The market is driven by growing emphasis on sustainability and cost-efficiency across industries. Recycled elastomers, derived from post-consumer and post-industrial rubber waste, are widely applied in automotive, infrastructure, and consumer goods. These materials help reduce environmental impact while meeting manufacturers’ performance requirements and circular economy goals. Technological advancements are playing a pivotal role, as innovations in devulcanization, pyrolysis, and multi-step reprocessing enhance material quality and consistency, enabling use in more demanding applications. Furthermore, refined extrusion and molding techniques allow the production of customized formats like pellets, sheets, and compounds tailored to industrial needs. Regionally, Asia-Pacific leads with mature recycling infrastructure and supportive regulations, while North America is expanding due to industrial growth and environmental awareness, and Europe maintains steady adoption fueled by sustainability mandates and green manufacturing practices. These dynamics create a diversified and robust global outlook for recycled elastomers.

The styrene butadiene rubber (SBR) segment held a 28.2% share in 2024 and is projected to grow at a CAGR of 8.4% through 2034. SBR’s widespread adoption stems from its mechanical strength, cost-effectiveness, and versatility across automotive, industrial, and infrastructure applications. Its position is reinforced by established recycling technologies and sustained demand from tire and asphalt modification sectors.

The infrastructure applications segment held a 24.4% share in 2024 and is anticipated to grow at a CAGR of 10.6% from 2025 to 2034. Recycled elastomers are increasingly used in road surfacing, asphalt modification, and construction materials, offering cost-effective and eco-friendly alternatives to virgin rubber while meeting durability and scale requirements.

North America Recycled Elastomers Market held an 11.3% share in 2024, emerging as a key growth region. The market’s expansion is driven by industrial demand, regulatory support for sustainable materials, and a mature recycling ecosystem. Advanced waste collection systems for tires and rubber products have facilitated broader applications of recycled elastomers across automotive, construction, and consumer goods industries.

Key players active in the Global Recycled Elastomers Market include Liberty Tire Recycling, GRP Ltd., Genan Holding, American Tire Recycling, West Coast Rubber Recycling, Monmouth Rubber & Plastics Corp., J. Allcock & Sons Limited, RubberForm Recycled Products LLC, American Recycling Center, Green Rubber Global, Austin Rubber Company LLC, and Klean Industries. Companies in the Global Recycled Elastomers Market are focusing on multiple strategies to strengthen their presence and market position. They are investing heavily in advanced processing technologies like devulcanization and pyrolysis to improve product quality and broaden application potential. Strategic partnerships with industrial users and municipalities enhance raw material supply chains and market penetration. Firms are also expanding production capacities, establishing regional recycling hubs, and targeting emerging markets to increase reach. Sustainability-driven marketing campaigns and alignment with circular economy initiatives build brand reputation.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Recycled Elastomers market report include:- Liberty Tire Recycling

- GRP Ltd.

- Genan Holding

- American Tire Recycling

- West Coast Rubber Recycling

- Monmouth Rubber & Plastics Corp.

- J. Allcock & Sons Limited

- RubberForm Recycled Products LLC

- American Recycling Center

- Green Rubber Global

- Austin Rubber Company LLC

- Klean Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

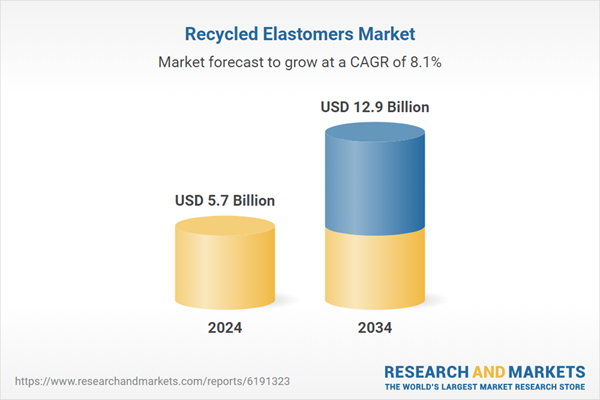

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 12.9 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |