The market growth is primarily driven by increasing demand for specialized metabolomic supplements and condition-specific formulations, alongside the broader adoption of vitamin- and amino acid-based products in precision nutrition applications. Advances in metabolomic profiling enable more personalized nutrition strategies, while clinical research continues to validate targeted health interventions. Regulatory guidance from the FDA and growing adoption of personalized nutrition in healthcare, biotechnology, and wellness sectors further reinforce market expansion. Next-generation metabolomic products integrate seamlessly into therapeutic development, delivering scalable, safe, and effective bioactive compounds. These innovations are creating commercial-scale opportunities in precision nutrition, expanding applications for specialized supplements, multi-biomarker technologies, and biomarker-driven formulations, while enabling wider acceptance of metabolomics-based approaches in specialty nutrition and wellness initiatives.

The specialized metabolomic supplements segment was valued at USD 998 million in 2024 and is projected to grow at a CAGR of 25.7% through 2034, accounting for a 35% share of the market. The segment’s growth is fueled by innovations in supplement design, its versatility across precision nutrition applications, and robust biomarker validation frameworks. These supplements allow scalable molecular profiling and bioactive component optimization, establishing steady demand across research, pilot, and commercial production environments.

The personalized and precision nutrition segment generated USD 1.1 billion in 2024 and is anticipated to grow at a CAGR of 27.1% through 2034. Its growth is supported by advancements in individualized nutritional profiling, versatility in health optimization, and validated metabolomic standards. Scalable profiling enables precise identification of metabolic responses to interventions, supporting consistent demand across clinical, research, and commercial wellness environments.

U.S. Metabolomics-based Nutritional Products Market was valued at USD 1 billion in 2024, accounting for an 80% share. This dominance is supported by government initiatives promoting precision nutrition research, advanced metabolomics infrastructure, and the presence of leading industry players. The market is shaped by FDA dietary supplement guidelines, personalized nutrition regulations, and innovations in metabolomic profiling technologies. Procurement and supplier standards are aligned with clinical trial frameworks and biomarker validation protocols, sustaining downstream demand for advanced metabolomics-based products in both personalized wellness and precision nutrition applications.

Key players in the Global Metabolomics-based Nutritional Products Market include Life Extension, Thorne Health, Metagenics, Designs for Health, Pure Encapsulations, Douglas Laboratories, Jarrow Formulas, Cambridge Isotope Laboratories, Sigma-Aldrich (Merck), NOW Foods, Integrative Therapeutics, XYMOGEN, Ortho Molecular Products, Allergy Research Group, SFI Health (Klaire Labs), Nutricology, Biotics Research, Vital Nutrients, Protocol for Life Balance, Researched Nutritionals, Apex Energetics, Bioclinic Naturals, Quicksilver Scientific, and Seeking Health. Companies in the Metabolomics-based Nutritional Products Market are pursuing several strategies to strengthen their market position. They are heavily investing in research and development to enhance metabolomic profiling capabilities, optimize bioactive component identification, and develop multi-biomarker formulations. Strategic collaborations and partnerships allow firms to expand product portfolios and access new markets. Companies are prioritizing clinical validation and regulatory compliance to reinforce product credibility.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Metabolomics-based Nutritional Products market report include:- Thorne Health

- Life Extension

- Metagenics

- Douglas Laboratories

- Designs for Health

- Pure Encapsulations

- Jarrow Formulas

- Cambridge Isotope Laboratories

- Sigma-Aldrich (Merck)

- NOW Foods

- Cayman Chemical

- Integrative Therapeutics

- XYMOGEN

- Ortho Molecular Products

- Allergy Research Group

- SFI Health (Klaire Labs)

- Nutricology

- Biotics Research

- Vital Nutrients

- Protocol for Life Balance

- Researched Nutritionals

- Apex Energetics

- Bioclinic Naturals

- Quicksilver Scientific

- Seeking Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

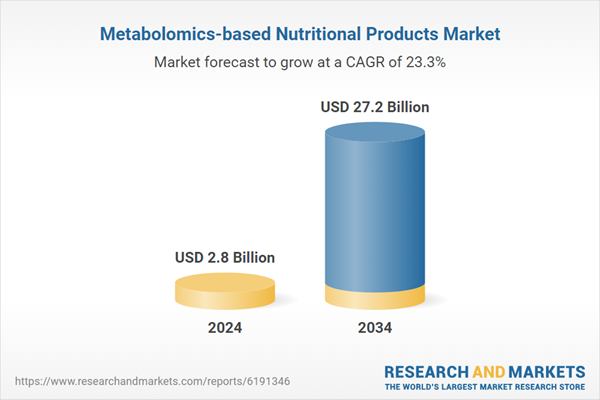

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 27.2 Billion |

| Compound Annual Growth Rate | 23.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |