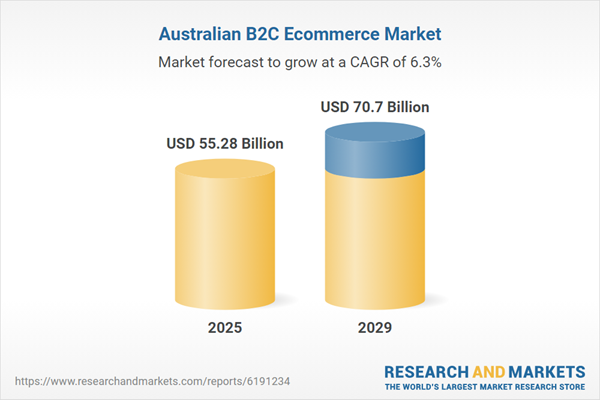

The ecommerce market in the country has experienced robust growth during 2020-2024, achieving a CAGR of 8.3%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 6.3% from 2025 to 2029. By the end of 2029, the ecommerce market is projected to expand from its 2024 value of US$51.57 billion to approximately US$70.70 billion.

Key Trends and Drivers

Anchor the market around three power clusters: supermarket ecosystems, global marketplaces, and vertical specialists

- Supermarket ecosystems (Woolworths, Coles, and discounters)

- Woolworths and Coles now treat ecommerce as part of broader food and everyday needs ecosystems combining grocery, liquor, marketplace ranges, loyalty, and on-demand delivery. Woolworths 2025 annual report emphasises digital engagement, integration with Everyday Rewards, and marketplace offers (e.g., Everyday Market, BIG W Market) as core growth levers, not side projects.

- The ACCC's supermarkets inquiry notes that Coles and Woolworths scale, networks, and loyalty programs give them significant advantages in accessing sites and building omnichannel offers, which spills over into their online reach.

- Global marketplaces (Amazon, Temu, Shein)

- Amazon remains one of Australia's most frequently used online retailers; recent press reports citing Roy Morgan shopper data indicate it serves millions of annual buyers and achieved double-digit growth over the past year.

- Temu and Shein are expanding on the back of extreme value positioning and heavy app-based marketing. News outlets report that both platforms are adding hundreds of thousands of Australian buyers year on year, significantly reshaping spending away from local retailers.

- Vertical specialists (Temple & Webster, THE ICONIC, Adore Beauty, Kogan)

- Temple & Webster has consolidated its position in online furniture and homewares, reporting strong revenue growth and highlighting the category's relatively early stage of online penetration.

- THE ICONIC remains a leading fashion and lifestyle platform, returning to growth through 2024-25 and regaining a top-two position in fashion web traffic.

- Adore Beauty has shifted focus to higher-margin owned brands and is now rolling out physical stores to complement its online beauty platform.

- Competition is no longer just online vs offline ; it is ecosystem vs ecosystem supermarket-centric ecosystems, global marketplace ecosystems, and vertically focused brand ecosystems, each trying to lock in shoppers through loyalty, range, and fulfilment.

- Mid-tier generalist online retailers and independent marketplaces sit between these clusters and face the toughest trade-offs on investment and differentiation.

- Expect deeper integration inside each cluster rather than a proliferation of new standalone sites: more cross-selling across Woolworths/Coles banners, more services tied into Amazon/Temu apps, and more category extensions from vertical specialists.

- Competitive strategy will focus on strengthening each ecosystem's gravity loyalty linkages, subscription benefits, exclusive ranges, and integrated delivery rather than launching new independent ecommerce brands.

Track global marketplaces share gains and the squeeze on domestic generalists

- News coverage built on recent Roy Morgan shopper data shows Amazon, Temu, and Shein all adding substantial numbers of Australian buyers in the year to mid-2025, with Amazon reaching the largest online shopper base and Temu and Shein growing rapidly from a smaller base.

- At the same time, local generalist platforms are retreating:

- Wesfarmers is shutting down Catch as a standalone business and repurposing its fulfilment centres and digital capabilities into Kmart Group and other divisions, explicitly citing intense competition from international platforms.

- Woolworths is closing MyDeal and consolidating marketplace activity into Everyday Market and BIG W Market, after concluding that MyDeal could not achieve sustainable profitability in the current online environment.

- Global marketplaces benefit from global scale in assortment, technology, and vendor relationships, enabling them to offer a wide range of low-priced products without carrying local inventory, as retailers with physical stores do.

- Domestic generalists that tried to replicate the marketplace model have had to carry local logistics and compliance costs without comparable scale, leading to sustained losses and retrenchment. Woolworths and Wesfarmers own statements emphasise that marketplaces attached to core retail brands (e.g., BIG W Market, Kmart-linked offers) are more viable than separate pure-play platforms.

- Temu's recent decision to open the platform to Australian sellers, with local fulfilment improving delivery times to around 4-6 days, narrows one of the few structural advantages local players previously held.

- Global marketplaces are likely to consolidate their position as the default destination for low-priced, long-tail products. In contrast, domestic generalist marketplaces continue to shrink or fold into larger retail groups.

- Local groups will increasingly use marketplaces as range-extension tools within their ecosystems (e.g., curated third-party sellers on Woolworths and BIG W platforms) rather than pursuing scale for its own sake.

- Regulatory pressure from the ACCC's Digital Platform Services Inquiry could alter how the largest platforms use data and present offers, but is unlikely to reverse their structural scale advantage; instead, it will influence compliance costs and conduct standards.

Watch category specialists deepen moats and move from online-only to omnichannel

- Home and furniture: Temple & Webster has moved from growth with thin margins to a more disciplined, profitable expansion, leveraging AI and drop-ship logistics to scale across a very wide range without owning inventory, as traditional furniture chains do.

- Fashion and lifestyle: THE ICONIC has returned to positive growth after a softer period, investing in customer retention, operations, and circular initiatives (e.g., its Rescued range of repaired and upcycled products).

- Beauty: Adore Beauty is using owned brands, retail media, and more selective marketing to lift profitability, while beginning a measured rollout of branded physical stores across major shopping centres in Australia.

- General online retail: Kogan remains a key player in value-oriented online general merchandise, even as it navigates volatility in its New Zealand arm Mighty Ape and works to refine its product and platform mix.

- Category depth, differentiated assortment (including private labels), and in-category expertise allow specialists to compete on more than price against global marketplaces.

- Many are now building omnichannel capabilities selectively, for example, Adore Beauty's physical stores and THE ICONIC's sustainability-led initiatives to strengthen brand equity and customer engagement while keeping capital intensity lower than traditional chains.

- Investor and board expectations have shifted towards sustainable profitability, encouraging tighter discipline on marketing spend, inventory, and logistics, which tends to favour focused specialists over broad, low-margin generalists.

- Expect further blurring between online pure-play and omnichannel retailer as successful specialists test physical formats, showrooms, and experiential spaces while keeping ecommerce as the primary sales channel.

- Competitive intensity within categories such as beauty and home will rise as global players (e.g., Amazon, Shein Home) push further into these verticals. Still, specialists with strong brands and community engagement should be able to defend their share if they continue to innovate in service, curation, and content.

- M&A interest in specialists may increase, especially from larger omnichannel groups or private equity, as they seek ready-made ecommerce capabilities and digitally native brands; recent academic and trade commentary on Woolworths earlier MyDeal acquisition illustrates how retailers view such deals as shortcuts into online scale (even if some are later reversed).

Expect consolidation and partnership-driven plays in logistics, food delivery, and fulfilment

- Grocery fulfilment: Coles has opened two automated Customer Fulfilment Centres with Ocado technology in Victoria and New South Wales, bringing high-automation capabilities into the Australian market and differentiating its online proposition.

- Quick commerce and on-demand grocery: Woolworths has integrated its Milkrun rapid delivery service more deeply into its grocery offer and, more recently, has folded Endeavour Group's Jimmy Brings alcohol delivery into the Milkrun app, creating a combined grocery-plus-alcohol delivery proposition.

- Restaurant delivery: The food-delivery field is consolidating. Menulog is exiting Australia in late 2025, with a commercial agreement to redirect its customers and merchants to Uber Eats, leaving Uber Eats and DoorDash as the two dominant third-party delivery apps alongside retailer-owned offerings.

- Fulfilment and last-mile delivery are capital-intensive and scale-dependent, favouring players that can spread fixed costs over very high order volumes national supermarkets, large marketplaces, and a small number of third-party delivery platforms.

- By folding standalone brands (Catch, MyDeal, Jimmy Brings, Menulog) into larger ecosystems or closing them, owners are trying to cut losses and focus capacity on networks where utilisation and cross-selling are stronger.

- Partnerships (e.g., Coles-Ocado, Menulog-Uber Eats transition) provide technology or customer access that would be costly to build independently, at the expense of some control.

- Logistics and on-demand delivery capacity will increasingly sit with a handful of large networks: the two major grocers, one or two global marketplaces, and two dominant restaurant-delivery platforms. Smaller retailers will choose between plugging into these networks or limiting their ecommerce promise (e.g., slower delivery, click-and-collect only).

- More category-specific partnerships are likely, for example, retailers outsourcing parts of their same-day delivery or returns logistics to Uber- or DoorDash-style networks, or using third-party fulfilment providers to run regional hubs.

- As consolidation continues, regulators will pay closer attention to how concentrated logistics and platform power affect competition and small merchants, building on the ACCC's current work on supermarkets and digital platforms.

Competitive Landscape

Competition is expected to concentrate further around a few large ecosystems. Global marketplaces will retain share gains, supermarket ecosystems will deepen integration across loyalty, marketplace offers, and rapid fulfilment, and specialists will continue measured omnichannel expansion. Smaller generalist platforms will likely exit or be absorbed.Current State of the Market

- Australia's ecommerce market is characterised by a shift toward ecosystem-led competition, where a small number of large retailers and platforms integrate loyalty, fulfilment, media, and marketplaces into unified consumer offerings. Supermarkets such as Woolworths and Coles now anchor the online landscape through broad coverage of everyday needs, deep loyalty programs, and accelerated investment in fulfilment. Global marketplaces, including Amazon, Temu, and Shein, continue to scale rapidly, reshaping expectations for assortment, delivery times, and prices. Category specialists in home, fashion, beauty, and electronics are stabilising after several years of volatility, operating with more disciplined growth and selective omnichannel expansion.

Key Players and New Entrants

- Woolworths and Coles remain the dominant omnichannel ecosystems, extending influence across grocery, liquor, everyday essentials, and curated marketplace assortments. Amazon continues to expand its fulfilment infrastructure and product categories, strengthening its relevance across general merchandise. Temu has accelerated user acquisition and recently opened the platform to Australian sellers, reducing delivery windows and solidifying local presence. Among specialists, Temple & Webster, THE ICONIC, Adore Beauty, and Kogan remain core players, with each investing in brand differentiation and operational efficiency. New entrants are increasingly platform-led rather than full retailers, with international marketplaces expanding seller programs to embed themselves in the local ecosystem.

Recent Launches, Mergers, and Acquisitions

- The past year has seen consolidation rather than expansion. Woolworths has folded MyDeal into its broader digital ecosystem while integrating Milkrun and Jimmy Brings to streamline rapid delivery. Wesfarmers is winding down Catch and repurposing its logistics and technology assets across the Kmart Group. In the food delivery space, Menulog's decision to exit Australia and transition consumers and merchants to Uber Eats marks a major structural shift. Coles continues to roll out automated fulfilment through its partnership with Ocado.

The report provides a detailed assessment of the ecommerce market across all major segments, including retail shopping, travel, food service, media, healthcare, and technology categories. It analyzes sales channels, engagement models, device and operating system usage, as well as domestic versus cross-border flows and city-tier contributions. The study also covers payment instruments and consumer demographics by age, income, and gender to map evolving purchasing behavior. Together, these datasets offer a comprehensive view of ecommerce market size, customer behavior, and digital channel performance.

The publisher's research methodology is based on industry best practices. It's unbiased analysis leverages a proprietary analytics platform to offer a detailed view of emerging business and investment market opportunities.

Report Scope

This report provides a detailed data-driven analysis of the B2C ecommerce market in Australia, focusing on the overall digital retail ecosystem and its growth trajectory. It examines key ecommerce segments, sales channels, and consumer behavior shaping the evolution of online purchasing in the country.Australia B2C Ecommerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Australia Social Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Australia Quick Commerce Market Size and Growth Dynamics

- Gross Merchandise Value

- Gross Merchandise Volume

- Average Value per Transaction

Australia B2C Ecommerce Market Segmentation by Ecommerce Vertical

- Retail Shopping

- Travel & Hospitality

- Online Food Service

- Media & Entertainment

- Healthcare & Wellness

- Technology Products & Services

- Other

Australia B2C Ecommerce Market Segmentation by Retail Shopping Category

- Clothing, Footwear & Accessories

- Health, Beauty & Personal Care

- Food & Beverage

- Appliances & Electronics

- Home Improvement

- Books, Music & Video

- Toys & Hobby

- Auto Parts & Accessories

- Other

Australia B2C Ecommerce Market Segmentation by Retail Shopping Sales Channel

- Platform-to-Consumer

- Direct-to-Consumer

- Consumer-to-Consumer

Australia B2C Ecommerce Market Segmentation by Travel & Hospitality Category

- Air Travel

- Train & Bus

- Taxi & Ride-Hailing

- Hotels & Resorts

- Other

Australia B2C Ecommerce Market Segmentation by Travel and Hospitality Sales Channel

- Air Travel- Aggregator App

- Air Travel- Direct-to-Consumer

- Train & Bus- Aggregator App

- Train & Bus- Direct-to-Consumer

- Taxi & Ride-Hailing- Aggregator App

- Taxi & Ride-Hailing- Direct-to-Consumer

- Hotels & Resorts- Aggregator App

- Hotels & Resorts- Direct-to-Consumer

- Other- Aggregator App

- Other- Direct-to-Consumer

Australia B2C Ecommerce Market Segmentation by Online Food Service Sales Channel

- Aggregator App

- Direct-to-Consumer

Australia B2C Ecommerce Market Segmentation by Media & Entertainment Sales Channel

- Streaming Services

- Movies & Events

- Theme Parks & Gaming

- Other

Australia B2C Ecommerce Market Segmentation by Engagement Model

- Website-Based

- Live Streaming

Australia B2C Ecommerce Market Segmentation by Location

- Cross-Border

- Domestic

Australia B2C Ecommerce Market Segmentation by Device

- Mobile

- Desktop

Australia B2C Ecommerce Market Segmentation by Operating System

- iOS / macOS

- Android

- Other Operating Systems

Australia B2C Ecommerce Market Segmentation by City Tier

- Tier 1

- Tier 2

- Tier 3

Australia B2C Ecommerce Market Segmentation by Payment Instrument

- Credit Card

- Debit Card

- Bank Transfer

- Prepaid Card

- Digital & Mobile Wallet

- Other Digital Payment

- Cash

Australia B2C Ecommerce Consumer Demographics & Behaviour

- Market Share by Age Group

- Market Share by Income Level

- Market Share by Gender

Australia B2C Ecommerce User Statistics & Ratios

- Internet Users

- Ecommerce Users

- Social Media Users

- Smartphone Penetration

- Banked Population

- Ecommerce Per Capita

- GDP Per Capita

- Ecommerce as % of GDP

- Cart Abandonment Rate

- Product Return Rate

Australia B2C Ecommerce Operational Metrics by Ecommerce Segment

- Gross Merchandise Value by Segment

Australia B2C Ecommerce Operational Metrics by Retail Shopping Category

- Gross Merchandise Value by Category

Australia B2C Ecommerce Operational Metrics by Sales Channel

- Gross Merchandise Value by Channel

Australia B2C Ecommerce Operational Metrics by Location

- Gross Merchandise Value by Location

Australia B2C Ecommerce Operational Metrics by Device

- Gross Merchandise Value by Device

Australia B2C Ecommerce Operational Metrics by Operating System

- Gross Merchandise Value by Operating System

Australia B2C Ecommerce Operational Metrics by City Tier

- Gross Merchandise Value by City Tier

Australia B2C Ecommerce Operational Metrics by Payment Instrument

- Gross Merchandise Value by Payment Instrument

Reasons to Buy

- Comprehensive Market Intelligence: Develop a complete understanding of the B2C ecommerce landscape in Australia with fundamental ecommerce metrics such as gross merchandise value, gross merchandise volume, and average value per transaction across all major ecommerce segments.

- Granular Segmentation and Cross-Analysis: Analyse the online retail ecosystem through detailed segmentation covering ecommerce segments, retail product categories, travel and hospitality verticals, media and entertainment services, sales channels, devices, operating systems, cities, and payment instruments, enabling deep insight into evolving consumer shopping patterns.

- Operational and Performance Benchmarking: Benchmark marketplaces, direct-to-consumer platforms, aggregators, and category-focused players using KPIs such as GMV share, category-level performance, channel efficiency, device contribution, and payment mode penetration, supporting comparative assessment of platform strengths and competitive positioning.

- Consumer Behavior and Ecosystem Readiness: Understand how demographics, income groups, gender mix, device usage, and payment preferences shape online purchasing decisions, influencing category demand, cart abandonment behavior, product return tendencies, and the shift toward digital-first commerce.

- Data-Driven Forecasts and KPI Tracking: Access a structured dataset of 80+ ecommerce KPIs with historical and forecast values up to 2029, providing clarity on growth drivers, category expansion, sales-channel transitions, and payment-instrument evolution across the B2C ecommerce value chain.

- Decision-Ready Databook Format: Delivered in a standardized, analytics-friendly databook format aligned with financial modeling requirements, enabling ecommerce companies, consumer brands, payment providers, technology firms, and investors to conduct evidence-based market assessment and strategic planning.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | November 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 55.28 Billion |

| Forecasted Market Value ( USD | $ 70.7 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Australia |