Edge AI adoption is entering a high-growth era as IoT devices integrate increasingly powerful AI SoCs, accelerators and MCUs to deliver low-latency and privacy-preserving intelligence

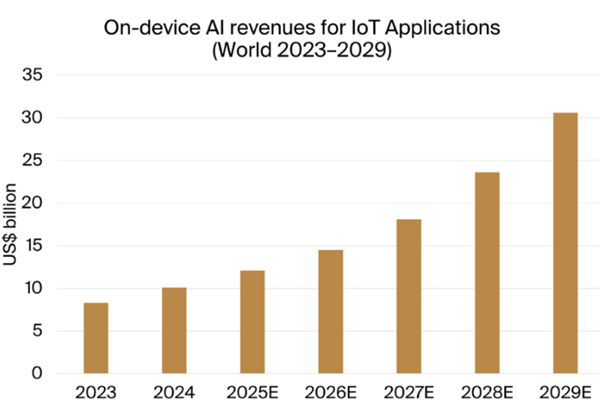

It is estimated that the revenues generated by on-device AI solutions reached US$ 10.1 billion in 2024, an increase of 22% year-on-year. This figure includes AI SoCs/SoMs, AI accelerators, AI MCUs and specialised on-device AI software and platforms, but excludes revenues generated by non-IoT applications such as smartphones, tablets and personal computers. The market is expected to grow to US$ 30.6 billion in 2029, representing a CAGR of 25%. Get up to date with the latest trends and developments with this unique 90-page report.

Internet of Things (IoT) is continually evolving and expanding into new domains. Among the most recent developments is the integration of artificial intelligence (AI) capabilities directly onto IoT devices to unlock a new generation of applications. Devices that integrate AI have numerous benefits over traditional rule-based or manually programmed methods, particularly for applications that require object detection, speech recognition, predictive maintenance, anomaly detection, dynamic resource optimisation and autonomous decision-making. Running AI algorithms directly on the device - known as edge AI or on-device AI - brings numerous advantages, such as real-time responsiveness, reduced data transfer, enhanced privacy and improved resilience. While cloud processing remains effective for many IoT use cases, a growing number of emerging use cases now demand the capabilities of on-device AI.

The market for on-device AI solutions is characterised by a high degree of heterogeneity in both technologies and applications, in contrast to cloud-based AI where the hardware is typically designed around predefined use cases and centralised infrastructure. Embedded AI processing can be architected in numerous ways depending on the end use case, and it can be integrated into an almost limitless range of devices across consumer, industrial and automotive domains. This leads to a differentiated market landscape, with unique design constraints, performance requirements and optimisation strategies. However, the overarching objective is typically the same for all vendors - to achieve the highest possible performance per watt for the intended use case.

The analyst has identified 40 key companies that shape the on-device AI landscape. The market can broadly be divided into two layers. The first encompasses hardware categories such as AI system-on-chips (SoCs) or system-onmodules (SoMs), AI accelerators and AI microcontroller units (MCUs), each optimised for different levels of performance, power efficiency and integration. AI SoCs typically integrate components such as general-purpose and specialised AI compute cores, on-chip memory and connectivity on a single chip, while SoMs extend this design by including external system memory, storage and interface components on a larger board, targeting more advanced use cases. AI accelerators are specialised chips or modules designed to enhance AI inference efficiency in existing systems, typically working alongside a separate host processor in embedded applications. AI MCUs serve lower-power devices by bringing neural network capabilities to sensors, wearables and IoT endpoints where energy efficiency and cost are most critical. The second layer consists of on-device AI platforms that combine hardware, software and developer tools to simplify model deployment and optimisation.

Over the past decade, the on-device AI market has been driven primarily by traditional machine learning use cases such as computer vision and anomaly detection, which have seen steady annual growth of around the 10% range. In recent years, the market has reached an inflexion point as emerging technologies and applications in generative AI, robotics and autonomous driving have opened up new dimensions of growth. These developments are expected to accelerate market growth and give rise to entirely new use cases and product categories. The analyst estimates that the revenue generated by on-device AI solutions reached US$ 10.1 billion in 2024, an increase of around 22% from 2023. This figure includes AI SoCs/SoMs, AI accelerators, AI MCUs and specialised on-device AI software and platforms, but excludes revenues generated by non-IoT applications such as smartphones, tablets and personal computers. The market is expected to grow to US$ 30.6 billion in 2029, representing a compound annual growth rate (CAGR) of 25%.

Highlights from the report:

- Insights from numerous executive interviews with market leading companies.

- 360-degree overview of the on-device AI ecosystem.

- Market value forecast for on-device AI hardware and software until 2029.

- Market shares for 40 key on-device AI hardware and software providers.

- Detailed profiles of 31 key on-device AI hardware and software providers.

- Use case descriptions across the most important industry verticals.

- In-depth analysis of market trends and key developments.

Questions answered in the report:

- How does on-device AI technology work?

- What is the business rationale between on-device, cloud and hybrid AI deployments?

- What are the prices and pricing models for different on-device AI solutions?

- What are the key success factors and challenges for stakeholders in the on-device AI market?

- Who are the leading providers of on-device AI hardware and software?

- How does the market differ across industry verticals and what are the key use cases?

- How will the edge AI market evolve over the next five years?

Who should read this report?

The On-device AI Market for IoT Applications is the foremost source of information about the emerging and impactful on-device AI market. Whether you are a hardware vendor, OEM, ODM, enterprise AI adopter, investor, consultant or government agency, you will gain valuable insights from this in-depth research.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro Devices (AMD)

- Ambarella

- Ambiq

- Apple

- Axelera

- Black Sesame Technologies

- DEEPX

- Edge Impulse

- EdgeCortix

- EmbedUR

- Hailo

- Horizon Robotics

- Hugging Face

- Intel

- MediaTek

- MemryX

- Mobileye

- Mythic

- Nota AI

- NVIDIA

- NXP Semiconductors

- Qualcomm

- Renesas Electronics

- Rockchip

- SigmaStar

- SiMa

- STMicroelectronics

- Synaptics

- Syntiant

- Tesla

- Texas Instruments