Speak directly to the analyst to clarify any post sales queries you may have.

A concise industry introduction describing evolving clinical priorities, regulatory pressure, and procurement shifts that are redefining device development and adoption

The specimen collection device landscape is undergoing a period of intensified scrutiny and strategic reorientation as clinical workflows, regulatory expectations, and end-user preferences continue to evolve. Clinicians, laboratory directors, and procurement professionals now prioritize devices that seamlessly integrate with diagnostic platforms while maintaining chain-of-custody integrity and biosafety standards. At the same time, the proliferation of decentralized testing models, including at-home and point-of-care diagnostics, has broadened the set of performance and usability criteria that determine successful adoption.Consequently, manufacturers and institutional buyers must balance traditional priorities such as sterility assurance and compatibility with emerging imperatives like sample stabilization for nucleic acid testing and designs that enable remote or self-collection. Regulatory clarity and harmonization remain pivotal as stakeholders navigate classification, sterility validation, and transport medium requirements. In this context, procurement strategies are shifting from transactional purchasing toward lifecycle thinking that emphasizes supply resilience, device interoperability, and total cost of ownership including waste management and cold chain logistics.

Taken together, these forces are reshaping product development roadmaps and procurement playbooks. Organizations that align design decisions with real-world clinical workflows and regulatory pathways will be better positioned to shorten time-to-adoption and mitigate downstream risks associated with sample integrity, diagnostic accuracy, and user compliance.

How decentralization, automation integration, nucleic acid stability demands, sustainability pressures, and regulatory tightening are reshaping device innovation and procurement

Several transformative shifts are converging to redefine how specimen collection devices are designed, validated, and deployed across clinical and nonclinical settings. First, decentralization of diagnostic testing has moved beyond pilot programs and into mainstream operational planning, leading to heightened demand for self-collection kits and remote-sampling workflows that preserve specimen integrity during transport and storage. This transition amplifies the importance of user-centered design, intuitive instructions for lay users, and transport media that stabilize analytes at ambient temperatures.Second, the integration of automation and instrument-compatibility within collection device portfolios is accelerating, as laboratories pursue throughput gains and process standardization. Instrument-compatible and robotic-ready devices enable tighter workflow coupling between collection and downstream analysis, reducing manual handling errors and improving traceability. Third, precision medicine and genomic applications are raising the bar on nucleic acid stabilization, introducing requirements for specialized collection matrices and preservatives that maintain analyte fidelity for complex molecular assays.

Fourth, sustainability and biohazard waste considerations are beginning to influence procurement, with stakeholders seeking single-use systems that reduce cross-contamination risk while also exploring recyclable or lower-waste packaging formats. Finally, regulatory frameworks and sterility expectations are tightening in multiple jurisdictions, prompting manufacturers to refine sterilization method validations and labeling to satisfy both clinical laboratories and point-of-care providers. Together, these shifts are driving realignment across R&D, quality, and commercial teams as companies adapt offerings to meet changing clinical, logistical, and regulatory demands.

The cascading operational and strategic consequences of tariff policy changes in the United States that are altering sourcing strategies, design choices, and regulatory considerations

The cumulative effect of tariff policy adjustments enacted in the United States has introduced renewed complexity across procurement channels, supply chain design, and global sourcing decisions for specimen collection devices. Tariff changes have influenced cost structures across raw materials, finished components, and imported assemblies, prompting organizations to reassess supplier portfolios and to evaluate nearshoring or diversification strategies to reduce exposure to trade-driven price variability. In addition, tariff-driven cost pressure has accelerated conversations about design simplification and material substitution, where clinically acceptable alternatives are identified to maintain performance while mitigating customs-related cost impacts.Procurement teams are responding by enhancing contract clauses that provide greater protection against sudden duty escalations and by negotiating inventory buffers for critical SKUs. At the same time, device manufacturers are prioritizing supply chain transparency and traceability to demonstrate compliance and to quantify the tariff exposure of specific product lines. Regulatory teams are also engaged because changes in manufacturing footprint or material sourcing can affect device regulatory submissions, sterility validations, and labeling requirements; consequently, any strategic move to shift production regions must be aligned with revalidation plans and regulatory notifications.

Furthermore, tariffs have indirectly shaped market entry strategies, with some firms accelerating partnerships with domestic distributors or assembly partners to preserve price competitiveness. These arrangements can expedite access to the U.S. clinical market while limiting direct import exposure. In sum, tariff developments have elevated supply chain risk management from an operational concern to a strategic priority that influences design decisions, supplier relationships, and compliance workflows.

Comprehensive segmentation analysis tying product categories, sample matrices, collection methods, materials, end users, and regulatory and packaging variables to distinct commercialization pathways

A nuanced segmentation framework reveals how product development and commercialization tactics must be tailored to distinct device and use-case attributes. When products are categorized by product type, clinical and commercial teams must consider a diverse array of items including blood collection devices with further distinctions between capillary collection devices and vacutainer tubes, buccal and saliva collection kits, microbiome and DNA collection kits, sputum and stool collection devices, a range of swabs, tissue and biopsy devices, transport media systems, and urine collection devices that include catheter collection systems and urine cups. Each product category demands specific sterility protocols, material choices, and packaging formats to satisfy clinical requirements and end-user expectations.Turning to sample type, device selection is influenced by the biological matrix being targeted, whether blood, buccal specimens, cerebrospinal fluid, environmental samples, nasopharyngeal and oropharyngeal swabs, saliva, sputum, stool, tissue, urine, or wound exudate. The analyte stability profile and collection invasiveness differ across these matrices, and therefore design trade-offs between sample volume, preservation chemistry, and user comfort become central to commercialization strategies. Collection method segmentation further differentiates device requirements: automated collection interfaces necessitate instrument-compatible form factors, home collection and remote kits require clear user instructions and robust stabilization, manual collection prioritizes ease-of-use for clinical staff, and point-of-care devices focus on rapid, low-complexity workflows.

Material selection also plays a central role, as component materials such as cotton and rayon, flocked or foam tips, glass, plastic, polypropylene, and stainless steel each impart distinct performance characteristics and sterilization compatibilities. End-user segmentation highlights divergent procurement drivers among clinics and physician offices, diagnostic laboratories, home users, hospitals, pharmacies and retailers, point-of-care settings, reference laboratories, research institutes, and veterinary clinics; each customer cohort prioritizes a different combination of cost, throughput, sterility assurance, and compatibility with downstream assays. Application-driven segmentation underscores use-case specific design imperatives across clinical trials, environmental monitoring, forensics, genetic and genomic testing, hormone and endocrine testing, infectious disease diagnostics, newborn screening, oncology, and veterinary diagnostics.

Transport medium considerations further modulate device performance, with choices spanning bacterial culture media, dry transport systems, fixatives and preservatives, nucleic acid stabilizers, and viral transport medium-each affecting cold chain requirements and sample viability timelines. Sterility options range from non-sterile to sterile products and various sterilization methods including aseptic packaging, ethylene oxide sterilization, and gamma irradiation, where validation standards and residuals testing are key differentiators. Regulatory classification and packaging format likewise influence market access and adoption; devices may be CE marked, classified as in vitro diagnostics or non-IVD, subject to regulatory approval status, and assigned risk classes that dictate labeling and clinical evidence requirements, while packaging formats vary from bulk packaging and custom OEM packaging to kits with accessories, pre-labeled systems, and single-use individual units. Automation levels-instrument compatible, manual only, or robotic integration-along with temperature requirements spanning ambient-stable, cold chain required, frozen, and refrigerated options, and sample volume ranges from large volume to microliter and milliliter, further narrow design choices.

Finally, pricing tiers from low cost to mid range and premium inform target segmentation and reimbursement dynamics, compelling manufacturers to align cost structures and feature sets with the expectations of each buyer segment. By synthesizing these segmentation lenses, stakeholders can design differentiated product strategies, prioritize validation investments, and tailor go-to-market messaging to address the unique performance, regulatory, and procurement drivers of each cohort.

How Americas, Europe Middle East and Africa, and Asia-Pacific regional dynamics are influencing device design choices, regulatory approaches, and distribution strategies

Regional dynamics are exerting a strong influence on product design priorities, regulatory strategies, and distribution choices. In the Americas, demand patterns emphasize high-throughput laboratory compatibility and a growing interest in decentralized testing models; regulatory agencies are focused on harmonizing device classification and sterility requirements with clinical evidence expectations, and procurement teams often prioritize supply chain resilience in response to trade policy fluctuations. As a result, manufacturers seeking market traction in this region must demonstrate end-to-end chain-of-custody controls and strong instrument compatibility to gain acceptance among large diagnostic laboratories and integrated health systems.Across Europe, the Middle East and Africa, regulatory heterogeneity and infrastructure variability necessitate flexible product configurations and adaptable labeling strategies. In many markets within this combined region, devices that offer robust ambient-stable transport solutions and simplified collection workflows can address logistical constraints while meeting diverse regulatory pathways. Meanwhile, in the Asia-Pacific region, rapid adoption of point-of-care testing, strong interest in genomics and large-scale screening initiatives, and a growing domestic manufacturing base are shaping competitive dynamics. Here, manufacturers benefit from partnerships with local distributors and from iterative product adaptations that reflect regional clinical workflows, procurement norms, and sterility expectations. Understanding these regional nuances is essential for shaping distribution models, regulatory submissions, and commercialization roadmaps that align with local healthcare delivery realities.

Competitive landscape insights highlighting product portfolio expansion, specialization in materials and stabilizers, and strategic partnerships to secure laboratory and decentralized testing adoption

Industry participants include established device manufacturers, specialty component suppliers, transport medium formulators, and vertically integrated diagnostic companies that bundle collection devices with assay platforms. Leading organizations are expanding portfolios to include instrument-compatible designs and stabilized transport solutions to meet the needs of molecular diagnostics and decentralized testing. Several firms are investing in partnerships that bring together biomaterial expertise, sterilization capacity, and rapid manufacturing capabilities to reduce time-to-market and to ensure supply continuity.In parallel, specialist suppliers of swab materials and preservatives are differentiating through proprietary flocking technologies, nucleic acid stabilizers, and validated sterilization methods that minimize residuals and maintain assay performance. Contract manufacturers and regional assemblers are also playing an increasing role by enabling nearshoring strategies and flexible capacity scaling. Across the competitive landscape, companies that demonstrate a clear understanding of regulatory pathways, provide robust clinical evidence of specimen stability, and support seamless integration with laboratory automation are gaining preferential consideration from large laboratory networks and health systems. Collaboration between quality, regulatory, and commercial functions is therefore a common characteristic of firms that secure long-term contracts and strategic partnerships.

Actionable strategic recommendations for manufacturers and buyers to align product design, supply chain resilience, regulatory strategy, and commercialization for long-term advantage

Industry leaders should pursue a coordinated set of actions to convert evolving trends into durable competitive advantage. First, prioritize user-centered design and validation for decentralized and home-collection workflows, ensuring that instructions, ergonomics, and stabilization chemistry reduce pre-analytical variability. Second, invest in compatibility testing and standards alignment for instrument-compatible and robotic-ready devices to facilitate laboratory automation adoption and to reduce integration friction.Third, establish supply chain transparency programs and flexible sourcing strategies that include regional assembly partners to manage trade policy exposure and to maintain service levels. Fourth, accelerate sterilization and regulatory strategy harmonization by documenting sterility validations and by proactively engaging with regulators on classification and labeling updates. Fifth, differentiate through transport media innovation that addresses ambient stability and nucleic acid preservation needs while minimizing cold chain dependency. Finally, develop commercial models that offer bundled value-combining devices, validated transport media, and workflows tailored to specific clinical or research applications-to simplify procurement decisions for large institutional buyers. Implementing these recommendations will require cross-functional coordination across R&D, regulatory, procurement, and commercial teams to ensure that product design, evidence generation, and market access efforts are tightly aligned.

Research methodology combining stakeholder interviews, technical validation review, regulatory guidance synthesis, and editorial analysis to produce practical device and procurement insights

This research synthesizes primary stakeholder interviews, technical validation literature, regulatory guidance, and public-domain clinical practice information to produce actionable insights. Primary stakeholder engagement included conversations with clinicians, laboratory managers, procurement officers, and product development leaders to capture real-world priorities, pain points, and performance expectations. These qualitative inputs were triangulated with device specifications, sterilization validation standards, and regulatory classification frameworks to create a robust framework for evaluating design and commercialization choices.Technical validation information was reviewed to understand material-performance relationships, sterilization method implications, and transport medium chemistries that influence analyte stability. Regulatory guidance documents and public adjudications were examined to identify prevailing trends in classification, labeling, and evidence expectations across major jurisdictions. Finally, synthesis and editorial review focused on translating technical and regulatory nuance into practical recommendations for product teams and procurement leaders, while ensuring clarity and applicability for both clinical and commercial audiences.

Concluding synthesis emphasizing cross-functional execution, evidence generation, and supply chain resilience as prerequisites for successful device adoption and sustained competitiveness

In closing, the specimen collection device ecosystem is transitioning from legacy paradigms toward a more integrated, evidence-driven, and user-centric environment. Innovations in collection materials, transport media stabilization, and automation compatibility are enabling new clinical pathways and decentralized testing models, while regulatory and trade developments are reshaping sourcing and validation priorities. Organizations that proactively align design choices with end-user workflows, document sterility and stability evidence, and implement resilient sourcing strategies will be positioned to capture priority opportunities in clinical diagnostics and related applications.Ultimately, success in this evolving landscape will hinge on cross-functional execution that brings together clinical validation, regulatory foresight, and supply chain agility. Stakeholders who prioritize these areas and who engage early with procurement and laboratory partners will not only reduce adoption barriers but will also create stronger defensibility around product value propositions and long-term contracts.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Blood Collection Devices

- Arterial Blood Collection Devices

- Arterial Blood Gas (ABG) Syringes

- Arterial Cannulas

- Needles

- Capillary Blood Collection Devices

- Lancets

- Microtainer Blood Collection Tubes

- Venous Blood Collection Device

- Blood Collection Tubes

- Vacutainer Needle Holder

- Venipuncture Needle

- Arterial Blood Collection Devices

- Cerebrospinal Fluid (CSF) Collection Devices

- Specimen Collection Vial

- Spinal Needle

- Microbiological Specimen Collection Devices

- Sterile Containers

- Swabs

- Transport Media

- Molecular Specimen Collection Devices

- Buccal Swabs

- Collection Tubes

- Saliva Collection Kits

- Sputum Collection Devices

- Stool Collection Devices

- Rectal Swabs

- Stool Containers

- Stool Transport Systems

- Tissue Collection Devices

- Urine Collection Devices

- Urine Collection Cups

- Urine Containers

- Urine Specimen Transport Tubes

- Blood Collection Devices

- Sterility

- Non-Sterile

- Sterile

- Mode of Usage

- Disposable Devices

- Reusable Devices

- Automation

- Fully-Automated

- Manual

- Semi-Automated

- Application

- Clinical Trials

- Environmental Monitoring

- Forensics

- Genetic & Genomic Testing

- Infectious Disease Diagnostics

- Oncology

- Pregnancy & Fertility Testing

- Therapeutic Drug Monitoring

- Veterinary Diagnostics

- End User

- Academic & Research Institutes

- Blood Banks

- Diagnostic Laboratories

- Home Care & Self-Testing

- Hospitals & Clinics

- Distribution Channel

- Offline

- Online

- Brand Platforms

- eCommerce Platforms

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Apacor Limited

- Becton, Dickinson and Company

- BioReference Health, LLC

- BIVDA Ltd

- Blue Life Solutions

- Copan Diagnostics, Inc.

- EKF Diagnostics Holdings plc

- FL MEDICAL s.r.l.

- GenTegra LLC

- Gentueri

- Grifols

- Hardy Diagnostics

- Heathrow Scientific

- IQVIA Inc.

- Mawi DNA Technologies LLC

- Medical Wire & Equipment Co Ltd.

- Porex Life Sciences Institute

- Pretium Packaging

- Puritan Medical Products

- QuidelOrtho Corporation

- RayBiotech, Inc.

- SteriPack Group Ltd.

- Tasso, Inc.

- Thermo Fisher Scientific Inc.

- Trajan Scientific Americas Inc.

- Trinity Biotech plc

- VIRCELL S.L.

- Xiamen Zeesan Biotech Co., Ltd.

- McKesson Corporation

- Henry Schein, Inc.

- Quest Diagnostics Incorporated

- Qiagen N.V.

- F. Hoffmann-La Roche AG

- Labcorp Holdings Inc.

- Greiner Bio-One International GmbH

- SARSTEDT AG & Co. KG

- Precision Bioscience Inc.

- Cardinal Health

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Specimen Collection Device market report include:- Apacor Limited

- Becton, Dickinson and Company

- BioReference Health, LLC

- BIVDA Ltd

- Blue Life Solutions

- Copan Diagnostics, Inc.

- EKF Diagnostics Holdings PLC

- FL MEDICAL s.r.l.

- GenTegra LLC

- Gentueri

- Grifols

- Hardy Diagnostics

- Heathrow Scientific

- IQVIA Inc.

- Mawi DNA Technologies LLC

- Medical Wire & Equipment Co Ltd.

- Porex Life Sciences Institute

- Pretium Packaging

- Puritan Medical Products

- QuidelOrtho Corporation

- RayBiotech, Inc.

- SteriPack Group Ltd.

- Tasso, Inc.

- Thermo Fisher Scientific Inc.

- Trajan Scientific Americas Inc.

- Trinity Biotech PLC

- VIRCELL S.L.

- Xiamen Zeesan Biotech Co., Ltd.

- McKesson Corporation

- Henry Schein, Inc.

- Quest Diagnostics Incorporated

- Qiagen N.V.

- F. Hoffmann-La Roche AG

- Labcorp Holdings Inc.

- Greiner Bio-One International GmbH

- SARSTEDT AG & Co. KG

- Precision Bioscience Inc.

- Cardinal Health

Table Information

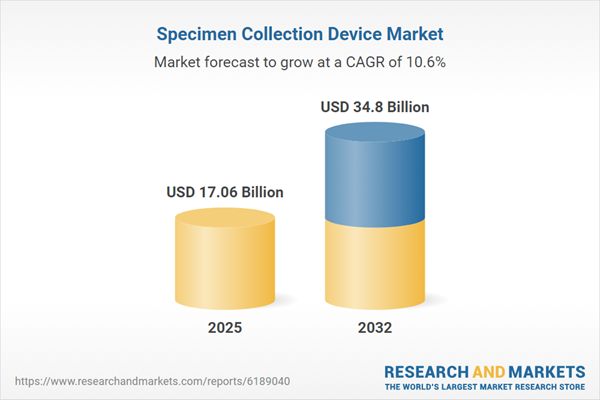

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 17.06 Billion |

| Forecasted Market Value ( USD | $ 34.8 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 39 |