The Australia cladding market growth is driven by the increasing appeal for materials like fibre cement, timer, and ceramic, among others. Cladding is widely used to improve the appearance of the buildings while providing thermal insulation and water resistance.

According to the Australian Bureau of Statistics, in December 2023, approved private sector houses reached 8,574 and the total number of dwelling units approved reached 13,654, which indicates the potential in Australia cladding market.

Australia Cladding Market Trends

Australia cladding market is driven by the advancements and developments in cladding materials that have surged the desire for sustainable and fuel-efficient cladding systems. Non-combustible cladding systems are being developed with recycled glass to lower the glass waste in landfills. These cladding systems are cheap and fire-resistant.Companies such as HVG Facades launched a new fibre cement cladding product called Veterro, a durable and versatile product whose panels are non-combustible and have distinctive patterns.

Buildings in Australia are being constructed with solar façade that helps them to generate more power, for instance - Kennon, an Australian-based studio has developed a solar façade for an eight-storey building with 1,182 solar panels which eventually drove the Australia cladding market.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- Steel

- Aluminium

- Composite Materials

- Fibre Cement

- Terracotta

- Ceramic

- Others

Market Breakup by Application

- Residential

- Industrial

- Commercial

- Offices

- Institutional

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Cladding Market Share

Based on product type, Australia cladding market growth is driven by composite materials used in the manufacturing of cladding systems.Recycled glass is being used as an alternative cladding material to meet environmentally sustainable requirements. Fibre cement is a durable and versatile cladding material with a concrete-like appearance, it can also be heavy including labour time and cost. These cladding panels are non-combustible and fire-resistant. Timber weatherboards are very durable and attractive. It can also contribute to thermal insulation and resistance to moisture.

Based on application type, Australia cladding market share is led by residential construction.

According to the Australian Bureau of Statistics, residential construction was valued at AUD 20.67 billion with a growth of 4.4% in 2022-2023 indicating its significant impact. For residential buildings, cladding protects them from external conditions while providing thermal insulation and weather resistance. Steel and aluminium are majorly used to manufacture commercial cladding which enhances its durability and protects them from environmental factors.

Companies manufacture and supply building products for commercial and residential construction, specialise in the installation of terracotta tiles, aluminium panels and distribute façade solutions and provide cladding products.

CSR Limited

CSR Limited, founded in 1855 and headquartered in Australia, manufactures and supplies building products for commercial and residential construction. They are involved in sales activities and property development.Australian Cladding Specialists

Australian Cladding Specialists, founded in 2014, are Australian-based contractor that specializes in the installation of terracotta tiles, aluminium panels, and commercial rain-screening cladding systems.FVA Group Pty Limited

FVA Group Pty Limited, founded in 2004 and headquartered in Australia, manufacture and distribute façade solutions and provide cladding products to the construction industry.Prestige Wall Systems

Prestige Wall Systems, established in Australia, manufacturer and supplier of architectural building products and is passionate about creating external facades and finishes.Other Australia cladding market key players are Masterwall, ArchiPro Pty Ltd., and Allstate Polystyrene Industries, among others.

Australia Cladding Market Analysis by Region

In 2023, as per ABS, the number of dwelling units approved in Victoria reached 4,545, simultaneously in New South Wales and Queensland, it reached 3,502 and 2,691 respectively which indicates the growth of house construction that eventually drives the Australia cladding market.Table of Contents

Companies Mentioned

- CSR Limited

- Australian Cladding Specialists

- FVA Group Pty Limited

- Prestige Wall Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 102 |

| Published | October 2025 |

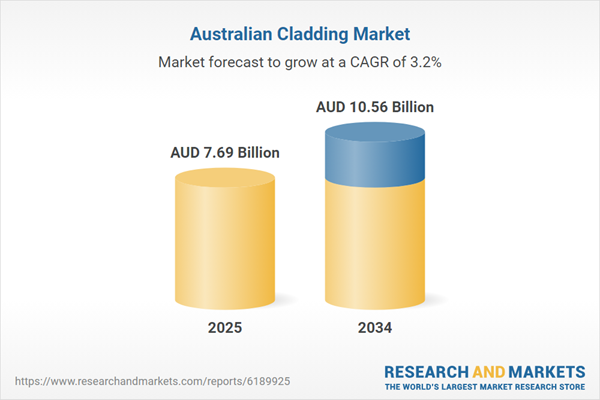

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 7.69 Billion |

| Forecasted Market Value ( AUD | $ 10.56 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 4 |