to critical materials. This realignment also catalyzes intensified research into substitute materials that can replicate performance attributes without incurring elevated duties. Transitioning towards domestically sourced thermochromic coatings and leveraging additive manufacturing techniques for advanced micro-structured surfaces have emerged as viable pathways. Ultimately, the tariff environment reinforces the importance of supply chain resilience and incentivizes greater vertical integration within the adaptive camouflage ecosystem.

Uncovering Deep Insights into Adaptive Camouflage Across Technology Modalities Operational Spectrums End Users and Application Environments

The adaptive camouflage market's trajectory is best understood through a multifaceted lens that examines technology modalities, operational spectrum coverage, end-user demands, and application scenarios. When focusing on underlying technologies, display-based solutions like E-Ink and electrophoretic displays offer low-power, high-contrast concealment ideal for soldier-worn systems, while electrochromic systems deliver rapid reflectance modulation suited to vehicle and naval platforms. In contrast, LED and projection-based camouflage deliver dynamic scene replication, and thermochromic coatings capitalize on temperature-sensitive pigments for cost-effective surface applications.From an operational spectrum perspective, infrared signature management remains critical to defeat thermal imaging threats, whereas multispectral systems provide holistic concealment across combined threat bands. Radar cross section control systems are increasingly embedded within hull and fuselage structures, and visual spectrum camouflage continues to evolve through pattern generation informed by machine learning. End users in homeland security prioritize rapid deployment and ease of integration, while military and defense forces demand scalable solutions that can be tailored across mission profiles. Application insights reveal divergent requirements: aircraft solutions must reconcile aerodynamic constraints on fixed and rotary wing configurations; military vehicles such as armored personnel carriers and tanks seek durable coatings resistant to abrasive environments; naval systems onboard submarines and surface ships contend with biofouling and corrosive seawater; and soldier systems range from lightweight helmets and gear to uniform fabrics engineered for multi-environment performance.

Examining Regional Drivers Innovation Ecosystems and Procurement Trends Impacting Adaptive Camouflage Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a decisive role in shaping investment priorities and procurement cycles for adaptive camouflage systems. In the Americas, strategic imperatives driven by modernization initiatives and defense budgets sustain robust demand for next-generation concealment solutions. Collaborative frameworks with academic institutions and national laboratories further catalyze innovation pipelines, particularly in the realms of electrochromic materials research and signature management algorithms.Within Europe, Middle East and Africa, heterogeneous threat environments spur diverse requirements, from border security applications in arid regions to naval stealth enhancements in contested maritime zones. Joint procurement programs and cross-border R&D consortia foster knowledge transfer, while geopolitical considerations influence prioritization of indigenous production capabilities. Asia-Pacific markets are marked by rapid fleet expansions, border security tensions, and rising investments in unmanned systems. Regional players are increasingly establishing localized manufacturing and testing facilities to address supply chain vulnerabilities and to expedite technology validation under realistic operational conditions. Across all territories, the interplay between regulatory regimes, industrial policy, and alliance structures determines the pace at which adaptive camouflage solutions transition from innovation to adoption.

Revealing the Competitive Dynamics and Collaboration Models Among Defense Primes Technology Innovators and Academic Research Partners in Adaptive Camouflage

Leading aerospace and defense companies are intensifying their focus on adaptive camouflage to differentiate platform offerings and to meet evolving procurement specifications. Established primes leverage their extensive integration expertise to embed signature management capabilities within next-generation combat vehicles and aircraft, while emerging technology firms contribute disruptive breakthroughs in material science and digital control systems. Collaborative ventures between technology specialists and systems integrators are becoming commonplace, allowing for the fusion of novel display technologies with mature platform architectures.Innovators specializing in nano-engineered coatings and metamaterials are expanding trial programs with defense departments, while software firms refine machine learning models for real-time environmental analysis and adaptive pattern deployment. Tier-two manufacturers are investing in pilot production lines to scale promising prototypes, and research partnerships with universities accelerate discovery of alternative pigments with reduced environmental impact. Collectively, this ecosystem of established defense contractors, high-tech startups, and academic collaborators underscores a market landscape defined by convergence between legacy industrial capabilities and cutting-edge innovation.

Driving Strategic Collaborations Manufacturing Innovations and Data Driven Design Practices to Accelerate Next Generation Adaptive Camouflage Deployment

To capitalize on the momentum in adaptive camouflage, industry leaders should prioritize cross-disciplinary research programs that integrate materials science with digital analytics. Establishing co-innovation labs with defense end users will enable rapid prototyping under realistic conditions and foster iterative refinement based on operational feedback. Furthermore, developing strategic supply chain partnerships with regional material suppliers can preempt tariff-induced disruptions and create pathways for cost-effective localization.Leaders must also invest in scalable manufacturing approaches such as roll-to-roll processing for smart films and advanced 3D printing of metamaterial structures to meet variable volume demands. Embedding data-driven decision support systems into the product lifecycle can streamline design optimization, expedite regulatory compliance, and enhance lifecycle management. Finally, pursuing collaborative alliances with unmanned systems manufacturers and sensor analytics providers will broaden the value proposition, enabling adaptive camouflage systems to evolve as integral components within networked defense platforms.

Detailing a Triangulated Research Approach Combining Secondary Intelligence Primary Expert Interviews and Rigorous Comparative Analysis for Adaptive Camouflage Insights

This research leverages a rigorous multi-stage methodology combining comprehensive secondary research with primary qualitative validation. Initially, an extensive review of industry publications, patent filings, regulatory documents, and technology white papers established a foundational understanding of key trends, material developments, and emerging system architectures. Subsequent mapping of competitive landscapes and supply chain structures provided context on partnerships, M&A activity, and regional production footprints.Key insights were then validated through in-depth interviews with subject matter experts spanning defense department officials, system integrators, material scientists, and strategy consultants. These interviews offered direct perspectives on operational requirements, procurement processes, and R&D roadmaps. Finally, data synthesis incorporated comparative analysis across technology readiness levels, geographical dynamics, and segmentation dimensions to deliver an integrated view of market opportunities and challenges. This triangulated approach ensures that the findings reflect both strategic foresight and practical considerations for stakeholders across the adaptive camouflage ecosystem.

Synthesizing Multidimensional Insights on Adaptive Camouflage Innovations Strategic Imperatives and Ecosystem Resilience to Inform Leadership Decisions in Defense

Adaptive camouflage systems occupy a pivotal nexus between materials innovation, digital analytics, and strategic defense imperatives. The confluence of evolving threat vectors, tariff-driven supply chain realignment, and accelerated technological breakthroughs underscores the imperative for stakeholders to stay vigilant and proactive. As the market continues to diversify across technology modalities, spectral domains, and platform applications, the ability to integrate multidisciplinary insights into coherent roadmaps will determine future leadership positions.In this dynamic environment, success hinges on fostering agile innovation ecosystems, embracing collaborative research models, and maintaining resilient supply chains. By synthesizing the insights presented-from segmentation nuances to regional dynamics and corporate strategies-decision-makers are equipped to formulate informed strategies that align with both current defense objectives and long-term modernization visions. The time is ripe for stakeholders to translate these insights into tangible actions that will shape the next generation of adaptive camouflage capabilities.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Technology

- E-Ink / Electrophoretic Displays

- Electrochromic Systems

- LED/Projection-Based Camouflage

- Thermochromic Coatings

- Operational Spectrum

- Infrared (IR) Signature Management

- Multispectral Systems

- Radar Cross Section (RCS) Control

- Visual Spectrum Camouflage

- End-user

- Homeland Security

- Military & Defense Forces

- Application

- Aircraft

- Fixed Wing

- Rotary Wing

- Military Vehicles

- Armored Personnel Carrier

- Tanks

- Naval Systems

- Submarines

- Surface Ships

- Soldier Systems

- Helmets And Gear

- Uniforms

- Aircraft

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- BAE Systems plc

- Saab AB

- Folium Optics Limited

- ArmorWorks Enterprises, Inc

- Wescom Group

- Lubawa S.A.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Adaptive Camouflage Systems market report include:- BAE Systems PLC

- Saab AB

- Folium Optics Limited

- ArmorWorks Enterprises, Inc

- Wescom Group

- Lubawa S.A.

Table Information

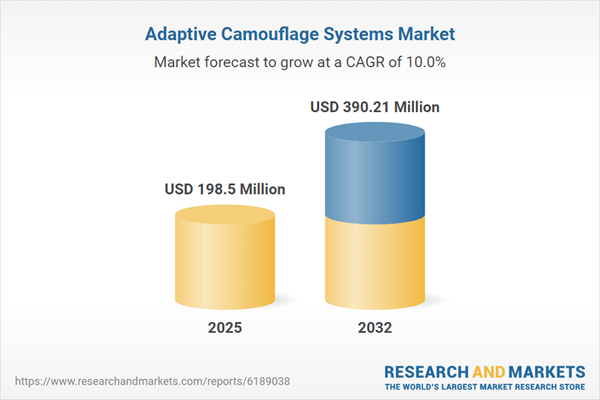

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 198.5 Million |

| Forecasted Market Value ( USD | $ 390.21 Million |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |