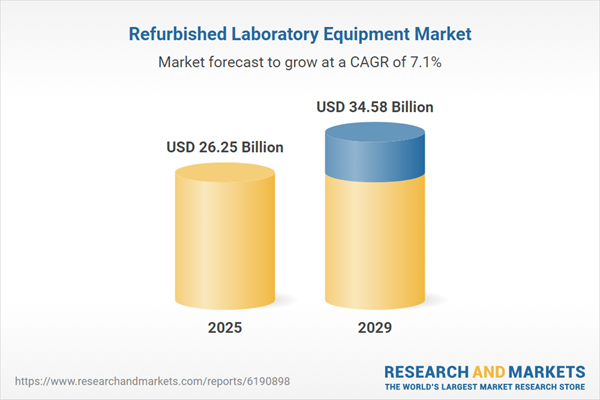

The refurbished laboratory equipment market size is expected to see strong growth in the next few years. It will grow to $34.58 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth during the forecast period can be attributed to the increasing focus on the circular economy, the implementation of stricter environmental regulations, the expansion of healthcare and diagnostic infrastructure, rising demand from emerging markets, and growing collaborations between original equipment manufacturers and refurbishers. Key trends in the forecast period include progress in remote diagnostics and IoT-enabled maintenance, innovations in calibration and validation processes, advancements in AI-based quality grading and pricing, research and development-driven upgrades supporting hybrid new-refurbished bundles, and the standardization of digital traceability and refurbishment certification.

The expansion of academic research institutions is expected to drive the growth of the refurbished laboratory equipment market in the coming years. Academic research institutions include universities, colleges, and specialized research organizations that conduct structured studies and experiments to advance scientific understanding. Their growth is supported by increasing government and private funding, which enables the establishment of new centers, attracts skilled researchers, and enhances research capabilities. Refurbished laboratory equipment provides these institutions with cost-effective access to advanced tools for high-quality experiments and hands-on training while promoting sustainability by extending the operational life of instruments. For example, in November 2024, the National Center for Science and Engineering Statistics, a US-based government organization, reported that research and development (R&D) spending by academic institutions increased by 11.2% in fiscal year 2023, marking the highest growth rate in current dollar terms. Total academic R&D expenditures reached $108.8 billion, reflecting a rise of $11 billion compared to fiscal year 2022. Therefore, the growth of academic research institutions is contributing to the expansion of the refurbished laboratory equipment market.

Leading companies in the refurbished laboratory equipment market are prioritizing sustainability-driven innovation, such as the introduction of My Green Lab Act-labeled products, to provide laboratories with environmentally responsible instruments and promote circular economy practices through refurbishment and recycling programs. My Green Lab Act-labeled products are laboratory instruments certified for their reduced environmental impact, including lower energy consumption, minimized waste generation, and sustainable design. For instance, in June 2024, Agilent Technologies Inc., a US-based provider of instruments, software, and services, published its annual ESG report emphasizing its dedication to sustainability. The report highlighted a growing portfolio of eco-friendly solutions that help laboratories minimize waste and reduce the use of nonrenewable resources. Agilent’s initiatives include energy-efficient instruments, refurbishment programs, and environmentally responsible consumables, supporting laboratories in adopting sustainable practices while maintaining operational efficiency.

In April 2025, Surplus Solutions LLC, a US-based provider of Equipment Lifecycle Management (ELM) services, partnered with Certified Genetool Inc. to offer high-quality refurbished laboratory equipment and technical services globally. This collaboration aims to strengthen equipment lifecycle management by improving refurbishment, maintenance, and technical support for laboratory instruments. Certified Genetool Inc. is a US-based manufacturer and supplier of refurbished, certified, and new laboratory equipment serving the academic, biotechnology, and pharmaceutical sectors.

Major players in the refurbished laboratory equipment market are Hitachi Ltd., Thermo Fisher Scientific Inc., Abbott Laboratories, Danaher Corporation, Siemens Healthineers AG, Merck KGaA Darmstadt Germany, GE Healthcare Inc., Carl Zeiss AG, Bruker Corporation, Agilent Technologies Inc., Olympus Corporation, Beckman Coulter Inc., Sartorius AG, Shimadzu Corporation, Waters Corporation, PerkinElmer Inc., HORIBA Ltd., Eppendorf AG, JASCO Inc., Copia Scientific LLC, Spectralab Scientific Inc., International Equipment Trading Ltd., ARC Scientific LLC, and American Instrument Exchange Inc.

North America was the largest region in the refurbished laboratory equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in refurbished laboratory equipment report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The fast surge in U.S. tariffs and the trade tensions that followed in spring 2025 are heavily affecting the medical equipment sector, particularly for imported imaging machine components, surgical-grade stainless steel, and plastic disposables. Hospitals and clinics resist price hikes, pressuring manufacturers’ margins. Regulatory hurdles compound the problem, as tariff-related supplier changes often require re-certification of devices, delaying time-to-market. Companies are mitigating risks by dual-sourcing critical parts, expanding domestic production of commoditized items, and accelerating R&D in cost-efficient materials.

The refurbished laboratory equipment market research report is one of a series of new reports that provides refurbished laboratory equipment market statistics, including refurbished laboratory equipment industry global market size, regional shares, competitors with a refurbished laboratory equipment market share, detailed refurbished laboratory equipment market segments, market trends and opportunities, and any further data you may need to thrive in the refurbished laboratory equipment industry. The refurbished laboratory equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Refurbished laboratory equipment refers to pre-owned instruments that have been carefully inspected, tested, and restored to ensure complete functionality. These instruments provide dependable performance comparable to new equipment while offering a more affordable solution for obtaining high-quality laboratory tools. The refurbishment process improves durability and extends the equipment’s operational lifespan, enhancing overall value for users.

The main categories of refurbished laboratory equipment include analytical instruments, general laboratory equipment, life science equipment, clinical laboratory equipment, and chromatography equipment. Analytical instruments are tools used to measure, analyze, and quantify the chemical, physical, or biological characteristics of samples with precision. The equipment is available in various pricing ranges, including low-cost, mid-range, premium-quality options, and leasing arrangements. It is distributed through multiple channels such as direct sales, online marketplaces, distributor networks, auctions, and third-party resellers, serving end users such as healthcare facilities, pharmaceutical and biotechnology companies, and academic and research institutions.

The countries covered in the refurbished laboratory equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The refurbished laboratory equipment market consists of sales of centrifuges, microscopes, spectrophotometers, incubators, and freezers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Refurbished Laboratory Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on refurbished laboratory equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for refurbished laboratory equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The refurbished laboratory equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Report Scope

Markets Covered:

1) By Type Of Equipment: Analytical Instruments; General Lab Equipment; Life Science Equipment; Clinical Laboratory Equipment; Chromatography Equipment2) By Product Pricing: Low-Cost Equipment; Mid-Range Equipment; Premium Quality Equipment; Leasing Options

3) By Sales Channel: Direct Sales; Online Marketplaces; Distributor Networks; Auctions; Third-Party Resellers

4) By End-User: Healthcare Facilities; Pharmaceutical and Biotechnology Companies; Academic and Research Institutions

Subsegments:

1) By Analytical Instruments: Spectrophotometers; Microscopes; Balances; pH Meters; Titrators; Centrifuges2) By General Lab Equipment: Hot Plates; Magnetic Stirrers; Incubators; Water Baths; Autoclaves; Fume Hoods

3) By Life Science Equipment: Polymerase Chain Reaction (PCR) Machines; DNA Sequencers; Gel Electrophoresis Systems; Microplate Readers; Cell Counters; Cryogenic Freezers

4) By Clinical Laboratory Equipment: Hematology Analyzers; Clinical Chemistry Analyzers; Immunoassay Analyzers; Blood Gas Analyzers; Coagulation Analyzers; Urinalysis Analyzers

5) By Chromatography Equipment: High-Performance Liquid Chromatography (HPLC) Systems; Gas Chromatography (GC) Systems; Ion Chromatography (IC) Systems; Thin Layer Chromatography (TLC) Equipment; Preparative Chromatography Systems

Companies Mentioned: Hitachi Ltd.; Thermo Fisher Scientific Inc.; Abbott Laboratories; Danaher Corporation; Siemens Healthineers AG; Merck KGaA Darmstadt Germany; GE Healthcare Inc.; Carl Zeiss AG; Bruker Corporation; Agilent Technologies Inc.; Olympus Corporation; Beckman Coulter Inc.; Sartorius AG; Shimadzu Corporation; Waters Corporation; PerkinElmer Inc.; HORIBA Ltd.; Eppendorf AG; JASCO Inc.; Copia Scientific LLC; Spectralab Scientific Inc.; International Equipment Trading Ltd.; ARC Scientific LLC; American Instrument Exchange Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Refurbished Laboratory Equipment market report include:- Hitachi Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Danaher Corporation

- Siemens Healthineers AG

- Merck KGaA Darmstadt Germany

- GE Healthcare Inc.

- Carl Zeiss AG

- Bruker Corporation

- Agilent Technologies Inc.

- Olympus Corporation

- Beckman Coulter Inc.

- Sartorius AG

- Shimadzu Corporation

- Waters Corporation

- PerkinElmer Inc.

- HORIBA Ltd.

- Eppendorf AG

- JASCO Inc.

- Copia Scientific LLC

- Spectralab Scientific Inc.

- International Equipment Trading Ltd.

- ARC Scientific LLC

- American Instrument Exchange Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | November 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 26.25 Billion |

| Forecasted Market Value ( USD | $ 34.58 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |