This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This distinct amino acid blend allows brands to appeal to urban consumers, especially those stressed and seeking cognitive boosts, in a market where mental wellness is highly valued. As per the study published in National Institutes of Health, 2023, matcha green tea may have positive effects on gut bacteria due to its high nutrient content of tea catechins and insoluble dietary fiber. The product has a high content of antioxidants, vitamins, minerals, and amino acids.

The oxygen radical absorbance capacity (ORAC) count of the product is estimated to be 1,384 units per gram, which is higher than the average ORAC count of 94 units per gram of other nutritious fruits and vegetables, such as pomegranates, goji berry, walnuts, broccoli, spinach, and blueberries. The anti-oxidant composition of the product enables it to prevent various chronic diseases and provide protection from the harmful effects of UV radiation. The antioxidants present in the product, known as EGCG short for epigallocatechin gallate, can prevent various types of cancer including brain, bladder, prostate, and cervix. It prevents the proliferation of malignant cells and thus regulates angiogenesis and metastasis.

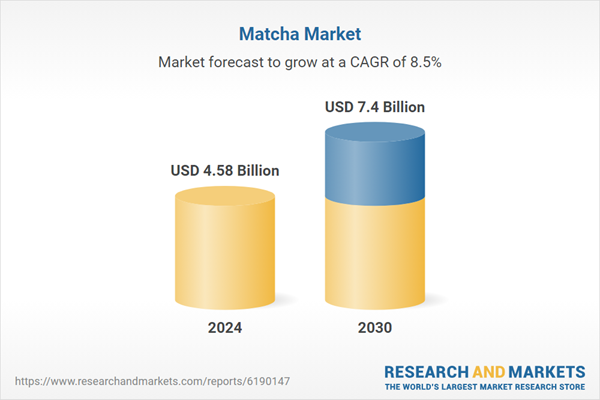

According to the report, the Global Matcha market was valued at more than USD 4.58 Billion in 2024, and expected to reach a market size of more than USD 7.40 Billion by 2030 with the CAGR of 8.48% from 2025-2030. Some of the key companies in the matcha market include The AOI Tea Company, Ippodo Tea US, DoMatcha and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Jade Monk specializes in handy matcha packets designed for easy consumption while on the move. Its matcha powder is available in traditional and flavored options such as Palau Peach and Lime Blossom, appealing to a broader range of consumers seeking a more easily enjoyable matcha experience.

ITO EN's debut of the Matcha Banana Latte and Matcha Cacao Latte in ready-to-drink formats underscores a successful flavor innovation. These offerings cater to convenience-driven consumers, all the while upholding authentic Japanese sourcing credentials. Aiya's launch of a sugar-free sweetened matcha showcases how innovation can simultaneously capture market share across diverse health-conscious demographics. Liquid-form products, especially ready-to-drink variants, are witnessing a surge due to their ability to simplify preparation complexities.

These formats not only command higher margins than their powdered counterparts but also broaden the market's reach. As turmeric lattes, spirulina smoothies, and moringa-based drinks vie for the attention of health-conscious consumers, the competition among alternative superfoods heats up. These contenders not only share a similar functional appeal but often come at more accessible price points and boast a deeper cultural resonance.

Market Drivers

- Rising Health Awareness: The growing global focus on health and wellness is a major driver for the matcha market. Consumers are increasingly seeking beverages and supplements that offer natural antioxidants, improve metabolism, and enhance mental alertness. Matcha, rich in catechins and L-theanine, has gained recognition for its potential to support heart health, weight management, and stress reduction. This health-conscious trend has expanded demand not only in traditional tea forms but also in matcha-based drinks, snacks, and dietary supplements.

- Elevated Cuisine Development: Another key driver is the rising trend of premium, specialty beverages and culinary applications. Matcha is being incorporated into lattes, smoothies, desserts, and even savory dishes, appealing to consumers who seek unique flavors and aesthetic appeal. Cafes, restaurants, and foodservice providers are leveraging matcha’s vibrant green color and perceived health benefits to create visually attractive, Instagram-friendly products, which in turn fuels market growth globally.

Market Challenges

- High Production Costs: One of the primary challenges in the matcha market is the high production cost and limited supply of authentic, high-quality matcha. The labor-intensive process of shading, hand-picking, and stone-grinding tea leaves increases production costs, making premium matcha expensive for consumers. Additionally, variations in cultivation conditions, climate sensitivity, and limited growing regions create supply constraints, affecting pricing and availability in global markets.

- Consumer Awareness Issues: Another challenge is the potential for adulteration and inconsistent quality, particularly in emerging markets. Many consumers may not be able to distinguish between high-grade ceremonial matcha and lower-quality or blended variants, leading to dissatisfaction or mistrust. Ensuring authenticity, educating consumers about quality grades, and establishing reliable certification systems remain critical challenges for industry players.

Market Trends

- Product Innovation: A dominant trend in the matcha market is aggressive product innovation and expansion into new categories beyond traditional tea preparation. Manufacturers and brands are developing an increasingly diverse portfolio of matcha-infused products to capture different consumption occasions and appeal to broader consumer segments. This includes ready-to-drink matcha beverages in convenient packaging, matcha-enhanced energy drinks and functional beverages, matcha protein powders for fitness enthusiasts, matcha-flavored snacks and confectionery, and even matcha-infused skincare and cosmetic products capitalizing on its antioxidant properties.

- Traceability Focus: The second emerging trend is the growing emphasis on sustainability, ethical sourcing, and supply chain traceability. Modern consumers, particularly millennials and Gen Z, are increasingly concerned about the environmental and social impact of their purchasing decisions. In response, matcha brands are highlighting sustainable farming practices, organic certifications, fair trade partnerships with Japanese farmers, and transparent supply chains that allow consumers to trace their matcha back to specific farms or regions.

The regular matcha segment dominates the global market primarily due to its widespread accessibility and comparatively lower cost compared to premium ceremonial grades.

Regular matcha, often referred to as culinary-grade matcha, is specifically designed for use in beverages, baking, cooking, and food preparation rather than traditional ceremonial consumption. Its lower price point, relative to high-grade ceremonial matcha, makes it accessible to a broader consumer base, including households, cafes, restaurants, and manufacturers. One of the key drivers of the regular matcha segment’s dominance is its versatility in culinary and commercial applications. Unlike ceremonial-grade matcha, which is primarily consumed as a whisked tea, regular matcha can be blended into smoothies, lattes, ice creams, pastries, and sauces without compromising flavor or texture.The vibrant green color, combined with its subtle umami taste, enhances the growth of e-commerce and ready-to-use culinary products has amplified the adoption of regular matcha. Packaged in convenient powders or pre-mixed blends, it caters to busy lifestyles, offering easy incorporation into beverages and recipes. the visual appeal and flavor profile of a variety of food and beverage products, making it highly popular among professional chefs, bakeries, and food manufacturers.

While ceremonial-grade matcha requires meticulous cultivation, shading, and hand-harvesting to ensure a delicate flavor and aroma, regular matcha can be produced at larger scales with slightly less stringent requirements, making it more widely available. This increased production volume translates to a more stable supply chain, enabling retailers, online sellers, and foodservice operators to meet the rising global demand efficiently.

The powder form of matcha dominates the global market due to its versatility, ease of use, longer shelf life and rapidly growing product type among consumers and commercial users worldwide.

Powdered matcha offers unmatched flexibility in consumption and application. Unlike other forms, such as ready-to-drink liquids or pre-mixed blends, powder can be easily incorporated into a wide range of products, from traditional tea to modern beverages like lattes, smoothies, and health drinks. Its culinary versatility extends to baked goods, desserts, sauces, and savory dishes, allowing cafes, restaurants, and home cooks to innovate and experiment with flavor and presentation. Powdered form has a longer shelf life compared to liquid preparations, as it retains freshness and nutritional properties when stored in airtight containers under proper conditions.Unlike liquid extracts or ready-to-drink matcha, which may require refrigeration and have shorter expiry periods, powdered matcha allows consumers and businesses to buy in bulk, store efficiently, and use as needed without the risk of rapid spoilage. Powdered matcha can be packaged in various sizes, from single-serve sachets for consumers to bulk packs for commercial kitchens and beverage manufacturers. This scalability allows producers and retailers to cater to different market segments while maintaining affordability, encouraging widespread adoption.

Powdered matcha contains high concentrations of antioxidants, catechins, L-theanine, and other bioactive compounds that support mental alertness, metabolism, and overall wellness. The ability to measure and control the dosage accurately in powdered form appeals to health-conscious consumers, fitness enthusiasts, and those seeking functional foods, boosting its demand across regions.

The classic grade segment dominates the global matcha market primarily because of its balanced quality, affordability, and versatility for culinary and beverage applications.

Classic grade matcha is designed to offer a middle ground between premium ceremonial grade and lower-quality culinary grade. While ceremonial grade is highly prized for its delicate flavor, vibrant color, and traditional tea preparation, it comes at a high cost, making it less accessible for everyday consumption and large-scale commercial use. Classic grade, on the other hand, maintains a strong flavor profile, decent antioxidant content, and bright green color while being more affordable, which allows it to cater to a wider audience globally. One of the main factors contributing to the growth of classic grade matcha is its versatility in culinary applications.Unlike ceremonial grade, which is primarily consumed as traditional tea, classic grade is suitable for a wide range of uses including lattes, smoothies, desserts, baked goods, and ready-to-drink beverages. This makes it an attractive option for cafes, restaurants, and food manufacturers who aim to provide matcha-infused products to a broad consumer base without incurring the high costs associated with premium grades. Produced in larger quantities than ceremonial grade, classic matcha is more readily available in retail stores, supermarkets, and online platforms.

Its stable supply chain ensures consistent product quality and availability, allowing global distributors and foodservice businesses to meet rising demand without disruption. Classic grade matcha requires less intensive cultivation and production techniques compared to premium ceremonial grade, which helps maintain reasonable pricing and wider accessibility.

The matcha beverages segment dominates and grows rapidly in the global matcha market due to the rising consumer preference for healthy and convenient drinks that provide antioxidants.

Matcha beverages have become a key driver of the global matcha market because of their ease of consumption and incorporation into daily routines. Unlike traditional tea or powdered matcha, which require preparation and careful measurement, ready-to-drink matcha beverages, matcha lattes, and bottled drinks provide instant access to the health benefits of matcha.Consumers are increasingly aware of the positive effects of antioxidants, L-theanine, and catechins present in matcha, which are known to improve metabolism, reduce stress, and enhance mental clarity. Unlike sugary or high-calorie drinks, matcha beverages are perceived as a healthier alternative, aligning perfectly with the rising demand for functional beverages.

Cafes and specialty beverage chains are incorporating matcha into signature drinks, which are visually appealing due to their vibrant green color and associated with premium, Instagram-friendly experiences. This premiumization trend has further fueled global demand, as consumers associate matcha beverages with both wellness and a sophisticated lifestyle.

Online platforms, subscription services, and grocery chains make matcha beverages more accessible to a wider audience. This accessibility, combined with the convenience of packaging and portability, ensures consistent demand across urban and semi-urban areas. Manufacturers are also innovating with packaging technologies to improve shelf life and maintain the quality of matcha in bottled or canned beverages, enhancing consumer confidence and repeat purchase behavior.

Online retail stores dominate and grow rapidly in the global matcha market due to the ease of access, wide product variety and the ability to cater to the growing digitally.

Unlike traditional brick-and-mortar stores, online platforms provide instant access to a diverse range of matcha types, grades, and brands from around the world. Consumers can easily compare ceremonial, classic, and culinary grades, as well as powder, capsules, and ready-to-drink options, all in one place. Convenience and doorstep delivery are key factors supporting the rapid growth of online retail. Modern consumers increasingly prefer to shop from the comfort of their homes or offices, avoiding the need to visit specialty tea shops or grocery stores. Online retailers provide detailed product information, user reviews, and instructional content, helping buyers make informed decisions.This convenience is particularly appealing in urban and semi-urban regions where busy lifestyles limit time for in-store shopping. Consumers worldwide are seeking functional beverages, dietary supplements, and healthy snacks, and matcha aligns perfectly with this demand. Online retail platforms capitalize on this trend by offering tailored recommendations, health-focused bundles, and targeted marketing campaigns, making it easier for health-conscious buyers to discover and purchase matcha products.

E-commerce platforms also enable international trade, breaking down geographical barriers. Consumers in regions without local production or specialty stores can purchase authentic matcha directly from global suppliers. This international accessibility supports both premium and regular matcha sales, broadening the consumer base and enhancing market penetration.

Asia-Pacific dominates and grows rapidly in the global matcha market due to the strong cultural roots, high consumer awareness of health and wellness, and increasing adoption of matcha.

The Asia-Pacific region, particularly East Asia, has a long-standing tradition of tea consumption, with matcha being an integral part of cultural rituals, culinary practices, and daily lifestyles. This historical affinity for tea has created a solid foundation for the matcha market, as consumers are already familiar with its taste, preparation methods, and health benefits. The cultural acceptance of matcha as a daily beverage contributes to high baseline demand, giving the region a competitive advantage over other markets where matcha is still emerging. Urban populations, in particular, are adopting health-focused lifestyles, and matcha is becoming a preferred choice over traditional sugary drinks and coffee.This trend has driven both individual consumption and product innovation, with matcha being incorporated into ready-to-drink beverages, smoothies, energy drinks, bakery products, and even dietary supplements, reinforcing the region’s leadership in the global market. Rapid urbanization and rising disposable incomes also play a significant role. As more consumers can afford premium and specialty products, the demand for high-quality matcha has surged. Cafes, restaurants, and specialty beverage chains in metropolitan areas are actively promoting matcha-based products, increasing its visibility and adoption.

Online platforms provide convenient access to a wide range of matcha products, from premium ceremonial grades to regular culinary grades, enabling consumers in both urban and semi-urban areas to purchase authentic matcha with ease. Subscription models, doorstep delivery, and targeted online marketing campaigns have made matcha more accessible and appealing, particularly to younger, digitally-savvy consumers who value health, convenience, and lifestyle trends.

- June 2025: Actress Sanya Malhotra launched a new matcha brand, Bree Matcha in partnership with Essanza Nutrition. The brand offers ceremonial matcha, regular matcha, and a matcha kit.

- June 2025: Miko launched a range of premium matcha powder. Miko's genuine Matcha Japanese green tea, boasting an earthy and bittersweet flavor, is packed with antioxidants and nutrients, making it a versatile choice for both hot and cold beverages.

- June 2025: Starbucks Japan launched a new limited-edition matcha drink at selected stores. The products include matcha green tea, matcha pistachio mousse latte, and many others. The drinks have smooth texture and unique taste.

- June 2024: Aiya America, Inc. recently revealed its distribution expansion to Whole Foods Market stores. The well-known natural foods chain now has 5 Aiya Matcha products.

- May 2024: Goli Nutrition Inc. announced the launch of its new Matcha Mind Cognitive Gummies. It combines clinically studied Cognizin and matcha to help support focus, attention and cognitive health.

- February 2024: Starbucks launched Iced Strawberry Matcha Tea Latte, a classic matcha mixed with vanilla syrup, ice and thick creamy strawberry cold foam.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aiya Co., Ltd.

- Ito En, Ltd.

- Unilever PLC

- Tata Consumer Products Limited

- Ingredion Incorporated

- Aoi Tea Company

- Matcha Kari

- Tenzo Tea, Inc.

- Jade Leaf Matcha

- Starbucks Corporation

- Green Foods Corporation

- Breakaway Matcha LLC

- Maeda-En

- Greenergy S.A.

- PerfectTed

- Matcha Maiden

- Marukyu Koyamaen Co., Ltd.

- Push Matcha S.A.

- TeaLand Trading LLC

- AVANTCHA Tea

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 205 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.58 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |