The industry’s expansion is influenced by the growing stringency of environmental laws worldwide, which are compelling oil and gas operators to comply with tighter standards on hazardous waste handling, emissions mitigation, and water contamination prevention. These evolving regulations are driving large-scale investments in innovative waste treatment systems and compliance infrastructure. Frameworks emphasizing landfill diversion, emission controls, and recycling initiatives are reshaping service models across the sector. In addition, the increasing focus on extended producer responsibility and waste minimization goals is prompting oilfield operators to integrate sustainable technologies into their workflows. As unconventional drilling methods such as hydraulic fracturing and horizontal drilling become more prevalent, the quantity and complexity of drilling waste have increased significantly. These techniques produce higher levels of contaminated cuttings, muds, and produced water, intensifying the need for advanced treatment, containment, and recycling systems. The continued rise of shale and tight oil exploration across North America and Asia is expected to accelerate demand for drilling waste management solutions over the coming years.

The onshore segment accounted for a 62% share in 2024 and is projected to grow at an 8% CAGR through 2034. The surge in onshore drilling waste management stems from the expansion of unconventional energy production, which generates greater volumes of cuttings, produced water, and drilling fluids than traditional exploration. The complexity of waste generated from dense shale formations calls for sophisticated treatment technologies such as centrifugation, solidification, and bioremediation.

The drill cuttings segment held a 53.3% share and is projected to grow at a CAGR of 7.8% through 2034. As one of the most significant waste types produced during drilling operations, drill cuttings are undergoing a shift from conventional offsite disposal to onsite treatment and reuse. Technologies such as thermal desorption and solids control systems are being increasingly utilized to process waste directly at drilling locations, recover usable fluids, and minimize transportation requirements, improving both efficiency and sustainability.

United States Treatment & Disposal Drilling Waste Management Market captured USD 700 million in 2024. The country’s growth is driven by regulatory enforcement and elevated drilling activity across key oil- and gas-producing regions. The Environmental Protection Agency (EPA) and the Bureau of Land Management (BLM) have implemented new guidelines addressing methane control and waste containment, pushing operators to adopt modern treatment technologies like solidification, thermal desorption, and bioremediation.

Prominent companies active in the Treatment & Disposal Drilling Waste Management Market include Baker Hughes, Augean Plc, Clean Harbors, Inc., Halliburton, Schlumberger, Weatherford, TWMA, Secure Energy Services, Inc., Ecoserv LLC, Pure Environmental, Milestone Environmental Services, Derrick Equipment Company, Newpark Resources Inc., NOV Inc., GN Solids Control, Imdex Limited, Ridgeline Canada Inc., Select Water Solutions, Soli-Bond, Inc., Tidal Logistics, and Environmental Development Company Ltd. Leading market players are focusing on technological innovation, capacity expansion, and strategic partnerships to reinforce their presence in the drilling waste management landscape. Companies are investing heavily in advanced treatment technologies such as thermal desorption, bioremediation, and centrifugation to deliver cost-effective and environmentally compliant solutions. Many are forming long-term service alliances with exploration and production firms to secure steady demand while enhancing their regional footprint. Expansions into emerging drilling regions and the integration of digital monitoring systems are helping firms improve operational efficiency and waste traceability.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Treatment and Disposal Drilling Waste Management market report include:- Augean Plc

- Baker Hughes

- Clean Harbors,Inc.

- Derrick Equipment Company

- GN Solids Control

- Halliburton

- Imdex Limited

- Newpark Resources Inc.

- NOV Inc.

- Ridgeline Canada Inc.

- Schlumberger

- Secure Energy Services,Inc.

- Select Water Solutions

- Soli-Bond,Inc.

- TWMA

- Weatherford

- Ecoserv LLC

- Milestone Environmental Services

- Pure Environmental

- Tidal Logistics

- Environmental Development Company Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

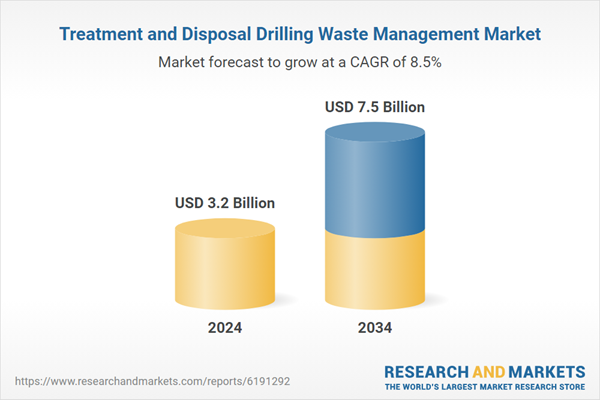

| Estimated Market Value ( USD | $ 3.2 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |