The growth is driven by the rising adoption of electric vehicles (EVs), renewable energy systems, and advanced computing applications that require efficient thermal management solutions. Cold plates are essential for removing excess heat from power electronics, batteries, and semiconductor components, ensuring system reliability and performance. Increasing investments in high-performance computing, 5G infrastructure, and energy storage are boosting demand for innovative liquid-cooled technologies. Manufacturers are focusing on developing compact, lightweight, and high-efficiency cooling systems using materials such as aluminum and copper to meet the needs of automotive, aerospace, and industrial sectors.

In 2024, the standard heat flux capacity segment, requiring a heat transfer rating below 50 W/cm², held a 43.3% share. This category primarily serves industrial electronics, automotive systems, and a range of general thermal management applications. Owing to its well-established large-scale manufacturing, this segment delivers cost-effective solutions tailored for everyday use across diverse industries.

The machined cold plates segment captured a 19.5% share in 2024 and is projected to grow at a CAGR of 6.4%. These solutions offer superior customization capabilities through precision CNC machining and specialized brazing processes. They are ideal for intricate flow path designs, precise mounting requirements, and the integration of fin inserts that enhance heat transfer efficiency in demanding environments such as advanced semiconductors, cloud computing, and AI-based systems.

North America Cold Plates Market held 33.4% share in 2024 with a CAGR of 5.6% through 2034. The region’s dominance is supported by its advanced technological infrastructure and widespread adoption of thermal management solutions across key sectors, including aerospace, data centers, and medical equipment. The presence of leading industry players, strong R&D activities, and the growing need for high-efficiency cooling systems to support high-performance electronics are driving innovation and continued market expansion in the region.

Leading players in the Global Cold Plates Market, such as Boyd Corporation, Dana Incorporated, TE Technology, Inc., Kawaso Texcel, Mersen, Pantronics India, Wakefield Thermal Solutions, Wieland Thermal Solutions, Tesio, QATS, KenFa Tech., DeltaT Aerospace, Advanced Cooling Technologies (ACT), are focusing on technological innovation, strategic partnerships, and capacity expansion to strengthen their market position. These companies are investing in advanced manufacturing processes like additive manufacturing and precision machining to enhance design flexibility and thermal performance. Strategic collaborations with EV manufacturers, aerospace firms, and data center operators are enabling customized solutions tailored to high-performance cooling requirements. Firms are emphasizing sustainability, developing lightweight recyclable materials, and eco-friendly coolants to reduce environmental impact.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Cold Plates market report include:- Advanced Cooling Technologies (ACT)

- Boyd Corporation

- Dana Incorporated

- DeltaT Aerospace

- Kawaso Texcel

- KenFa Tech.

- Mersen

- Pantronics India

- QATS

- TE Technology, Inc

- Tesio

- Wakefield Thermal Solutions

- Wieland Thermal Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

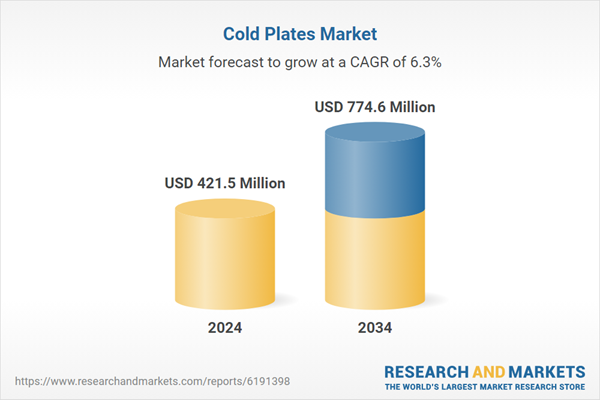

| Estimated Market Value ( USD | $ 421.5 Million |

| Forecasted Market Value ( USD | $ 774.6 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |