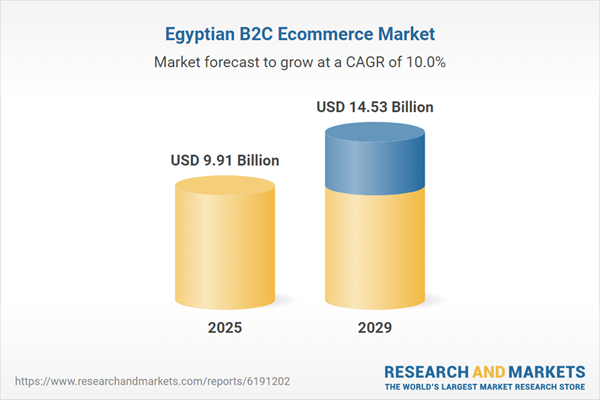

The ecommerce market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 7.8%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 10% from 2025 to 2029. By the end of 2029, the ecommerce market is projected to expand from its 2024 value of US$8.88 billion to approximately US$14.53 billion.

Key Trends and Drivers

Digital payments expand the effective ecommerce customer base

- Egypt is moving from cash-on-delivery and over-the-counter cash payments toward mobile wallets, card payments and instalment/BNPL options in online retail. The number of active mobile wallets has risen sharply in the last few years, and wallets are now used for everyday payments as well as online shopping. Fintech players such as Fawry are integrating with POS systems, ERP tools and consumer finance providers (e.g., partnerships with Contact, Ottu and CDS Solutions) so that online and offline merchants can accept digital payments and instalments through a single stack.

- Central Bank and government financial-inclusion policies have encouraged banks and telcos to roll out wallets and low-cost digital accounts. Payment providers are targeting ecommerce specifically: Fawry and others position themselves as ways for shoppers to pay online with cash or wallets at thousands of locations, reducing abandonment among card-averse customers. BNPL and instalment offers embedded in checkout journeys are attractive in an inflationary environment, especially for electronics, household goods and fashion.

- A growing share of ecommerce orders is likely to shift from pure COD to pre-paid or wallet-based payment methods, improving collection reliability and unit economics for platforms. Digital payments will make it easier for platforms to onboard micro- and small merchants that lack card terminals but can accept wallet or voucher-based payments. Competition between fintechs, banks and telcos is likely to keep fees under pressure. Still, it should broaden the reachable online shopper base and support higher-value categories such as travel and consumer finance-linked purchases.

Government digital programmes pull SMEs and public services into ecommerce

- Under the ICT 2030 and Digital Egypt strategies, the government is digitalising public services, infrastructure and business processes, and positioning ICT as a growth sector. Policy work in 2025 has emphasised SME digitalisation, including support for cloud, e-payments and online selling tools. Egypt Post has introduced parcel and cash-collection services tailored to small online sellers, explicitly linking postal reform with ecommerce enablement.

- Digital transformation is a core pillar of Egypt's economic strategy, with priorities around digital government, smart infrastructure and AI adoption. Authorities see ecommerce as a channel to support SME exports and formalise the domestic market; initiatives to streamline company registration and create integrated digital platforms for investors align with this agenda. Public postal and logistics entities are under pressure to remain relevant to private couriers, prompting them to build SME-focused ecommerce offerings (tracking, COD, settlement).

- Lower administrative and logistics barriers should bring more small manufacturers, artisans and informal traders onto marketplaces and social platforms. As more SMEs adopt digital tools for invoicing, inventory and payments, platforms can integrate directly with their systems, enabling faster onboarding and more reliable fulfilment. Over time, this is likely to deepen domestic online assortment and intensify price competition, especially in non-branded categories such as homeware, apparel and local FMCG.

Social and influencer commerce reshape how Egyptians discover products

- Social media ads and creator content on Facebook, Instagram and TikTok are becoming central to how Egyptians discover and buy products, especially fashion, beauty, electronics, accessories and home items. Many micro-merchants operate via social feeds and messaging apps, directing customers to DM or WhatsApp rather than a formal website; larger brands run always-on campaigns that lead directly to app or marketplace listings. Advertising spend is also rising in digital and out-of-home formats around Cairo, reinforcing brand visibility for ecommerce platforms and D2C brands.

- High social media usage and relatively low trust in lesser-known standalone websites make creator recommendations and social proof important filters for purchase decisions. The cost of setting up a basic social commerce presence is low, which suits informal and small sellers trying to hedge against macroeconomic volatility. Platforms own algorithms reward short-form video and live content, which are well-suited to product demonstrations and limited-time offers.

- Marketing budgets for ecommerce players are likely to tilt further towards influencers, performance social ads and content production rather than traditional display. Platforms may deepen integrations with social channels (e.g., tracking, catalog feeds, in-app storefronts) to capture demand originating on social. As social commerce scales, regulators may increase scrutiny on disclosure, consumer protection and counterfeit goods, pushing larger players to formalise seller vetting and returns processes.

Logistics platforms and on-demand delivery raise service expectations

- Urban consumers now expect fast delivery for food and groceries, and increasingly for non-food retail, driven by platforms such as Talabat (operating multi-vertical on-demand delivery across Egypt) and local last-mile specialists. Egypt Post has reoriented parts of its network toward ecommerce parcels and SME logistics, while private couriers and tech-enabled last-mile firms compete on speed and tracking capabilities. Pan-African players like Jumia are optimising networks and shifting focus to core markets, including Egypt, with an emphasis on operational efficiency and category mix (e.g., groceries, everyday essentials).

- Investments in transport infrastructure and urban road networks have improved connectivity between new districts and established city centres, making same-day and next-day delivery more feasible on dense corridors. Food-delivery usage has normalised rapid-delivery expectations; customers now compare general ecommerce delivery times with those on food and grocery apps. Rising competition among logistics providers and the need for platforms to control costs are driving experimentation with consolidated delivery, pickup points, and lockers.

- In Cairo, Alexandria, and other large new cities, next-day delivery is likely to become a standard expectation for major platforms in key categories; smaller sellers may piggyback on postal and aggregator networks to meet these standards. Second-tier cities should see improved coverage as ecommerce players extend routes tested in other African markets, but with a tighter focus on unit economics and minimum order sizes. Logistics performance will become a key differentiator: platforms that can combine reliable, trackable delivery with flexible payment options will have an advantage in customer retention and seller acquisition.

Competitive Landscape

Over the next two to four years, competition is expected to intensify as platforms expand geographically and deepen vertical integration. Leading players are likely to prioritise fulfilment efficiencies, embedded financial services and richer integration with social-commerce channels to drive qualified demand. Second-tier cities will attract renewed investment, though unit economics will remain a key determinant of the pace of expansion. Consolidation may continue, especially in B2B marketplaces, vertical-specific ecommerce and technology-enabled logistics. International operators will leverage scale to manage inflationary pressures and FX volatility, while domestic players may differentiate through localisation, tailored credit options and agile last-mile models.Current State of the Market

- Egypt's e-commerce market is moderately concentrated, with a mix of global, regional and local players competing across general merchandise, electronics, fashion and fast-moving categories. Penetration is deeper in Cairo, Giza and Alexandria, where logistics density and payment readiness are stronger, while other governorates remain comparatively underserved. The market continues to shift from cash-dominant behaviour toward more diversified payment channels, including mobile wallets and instalment offerings, thereby improving conversion rates for large-ticket purchases. Marketplaces have strengthened their fulfilment models, and same-day and next-day delivery in major cities is becoming the norm for leading platforms, raising the overall bar on service expectations. As price sensitivity remains high due to economic conditions, platforms increasingly differentiate through reliability, flexible payment options, and assortment rather than solely through discount-led strategies.

Key Players and New Entrants

- Amazon. E.g. and Noon anchors the marketplace landscape, each leveraging wide assortments, large seller fleets and continuously optimised fulfilment networks. Local omnichannel retailers such as B.TECH, Carrefour Egypt and Jumia complement this landscape by combining physical footprints with online delivery, allowing them to serve high-demand verticals like electronics, appliances and groceries with greater operational control. Newer entrants and challenger platforms are emerging in niche areas, especially in pharmacy-commerce, homeware, cosmetics, and social-commerce-driven fashion, building on social media demand and influencer-led discovery. Fintech-enabled instalment providers and last-mile networks are also acting as quasi-entrants, as ecommerce players increasingly rely on them to improve checkout flexibility and speed.

Recent Launches, Mergers, and Acquisitions

- The market has seen notable consolidation activity. The MaxAB-Wasoko group acquired Egypt-based Fatura, enabling a deeper national footprint across B2B supply chains and expanding access to wholesalers across multiple governorates. In digital health commerce, Duaya's acquisition of EXMGO introduced a new pharmacy-commerce channel, positioning the company to offer technology-driven ordering and fulfilment services for pharmacies. These transactions indicate a strategic shift toward integrating upstream supply, logistics and digital tools to strengthen margins and improve merchant retention, especially in categories where fragmentation and informality remain high.

The report provides a detailed assessment of the ecommerce market across all major segments, including retail shopping, travel, food service, media, healthcare, and technology categories. It analyzes sales channels, engagement models, device and operating system usage, as well as domestic versus cross-border flows and city-tier contributions. The study also covers payment instruments and consumer demographics by age, income, and gender to map evolving purchasing behavior. Together, these datasets offer a comprehensive view of ecommerce market size, customer behavior, and digital channel performance.

The publisher's research methodology is based on industry best practices. It's unbiased analysis leverages a proprietary analytics platform to offer a detailed view of emerging business and investment market opportunities.

Report Scope

This report provides a detailed data-driven analysis of the B2C ecommerce market in Egypt, focusing on the overall digital retail ecosystem and its growth trajectory. It examines key ecommerce segments, sales channels, and consumer behavior shaping the evolution of online purchasing in the country.Egypt B2C Ecommerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Egypt Social Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Egypt Quick Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Egypt B2C Ecommerce Market Segmentation by Ecommerce Vertical

- Retail Shopping

- Travel & Hospitality

- Online Food Service

- Media & Entertainment

- Healthcare & Wellness

- Technology Products & Services

- Other

Egypt B2C Ecommerce Market Segmentation by Retail Shopping Category

- Clothing, Footwear & Accessories

- Health, Beauty & Personal Care

- Food & Beverage

- Appliances & Electronics

- Home Improvement

- Books, Music & Video

- Toys & Hobby

- Auto Parts & Accessories

- Other

Egypt B2C Ecommerce Market Segmentation by Retail Shopping Sales Channel

- Platform-to-Consumer

- Direct-to-Consumer

- Consumer-to-Consumer

Egypt B2C Ecommerce Market Segmentation by Travel & Hospitality Category

- Air Travel

- Train & Bus

- Taxi & Ride-Hailing

- Hotels & Resorts

- Other

Egypt B2C Ecommerce Market Segmentation by Travel and Hospitality Sales Channel

- Air Travel- Aggregator App

- Air Travel- Direct-to-Consumer

- Train & Bus- Aggregator App

- Train & Bus- Direct-to-Consumer

- Taxi & Ride-Hailing- Aggregator App

- Taxi & Ride-Hailing- Direct-to-Consumer

- Hotels & Resorts- Aggregator App

- Hotels & Resorts- Direct-to-Consumer

- Other- Aggregator App

- Other- Direct-to-Consumer

Egypt B2C Ecommerce Market Segmentation by Online Food Service Sales Channel

- Aggregator App

- Direct-to-Consumer

Egypt B2C Ecommerce Market Segmentation by Media & Entertainment Sales Channel

- Streaming Services

- Movies & Events

- Theme Parks & Gaming

- Other

Egypt B2C Ecommerce Market Segmentation by Engagement Model

- Website-Based

- Live Streaming

Egypt B2C Ecommerce Market Segmentation by Location

- Cross-Border

- Domestic

Egypt B2C Ecommerce Market Segmentation by Device

- Mobile

- Desktop

Egypt B2C Ecommerce Market Segmentation by Operating System

- iOS / macOS

- Android

- Other Operating Systems

Egypt B2C Ecommerce Market Segmentation by City Tier

- Tier 1

- Tier 2

- Tier 3

Egypt B2C Ecommerce Market Segmentation by Payment Instrument

- Credit Card

- Debit Card

- Bank Transfer

- Prepaid Card

- Digital & Mobile Wallet

- Other Digital Payment

- Cash

Egypt B2C Ecommerce Consumer Demographics & Behaviour

- Market Share by Age Group

- Market Share by Income Level

- Market Share by Gender

Egypt B2C Ecommerce User Statistics & Ratios

- Internet Users

- Ecommerce Users

- Social Media Users

- Smartphone Penetration

- Banked Population

- Ecommerce Per Capita

- GDP Per Capita

- Ecommerce as % of GDP

- Cart Abandonment Rate

- Product Return Rate

Egypt B2C Ecommerce Operational Metrics by Ecommerce Segment

- Gross Merchandise Value by Segment

Egypt B2C Ecommerce Operational Metrics by Retail Shopping Category

- Gross Merchandise Value by Category

Egypt B2C Ecommerce Operational Metrics by Sales Channel

- Gross Merchandise Value by Channel

Egypt B2C Ecommerce Operational Metrics by Location

- Gross Merchandise Value by Location

Egypt B2C Ecommerce Operational Metrics by Device

- Gross Merchandise Value by Device

Egypt B2C Ecommerce Operational Metrics by Operating System

- Gross Merchandise Value by Operating System

Egypt B2C Ecommerce Operational Metrics by City Tier

- Gross Merchandise Value by City Tier

Egypt B2C Ecommerce Operational Metrics by Payment Instrument

- Gross Merchandise Value by Payment Instrument

Reasons to Buy

- Comprehensive Market Intelligence: Develop a complete understanding of the B2C ecommerce landscape in Egypt with fundamental ecommerce metrics such as gross merchandise value, gross merchandise volume, and average value per transaction across all major ecommerce segments.

- Granular Segmentation and Cross-Analysis: Analyse the online retail ecosystem through detailed segmentation covering ecommerce segments, retail product categories, travel and hospitality verticals, media and entertainment services, sales channels, devices, operating systems, cities, and payment instruments, enabling deep insight into evolving consumer shopping patterns.

- Operational and Performance Benchmarking: Benchmark marketplaces, direct-to-consumer platforms, aggregators, and category-focused players using KPIs such as GMV share, category-level performance, channel efficiency, device contribution, and payment mode penetration, supporting comparative assessment of platform strengths and competitive positioning.

- Consumer Behavior and Ecosystem Readiness: Understand how demographics, income groups, gender mix, device usage, and payment preferences shape online purchasing decisions, influencing category demand, cart abandonment behavior, product return tendencies, and the shift toward digital-first commerce.

- Data-Driven Forecasts and KPI Tracking: Access a structured dataset of 80+ ecommerce KPIs with historical and forecast values up to 2029, providing clarity on growth drivers, category expansion, sales-channel transitions, and payment-instrument evolution across the B2C ecommerce value chain.

- Decision-Ready Databook Format: Delivered in a standardized, analytics-friendly databook format aligned with financial modeling requirements, enabling ecommerce companies, consumer brands, payment providers, technology firms, and investors to conduct evidence-based market assessment and strategic planning.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | November 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.91 Billion |

| Forecasted Market Value ( USD | $ 14.53 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Egypt |