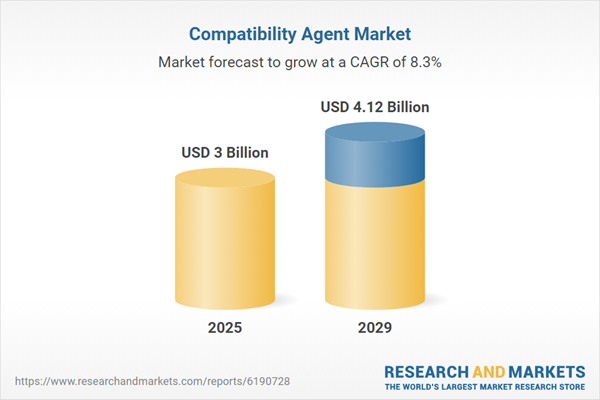

The compatibility agent market size is expected to see strong growth in the next few years. It will grow to $4.12 billion in 2029 at a compound annual growth rate (CAGR) of 8.3%. The growth projected for the forecast period can be linked to rising adoption of smart home devices, increasing need for seamless integration across multiple platforms and devices, growing consumer preference for connected ecosystems, expanding use of IoT-enabled devices, and the rising trend of cloud-based services. Key trends in the forecast period include advancements in AI-driven compatibility tools, innovations in API integration, developments in real-time data synchronization, increased investments in adaptive software research and development, and progress in automated testing and validation systems.

The rising demand for cosmetics is expected to drive growth in the compatibility agent market. Cosmetics are products applied to the body to enhance appearance, fragrance, or maintain personal hygiene and beauty. Their increasing use is driven by growing consumer focus on personal appearance and self-care, influenced by social media and beauty awareness. Compatibility agents are essential in cosmetic formulations, ensuring that ingredients blend effectively without adverse reactions, thereby improving texture, stability, performance, and skin safety. For example, in September 2024, McKinsey & Company, a US-based management consulting firm, reported that global retail sales in the beauty market reached $446 billion in 2023, marking a 10% increase from 2022. Consequently, rising cosmetic usage is propelling the compatibility agent market.

Companies in the compatibility agent market are focusing on innovations such as tank-mix adjuvants to enhance formulation stability, improve spray efficiency, and ensure seamless mixing of agricultural chemicals. A tank-mix adjuvant is a substance added to spray solutions that helps different agrochemicals blend smoothly, prevents separation or antagonism, and optimizes effectiveness in the field. In August 2025, Dow Inc., a US-based chemical company, introduced two new lines of adjuvants in Brazil compatible with biological inputs, emphasizing biocompatibility. These adjuvants improve the effectiveness of both chemical and biological crop protection products by maintaining formulation stability and activity until application. They support sustainable agriculture by enhancing leaf coverage, ensuring compatibility with biological inputs, and reducing environmental impact, enabling safer and more efficient integrated pest management for diverse Brazilian agricultural conditions.

In September 2025, NiCE, a US-based software company, acquired Cognigy GmbH for an undisclosed amount. The acquisition aims to accelerate NiCE’s AI innovation agenda by integrating its CX AI platform with Cognigy’s conversational AI, delivering faster, smarter, and more impactful AI-powered customer interactions across all touchpoints. Cognigy GmbH is a US-based company offering compatibility agents.

Major players in the compatibility agent market are BASF SE, Dow Inc., Saudi Basic Industries Corporation, 3M Company, Henkel AG & Co. KGaA, Shin-Etsu Chemical Co. Ltd., Sumitomo Chemical Co. Ltd., Evonik Industries AG, Sika AG, Mitsui Chemicals Inc., Akzo Nobel N.V., Celanese Corporation, Arkema S.A., Eastman Chemical Company, LANXESS AG, Wacker Chemie AG, Kuraray Co. Ltd., Kaneka Corporation, Clariant AG, H.B. Fuller Company, Croda International Plc, Helena Agri-Enterprises, Loveland Products, Precision Laboratories.

North America was the largest region in the compatibility agent market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in compatibility agent report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The rapid escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are significantly impacting the information technology sector, particularly in hardware manufacturing, data infrastructure, and software deployment. Higher duties on imported semiconductors, circuit boards, and networking equipment have raised production and operational costs for tech firms, cloud service providers, and data centers. Companies relying on globally sourced components for laptops, servers, and consumer electronics are facing longer lead times and increased pricing pressures. In parallel, tariffs on specialized software tools and retaliatory measures from key international markets have disrupted global IT supply chains and reduced overseas demand for U.S.-developed technologies. To navigate these challenges, the sector is accelerating investments in domestic chip fabrication, diversifying supplier bases, and adopting AI-driven automation to enhance operational resilience and cost efficiency.

The compatibility agent market research report is one of a series of new reports that provides compatibility agent market statistics, including compatibility agent industry global market size, regional shares, competitors with a compatibility agent market share, detailed compatibility agent market segments, market trends and opportunities, and any further data you may need to thrive in the compatibility agent industry. This compatibility agent market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

A compatibility agent is a software component or tool designed to ensure that two systems, applications, or devices can operate together without conflicts. Its primary function is to check, facilitate, or enable compatibility across different hardware, software versions, or platforms.

The primary types of compatibility agent components are software, hardware, and services. Software includes programs and applications developed to manage, integrate, or optimize various processes. These solutions are deployed on-premises or via the cloud and cater to enterprises of all sizes, including small and medium enterprises as well as large enterprises. Their applications span industries such as pharmaceuticals, cosmetics, food and beverages, and agriculture, serving end users in sectors including banking, financial services, and insurance, healthcare, retail and e-commerce, manufacturing, information technology and telecommunications, and more.

The countries covered in the compatibility agent market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The compatibility agent market consists of revenues earned by entities by providing services such as system compatibility checks, conflict resolution, and integration support. The market value includes the value of related goods sold by the service provider or included within the service offering. The compatibility agent market also includes sales of porters compatibility agent, corn belt compatibility agent, and mix compatibility agent. Values in this market are ‘factory gate’ values; that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Compatibility Agent Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on compatibility agent market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for compatibility agent? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The compatibility agent market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Component: Software; Hardware; Services2) By Deployment Mode: On-Premises; Cloud

3) By Enterprise Size: Small and Medium Enterprises; Large Enterprises

4) By Application: Pharmaceuticals; Cosmetics; Food and Beverages; Agriculture; Other Applications

5) By End User: Banking, Financial Services, and Insurance; Healthcare; Retail and E-Commerce; Manufacturing; Information Technology and Telecommunications; Other End Users

Subsegments:

1) By Software: Compatibility Testing Tools; Simulation and Modeling Platforms; Integration and Middleware Solutions2) By Hardware: Testing Devices and Analyzers; Network and Connectivity Equipment; Computing and Storage Systems

3) By Services: Consulting and Advisory Services; Integration and Implementation Services; Support and Maintenance Services

Companies Mentioned: BASF SE; Dow Inc.; Saudi Basic Industries Corporation; 3M Company; Henkel AG & Co. KGaA; Shin-Etsu Chemical Co. Ltd.; Sumitomo Chemical Co. Ltd.; Evonik Industries AG; Sika AG; Mitsui Chemicals Inc.; Akzo Nobel N.V.; Celanese Corporation; Arkema S.A.; Eastman Chemical Company; LANXESS AG; Wacker Chemie AG; Kuraray Co. Ltd.; Kaneka Corporation; Clariant AG; H.B. Fuller Company; Croda International Plc; Helena Agri-Enterprises; Loveland Products; Precision Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Compatibility Agent market report include:- BASF SE

- Dow Inc.

- Saudi Basic Industries Corporation

- 3M Company

- Henkel AG & Co. KGaA

- Shin-Etsu Chemical Co. Ltd.

- Sumitomo Chemical Co. Ltd.

- Evonik Industries AG

- Sika AG

- Mitsui Chemicals Inc.

- Akzo Nobel N.V.

- Celanese Corporation

- Arkema S.A.

- Eastman Chemical Company

- LANXESS AG

- Wacker Chemie AG

- Kuraray Co. Ltd.

- Kaneka Corporation

- Clariant AG

- H.B. Fuller Company

- Croda International Plc

- Helena Agri-Enterprises

- Loveland Products

- Precision Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | November 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 4.12 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |